Iron Ore Price Plunge: China's Steel Output Restrictions And Market Consequences

Table of Contents

China's Steel Production Curbs: The Primary Driver

China's steel industry, the world's largest, is facing unprecedented pressure to curb production. This is primarily driven by two major factors: stringent environmental regulations and a slowdown in the real estate market.

Environmental Regulations and Carbon Emission Targets

China's commitment to reducing carbon emissions and achieving its ambitious environmental targets is significantly impacting steel production. The country is implementing increasingly stricter emission standards for steel mills, leading to production cuts and increased scrutiny.

- Increased scrutiny of steel mills: Authorities are conducting more frequent inspections, imposing heavier penalties for non-compliance, and pushing for greater transparency in emissions reporting.

- Stricter emission standards: New, more stringent regulations are forcing steel mills to invest heavily in pollution control technologies or risk facing significant fines and production halts. This directly contributes to the iron ore price plunge as demand decreases.

- Penalties for non-compliance: The penalties for exceeding emission limits are substantial, creating a strong incentive for steel mills to reduce their output. This has a direct and immediate impact on the demand for iron ore.

- Government initiatives to promote green steel production: While aiming for long-term sustainability, these initiatives in the short-term reduce overall steel production, impacting the iron ore price. The transition to green steel is a long-term solution, but currently contributes to reduced demand.

Keywords: China steel production cuts, environmental regulations iron ore, carbon emission targets impact on iron ore.

Real Estate Market Slowdown and Reduced Steel Demand

The slowdown in China's real estate sector, fueled by the Evergrande crisis and government measures to curb property speculation, has significantly reduced the demand for steel. Construction activity, a major consumer of steel, has dramatically decreased.

- Impact of Evergrande crisis: The financial difficulties faced by Evergrande and other major developers have led to a significant decrease in new construction projects. This translates directly to lower demand for steel.

- Reduced construction activity: Government regulations aimed at controlling property prices and speculation have resulted in a significant slowdown in construction across the country.

- Lower demand for steel reinforcing bars: Reinforcing bars, a crucial component in construction, are amongst the hardest hit. The drop in demand is a key contributor to the iron ore price plunge.

- Government measures to control property speculation: These measures, while aimed at long-term market stability, have had a significant short-term impact on steel demand, directly impacting the price of iron ore.

Keywords: China real estate, steel demand slowdown, iron ore price forecast, construction activity impact.

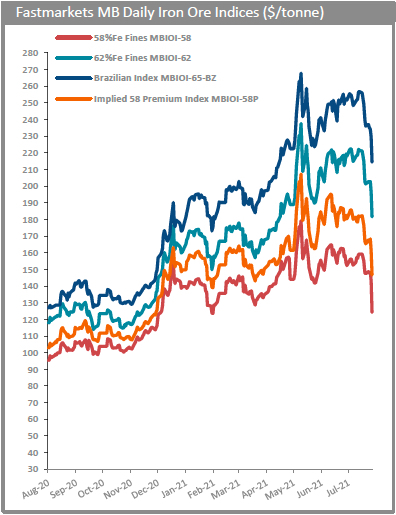

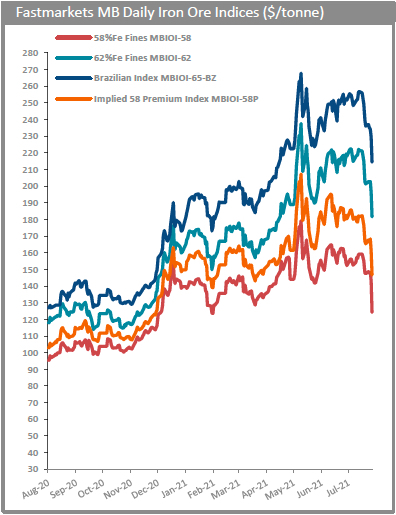

Global Market Consequences of the Iron Ore Price Plunge

The iron ore price plunge isn't confined to China; it has far-reaching global consequences.

