Is China A Problem For Luxury Carmakers? Examining The Experiences Of BMW And Porsche.

Table of Contents

The Allure of the Chinese Luxury Car Market

Unprecedented Growth Potential

The Chinese luxury car market is undeniably attractive. Its sheer size and rapid expansion are unparalleled globally.

- Market Size: Already one of the world's largest luxury car markets, it continues to grow at a phenomenal rate.

- Growth Rate: Annual growth consistently outpaces many other major economies, attracting significant investment from global players.

- Projected Future Growth: Experts predict continued robust growth for the foreseeable future, fueled by a burgeoning middle class.

This expansion is driven by a rapidly expanding middle class with significant disposable income and a growing desire for luxury goods. The number of luxury car owners in China, while still lower per capita than in some Western countries, is increasing exponentially. This presents a huge untapped market for luxury brands willing to adapt and invest.

Shifting Consumer Preferences

Understanding Chinese consumer preferences is crucial for success. The market is dynamic, with tastes evolving rapidly.

- Brand Preference: While established European brands hold sway, domestic Chinese brands are increasingly competitive, demanding attention to brand building and loyalty.

- Technological Advancements: Chinese consumers are highly tech-savvy, demanding cutting-edge technology and advanced features in their vehicles. Connectivity, autonomous driving features, and electric vehicle options are particularly important.

- Design Trends: Aesthetic preferences differ from Western markets. Luxury carmakers need to adapt their designs to resonate with Chinese tastes.

Social media and online reviews play a significant role in shaping consumer opinions, underscoring the need for effective digital marketing strategies and robust customer service. Localized marketing campaigns tailored to specific regional preferences are essential for building brand recognition and trust.

Challenges Faced by Luxury Carmakers in China

Intense Competition

The Chinese luxury car market is fiercely competitive. International brands face pressure not only from each other but also from increasingly sophisticated domestic competitors.

- Key Competitors: Established players like Mercedes-Benz, Audi, and local brands like NIO and Li Auto present significant challenges.

- Price Wars: The intense competition often leads to price wars, impacting profitability.

- Competitive Marketing Strategies: Brands employ aggressive marketing strategies to gain market share, further intensifying the competition.

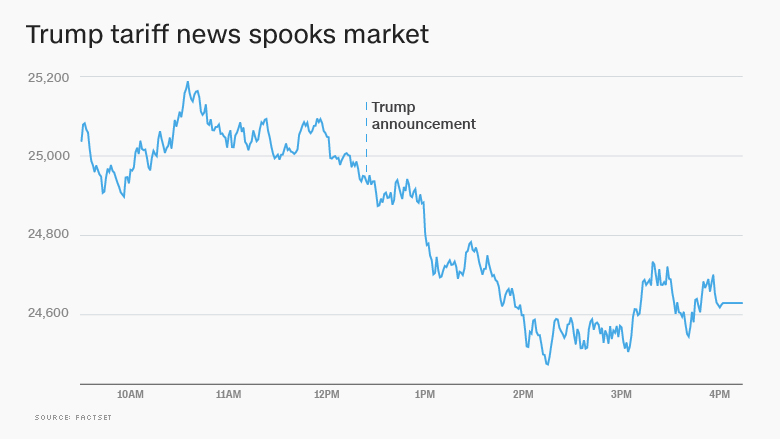

Regulatory Hurdles and Tariffs

Navigating the regulatory landscape in China is complex. Government regulations, import tariffs, and trade policies significantly impact the profitability of luxury carmakers.

- Emission Standards: Stringent emission regulations necessitate investment in cleaner technologies.

- Import Tariffs: High import duties can significantly increase the cost of imported vehicles.

- Localization Requirements: Regulations often mandate local production, requiring substantial investment in manufacturing facilities.

Supply Chain Disruptions and Geopolitical Risks

Geopolitical tensions, supply chain vulnerabilities, and economic instability pose additional challenges to luxury carmakers operating in China.

- Supply Chain Disruptions: Global events can disrupt the supply of parts and components, impacting production and sales.

- Economic Instability: Economic downturns can reduce consumer spending on luxury goods.

