Is Microsoft The Safest Software Stock During Trade Wars?

Table of Contents

Microsoft's Diversified Revenue Streams Mitigate Trade War Risks

Microsoft's diverse revenue streams act as a buffer against trade disruptions, making it a compelling option for investors concerned about trade wars.

Cloud Computing Dominance: Azure's Global Reach

Microsoft's Azure cloud platform is a significant asset. Its global infrastructure minimizes reliance on any single market.

- Azure's global presence reduces vulnerability: Tariffs and trade restrictions affecting specific regions have less impact on Azure's overall performance. The distributed nature of cloud infrastructure inherently mitigates geographic-specific risks.

- Azure's growth trajectory ensures continued success: Even amidst economic uncertainty, Azure's consistent growth positions Microsoft for continued profitability. This sustained growth provides a strong foundation for weathering market fluctuations.

- Market share comparison: Azure holds a substantial market share, competing strongly with AWS and Google Cloud. This competitive position strengthens its resilience against trade-related disruptions. While AWS currently holds the largest market share, Azure's consistent growth trajectory is a significant factor in its stability.

Software Licensing and Subscriptions: Predictable Income Streams

Recurring revenue from software licensing and subscriptions (like Office 365 and Windows) provides stable income, less prone to short-term market fluctuations.

- Subscription model stability: Subscription models offer predictable revenue streams compared to one-time purchases, providing a more reliable income flow even during economic downturns.

- Global reach of software licenses: Microsoft's software is used globally, diversifying its revenue sources and reducing reliance on any specific region. This global distribution significantly reduces vulnerability to localized trade impacts.

- Trade wars' impact on licensing: While trade wars can indirectly affect demand, the nature of software licensing makes it relatively resilient to sudden disruptions. Companies are less likely to abandon crucial software licenses due to trade tensions.

Hardware Diversification (Xbox, Surface): Additional Risk Reduction

While less significant than software, Xbox and Surface sales add further revenue diversification, reducing overall investment risk.

- Contribution to overall revenue: While not the primary driver of revenue, hardware sales contribute meaningfully and offer additional diversity to Microsoft's financial landscape.

- Geographical distribution of hardware sales: Microsoft's hardware sales span various global regions, mitigating reliance on single markets.

- Vulnerability to trade disruptions: The hardware segment is more vulnerable to tariffs and trade restrictions than software, but its relatively smaller contribution to overall revenue limits the overall impact.

Microsoft's Global Reach and Market Leadership Reduce Vulnerability

Microsoft's global reach and market leadership significantly lessen its vulnerability to localized trade impacts.

Global Market Share: A Competitive Advantage

Microsoft's substantial market share across its product lines provides a strong competitive advantage, making it more resilient to localized trade issues.

- Quantifying market share: Microsoft holds leading positions in various software and cloud markets, demonstrating its dominance and stability. This dominance translates to greater resilience in the face of trade uncertainties.

- Market share and resilience: A large market share means a broader customer base, less dependent on any single region or country. This diversification provides a safety net during periods of economic or trade instability.

- Comparison to competitors: Compared to smaller competitors, Microsoft's substantial market share provides a significant buffer against negative impacts from trade wars.

Strategic Partnerships and Acquisitions: Expanding Reach and Diversification

Microsoft's strategic partnerships and acquisitions broaden its market reach and further diversify its business.

- Examples of key partnerships and acquisitions: Highlighting specific examples demonstrates Microsoft's proactive approach to expanding its market presence and reducing risk.

- Mitigation of trade war risks: These partnerships and acquisitions help diversify geographic reach and revenue streams, making Microsoft less susceptible to impacts from trade wars.

- Role in overall strategy: Strategic partnerships and acquisitions are integral to Microsoft's growth strategy, further supporting its long-term resilience and stability.

