Iron Ore Market Forecast: Considering China's Steel Production Adjustments

Table of Contents

The global iron ore market is experiencing significant shifts driven primarily by adjustments in China's steel production. This forecast analyzes the evolving dynamics, considering the implications of China's policies on iron ore prices, supply chains, and the overall health of the global steel industry. Understanding these changes is crucial for stakeholders across the entire iron ore value chain, from mining companies and steel mills to investors and policymakers. The iron ore market forecast requires a keen eye on China's evolving steel sector.

China's Steel Production Slowdown and its Impact on Iron Ore Demand

China's steel production, historically a major driver of global iron ore demand, is undergoing a significant slowdown. This has profound implications for the entire iron ore market forecast.

Reduced Infrastructure Spending

The decrease in infrastructure projects within China is a key factor influencing reduced steel demand. This impacts the iron ore market forecast significantly.

- Examples of reduced projects: High-speed rail expansion, large-scale bridge construction, and ambitious urban development projects have seen significant scaling back.

- Impact on steel consumption: The reduced construction activity translates directly into lower steel consumption, creating a ripple effect throughout the supply chain.

- Ripple effects on iron ore imports: China, being the world's largest importer of iron ore, sees a direct reduction in its import volume, impacting prices and impacting the iron ore market forecast.

Reduced infrastructure spending significantly impacts the quantity of steel needed, thus reducing the demand for the raw material, iron ore. The quantitative impact is substantial; analysts predict a decrease of X% in steel demand leading to a Y% reduction in iron ore imports, based on recent government spending data and industry reports. This directly impacts the iron ore market forecast.

Environmental Regulations and Carbon Emission Targets

China's commitment to stricter environmental policies and its ambitious carbon neutrality goals are further curbing steel production. This is another crucial aspect of the iron ore market forecast.

- Specific regulations impacting steel mills: New regulations on emissions, energy consumption, and waste disposal are forcing steel mills to either reduce production or invest heavily in cleaner technologies.

- The push for cleaner steel production: The transition to cleaner steel production methods, while essential for environmental sustainability, necessitates significant capital investment and potential temporary production slowdowns, further impacting the iron ore market forecast.

- Implications for iron ore demand in the short and long term: In the short term, we see a reduction in iron ore demand. Long-term, the impact depends on the speed of technological adoption and the success of initiatives aimed at decarbonizing the steel industry.

The implementation of these environmental regulations is a significant challenge. However, technological advancements, such as the adoption of electric arc furnaces and hydrogen-based steelmaking, offer potential solutions to mitigate the negative impact on steel production while achieving carbon emission reduction targets. This is a crucial factor to be considered when analyzing the iron ore market forecast.

Global Iron Ore Supply and Price Dynamics

The global iron ore market forecast also considers the supply side, including the actions of major producers and price volatility.

Major Iron Ore Producers and Their Strategies

Australia and Brazil are the dominant players in the global iron ore market. Their production strategies and responses to the changing demand from China significantly shape the iron ore market forecast.

- Production capacities: Australia and Brazil possess vast iron ore reserves and significant production capacity.

- Export volumes: Their export volumes directly influence global iron ore supply and prices.

- Market share: These two nations hold the lion's share of the global iron ore export market.

- Potential for increased or decreased production: Their response to reduced demand from China will significantly influence price stability and the overall iron ore market forecast.

Supply chain disruptions, such as logistical challenges and geopolitical instability, can also impact the availability and cost of iron ore, adding further complexity to the iron ore market forecast.

Price Volatility and Forecasting Models

Iron ore prices are notoriously volatile, influenced by a multitude of factors. Accurate prediction is challenging, requiring sophisticated forecasting models.

- Key factors influencing price volatility: Speculation, geopolitical events (e.g., trade wars), currency fluctuations, and unexpected supply chain disruptions all contribute to price volatility and shape the iron ore market forecast.

