Is Investing In XRP (Ripple) Right For You? A Financial Analysis

Table of Contents

Understanding XRP and its Technology

What is XRP and how does it differ from other cryptocurrencies?

XRP is the native cryptocurrency of Ripple, a company focused on enabling fast and low-cost cross-border payments. Unlike Bitcoin, which uses a proof-of-work consensus mechanism, or Ethereum, which utilizes proof-of-stake, XRP operates on a unique consensus mechanism within the Ripple network. This allows for significantly faster transaction speeds and lower transaction fees compared to many other cryptocurrencies.

- Speed: XRP transactions are processed in a matter of seconds, a stark contrast to the minutes or even hours it can take for Bitcoin or Ethereum transactions to confirm.

- Low Fees: XRP boasts incredibly low transaction fees, making it a cost-effective solution for large-volume transactions.

- Use Cases: Beyond cross-border payments, XRP is being explored for various applications, including micropayments and decentralized finance (DeFi).

- Institutional Adoption: Ripple actively targets institutional clients, focusing on banks and financial institutions to leverage XRP for efficient international money transfers. This institutional focus differentiates XRP from many other cryptocurrencies primarily focused on retail markets.

Keywords: XRP, Ripple, cryptocurrency, cross-border payments, blockchain technology, transaction fees, micropayments, DeFi, institutional investors

The Ripple Network and its Partnerships

RippleNet, Ripple's payment network, boasts partnerships with numerous major financial institutions globally. These partnerships are crucial to XRP's adoption and value. Successful implementations of XRP in cross-border transactions demonstrate its practical application and potential to disrupt the traditional financial system.

- Strategic Alliances: Ripple has forged partnerships with banks like Santander, SBI Holdings, and many others, integrating XRP into their payment infrastructure.

- Real-World Applications: These partnerships have resulted in live deployments of XRP for facilitating faster and cheaper international money transfers, showcasing the technology's effectiveness.

- Impact on Value: The success of these partnerships and the growing adoption of RippleNet directly impact XRP's value and market capitalization. Positive news regarding partnerships often leads to increased demand and price appreciation.

Keywords: RippleNet, financial institutions, partnerships, institutional adoption, XRP adoption, international money transfers, Santander, SBI Holdings

