Is Gold A Safe Investment During Trade Wars? Analyzing Bullion's Performance

Table of Contents

Gold's Historical Performance During Trade Wars

Examining gold's historical performance during periods of trade friction provides valuable insights. Let's look at some significant examples:

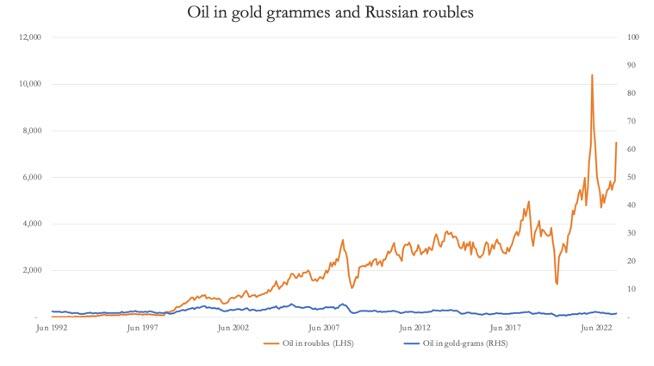

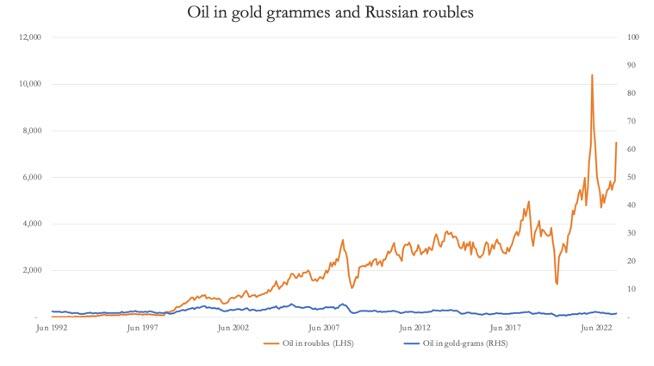

The US-China trade tensions of 2018-2020 serve as a recent case study. As tariffs escalated and uncertainty grew, the price of gold steadily climbed. This upward trend reflected investors seeking refuge from the heightened economic and geopolitical risks associated with the trade dispute. Similarly, during the trade disputes of the early 1980s between the US and Japan, and later between the US and various other nations in the late 1980s and 1990s, gold prices exhibited strength.

-

Example 1: Gold price increase during the 2018-2020 US-China trade war due to increased investor demand for safe haven assets amidst growing uncertainty about global economic growth. The price rose significantly, outperforming many other asset classes during this period.

-

Example 2: Gold's relative performance compared to other asset classes (stocks, bonds) during the 2018-2020 trade war showed its resilience. While stock markets experienced volatility, gold provided a degree of stability, albeit with its own price fluctuations.

-

Investor Sentiment and Flight to Safety: The impact of investor sentiment and the "flight to safety" phenomenon were crucial during these periods. As uncertainty increased, investors moved away from riskier assets like stocks and bonds, seeking the perceived security of gold.

Factors Influencing Gold Prices During Trade Wars

Several macroeconomic factors and geopolitical events significantly influence gold prices during trade wars:

-

Macroeconomic Factors: Inflation, interest rates, and currency fluctuations are all key drivers. Trade war uncertainty often fuels inflation, making gold a more attractive investment as a hedge against inflation. Falling interest rates can also increase gold's appeal as a non-yielding asset compared to interest-bearing instruments. Currency devaluation in one country can lead to increased demand for gold in other nations as a store of value.

-

Geopolitical Risks: Escalating tensions between nations, political instability, and other geopolitical events can dramatically impact gold prices. Increased uncertainty leads to greater demand for safe-haven assets like gold.

-

Bullet Points:

- Inflationary pressures often drive gold prices higher.

- Falling interest rates can boost gold's appeal as a non-yielding asset.

- Currency devaluation in one country can lead to increased gold demand in other nations.

- Geopolitical instability (e.g., escalating tensions between nations) often increases demand for safe-haven assets like gold.

The Role of Investor Sentiment

Investor sentiment plays a crucial role in driving gold prices. Fear and uncertainty associated with trade wars often prompt investors to seek the perceived safety of gold. Media coverage, expert opinions, and overall market sentiment significantly influence these decisions. The concept of "flight to safety" describes this behavior—investors move towards gold and other safe-haven assets during times of economic or political turmoil.

Alternative Investment Strategies During Trade Wars

While gold can be a valuable part of a portfolio, diversification is crucial.

-

Diversification: Spreading investments across different asset classes reduces overall portfolio risk.

-

Other Safe-Havens: Government bonds and the Swiss franc are often considered safe-haven assets. Government bonds offer stability but typically provide lower returns than gold. The Swiss franc is a currency often sought during global uncertainty due to Switzerland's political and economic stability.

-

Bullet Points:

- Diversification reduces overall portfolio risk.

- Government bonds offer stability but may offer lower returns compared to gold.

- The Swiss franc is often seen as a safe currency during times of global uncertainty.

Risks Associated with Investing in Gold During Trade Wars

Despite its reputation as a safe haven, investing in gold carries risks:

-

Volatility: Gold prices can fluctuate significantly in the short term, impacting returns.

-

Opportunity Cost: Holding a non-yielding asset like gold means missing out on potential gains from other asset classes, such as stocks or bonds.

-

Geopolitical Events: Unexpected geopolitical events can negatively impact gold's performance, despite its usual safe haven status.

-

Bullet Points:

- Gold prices can fluctuate significantly in the short-term.

- Investors miss out on potential gains from other asset classes.

- Unforeseen global events can impact gold's performance unexpectedly.

Conclusion

Gold has historically shown a positive correlation with periods of trade war uncertainty, often serving as a safe-haven asset due to increased investor demand during times of economic instability. However, its price remains volatile, and alternative investment strategies should be considered as part of a diversified portfolio. While gold can be a valuable part of a diversified investment portfolio during trade wars, careful consideration of market trends and your own risk tolerance is essential. Conduct thorough research before making any investment decisions regarding gold as a safe investment during trade wars. Consult a financial advisor for personalized guidance.

Featured Posts

-

Closure Of Anchor Brewing Company After 127 Years

Apr 26, 2025

Closure Of Anchor Brewing Company After 127 Years

Apr 26, 2025 -

A Timeline Of Karen Reads Murder Cases

Apr 26, 2025

A Timeline Of Karen Reads Murder Cases

Apr 26, 2025 -

Secret Service Investigation Concludes Cocaine Found At White House

Apr 26, 2025

Secret Service Investigation Concludes Cocaine Found At White House

Apr 26, 2025 -

Transatlantic Clash Trump Administration And Europes Ai Rulebook

Apr 26, 2025

Transatlantic Clash Trump Administration And Europes Ai Rulebook

Apr 26, 2025 -

Cocaine Found At White House Secret Service Announces End Of Investigation

Apr 26, 2025

Cocaine Found At White House Secret Service Announces End Of Investigation

Apr 26, 2025