Is Bitcoin's Rebound Just The Beginning? A Deep Dive Into The Market

Table of Contents

Analyzing Bitcoin's Recent Price Surge

Bitcoin's recent price increase is a complex phenomenon influenced by several interacting factors. Let's examine the key contributors to this rebound in the Bitcoin price and explore what the charts are telling us.

Factors Contributing to the Rebound

Several factors have contributed to Bitcoin's recent price surge. These include:

- Increased Institutional Investment: Major corporations like MicroStrategy and Tesla have significantly increased their Bitcoin holdings, signaling a growing acceptance of Bitcoin as an asset class within traditional financial structures. This institutional interest lends credibility and stability to the Bitcoin investment landscape.

- Growing Adoption Among Retail Investors: Retail investor participation continues to rise, driven by increased awareness, improved accessibility through user-friendly platforms, and a desire for diversification beyond traditional assets. This increased demand directly impacts Bitcoin price.

- Positive Regulatory Developments: While regulatory clarity remains a work in progress globally, some jurisdictions have shown more favorable stances towards cryptocurrencies, reducing uncertainty and potentially boosting investor confidence. This clearer regulatory landscape is vital for the continued growth of Bitcoin.

- Technological Advancements: Improvements to the Bitcoin network, such as the Lightning Network, are enhancing scalability and transaction speeds. These upgrades address some of Bitcoin's historical limitations, making it a more practical and attractive investment.

- Macroeconomic Factors: Global inflation and geopolitical instability have driven some investors to seek alternative assets like Bitcoin as a hedge against traditional fiat currencies. The uncertain macroeconomic climate increases demand for Bitcoin as a store of value.

Technical Analysis of Bitcoin's Chart

Analyzing Bitcoin's price chart provides further insights into its recent rebound.

- Support and Resistance Levels: Examining key support and resistance levels on the Bitcoin price chart helps to identify potential price reversal points and predict future movements.

- Technical Indicators: Technical indicators like moving averages and the Relative Strength Index (RSI) offer valuable signals about Bitcoin's momentum and potential overbought or oversold conditions. These indicators provide a quantitative assessment of Bitcoin's price trajectory.

- Chart Patterns: Identifying chart patterns such as head and shoulders or double bottoms can provide further clues about the potential direction of Bitcoin's price. These patterns are valuable tools for experienced technical analysts in forecasting market behavior.

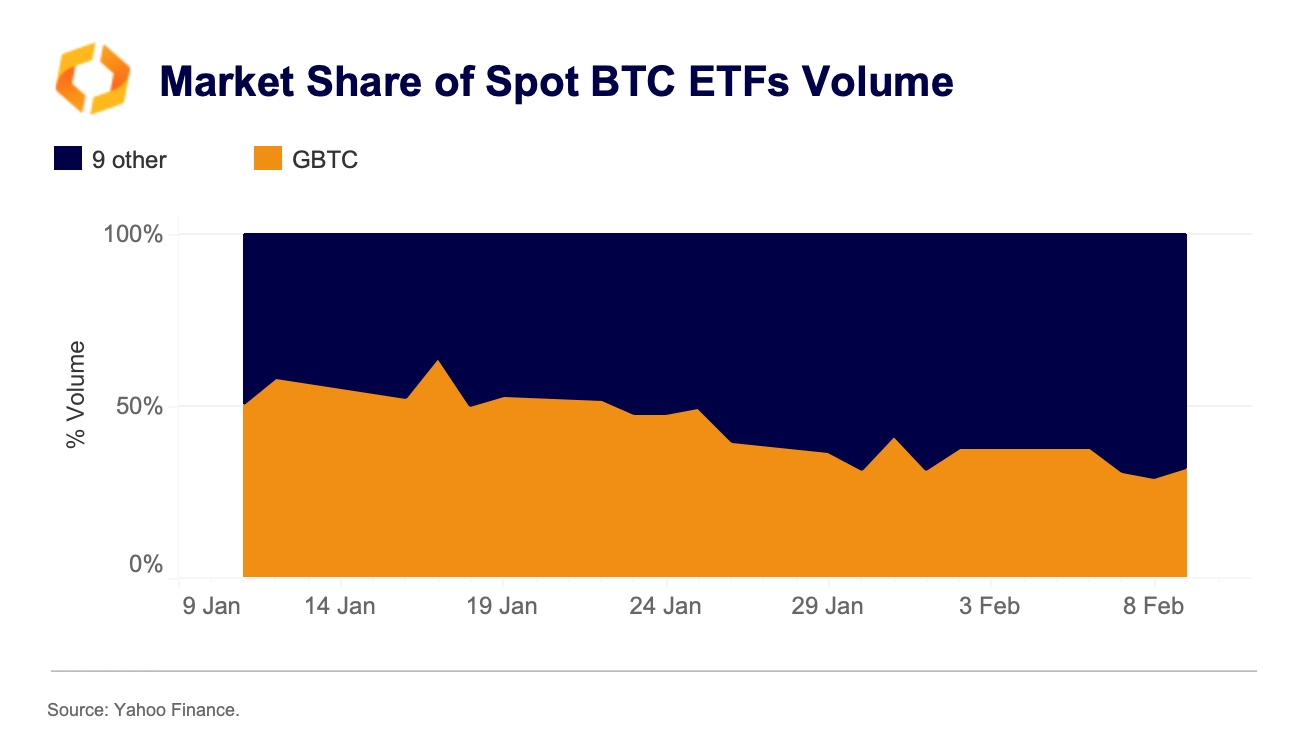

- (Include relevant charts and graphs here to visually support the analysis.)