- Different forecasting models and their accuracy: Various models, ranging from simple time-series analysis to complex econometric models, are used to predict future prices. However, the accuracy of these models is often limited.

- Limitations of forecasting models: The complexity of the iron ore market, the influence of unpredictable events, and inherent uncertainties in data make accurate long-term forecasting incredibly challenging.

Understanding the limitations of these models is critical when interpreting the iron ore market forecast.

Opportunities and Challenges for the Iron Ore Market

While challenges exist, opportunities also emerge in the iron ore market forecast.

Emerging Markets and Demand Growth

Developing economies outside China present potential for increased iron ore demand, offering a counterbalance to the slowdown in China.

- Growth projections in specific regions: India, Southeast Asia, and Africa are experiencing rapid infrastructure development, driving steel demand and thus iron ore demand. This influences the iron ore market forecast.

- Infrastructure development plans: Massive infrastructure projects in these regions are fueling significant growth in steel and iron ore consumption.

- Impact on iron ore consumption: This increased demand could offset some of the reduction in demand from China, shaping the iron ore market forecast positively.

However, political and economic instability in some of these regions presents risks. This is a key factor for the iron ore market forecast.

Technological Advancements in Steelmaking

Innovative steelmaking technologies offer the potential to reshape the iron ore market in the long term.

- Examples of new technologies: Hydrogen-based steelmaking, for instance, promises a significant reduction in carbon emissions and potentially lower iron ore consumption per unit of steel produced.

- Their potential for reducing iron ore consumption: If widely adopted, these technologies could alter the demand for iron ore significantly, requiring adjustments to the iron ore market forecast.

- Timeline for adoption: The speed at which these technologies are adopted will be a key factor influencing the long-term iron ore market forecast.

The long-term implications of these advancements are profound and need careful consideration when constructing the iron ore market forecast.

Conclusion

The iron ore market forecast is complex and depends on several intertwined factors. China's steel production adjustments, driven by reduced infrastructure spending and stricter environmental regulations, significantly impact global iron ore demand. However, the strategies of major producers, price volatility, and emerging market opportunities add layers of complexity. Technological advancements in steelmaking could reshape the future demand for iron ore. Staying informed on these evolving dynamics is crucial for navigating the iron ore market effectively. Continue your research and stay updated on the latest developments in the global iron ore and steel sectors to develop a robust iron ore market forecast.

