Is Bitcoin's Rebound Just The Beginning? A Deep Dive Into Market Predictions

Table of Contents

Analyzing Bitcoin's Recent Price Action and Technical Indicators

Understanding Bitcoin's recent price movements is crucial to predicting its future. Analyzing technical indicators and trading volume provides valuable insights.

Technical Analysis: Support and Resistance Levels

Support and resistance levels are crucial in technical analysis. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Conversely, resistance levels indicate price points where selling pressure is likely to dominate, hindering upward momentum. Identifying these levels helps predict potential price reversals and future price targets.

- Key Technical Indicators: Moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are commonly used to analyze Bitcoin's price trends and momentum. Moving averages smooth out price fluctuations, identifying trends. RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. MACD identifies changes in momentum by comparing two moving averages.

- Chart Analysis: (Insert chart here showing Bitcoin's price action with key support and resistance levels highlighted, along with moving averages, RSI, and MACD indicators.) This chart illustrates how support and resistance levels have historically influenced Bitcoin's price, providing a visual representation of these concepts.

Volume and Market Sentiment

Trading volume is a key indicator of the strength of a price movement. High volume during a Bitcoin price increase confirms the strength of the rebound, suggesting sustained buying pressure. Conversely, low volume raises concerns about the sustainability of the upward trend.

- Market Sentiment: The Fear and Greed Index, social media sentiment analysis, and news coverage provide insights into overall investor sentiment. High fear often precedes buying opportunities, while extreme greed can signal an impending correction.

- Past Performance: Examining Bitcoin's past performance in relation to volume and market sentiment reveals patterns and helps in predicting future trends. For instance, periods of high fear followed by increased volume have historically led to significant price increases.

Factors Driving Bitcoin's Potential Future Growth

Several factors could contribute to Bitcoin's continued growth and a sustained rebound.

Increasing Institutional Adoption

The growing interest from institutional investors like hedge funds and corporations significantly impacts Bitcoin's price stability and liquidity. Large institutional investments inject capital into the market, providing increased price support and reducing volatility.

- Examples: Several well-known financial institutions have publicly acknowledged their Bitcoin holdings, demonstrating a growing acceptance of Bitcoin as an asset class. This institutional adoption lends credibility and reduces the perception of Bitcoin as solely a speculative asset.

Growing Global Adoption and Use Cases

The expanding adoption of Bitcoin as a payment method and store of value is a primary driver of its price. New use cases in decentralized finance (DeFi) and non-fungible tokens (NFTs) are further fueling demand.

- Global Adoption: Countries like El Salvador have already embraced Bitcoin as legal tender, and others are exploring similar options, which could significantly increase demand. The increasing number of merchants accepting Bitcoin as payment also contributes to its wider adoption.

Technological Advancements in the Bitcoin Ecosystem

Technological advancements like the Lightning Network aim to enhance Bitcoin's scalability and transaction speeds, making it more practical for everyday use.

- Lightning Network: This second-layer solution significantly reduces transaction fees and increases the speed of Bitcoin transactions, addressing some of the limitations of the original Bitcoin protocol. Further technological developments in areas like privacy and security are also anticipated.

Potential Risks and Challenges Facing Bitcoin

Despite the potential for growth, Bitcoin faces significant risks and challenges.

Regulatory Uncertainty and Government Interventions

Regulatory uncertainty remains a significant risk. Governments worldwide are grappling with how to regulate cryptocurrencies, and differing approaches could impact Bitcoin's price and adoption.

- Examples: Some countries are embracing a regulatory framework that fosters innovation, while others are taking a more restrictive approach. These varying regulations create uncertainty and could affect Bitcoin's price.

Volatility and Market Manipulation

Bitcoin's price is notoriously volatile and susceptible to market manipulation. Large price swings can occur quickly, leading to significant losses for investors.

- Risk Mitigation: Diversification, dollar-cost averaging, and setting stop-loss orders are strategies to mitigate these risks.

