Investor Uncertainty: Japan's Steep Bond Curve And Its Market Effects

Table of Contents

Understanding Japan's Steepening Yield Curve

The Mechanics of a Steep Yield Curve

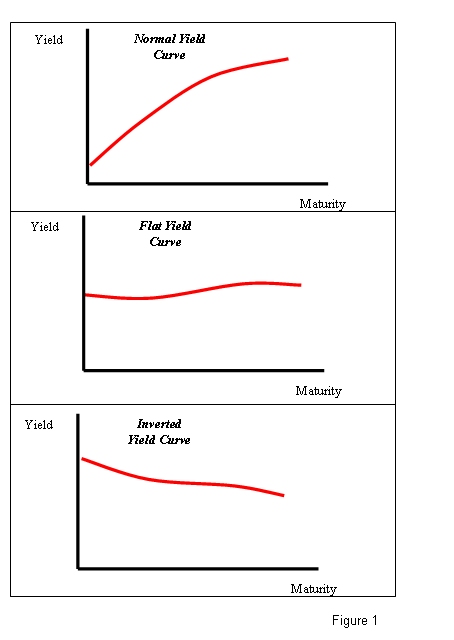

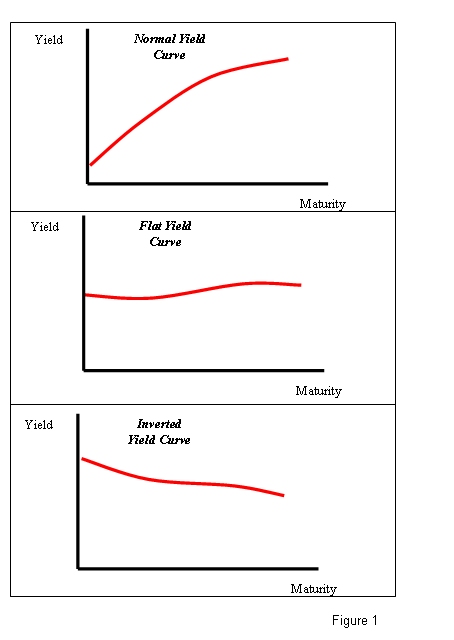

A steep yield curve, graphically represented as a significant upward slope, depicts a scenario where long-term interest rates are considerably higher than short-term interest rates. This typically signals market expectations of future economic growth and inflation. However, the current steepening of Japan's yield curve presents a unique and complex situation, deviating from the typical interpretations.

-

Definition of yield curve and its various shapes: A yield curve plots the interest rates (yields) of bonds with different maturities. A normal yield curve slopes upward, a flat yield curve shows similar yields across maturities, and an inverted yield curve slopes downward. Japan's curve, while traditionally flatter, is now exhibiting a pronounced steepening.

-

Factors contributing to the steepening: Several factors contribute to Japan's steepening yield curve, including: the Bank of Japan's (BOJ) recent policy adjustments, shifting inflation expectations fueled by global inflationary pressures and rising import costs, and the anticipation of future interest rate hikes. Global economic factors also play a significant role, including rising US Treasury yields.

-

Comparison with historical yield curve trends: Historically, Japan's yield curve has been relatively flat, a reflection of the BOJ's prolonged quantitative easing (QE) policies. The current steepening represents a stark departure from this long-standing trend, signaling a potential paradigm shift in Japanese monetary policy and market expectations.

The Bank of Japan's Role and Policy Shifts

The BOJ's Yield Curve Control (YCC) Policy

For years, the BOJ implemented its Yield Curve Control (YCC) policy, aiming to keep 10-year JGB yields around zero percent. This policy aimed to stimulate economic growth by keeping borrowing costs low. However, persistent inflation and global economic pressures forced a reevaluation of this strategy.

-

Explanation of the YCC policy and its intended effects: YCC was designed to manage long-term interest rates, intending to lower borrowing costs and encourage investment.

-

Analysis of recent changes: The BOJ recently announced adjustments to its YCC policy, allowing for greater flexibility in managing 10-year JGB yields. This signifies a shift away from its ultra-loose monetary policy. This move reflects the increasing pressure from rising inflation and the need for a more balanced approach to monetary policy.

