Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Market Valuations

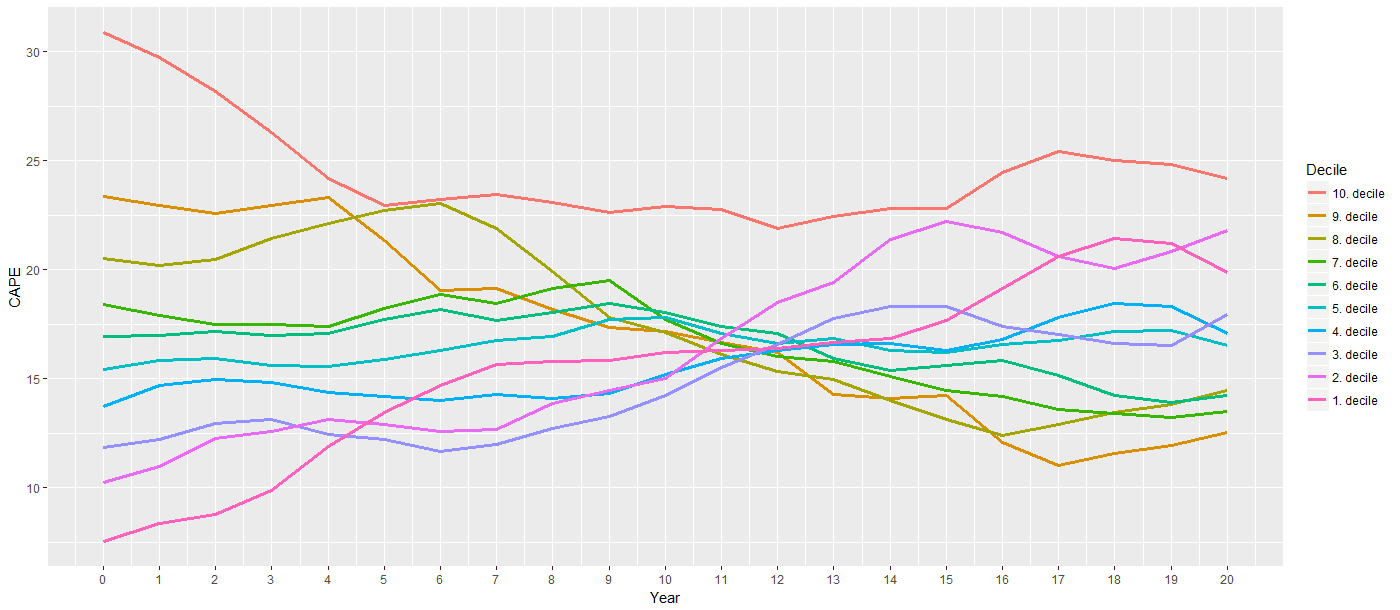

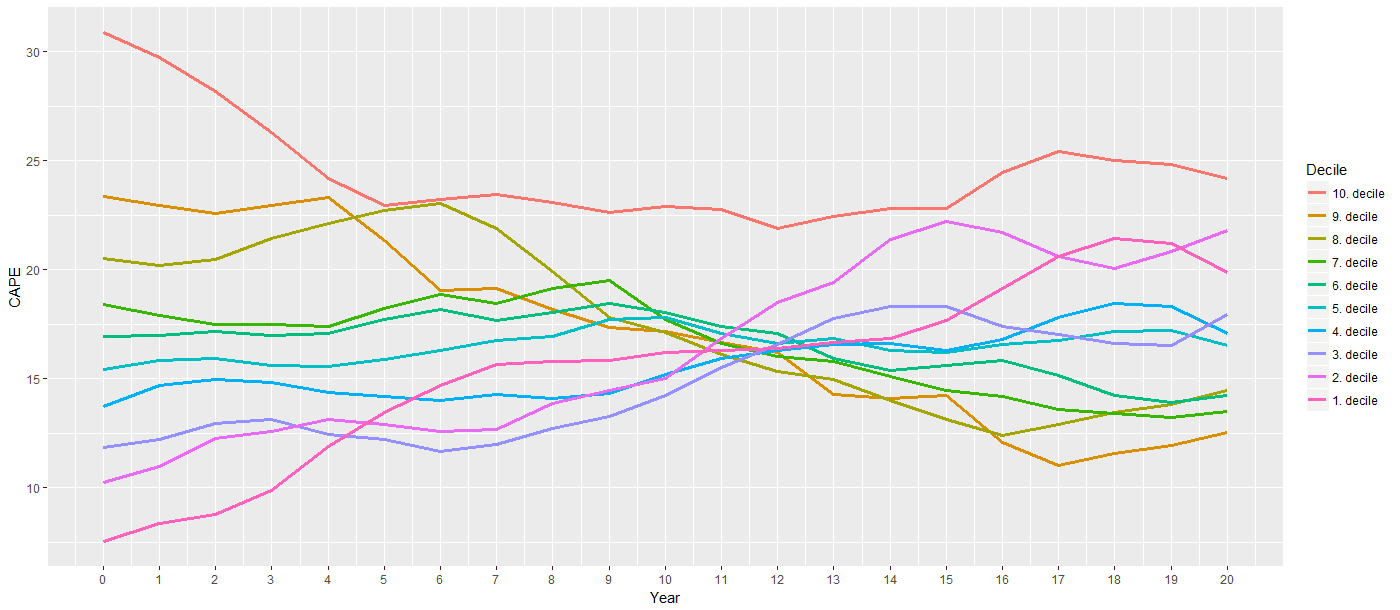

Bank of America's analysts continuously monitor the market, employing various valuation metrics to gauge the overall health and potential risks. Their BofA market outlook often considers factors beyond simple price-to-earnings ratios (P/E), incorporating more nuanced analyses like price-to-sales ratios, discounted cash flow (DCF) models, and other relevant market capitalization indicators.