Impact on Iron Ore Mining Companies

Major iron ore producers like BHP, Rio Tinto, and Vale are facing significant financial challenges due to the price decline.

- Reduced profits: Lower iron ore prices directly translate to reduced profits for mining companies.

- Stock price fluctuations: The uncertainty surrounding the iron ore market has led to significant fluctuations in the stock prices of these major players.

- Potential job losses: Mining companies are likely to implement cost-cutting measures, which may include workforce reductions.

- Cost-cutting measures: To offset the impact of lower prices, mining companies are streamlining operations and reducing exploration budgets.

- Exploration budget reductions: Investment in future projects may be deferred or cancelled altogether, impacting long-term growth.

Keywords: BHP iron ore price, Rio Tinto production cuts, Vale profit margins, iron ore mining industry outlook.

Ripple Effects on Related Industries

The decline in iron ore prices has ripple effects throughout related industries.

- Decreased steel prices: Lower iron ore costs translate to lower steel prices, impacting steel mills' profitability.

- Reduced profitability for steel mills: Steel mills are facing reduced margins and are struggling to maintain profitability.

- Impact on shipping and logistics companies: Reduced volumes of iron ore transported lead to lower revenue for shipping and logistics companies.

- Potential job losses in related industries: The overall slowdown in the steel industry could lead to job losses in related sectors.

Keywords: Steel price forecast, iron ore price impact on steel industry, shipping industry affected by iron ore price.

Future Outlook and Predictions for the Iron Ore Market

While the current outlook is challenging, several factors could influence a potential recovery.

Potential for Price Recovery

Several factors could lead to a rebound in iron ore prices.

- Increased infrastructure spending in other countries: Increased investment in infrastructure projects globally could boost demand for iron ore.

- Global economic recovery: A stronger global economy could stimulate demand for steel and, consequently, iron ore.

- Potential easing of Chinese restrictions: A potential relaxation of environmental regulations in China could lead to increased steel production and higher iron ore demand.

- Changes in supply dynamics: Unexpected disruptions to supply from other major producers could also contribute to price increases.

Keywords: Iron ore price prediction, iron ore market recovery, future of iron ore.

Long-Term Trends and Sustainability

The long-term outlook for iron ore is intertwined with the global push towards sustainable development and the transition to green steel.

- Demand for sustainable steel: Growing environmental concerns are driving increased demand for steel produced with sustainable and environmentally friendly methods.

- Investment in green technologies: The development and adoption of green technologies in steel production will play a crucial role in shaping the future of the iron ore market.

- Impact of government policies promoting sustainable practices: Government policies and incentives aimed at promoting sustainable steel production will influence both supply and demand.

Keywords: Green steel, sustainable iron ore, future of iron ore industry, responsible sourcing.

Conclusion

The dramatic iron ore price plunge is primarily driven by China's stringent steel output restrictions, impacting both the global iron ore market and related industries. While the short-term outlook remains uncertain, understanding the interplay between environmental regulations, economic slowdowns, and global demand is crucial for navigating this volatile market. Stay informed about developments affecting the iron ore price and related factors to make informed decisions. Continuously monitor the iron ore price plunge and its repercussions for a comprehensive understanding of the market.

Featured Posts

-

Three Countries Targeted In Uks New Asylum Crackdown Policy

May 10, 2025

Three Countries Targeted In Uks New Asylum Crackdown Policy

May 10, 2025 -

Family Devastated A Brutal Unprovoked Racist Murder Leaves A Community In Mourning

May 10, 2025

Family Devastated A Brutal Unprovoked Racist Murder Leaves A Community In Mourning