-

Potential future policy adjustments: The future direction of BOJ policy remains uncertain. Further adjustments to the YCC framework or even its complete abandonment are possibilities, with significant consequences for Japan's bond market and the broader economy.

Impact on Investor Sentiment and Market Volatility

Uncertainty and Risk Aversion

The steepening yield curve has introduced considerable uncertainty, impacting investor sentiment both domestically and internationally. This uncertainty fuels risk aversion, leading to market volatility.

-

Fluctuations in the Japanese Yen: The steepening yield curve is closely linked to fluctuations in the Japanese Yen. A stronger Yen can impact exports and economic growth, creating further uncertainty.

-

Impact on Japanese stock market performance: The increased volatility in the JGB market has spilled over into the Japanese equity market, causing fluctuations in stock prices and impacting investor confidence.

-

Spillover effects on other global markets: The changes in Japan's bond market have global implications. The shift in investor sentiment and potential capital flows can influence US Treasury yields and other global equity markets, creating a ripple effect across the international financial system.

Long-Term Economic Implications for Japan

Inflationary Pressures and Economic Growth

The steepening yield curve presents both challenges and opportunities for the Japanese economy in the long term.

-

Potential for increased inflation: Higher interest rates, a consequence of the steepening yield curve, may lead to increased inflation, potentially impacting consumer spending and overall economic growth.

-

Effects on government borrowing costs: The rising yields on JGBs increase the government's borrowing costs, potentially straining fiscal sustainability and demanding difficult policy choices.

-

Long-term impact on Japan's economic competitiveness: The adjustments in monetary policy and the resulting changes in the cost of capital can affect Japan's competitiveness in the global market.

Conclusion

The steepening of Japan's yield curve represents a significant development with far-reaching implications. The Bank of Japan's policy response, the resulting investor uncertainty, and the potential long-term economic consequences for Japan necessitate careful monitoring and analysis. The shift from the long-standing, ultra-loose monetary policy era marks a period of considerable change and readjustment in the Japanese economy. Understanding the dynamics of Japan's steep bond curve is crucial for navigating the current market volatility. Stay updated on our analyses to make informed investment decisions concerning Japanese government bonds and related assets. [Link to relevant resources]

Featured Posts

-

Broadcaster Breens Lighthearted Banter With Mikal Bridges

May 17, 2025

Broadcaster Breens Lighthearted Banter With Mikal Bridges

May 17, 2025 -

Watch Seattle Mariners Vs Chicago Cubs Spring Training Free Online

May 17, 2025

Watch Seattle Mariners Vs Chicago Cubs Spring Training Free Online

May 17, 2025 -

Mlb Game Day Mariners Vs Reds Predictions And Betting Odds

May 17, 2025

Mlb Game Day Mariners Vs Reds Predictions And Betting Odds

May 17, 2025 -

Canadian Tire Acquires Hudsons Bay Assets For 30 Million

May 17, 2025

Canadian Tire Acquires Hudsons Bay Assets For 30 Million

May 17, 2025 -

The Post Roe Shift Over The Counter Birth Control And Its Implications

May 17, 2025

The Post Roe Shift Over The Counter Birth Control And Its Implications

May 17, 2025

Latest Posts

-

Two Decades On The Continued Impact Of Seattle Mariners Legend Ichiro Suzuki

May 17, 2025

Two Decades On The Continued Impact Of Seattle Mariners Legend Ichiro Suzuki

May 17, 2025 -

The Impact Of False Angel Reese Quotes On Social Media

May 17, 2025

The Impact Of False Angel Reese Quotes On Social Media

May 17, 2025 -

The Lasting Influence Of Ichiro Suzuki A Look Back At Two Decades Of Excellence

May 17, 2025

The Lasting Influence Of Ichiro Suzuki A Look Back At Two Decades Of Excellence

May 17, 2025 -

First Inning Domination Mariners 14 0 Shutout Of Marlins

May 17, 2025

First Inning Domination Mariners 14 0 Shutout Of Marlins

May 17, 2025 -

Identifying And Reporting Fake Angel Reese Quotes

May 17, 2025

Identifying And Reporting Fake Angel Reese Quotes

May 17, 2025