Investing In The Future Of Uber: Driverless Cars And ETF Opportunities

Table of Contents

The Promise of Autonomous Vehicles and their Impact on Uber's Future

The potential of self-driving technology to transform transportation is immense, particularly for ride-sharing giants like Uber. Autonomous vehicles promise a future with increased efficiency, reduced costs, and expanded service capabilities. This translates into significant opportunities for investors.

- Increased operational efficiency through reduced labor costs: Self-driving cars eliminate the need for human drivers, representing a substantial reduction in operational expenses for companies like Uber. This leads to higher profit margins and increased competitiveness.

- Expansion into new markets and underserved areas: Autonomous vehicles can operate in areas currently inaccessible due to high labor costs or a lack of available drivers. This opens up new revenue streams and market penetration opportunities for companies like Uber.

- Potential for new revenue streams (e.g., autonomous delivery services): The technology behind self-driving cars extends beyond ride-sharing. Uber and similar companies can leverage this technology to offer autonomous delivery services for food, packages, and other goods, creating entirely new revenue streams.

- Enhanced safety through reduced human error: Autonomous vehicles have the potential to significantly reduce accidents caused by human error, leading to improved public safety and potentially lower insurance costs.

Identifying Key Players in the Driverless Car Industry

The driverless car revolution isn't solely dependent on ride-sharing companies. Numerous companies are contributing to the development and implementation of this technology. Understanding these key players is crucial for effective investment strategies in this sector.

- Technology companies developing autonomous driving systems (e.g., Waymo, Cruise, Tesla): These companies are at the forefront of developing the core technology that powers self-driving cars. Their success is directly linked to the overall growth of the autonomous vehicle market.

- Companies developing the infrastructure for autonomous vehicles (e.g., mapping companies, sensor manufacturers): High-quality maps and reliable sensor technology are essential for the safe and effective operation of autonomous vehicles. Investing in companies that provide this infrastructure is another way to gain exposure to the sector.

- Companies involved in the production of autonomous vehicle components: The manufacturing of self-driving car components, including lidar sensors, cameras, and advanced processors, represents a significant part of the supply chain. These companies are vital for the continued development and expansion of the industry.

Investing in Driverless Car Technology Through ETFs

Exchange Traded Funds (ETFs) offer a compelling approach to investing in the driverless car market. They provide diversified exposure, mitigating the risks associated with investing in individual companies.

- Diversification across multiple companies reduces risk: ETFs typically hold a basket of stocks, reducing the impact of any single company's underperformance on your overall investment.

- Lower management fees compared to actively managed funds: ETFs generally have lower expense ratios than actively managed funds, meaning more of your investment returns go to you.

- Easy to buy and sell on major stock exchanges: ETFs are highly liquid and trade like individual stocks, making them easy to buy and sell throughout the day.

- Examples of ETFs with exposure to autonomous vehicle companies: While specific ETF tickers can change, research ETFs that focus on technology, robotics, or transportation sectors. Look for funds that explicitly mention exposure to companies involved in autonomous vehicle technology. Always conduct thorough due diligence before investing in any ETF.

Assessing the Risks Associated with Driverless Car Investments

While the potential rewards are significant, investing in driverless car technology also carries inherent risks. A realistic assessment of these risks is crucial for informed decision-making.

- Regulatory uncertainty and evolving legislation: The regulatory landscape for autonomous vehicles is still developing, and changes in regulations could significantly impact the industry.

- Technological hurdles and unforeseen delays in development: The development of fully autonomous vehicles is complex, and unforeseen technical challenges could lead to delays and setbacks.

- Public perception and acceptance of autonomous vehicles: Widespread public acceptance is crucial for the success of autonomous vehicles. Negative perceptions or safety concerns could hinder market adoption.

- Competition among various companies in the sector: The driverless car market is highly competitive, and the success of any single company is not guaranteed.

Mitigating Investment Risks in the Driverless Car Market

To mitigate the risks associated with driverless car investments, investors should adopt a strategic approach:

- Invest in a diversified portfolio of ETFs, not just one: Don't put all your eggs in one basket. Diversifying your investments across multiple ETFs reduces the overall risk.

- Conduct thorough research before investing in any ETF: Understand the specific companies held by each ETF and their exposure to the autonomous vehicle market.

- Consider a long-term investment horizon to weather short-term market fluctuations: The driverless car market is likely to experience volatility in the short term. A long-term perspective can help mitigate these fluctuations.

Conclusion:

Investing in the future of Uber and the broader driverless car market offers significant potential for growth, but it's crucial to understand the risks involved. ETFs provide a relatively accessible and diversified way to participate in this exciting sector. By carefully considering the key players, potential risks, and available investment vehicles, investors can position themselves to capitalize on the transformative potential of this technology. Start your journey towards profiting from the revolution in driverless car technology today. Research the ETFs mentioned in this article and consider how to incorporate driverless car investments into your portfolio for long-term growth. Don't miss out on the opportunity to invest in the future of transportation!