Assessing the Long-Term Potential of Bitcoin

Beyond the current rebound, Bitcoin's long-term potential hinges on several crucial factors, which we will explore below.

Bitcoin's Role as a Hedge Against Inflation

Bitcoin's limited supply of 21 million coins makes it a potentially attractive hedge against inflation. Its fixed supply contrasts sharply with fiat currencies that can be inflated through government policies. Historically, during periods of high inflation, Bitcoin's value has often risen relative to traditional assets.

Bitcoin Adoption and Global Market Penetration

The increasing adoption of Bitcoin by businesses and individuals worldwide is a key factor driving its long-term potential. The growing global market capitalization and the emergence of new use cases, such as cross-border payments, contribute to Bitcoin's sustained growth.

Regulatory Landscape and its Impact

The regulatory environment significantly influences the growth of Bitcoin. Favorable regulations foster institutional adoption and investor confidence. However, strict or unclear regulations can stifle innovation and limit market growth. The ongoing evolution of regulatory frameworks globally is crucial to Bitcoin's future.

Risks and Challenges Facing Bitcoin

Despite the potential for growth, Bitcoin also faces several significant challenges.

Volatility and Price Fluctuations

Bitcoin is notoriously volatile. Its price is highly susceptible to market sentiment, news events, and regulatory changes. This volatility introduces significant risk for investors who are unprepared for substantial price fluctuations.

Security Concerns and Potential Hacks

The cryptocurrency landscape is not immune to security threats. Exchanges have been hacked in the past, resulting in the loss of user funds. Securely storing private keys and using reputable exchanges are crucial to mitigating these risks.

Environmental Concerns Related to Bitcoin Mining

The energy consumption associated with Bitcoin mining is a major environmental concern. The transition towards renewable energy sources for mining is critical to address these sustainability challenges.

Conclusion: Is Bitcoin's Rebound a Sign of Things to Come?

Bitcoin's recent rebound is a complex event with various contributing factors. While the potential for continued growth is significant, driven by institutional investment, increasing adoption, and its role as a potential inflation hedge, it's crucial to acknowledge the inherent risks associated with its volatility and security concerns. The regulatory landscape and environmental impact of Bitcoin mining also play crucial roles in shaping its future. To make informed decisions about Bitcoin investment, learn more about Bitcoin's rebound, understand the potential of Bitcoin's future, and dive deeper into Bitcoin market analysis. Share your thoughts on Bitcoin's future in the comments below.

Featured Posts

-

Open Ai Under Ftc Scrutiny Chat Gpts Future In Question

May 08, 2025

Open Ai Under Ftc Scrutiny Chat Gpts Future In Question

May 08, 2025 -

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Rally

May 08, 2025

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Rally

May 08, 2025 -

F4 Elden Ring Possum And Superman A Quick News Summary

May 08, 2025

F4 Elden Ring Possum And Superman A Quick News Summary

May 08, 2025 -

Gta 6 Second Trailer Breakdown Bonnie And Clyde Dynamics Explored

May 08, 2025

Gta 6 Second Trailer Breakdown Bonnie And Clyde Dynamics Explored

May 08, 2025 -

Lahwr Ky Panch Ahtsab Edaltyn Khtm Bqyh Edaltwn Ka Mstqbl

May 08, 2025

Lahwr Ky Panch Ahtsab Edaltyn Khtm Bqyh Edaltwn Ka Mstqbl

May 08, 2025

Latest Posts

-

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025 -

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025 -

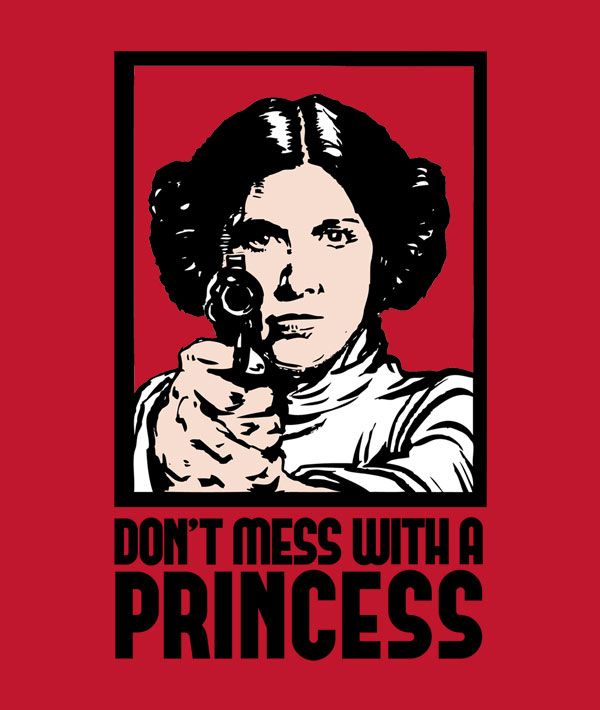

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

3 Reasons A Princess Leia Cameo In The New Star Wars Show Is Likely

May 08, 2025

3 Reasons A Princess Leia Cameo In The New Star Wars Show Is Likely

May 08, 2025