- Geopolitical Risks: Escalating tensions between China and other countries can create uncertainty and impact business operations.

Case Studies: BMW and Porsche in China

BMW's China Strategy

BMW has established a strong presence in China through a combination of localized production, targeted marketing, and a focus on meeting local demands. Their success stems from their investment in local manufacturing facilities and the adaptation of models to suit local tastes. They've also emphasized digital marketing and online sales channels to reach a tech-savvy audience. Specific models like the BMW X series have enjoyed particular success.

- Localized Production: Significant investments in manufacturing plants within China.

- Marketing Efforts: Targeted campaigns emphasizing features relevant to Chinese consumers.

- Sales Figures: Consistently strong sales numbers demonstrate their success in the market.

Porsche's China Strategy

Porsche has also succeeded in China by focusing on high-end models and cultivating a strong brand image that resonates with affluent Chinese consumers. Their focus on exclusive dealerships and personalized customer experiences has solidified their position in the luxury segment.

- Localized Production: Production of select models within China to reduce costs and improve responsiveness to consumer demand.

- Marketing Efforts: Emphasis on brand exclusivity and luxury lifestyle.

- Sales Figures: Strong sales demonstrate their market appeal.

Comparative Analysis

Both BMW and Porsche have demonstrated success in China, but their strategies differ. BMW has adopted a broader approach, focusing on a wider range of models and adapting to local preferences. Porsche, on the other hand, has maintained its focus on luxury and exclusivity. Both demonstrate the need for flexible, adaptive strategies to navigate the complexities of the Chinese luxury car market.

Conclusion

The Chinese luxury car market offers unparalleled growth potential but presents significant challenges. From intense competition and regulatory hurdles to supply chain disruptions and geopolitical risks, success requires a deep understanding of the local market and strategic adaptation. BMW and Porsche's experiences showcase the importance of localized production, targeted marketing, and a keen awareness of shifting consumer preferences. Understanding the complexities of the Chinese market for luxury carmakers is crucial for long-term success. Mastering the challenges of the Chinese luxury car market, however, opens the door to substantial rewards. Further research into the successes and challenges faced by these brands—and others operating in this dynamic region—is essential for those seeking to navigate this complex yet lucrative landscape.

Featured Posts

-

Mariners Vs Tigers Injured Players For Opening Series March 31 April 2

May 17, 2025

Mariners Vs Tigers Injured Players For Opening Series March 31 April 2

May 17, 2025 -

Japans Economy Contracts In Q1 2018 Pre Tariff Impact

May 17, 2025

Japans Economy Contracts In Q1 2018 Pre Tariff Impact

May 17, 2025 -

April 4 6 Giants Vs Mariners Whos On The Injured List

May 17, 2025

April 4 6 Giants Vs Mariners Whos On The Injured List

May 17, 2025 -

Yankees Vs Mariners Mlb Game Prediction Analysis And Best Odds Today

May 17, 2025

Yankees Vs Mariners Mlb Game Prediction Analysis And Best Odds Today

May 17, 2025 -

Major Advertisers Deny Musks Boycott Accusations

May 17, 2025

Major Advertisers Deny Musks Boycott Accusations

May 17, 2025

Latest Posts

-

2024 25 High School Confidential Key Events Of Week 26

May 17, 2025

2024 25 High School Confidential Key Events Of Week 26

May 17, 2025 -

15 Day Il For Mariners Bryce Miller Elbow Injury Update

May 17, 2025

15 Day Il For Mariners Bryce Miller Elbow Injury Update

May 17, 2025 -

Jaylen Browns Game 5 Performance Josh Harts Wife Weighs In

May 17, 2025

Jaylen Browns Game 5 Performance Josh Harts Wife Weighs In

May 17, 2025 -

Week 26 High School Confidential 2024 25 Update

May 17, 2025

Week 26 High School Confidential 2024 25 Update

May 17, 2025 -

Rhp Bryce Miller Elbow To 15 Day Injured List For Mariners

May 17, 2025

Rhp Bryce Miller Elbow To 15 Day Injured List For Mariners

May 17, 2025