Competition from Alternative Cryptocurrencies (Altcoins)

The emergence of altcoins presents a competitive challenge to Bitcoin's dominance. New cryptocurrencies with potentially superior technology or features could attract investors and reduce Bitcoin's market share.

Conclusion: Is Bitcoin's Rebound Just the Beginning? A Final Look at Market Predictions

Analyzing Bitcoin's recent price action, underlying factors, and potential risks paints a complex picture. While the current rebound shows promise, driven by increasing institutional adoption, expanding global usage, and technological advancements, volatility, regulatory uncertainty, and competition from altcoins remain significant challenges. It's crucial to consider both bullish and bearish scenarios when forming predictions about Bitcoin's future. Whether this rebound marks a sustained upward trend or a temporary phenomenon remains to be seen. While this analysis offers insights into Bitcoin's potential, remember that thorough research is crucial before engaging with Bitcoin's rebound. Continue your own due diligence to make informed decisions about Bitcoin investments.

Featured Posts

-

1 500 Bitcoin Growth Is This Realistic A 5 Year Forecast

May 08, 2025

1 500 Bitcoin Growth Is This Realistic A 5 Year Forecast

May 08, 2025 -

Nereden Izlenir Arsenal Psg Macini Sifresiz Canli Yayin

May 08, 2025

Nereden Izlenir Arsenal Psg Macini Sifresiz Canli Yayin

May 08, 2025 -

Wall Streets Next Big Thing Billionaire Backed Etf Poised For 110 Growth

May 08, 2025

Wall Streets Next Big Thing Billionaire Backed Etf Poised For 110 Growth

May 08, 2025 -

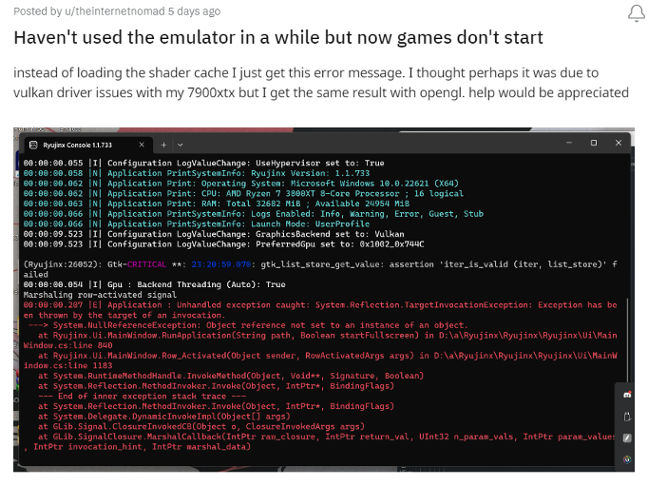

Ryujinx Emulator Project Ends After Nintendo Intervention

May 08, 2025

Ryujinx Emulator Project Ends After Nintendo Intervention

May 08, 2025 -

Choosing The Right Surface Pro 12 Inch Model Deep Dive

May 08, 2025

Choosing The Right Surface Pro 12 Inch Model Deep Dive

May 08, 2025

Latest Posts

-

F4 Elden Ring Possum And Superman A Quick News Summary

May 08, 2025

F4 Elden Ring Possum And Superman A Quick News Summary

May 08, 2025 -

Biggest Oscars Snubs The Most Shocking Moments In Academy Awards History

May 08, 2025

Biggest Oscars Snubs The Most Shocking Moments In Academy Awards History

May 08, 2025 -

Matt Damons Smart Career Moves Ben Afflecks Perspective

May 08, 2025

Matt Damons Smart Career Moves Ben Afflecks Perspective

May 08, 2025 -

Krypto The Last Dog Of Krypton Dcs Latest Animated Movie Explored

May 08, 2025

Krypto The Last Dog Of Krypton Dcs Latest Animated Movie Explored

May 08, 2025 -

Latest News F4 Elden Ring Possum And Superman In The Headlines

May 08, 2025

Latest News F4 Elden Ring Possum And Superman In The Headlines

May 08, 2025