While BofA doesn't offer a simple "overvalued" or "undervalued" blanket statement, their analysis often highlights specific sectors and individual stocks. Their findings often consider the interplay between current earnings, projected future growth, and prevailing interest rates.

- Summary of BofA's key findings regarding market valuations: BofA's reports typically avoid broad generalizations, focusing instead on granular analysis of specific sectors and companies. Their findings often suggest a mixed bag, with some sectors appearing richly valued while others offer more attractive entry points.

- Specific examples of stocks or sectors analyzed by BofA: BofA's research frequently covers a broad spectrum, analyzing major indices, individual blue-chip stocks, and emerging market opportunities. Their reports often pinpoint specific companies that exhibit strong fundamentals despite elevated valuations or conversely, those where valuations may outweigh intrinsic value.

- Mention of any alternative valuation metrics used beyond standard ratios: BofA's analysts employ a range of sophisticated valuation models, incorporating factors beyond traditional P/E ratios. This frequently includes DCF analysis, which considers future cash flows and the time value of money, adding a more predictive element to valuation.

Identifying the Sources of Investor Anxiety

The current market climate is fraught with factors contributing to investor apprehension. Understanding these sources of market uncertainty is crucial for developing a robust investment strategy.

- Impact of inflation on stock valuations: High inflation erodes purchasing power and increases the cost of doing business, potentially impacting corporate profitability and negatively affecting stock prices.

- The role of rising interest rates in impacting market sentiment: Higher interest rates increase borrowing costs for businesses and consumers, slowing economic growth and making bonds a more attractive alternative to stocks for some investors. This can lead to decreased demand and potentially lower stock prices.

- Geopolitical risks and their effect on market stability: Global events like the war in Ukraine introduce significant uncertainty, impacting supply chains, energy prices, and investor confidence. These events often contribute to market volatility.

- Analysis of recession probabilities and their implications: The threat of a recession looms large in many market analyses, and a downturn could significantly impact stock valuations, causing widespread corrections.

BofA's Recommended Investment Strategies

Given the concerns surrounding high stock market valuations, BofA typically advises a cautious approach, emphasizing risk management and portfolio diversification.

- Specific asset allocation recommendations from BofA: BofA's recommendations usually emphasize diversification across various asset classes, including stocks, bonds, and potentially alternative investments like real estate or commodities. The specific allocations will depend on individual risk tolerance and investment goals.

- Strategies for reducing portfolio volatility: Diversification, strategic asset allocation, and potentially hedging strategies are recommended to reduce the impact of market fluctuations. BofA likely suggests considering defensive sectors that tend to perform better during economic downturns.

- Discussion of defensive versus growth investment approaches: BofA's advice often involves a balance between growth stocks (with higher potential returns but also higher risk) and defensive stocks (with lower growth potential but greater stability). The optimal balance depends on individual risk profiles.

- Advice on managing risk within a portfolio: Proper risk management involves carefully assessing individual risk tolerance, setting realistic investment goals, and regularly reviewing and adjusting the portfolio based on market conditions and economic forecasts.

Long-Term Outlook and Potential Market Scenarios

BofA's market forecast usually acknowledges the inherent uncertainties in predicting future market performance. However, they often provide potential scenarios based on their economic outlook and analysis.

- BofA's prediction for future market performance: Their predictions are usually probabilistic rather than deterministic, outlining potential ranges of outcomes based on different economic scenarios.

- Discussion of potential market corrections and their magnitude: BofA's analyses often include discussions of the probability and potential severity of market corrections, highlighting the need for robust risk management strategies.

- BofA's outlook on economic growth in the coming years: Their projections consider various factors, including inflation rates, interest rate policies, and global economic conditions.

- Advice for long-term investors navigating market uncertainty: BofA generally recommends that long-term investors maintain a disciplined approach, sticking to their investment plan and avoiding impulsive decisions based on short-term market fluctuations.

Conclusion

This article has reviewed investor concerns about high stock market valuations and presented BofA's perspective on the current market climate. BofA's analysis highlights the need for careful risk management and diversified investment strategies in this uncertain environment. Their emphasis on granular analysis, sophisticated valuation metrics, and a balanced approach to growth and defensive investing provides a valuable framework for navigating these complex market conditions.

Understanding and responding effectively to concerns about high stock market valuations requires diligent research and a well-defined investment strategy. Continue to stay informed about BofA's market analysis and other expert opinions to navigate the complexities of high stock market valuations effectively.

Featured Posts

-

Becciu Condannato Dal Vaticano Il Risarcimento Agli Accusatori

Apr 30, 2025

Becciu Condannato Dal Vaticano Il Risarcimento Agli Accusatori

Apr 30, 2025 -

Understanding The Delays In Storm Damage Assessments In Kentucky

Apr 30, 2025

Understanding The Delays In Storm Damage Assessments In Kentucky

Apr 30, 2025 -

Ben Afflecks New Movie Shootout Scene With Gillian Anderson

Apr 30, 2025

Ben Afflecks New Movie Shootout Scene With Gillian Anderson

Apr 30, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th

Apr 30, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th

Apr 30, 2025 -

Revealed Coronation Streets Daisys Career Before Soap Fame

Apr 30, 2025

Revealed Coronation Streets Daisys Career Before Soap Fame

Apr 30, 2025