Analyzing XRP's Market Performance and Volatility

Historical Price Analysis of XRP

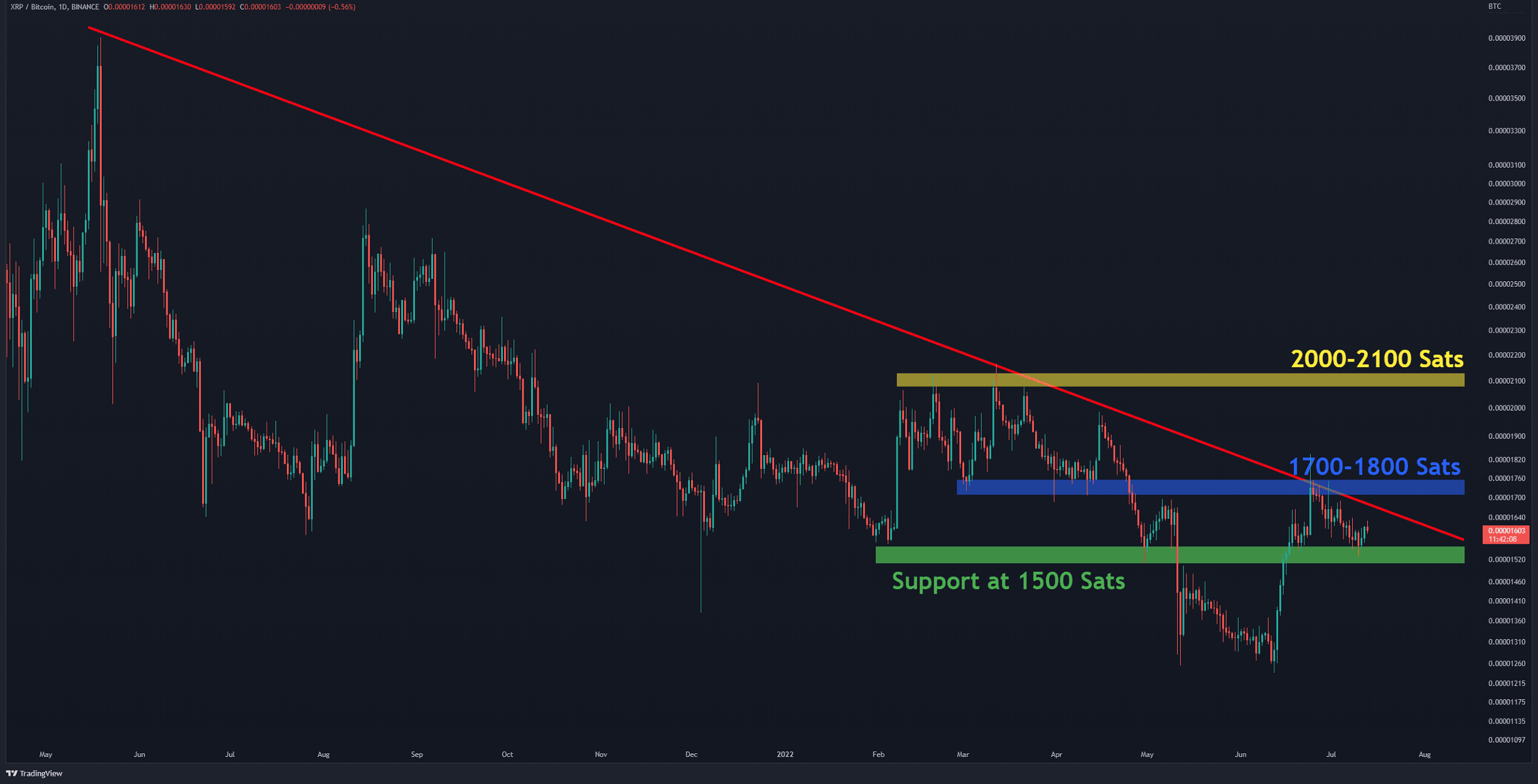

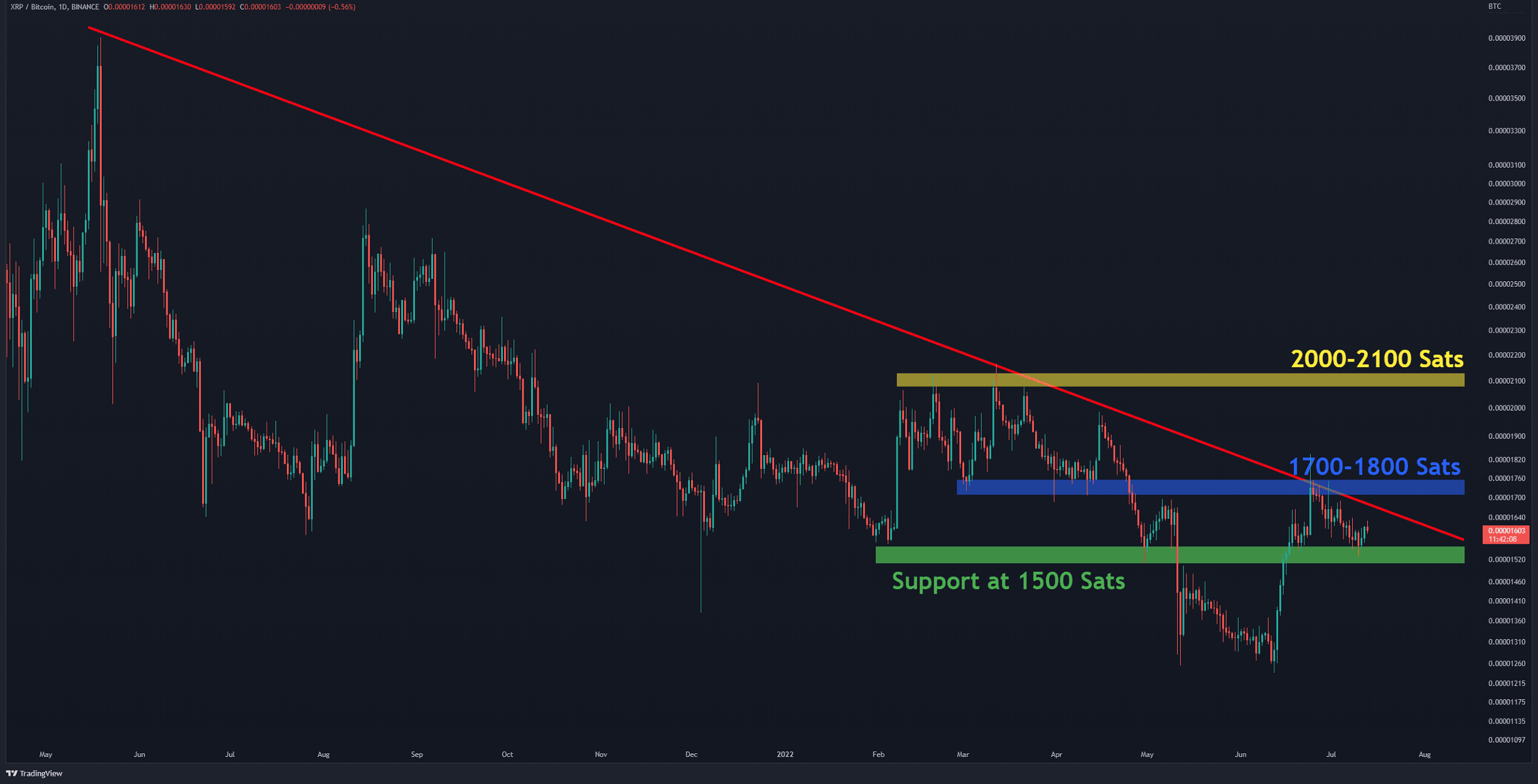

XRP's price history has been characterized by significant volatility, mirroring the broader cryptocurrency market. However, its price has also demonstrated periods of substantial growth, driven by factors such as positive regulatory developments, increased partnerships, and market sentiment. Analyzing historical price charts provides valuable insights into past performance, although past performance is not indicative of future results.

- Price Fluctuations: XRP has experienced both dramatic price surges and sharp corrections, reflecting the speculative nature of the cryptocurrency market.

- Influencing Factors: Regulatory announcements, market sentiment (bullish or bearish), and major partnerships heavily influence XRP's price.

- Chart Analysis: Studying historical price charts using technical indicators can help understand price trends and potential future movements. (Note: Include a relevant chart here if possible.)

Keywords: XRP price, price volatility, cryptocurrency market, market analysis, price chart, technical analysis, bullish, bearish

Risk Assessment of Investing in XRP

Investing in XRP, like any cryptocurrency, involves significant risk. The cryptocurrency market is notoriously volatile, and XRP is no exception. Furthermore, regulatory uncertainty surrounding Ripple and XRP adds another layer of risk.

- Volatility Risk: The price of XRP can fluctuate dramatically in short periods, leading to potential substantial losses.

- Regulatory Risk: The ongoing legal battle between Ripple and the SEC in the United States creates uncertainty about the future regulatory landscape for XRP.

- Diversification: To mitigate risk, diversification is crucial. Do not invest a large portion of your portfolio in a single asset, especially a volatile one like XRP.

Keywords: risk management, cryptocurrency investment, volatility risk, regulatory risk, diversification, SEC, Ripple lawsuit

Future Projections and Potential of XRP

Long-term Growth Potential of XRP

The long-term growth potential of XRP hinges on several factors, including wider adoption by financial institutions, advancements in Ripple's technology, and positive regulatory developments. While predictions are inherently speculative, analysts have offered various price projections based on different scenarios.

