Is BigBear.ai (BBAI) A Promising Penny Stock Investment?

Table of Contents

BigBear.ai (BBAI)'s Business Model and Financial Performance

BigBear.ai (BBAI) is a publicly traded company operating in the lucrative artificial intelligence (AI) and big data analytics market. They provide a range of advanced analytics, AI-powered solutions, and digital engineering services to government and commercial clients. As a penny stock, BBAI's share price is inherently more volatile than established companies, presenting both high-risk and high-reward possibilities. Understanding its financial health is crucial.

Analyzing recent financial reports reveals a mixed picture. While BBAI has shown potential in securing key contracts and partnerships within the defense and intelligence sectors, profitability remains a challenge. Let's break down some key financial aspects:

- Revenue growth trajectory: While recent quarters might show some growth, consistent year-over-year positive revenue growth is key to long-term viability. Detailed examination of financial statements is necessary to assess this trend accurately.

- Profitability: Currently, BBAI likely operates at a loss. Investors should carefully scrutinize the company's operating expenses and margins to understand the path to profitability.

- Debt levels and solvency: High debt levels can significantly impact a company's financial stability and future growth potential. Evaluating BBAI's debt-to-equity ratio and other solvency metrics is crucial.

- Key contracts and partnerships: The success of BBAI often hinges on securing large contracts with government agencies and major corporations. Examining these partnerships provides insight into future revenue streams.

- Comparison to competitors: Benchmarking BBAI's financial performance against competitors like Palantir Technologies or smaller AI-focused companies in the same space provides valuable context.

Market Analysis and Future Growth Potential

The market for AI and big data solutions is undeniably expanding rapidly. Governments and businesses are increasingly investing in AI-driven technologies to enhance efficiency, improve decision-making, and gain a competitive edge. This creates a significant growth opportunity for companies like BBAI. However, BBAI faces fierce competition from established tech giants and smaller, agile startups.

- Market size and projected growth rate: Research industry reports to understand the projected market size and growth rate for AI and big data solutions in the coming years. This will help assess BBAI's potential market share.

- Key industry trends impacting BBAI: Factors like cloud computing adoption, advancements in machine learning, and increased government regulation will affect BBAI's growth trajectory. Staying abreast of these trends is vital.

- BBAI's competitive strengths and weaknesses: Does BBAI possess unique technologies or specialized expertise that set it apart? What are its weaknesses compared to competitors with larger resources and market share?

- Potential for disruptive innovation: Could BBAI develop groundbreaking AI solutions that significantly disrupt the market and boost its growth? This potential needs careful evaluation.

- Long-term growth projections (with caveats): Based on market trends and BBAI's performance, create cautious long-term growth projections, acknowledging significant uncertainties.

Risks Associated with Investing in BBAI

Investing in penny stocks like BBAI inherently involves significant risk. The stock price can be extremely volatile, leading to substantial gains or losses in a short period. Several other risks deserve attention:

- Volatility of the stock price: Penny stocks are known for wild price swings, making them unsuitable for risk-averse investors.

- Financial risk (debt, profitability): As mentioned earlier, BBAI's financial stability and profitability need close scrutiny.

- Competitive pressures: The intense competition in the AI market poses a considerable threat to BBAI's market share and revenue growth.

- Regulatory and legal risks: Operating in sectors like defense and intelligence exposes BBAI to potential regulatory hurdles and legal challenges.

- Technological risks (obsolescence): Rapid technological advancements in the AI sector could render BBAI's technologies obsolete, impacting its competitiveness.

Valuation and Investment Strategies

Evaluating BBAI's current valuation requires examining several metrics, including its market capitalization, price-to-earnings ratio (if applicable), and comparison to similar companies. However, with a penny stock, traditional valuation metrics might be less reliable due to volatility and potential for rapid changes in market sentiment.

- Current market capitalization: Understand BBAI's current market capitalization to gauge its overall size and value.

- Price-to-earnings ratio (if applicable): Analyze the P/E ratio (if applicable and meaningful) to compare BBAI's valuation to industry peers.

- Comparison to similar companies' valuations: Compare BBAI's valuation to similar companies in the AI and big data sector.

- Potential return on investment (ROI) scenarios (under different market conditions): Develop potential ROI scenarios under various market conditions, considering both positive and negative outcomes.

- Diversification strategies to mitigate risk: Diversifying your investment portfolio is crucial to mitigate the risks associated with investing in a single penny stock like BBAI.

Conclusion: Is BigBear.ai (BBAI) Right for Your Portfolio?

BigBear.ai (BBAI) operates in a high-growth market with significant potential. However, its financial performance, competitive landscape, and the inherent volatility of penny stocks present substantial risks. While the potential rewards are enticing, the possibility of substantial losses is equally real.

Investing in BBAI requires a high-risk tolerance and a thorough understanding of the company's financials and the broader AI market. This analysis provides a framework for your own research, but it's not a recommendation. Before investing in BigBear.ai (BBAI) or any penny stock, conduct your own in-depth due diligence and consult a qualified financial advisor to assess if it aligns with your risk profile and investment goals. Remember, always prioritize responsible investing and diversification to manage your risk effectively.

Featured Posts

-

Understanding The Love Monster Exploring Its Origins And Meaning

May 21, 2025

Understanding The Love Monster Exploring Its Origins And Meaning

May 21, 2025 -

Mia Wasikowskas New Role Taika Waititi Family Movie

May 21, 2025

Mia Wasikowskas New Role Taika Waititi Family Movie

May 21, 2025 -

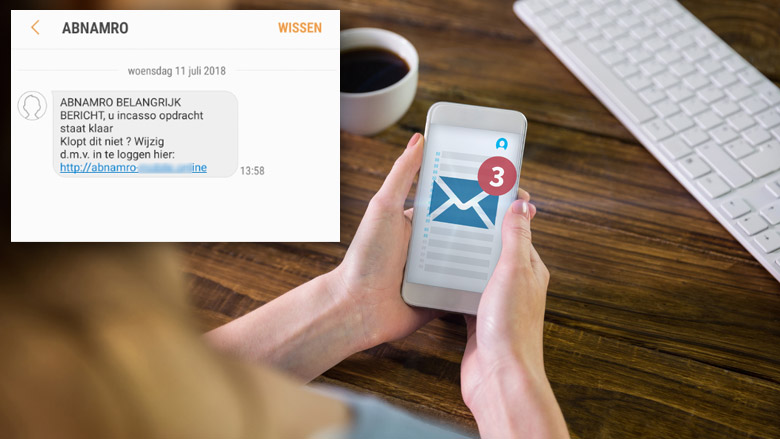

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 21, 2025

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 21, 2025 -

Saskatchewan Politics Examining The Impact Of The Costco Campaign

May 21, 2025

Saskatchewan Politics Examining The Impact Of The Costco Campaign

May 21, 2025 -

How Climate Change Could Affect Your Mortgage Application

May 21, 2025

How Climate Change Could Affect Your Mortgage Application

May 21, 2025