Is BigBear.ai Stock A Buy Now? A Motley Fool Analysis

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

AI Solutions for National Security and Commercial Markets

BigBear.ai focuses on delivering cutting-edge AI-powered solutions to both government agencies and commercial clients. Their expertise spans several key areas:

- National Security Contracts: BigBear.ai secures significant contracts to provide advanced AI capabilities for national defense and intelligence operations. This includes crucial work in areas such as threat detection, predictive modeling and cybersecurity.

- Cybersecurity Solutions: The company offers sophisticated cybersecurity solutions leveraging AI to protect critical infrastructure and sensitive data from evolving threats. This is a rapidly growing sector, presenting significant opportunities for BigBear.ai.

- Data Analytics Services: BigBear.ai leverages AI and machine learning to provide advanced data analytics services, helping clients extract valuable insights from large datasets. This spans various sectors, including finance and healthcare.

- Commercial Applications of AI: Beyond government contracts, BigBear.ai is actively expanding into commercial applications of AI, offering customized solutions to businesses in various sectors.

BigBear.ai's unique selling propositions (USPs) include its deep expertise in AI, its strong relationships with government agencies, and its ability to deliver tailored solutions to meet specific client needs. However, the company faces competition from established players in the AI market, including large technology companies and specialized AI firms. While precise market share data is often difficult to obtain for such specialized companies, BigBear.ai's competitive advantage lies in its focus on niche government and high-security sectors.

Revenue Streams and Financial Performance

BigBear.ai's revenue is derived from both government and commercial contracts. Analyzing recent financial reports is crucial to assess its financial health. Key financial metrics to consider include:

- Revenue Growth Rate: A consistently increasing revenue growth rate indicates strong market demand and business performance.

- Profit Margins: High profit margins suggest efficient operations and pricing strategies. This is crucial for long-term sustainability.

- Debt-to-Equity Ratio: A lower debt-to-equity ratio implies lower financial risk.

A comparative analysis of BigBear.ai's financial performance against industry benchmarks and competitors is necessary to fully understand its financial strength and its position within the competitive landscape. Analyzing trends in revenue growth from government vs. commercial sectors helps understand the business's diversification and future resilience.

Growth Potential and Future Outlook for BigBear.ai

Market Opportunities in the AI Sector

The artificial intelligence market is experiencing explosive growth, driven by increased demand for AI-powered solutions across various sectors. BigBear.ai is strategically positioned to capitalize on this growth through:

- Increasing Demand for AI Solutions: The global need for AI-powered solutions is rapidly expanding, creating a significant market opportunity for BigBear.ai's services.

- Government Spending on AI: Government agencies worldwide are significantly increasing their investment in AI technologies, fueling growth for companies like BigBear.ai.

- Expansion into New Markets: BigBear.ai can expand its market reach by targeting new commercial sectors and geographical regions.

These key growth drivers position BigBear.ai for substantial future growth, though success will depend on execution and maintaining a competitive edge.

Risks and Challenges

Despite its potential, BigBear.ai faces several challenges:

- Competition: The AI sector is intensely competitive, with many established and emerging players vying for market share.

- Regulatory Changes: Evolving government regulations and policies in the AI sector could impact BigBear.ai's operations.

- Dependence on Government Contracts: A significant portion of BigBear.ai's revenue is derived from government contracts, making it vulnerable to changes in government spending.

- Economic Downturn: A broader economic downturn could negatively impact demand for BigBear.ai's services, especially in the commercial sector.