- Future Applications: The continued expansion of RippleNet and potential applications of XRP in other sectors could drive growth.

- Technological Advancements: Improvements in blockchain technology and the overall efficiency of the Ripple network can enhance its appeal.

- Market Predictions: While you should approach any price prediction with caution, many analysts believe the future of XRP is tied to the success of Ripple's strategic partnerships and the overall growth of the cross-border payments sector.

Keywords: XRP future, price prediction, cryptocurrency forecast, long-term investment, growth potential, cross-border payments, RippleNet

Competitor Analysis

XRP faces competition from other cryptocurrencies in the payments space, notably Stellar Lumens (XLM). Comparing XRP and its competitors helps gauge its competitive advantage and potential challenges.

- XRP vs. Stellar Lumens: Both XRP and XLM aim to facilitate fast and low-cost cross-border transactions, but they differ in their approach and adoption levels.

- Competitive Landscape: The broader cryptocurrency market is dynamic, with new players and technologies constantly emerging. Staying informed about the competitive landscape is essential.

Keywords: XRP competitors, Stellar Lumens, market competition, competitive advantage, blockchain technology

Conclusion

Investing in XRP presents both exciting opportunities and significant risks. While its use in cross-border payments and its partnerships with major financial institutions suggest potential for growth, the inherent volatility of the cryptocurrency market and regulatory uncertainties demand careful consideration. Before investing in XRP, conduct thorough research, understand the risks involved, and diversify your portfolio. Ultimately, whether investing in XRP is right for you depends on your individual risk tolerance, investment goals, and financial situation. Make an informed decision based on your own research and consult with a financial advisor if needed. Remember to carefully assess the risks before investing in XRP or any other cryptocurrency.

Featured Posts

-

The Kashmir Issue A Critical Analysis Of India Pakistan Tensions And The Potential For War

May 08, 2025

The Kashmir Issue A Critical Analysis Of India Pakistan Tensions And The Potential For War

May 08, 2025 -

How To Watch Oklahoma City Thunder Vs Houston Rockets Game Preview And Betting Tips

May 08, 2025

How To Watch Oklahoma City Thunder Vs Houston Rockets Game Preview And Betting Tips

May 08, 2025 -

The Rise Of Bitcoin Miners Analyzing This Weeks Growth

May 08, 2025

The Rise Of Bitcoin Miners Analyzing This Weeks Growth

May 08, 2025 -

Los Dodgers Rompen Records Su Mejor Inicio De Temporada En La Mlb

May 08, 2025

Los Dodgers Rompen Records Su Mejor Inicio De Temporada En La Mlb

May 08, 2025 -

Cnn Reports Van Driver Involved In Road Rage Motorcycle Collision

May 08, 2025

Cnn Reports Van Driver Involved In Road Rage Motorcycle Collision

May 08, 2025

Latest Posts

-

Dwp Benefit Stoppage 355 000 Affected 3 Month Warning Issued

May 08, 2025

Dwp Benefit Stoppage 355 000 Affected 3 Month Warning Issued

May 08, 2025 -

Universal Credit Refund Dwp Explains 5 Billion Cuts And April May Payments

May 08, 2025

Universal Credit Refund Dwp Explains 5 Billion Cuts And April May Payments

May 08, 2025 -

Dwp Home Visit Increase Concerns For Benefit Claimants

May 08, 2025

Dwp Home Visit Increase Concerns For Benefit Claimants

May 08, 2025 -

Urgent Dwp Issues 3 Month Warning On Benefit Cessation For 355 000 Claimants

May 08, 2025

Urgent Dwp Issues 3 Month Warning On Benefit Cessation For 355 000 Claimants

May 08, 2025 -

Are You Getting A Universal Credit Refund Dwp Payments After 5 Billion Cuts April May

May 08, 2025

Are You Getting A Universal Credit Refund Dwp Payments After 5 Billion Cuts April May

May 08, 2025