Iran Plastics Exports To China Jeopardized By US Sanctions

Table of Contents

The Impact of US Sanctions on Iranian Businesses

US sanctions significantly impede Iran's ability to engage in international trade, particularly impacting its plastics exports to China. These restrictions create a complex web of challenges for Iranian businesses.

Financial Restrictions

US sanctions severely restrict Iran's access to the international financial system, making transactions with Chinese importers incredibly difficult. This creates significant hurdles in the already complex process of international trade.

- Difficulty in opening Letters of Credit (LCs): Banks are hesitant to process LCs for Iranian businesses due to the risk of sanctions violations. This makes securing financing for exports extremely challenging.

- Challenges in accessing international payment systems like SWIFT: Exclusion from SWIFT, the global interbank financial telecommunication network, significantly limits Iran's ability to conduct secure and efficient international payments.

- Increased reliance on less transparent and riskier payment methods: The lack of access to traditional banking channels forces Iranian businesses to rely on alternative, often less secure and more costly, payment methods. This increases vulnerability to fraud and financial instability.

- Higher transaction costs and delays: The complexities and risks associated with sanctioned transactions lead to higher costs and significantly longer processing times, impacting profitability and competitiveness.

Shipping and Logistics Hurdles

Beyond financial constraints, sanctions also create significant logistical challenges for Iranian plastics exports to China.

- Difficulty securing insurance for shipments: Insurers are reluctant to cover shipments to or from Iran due to the sanctions-related risks, increasing costs and uncertainties for exporters.

- Limited access to international shipping lines: Many international shipping companies avoid carrying Iranian goods to avoid potential sanctions violations, reducing available shipping options and increasing costs.

- Increased scrutiny of shipments by various countries: Shipments from Iran are subject to increased scrutiny by customs authorities in various countries, potentially leading to delays and seizures.

- Risk of cargo seizure or delays: The risk of cargo seizure or prolonged delays due to sanctions compliance checks adds to the uncertainty and cost of transporting goods.

The Diminishing Trade Volume Between Iran and China in Plastics

The impact of US sanctions is clearly reflected in the declining trade volume between Iran and China in the plastics sector. While precise figures are difficult to obtain due to the opacity surrounding sanctioned trade, anecdotal evidence and reports suggest a considerable downturn.

Decreasing Exports

The volume of Iranian plastics exports to China has demonstrably decreased since the intensification of US sanctions. Specific plastics like polyethylene (PE) and polypropylene (PP), commonly used in packaging and various manufacturing processes, are among the most affected.

- Data on export volume decline (if available): While precise quantitative data is scarce due to the nature of sanctioned trade, reports from industry analysts and trade publications indicate a significant drop in export volumes. Further research into this area is necessary.

- Impact on specific Iranian plastic manufacturing companies: Numerous Iranian plastic manufacturers have reported significant losses in revenue and market share due to the inability to export to China.

- Analysis of market share loss to competitors: Competitors from other countries, particularly in the Middle East and Asia, have filled the gap created by the decline in Iranian plastics exports to China.

Chinese Businesses' Concerns

The challenges extend beyond Iranian businesses; Chinese importers also face significant difficulties sourcing Iranian plastics.

- Increased risks and uncertainties associated with sourcing from Iran: The inherent risks of sanctions violations and the resulting financial and legal repercussions deter many Chinese companies from engaging in trade with Iran.

- Potential for reputational damage due to sanctions compliance issues: Chinese companies risk reputational damage and potential legal action if found to be in violation of US sanctions.

- Loss of a potentially cost-effective supplier: Despite the challenges, Iran remains a potentially cost-effective supplier of plastics for China. The loss of this supply source represents an economic disadvantage for some Chinese businesses.

Potential Alternatives and Mitigation Strategies

Despite the significant challenges, Iranian businesses and their Chinese partners are exploring alternative strategies to mitigate the impact of US sanctions.

Exploring Alternative Trade Routes

One strategy is to explore alternative trade routes that circumvent direct transactions between Iran and China.

- Potential intermediary countries: Third-party countries with less stringent sanctions enforcement may act as intermediaries, facilitating trade between Iran and China. However, this often adds complexity and costs.

- Challenges and complexities of using intermediary countries: Utilizing intermediary countries increases transaction costs, time, and logistical complexity, making this option less appealing for many businesses.

