Iron Ore Market Volatility: The Role Of China's Steel Production Cuts

Table of Contents

China's Steel Production and its Impact on Iron Ore Demand

The Dependence of Iron Ore on Chinese Steel

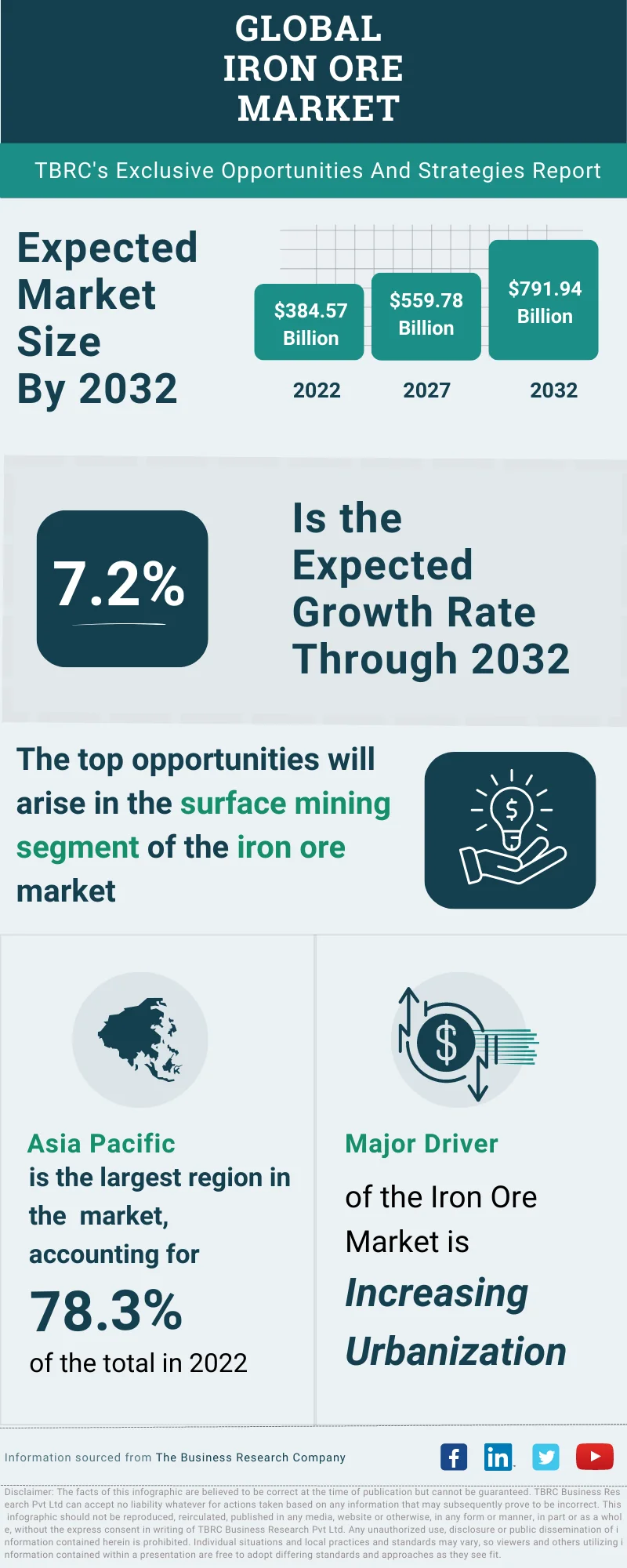

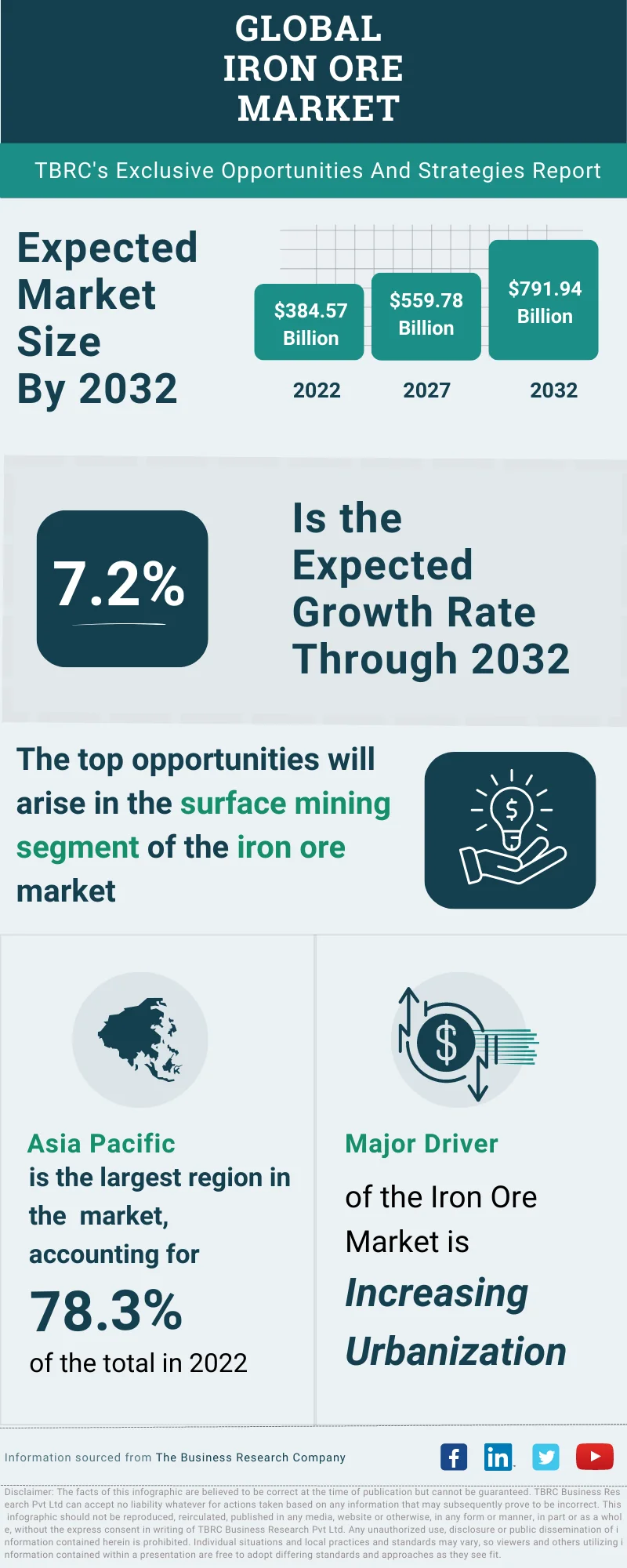

China's colossal steel industry holds an undeniable grip on the global iron ore market. The country consumes well over half of the world's iron ore production, making it the undisputed kingpin in this vital raw materials market. Any alteration in China's steel output directly and significantly impacts global iron ore demand.

- China's Steel Production Dominance: China's steel production accounts for approximately 50-60% of global output, dwarfing other major producers like India, Japan, and the United States. This sheer scale underscores its influence on iron ore prices.

- Direct Correlation: China's iron ore imports are intrinsically linked to its steel production levels. A rise in steel production translates into increased iron ore imports, and vice-versa. This correlation is a key driver of iron ore market volatility.

- Statistical Evidence: Analyzing historical data showcasing the parallel trends between Chinese steel output and iron ore imports paints a clear picture of this dependency. Periods of robust steel production correlate with soaring iron ore imports, while production cuts trigger a sharp decline in demand.

Government Regulations and Environmental Policies