Featured Posts

-

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 09, 2025

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 09, 2025 -

Disney Profit Increases Parks And Streaming Fuel Positive Forecast

May 09, 2025

Disney Profit Increases Parks And Streaming Fuel Positive Forecast

May 09, 2025 -

Bao Hanh Tre Em Tien Giang Phai Xu Ly Nghiem Cac Bao Mau

May 09, 2025

Bao Hanh Tre Em Tien Giang Phai Xu Ly Nghiem Cac Bao Mau

May 09, 2025 -

Manchester Uniteds De Ligt Inter Milans Shock Loan Pursuit

May 09, 2025

Manchester Uniteds De Ligt Inter Milans Shock Loan Pursuit

May 09, 2025 -

The Impact Of Daycare On Children Evidence Based Insights

May 09, 2025

The Impact Of Daycare On Children Evidence Based Insights

May 09, 2025

Latest Posts

-

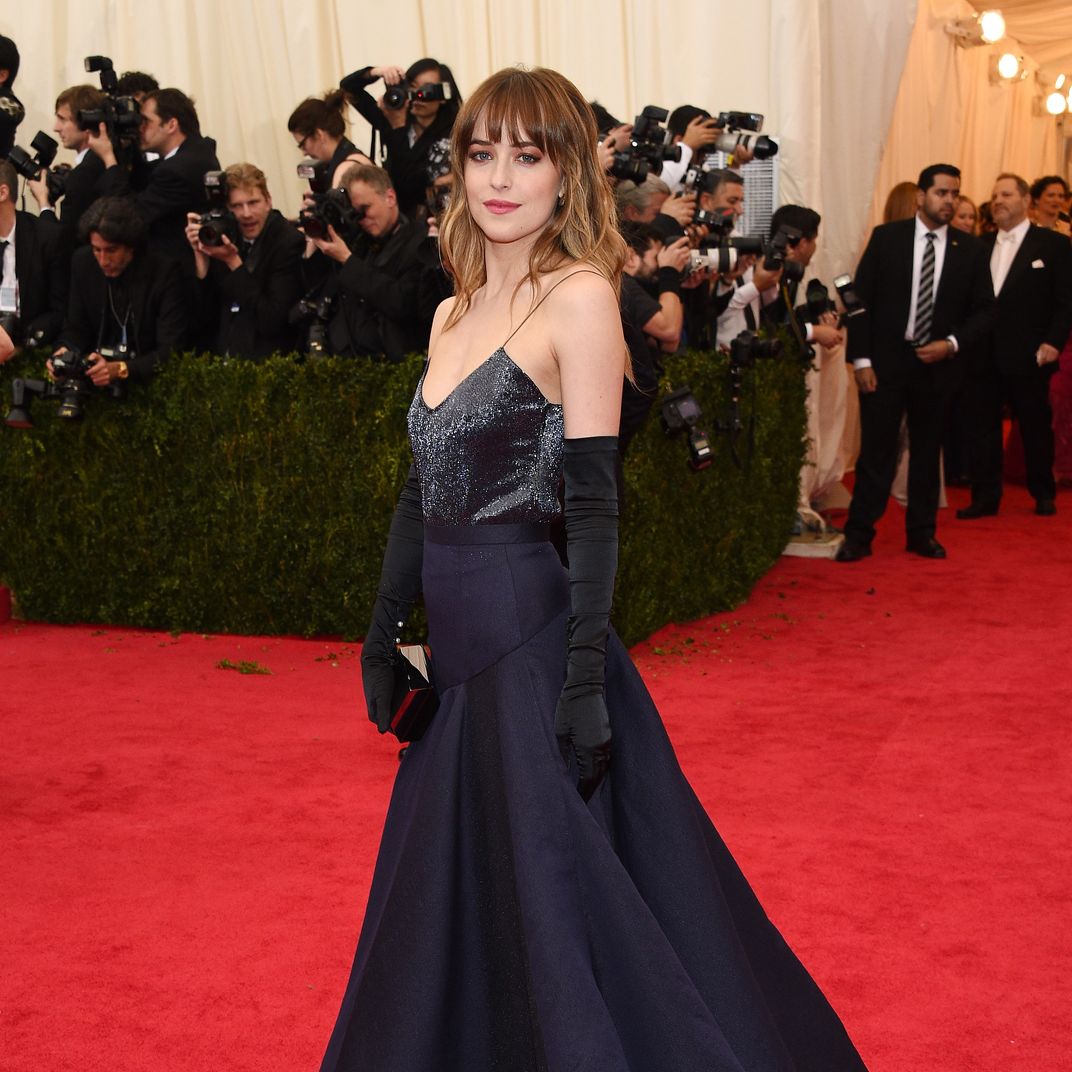

Dakota Johnsons Spring Dress A Mother Daughter Fashion Moment

May 09, 2025

Dakota Johnsons Spring Dress A Mother Daughter Fashion Moment

May 09, 2025 -

Dakota Johnson And Melanie Griffiths Chic Spring Style

May 09, 2025

Dakota Johnson And Melanie Griffiths Chic Spring Style

May 09, 2025 -

Exploring The Relationship Between Dakota Johnsons Roles And Chris Martins Influence

May 09, 2025

Exploring The Relationship Between Dakota Johnsons Roles And Chris Martins Influence

May 09, 2025 -

Has Chris Martins Influence Shaped Dakota Johnsons On Screen Persona

May 09, 2025

Has Chris Martins Influence Shaped Dakota Johnsons On Screen Persona

May 09, 2025 -

Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025

Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025