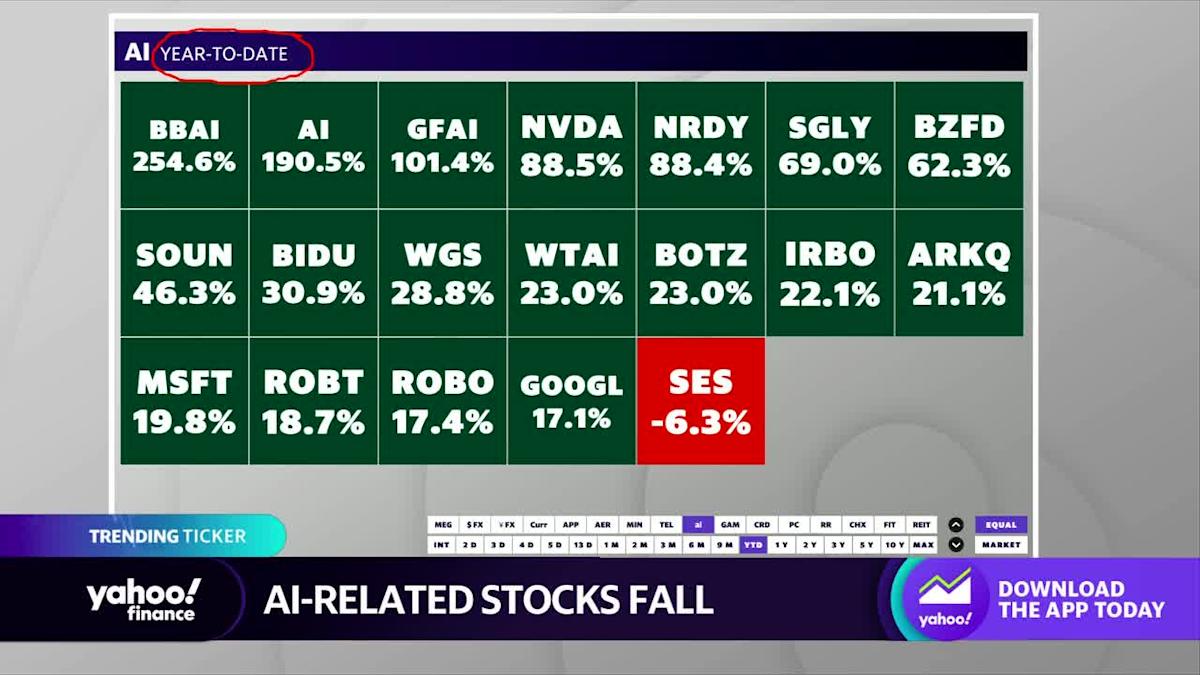

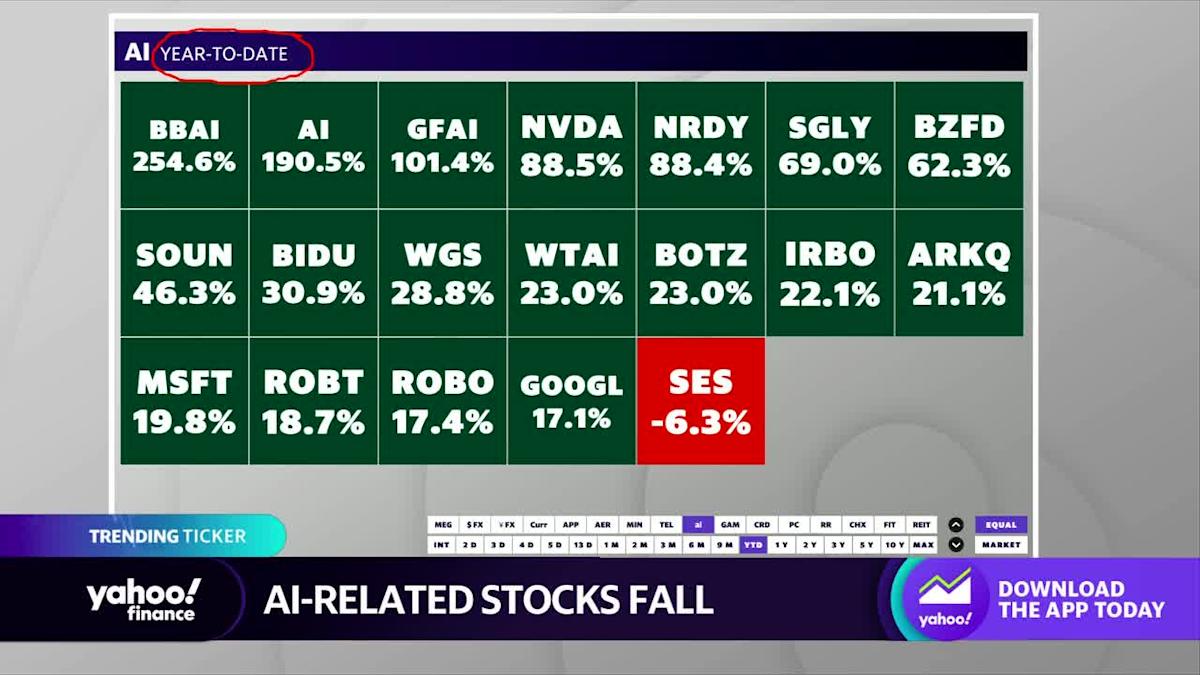

- Stock Volatility: The AI sector is known for its volatility, meaning BigBear.ai's stock price can experience significant fluctuations.