May 10, 2025 -

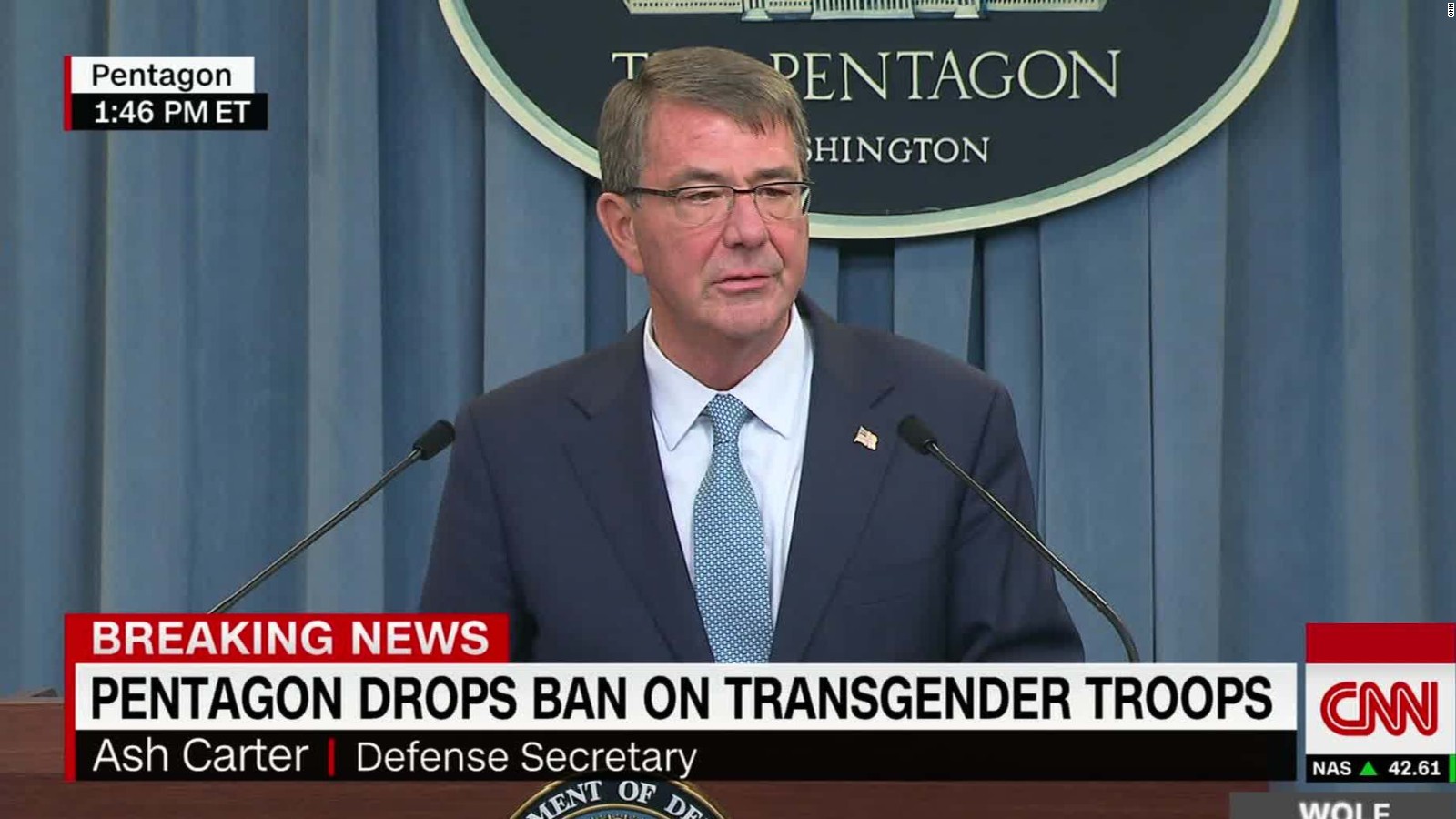

Opinion The Truth Behind Trumps Transgender Military Policy

May 10, 2025

Opinion The Truth Behind Trumps Transgender Military Policy

May 10, 2025 -

Did Ag Pam Bondi Obtain The Jeffrey Epstein Client List A Deeper Look

May 10, 2025

Did Ag Pam Bondi Obtain The Jeffrey Epstein Client List A Deeper Look

May 10, 2025 -

Putin Orders Ceasefire For Victory Day What To Expect

May 10, 2025

Putin Orders Ceasefire For Victory Day What To Expect

May 10, 2025