China's commitment to environmental sustainability and curbing pollution has led to significant government initiatives impacting steel production. These policies, aimed at achieving ambitious carbon emission reduction targets, have resulted in production cuts and consequently, influenced iron ore prices.

- Environmental Policies: The implementation of stricter environmental regulations, including emission caps and limitations on production capacity, has forced steel mills to reduce output.

- Carbon Emission Reduction Targets: China's ambitious carbon neutrality goals necessitate a significant reduction in carbon emissions across various sectors, including steel production. These targets are driving production adjustments.

- Policy Effectiveness: While the environmental impact of these policies is positive, their influence on the iron ore market is undeniably volatile, creating uncertainty for market participants.

The Ripple Effect on Global Iron Ore Prices

Price Fluctuations and Market Sentiment

Decreased demand from China, a consequence of production cuts, creates an oversupply of iron ore in the global market. This surplus directly translates into a downward pressure on iron ore prices. This price drop further impacts market sentiment, leading to decreased investment and a cautious approach by market players.

- Mechanism of Price Drops: Basic supply and demand economics dictates that an excess supply relative to demand drives prices lower. Reduced Chinese demand amplifies this effect in the iron ore market.

- Speculation and Market Psychology: Market sentiment plays a significant role. Anticipating further production cuts or policy changes can trigger speculative selling, exacerbating price declines.