Valuation and Investment Considerations for BigBear.ai Stock

Stock Price Analysis and Performance

Analyzing BigBear.ai's current stock price and historical performance is crucial. Factors such as earnings reports, news events, and overall market sentiment can significantly influence the stock price. Comparing its valuation to industry peers using metrics such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio provides a more comprehensive understanding of its investment worth.

Investment Recommendations (Motley Fool Style)

Based on the analysis above, a definitive buy, sell, or hold recommendation requires careful consideration of the identified strengths and weaknesses. The high growth potential in the AI sector and BigBear.ai's strong position in national security AI are significant positives, however, the dependence on government contracts and potential volatility are substantial risks. Therefore, a thorough assessment of your own risk tolerance is paramount. This analysis should not be considered financial advice.

Disclaimer: Investing in the stock market involves significant risk, and there is always the potential to lose money. This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Conclusion

BigBear.ai operates in a high-growth sector with potential for significant returns, leveraging its expertise in AI for both national security and commercial applications. However, its dependence on government contracts and the inherent volatility of the AI market present substantial risks. Is BigBear.ai stock right for your portfolio? Should you consider adding BigBear.ai to your investment strategy? The answer hinges on your individual risk tolerance and investment goals. Learn more about investing in BigBear.ai, but remember to carefully weigh the potential rewards against the considerable risks involved before making any investment decisions. Remember, thorough due diligence is essential before investing in any stock, including BigBear.ai.

Featured Posts

-

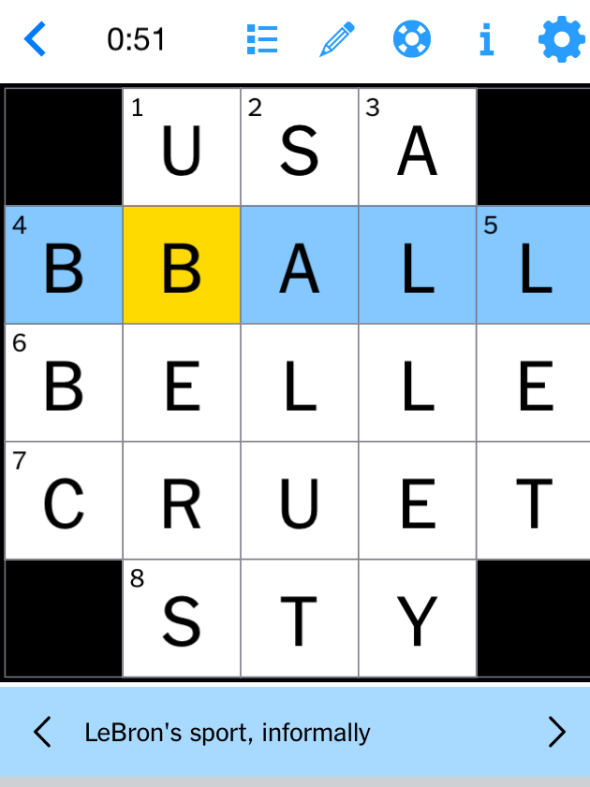

Nyt Mini Crossword Answers For March 18 Complete Solution Guide

May 20, 2025

Nyt Mini Crossword Answers For March 18 Complete Solution Guide

May 20, 2025 -

Big Bear Ai Stock Potential Risks And Rewards

May 20, 2025

Big Bear Ai Stock Potential Risks And Rewards

May 20, 2025 -

Sabalenkas Top Ranked Victory Over Mertens In Madrid

May 20, 2025

Sabalenkas Top Ranked Victory Over Mertens In Madrid

May 20, 2025 -

Ecowas Economic Affairs Charting A Course For The Future At Niger Retreat

May 20, 2025

Ecowas Economic Affairs Charting A Course For The Future At Niger Retreat

May 20, 2025 -

Paulina Gretzky Channels The Soprano In Stunning Leopard Print Dress

May 20, 2025

Paulina Gretzky Channels The Soprano In Stunning Leopard Print Dress

May 20, 2025