Featured Posts

-

Erdogan Ve Netanyahu Nun Karsilasmasi Abd Li Dergi Suriye Deki Gerilimi Degerlendirdi

May 18, 2025

Erdogan Ve Netanyahu Nun Karsilasmasi Abd Li Dergi Suriye Deki Gerilimi Degerlendirdi

May 18, 2025 -

2 2011

May 18, 2025

2 2011

May 18, 2025 -

Snls Marcello Hernandez A Hilarious Ram Fest Set

May 18, 2025

Snls Marcello Hernandez A Hilarious Ram Fest Set

May 18, 2025 -

Where To Invest Mapping The Countrys Rising Business Centers

May 18, 2025

Where To Invest Mapping The Countrys Rising Business Centers

May 18, 2025 -

Springsteen Calls Trump Treasonous Trump Responds

May 18, 2025

Springsteen Calls Trump Treasonous Trump Responds

May 18, 2025

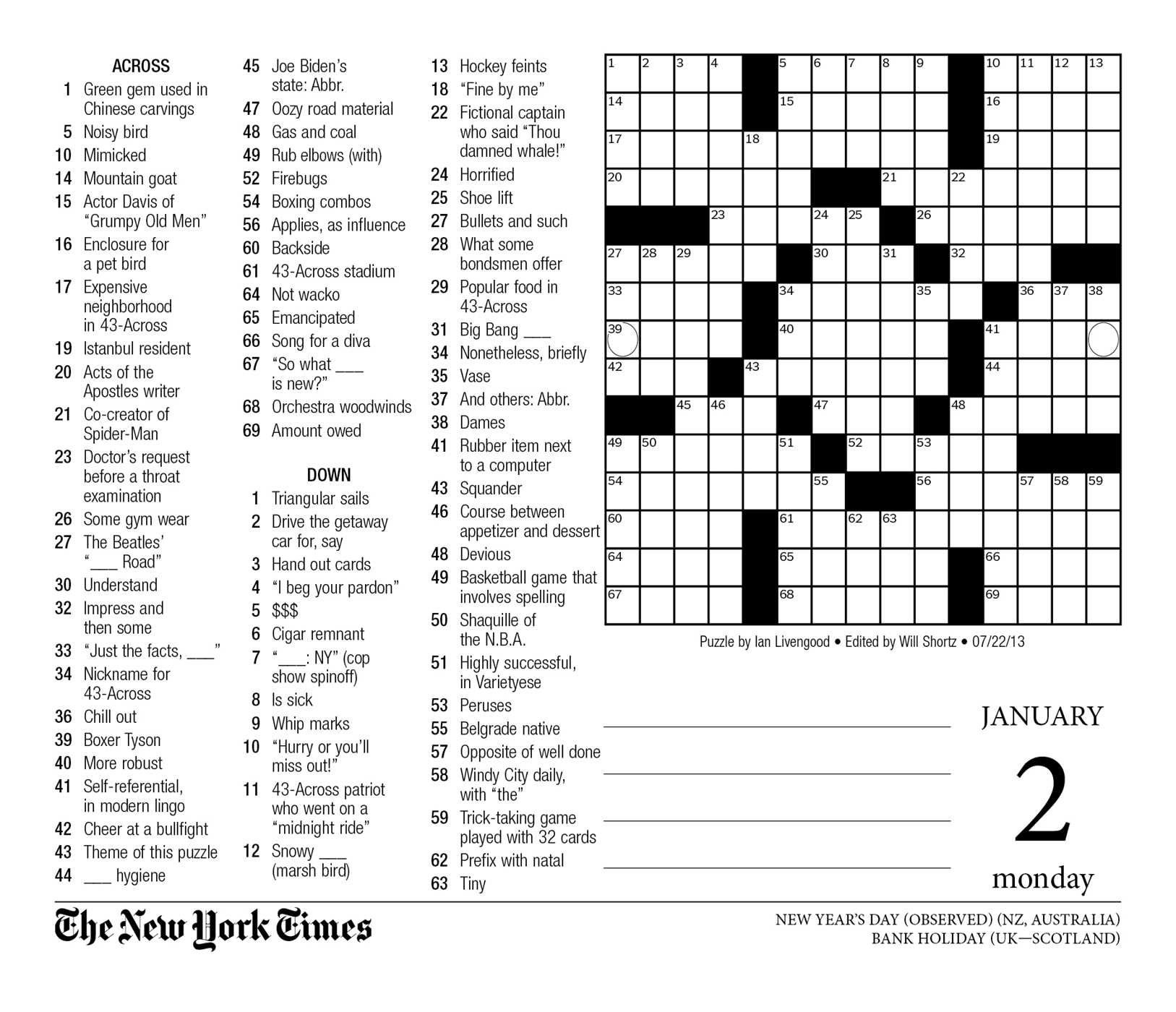

March 16 2025 Nyt Mini Crossword Solutions And Clues

March 16 2025 Nyt Mini Crossword Solutions And Clues