- Historical Examples: Reviewing historical data reveals a clear link between periods of reduced Chinese steel production and corresponding drops in iron ore prices. These events serve as clear illustrations of market dynamics.

Impact on Iron Ore Producing Countries

The reduced demand stemming from China's production cuts has significant implications for iron ore-exporting nations. Their economies, often heavily reliant on iron ore revenue, experience considerable impacts.

- Economies Reliant on Iron Ore Exports: Countries like Australia, Brazil, and several African nations are heavily dependent on iron ore exports. Fluctuations in iron ore prices directly affect their GDP and foreign exchange earnings.

- Impact on Employment and Revenue: Reduced demand can lead to job losses in the mining sector and decreased government revenue, impacting public services and economic development.

- Diversification Strategies: To mitigate risks, many iron ore-dependent nations are actively exploring diversification strategies to lessen their reliance on this single commodity.

Future Outlook and Potential Mitigation Strategies

Predicting Future Trends

Forecasting future trends in the iron ore market requires careful consideration of future Chinese steel production. This involves analyzing factors like government policies, infrastructure projects, and the broader global demand for steel.

- Expert Predictions: Analyzing expert predictions on China's future steel output offers insights into potential future iron ore price movements.

- Infrastructure Spending: Large-scale infrastructure projects in China and other emerging economies can significantly influence steel (and thus iron ore) demand.

- Global Steel Demand: Growth in steel consumption from other countries can partially offset reduced Chinese demand, influencing the overall market equilibrium.

Strategies for Managing Volatility

Mitigating risks associated with iron ore price volatility necessitates employing effective risk management strategies. This includes diversification, hedging, and long-term contracts.

- Risk Management Strategies: Iron ore producers and consumers need to implement strategies such as hedging to mitigate price fluctuations and secure stable pricing.

- Hedging and Long-Term Contracts: Hedging using financial instruments and entering into long-term contracts can help lock in prices and reduce exposure to market volatility.

- Alternative Investment Strategies: Diversifying investment portfolios and exploring alternative investments can minimize dependence on the iron ore market.

Conclusion

The iron ore market's volatility is undeniably intertwined with the ebb and flow of China's steel production. Understanding this dynamic relationship is crucial for all stakeholders, from miners to steel manufacturers and investors. By meticulously analyzing trends, implementing effective risk management strategies, and diversifying investments, businesses can better navigate the challenges presented by iron ore market volatility. Staying abreast of developments in Chinese steel production and environmental policies is vital for success in this dynamic market. Continue to monitor the iron ore price and related news for informed decision-making.

Featured Posts

-

Sergio Perez And Franco Colapintos Emotional Tributes After F1 Tragedy

May 09, 2025

Sergio Perez And Franco Colapintos Emotional Tributes After F1 Tragedy

May 09, 2025 -

Nepogoda V Yaroslavskoy Oblasti Gotovnost K Snegopadam

May 09, 2025

Nepogoda V Yaroslavskoy Oblasti Gotovnost K Snegopadam

May 09, 2025 -

Snegopad V Permi Aeroport Zakryt Do 4 00

May 09, 2025

Snegopad V Permi Aeroport Zakryt Do 4 00

May 09, 2025 -

Tien Giang Dieu Tra Ky Luong Vu Bao Mau Bao Hanh Tre Em

May 09, 2025

Tien Giang Dieu Tra Ky Luong Vu Bao Mau Bao Hanh Tre Em

May 09, 2025 -

Colapinto Rumors Williams Team Principals Statement On Doohans Future

May 09, 2025

Colapinto Rumors Williams Team Principals Statement On Doohans Future

May 09, 2025

Latest Posts

-

London Outing Harry Styles Rocks A Retro Mustache

May 09, 2025

London Outing Harry Styles Rocks A Retro Mustache

May 09, 2025 -

Harry Styles New Mustache A 70s Vibe In London

May 09, 2025

Harry Styles New Mustache A 70s Vibe In London

May 09, 2025 -

Nottingham Attacks Police Misconduct Meeting Scheduled

May 09, 2025

Nottingham Attacks Police Misconduct Meeting Scheduled

May 09, 2025 -

Singer Harry Styles Spotted With A Seventies Style Moustache In London

May 09, 2025

Singer Harry Styles Spotted With A Seventies Style Moustache In London

May 09, 2025 -

Officers Face Misconduct Meeting Nottingham Attacks Investigation

May 09, 2025

Officers Face Misconduct Meeting Nottingham Attacks Investigation

May 09, 2025