- Increased costs associated with these alternative routes: The indirect nature of these routes naturally leads to higher costs compared to direct trade.

Adapting to Sanctions

Iranian businesses are also adapting their strategies to navigate the sanctions environment.

- Diversification of export markets: Seeking alternative export markets to reduce reliance on China can lessen the impact of restricted trade with China.

- Investment in domestic consumption: Focusing on the domestic market can provide a more stable and reliable source of revenue.

- Negotiating more favorable payment terms with Chinese partners: Innovative payment solutions and flexible agreements may help to mitigate some of the financial challenges.

- Strengthening compliance programs: Implementing robust compliance programs to minimize sanctions risks is crucial for reducing exposure to legal and financial penalties.

Conclusion

US sanctions pose a significant threat to Iran's plastics exports to China, impacting both Iranian producers and Chinese importers. The difficulties in international finance, shipping, and overall trade risk severely curtailing this important economic relationship. While alternative strategies exist, they are often costly and complex. The future of Iran plastics exports to China hinges on a resolution of the sanctions or a successful adaptation by businesses on both sides. Understanding the challenges and potential solutions is crucial for navigating this complex geopolitical and economic landscape. Further research into the ongoing impact of US sanctions on Iran's plastics trade with China is warranted.

Featured Posts

-

Ayesha Currys Approach To A Successful Marriage

May 07, 2025

Ayesha Currys Approach To A Successful Marriage

May 07, 2025 -

Cobra Kai And The Karate Kid Exploring The Netflix Shows Connections

May 07, 2025

Cobra Kai And The Karate Kid Exploring The Netflix Shows Connections

May 07, 2025 -

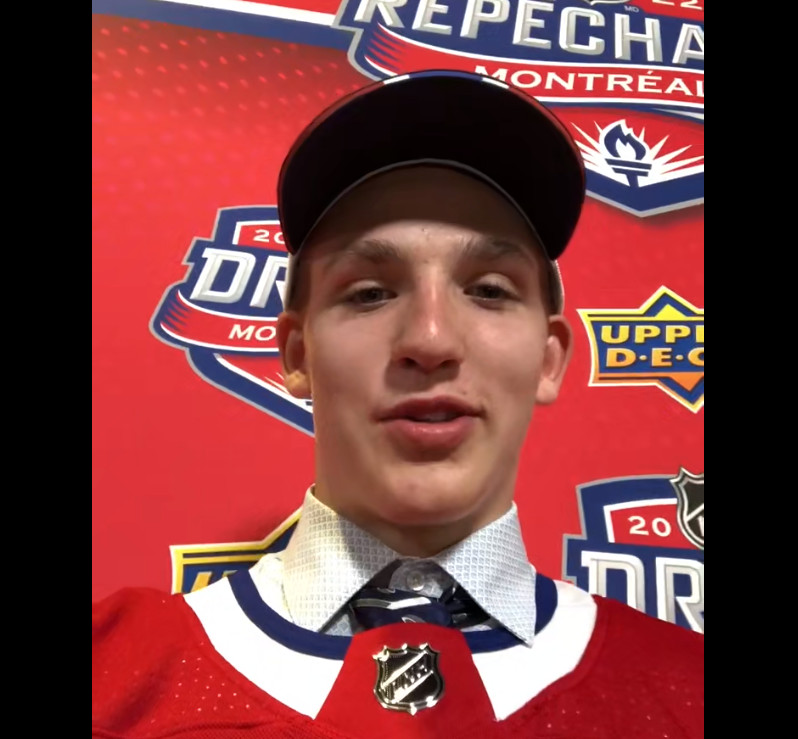

Lane Hutson Un Futur Defenseur Numero 1 Dans La Lnh

May 07, 2025

Lane Hutson Un Futur Defenseur Numero 1 Dans La Lnh

May 07, 2025 -

Ayesha Curry Prioritizes Marriage Over Children A Closer Look

May 07, 2025

Ayesha Curry Prioritizes Marriage Over Children A Closer Look

May 07, 2025 -

Drogi S8 I S16 Kluczowy Element Zrownowazonego Rozwoju Wg Nawrockiego

May 07, 2025

Drogi S8 I S16 Kluczowy Element Zrownowazonego Rozwoju Wg Nawrockiego

May 07, 2025