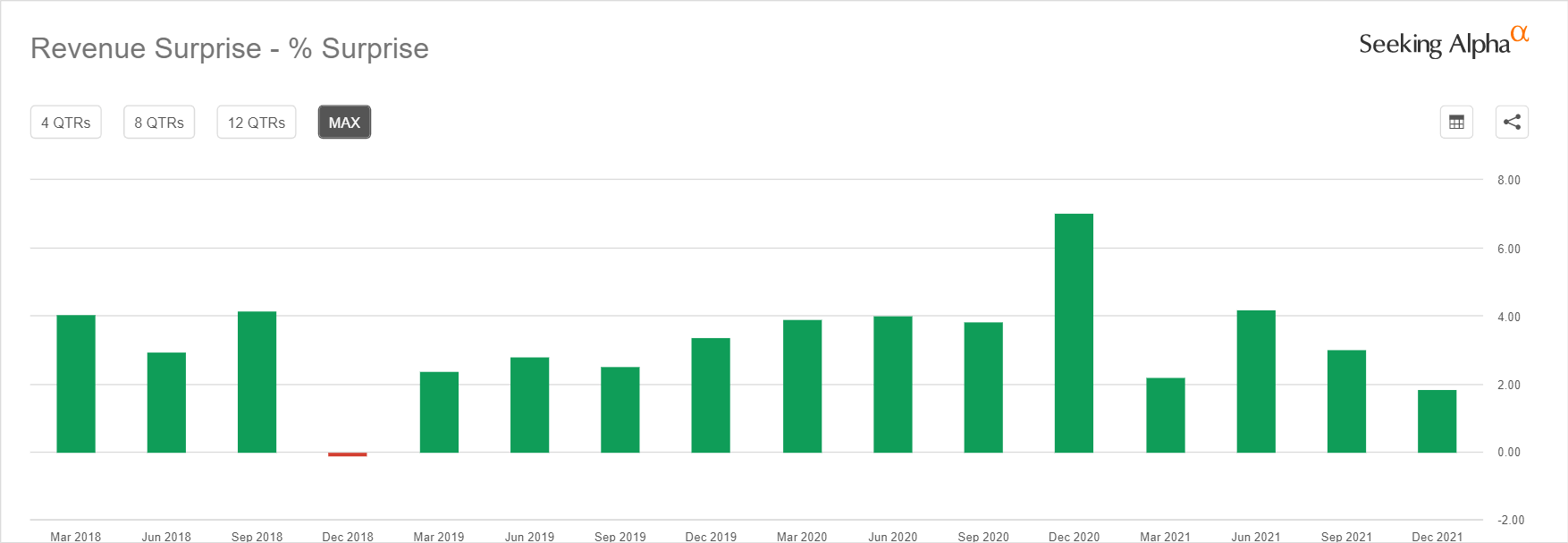

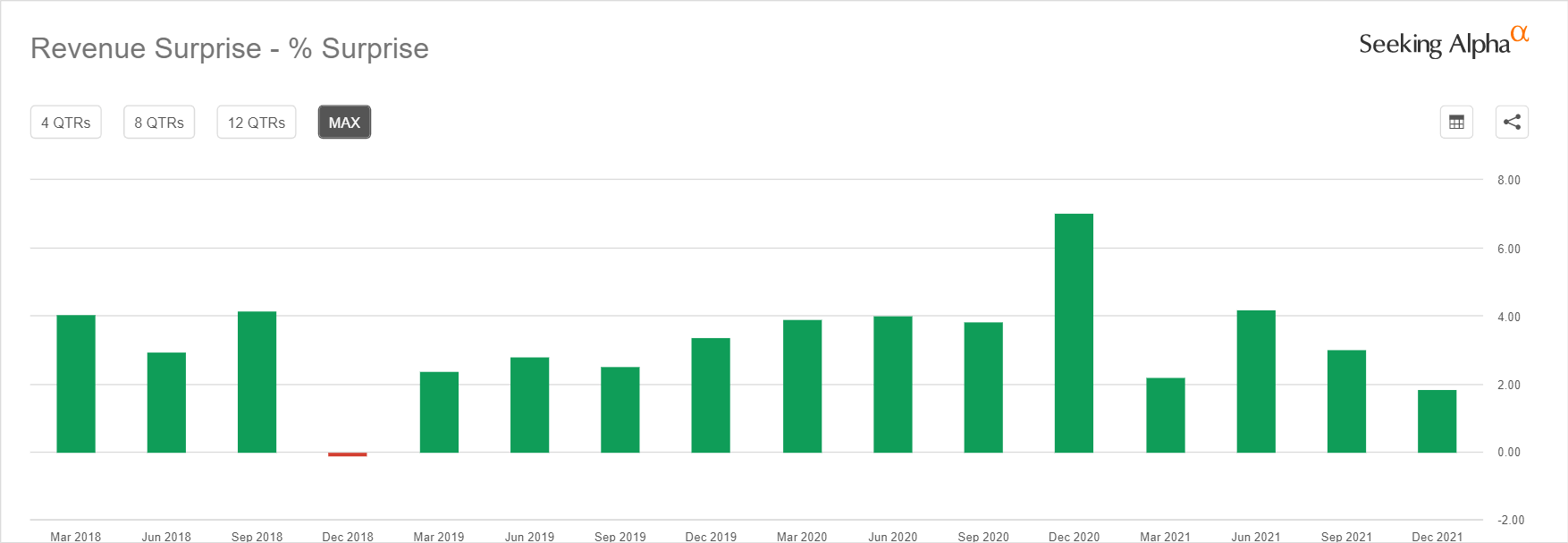

Analyzing Microsoft's Stock Performance During Past Trade Tensions

Examining Microsoft's stock performance during past trade tensions helps assess its resilience.

Historical Data Analysis: Resilience During Uncertainty

Analyzing Microsoft's past stock performance during periods of economic uncertainty or heightened trade tensions reveals its resilience.

- Historical data presentation: Provide relevant data points on Microsoft's stock price and performance during past periods of trade tension. This data should be presented clearly and concisely.

- Correlation analysis: Analyze any correlations between trade events and changes in Microsoft's stock price. This analysis will help determine the impact of trade wars on Microsoft's stock performance.

- Conclusions on historical resilience: Based on the historical data, draw conclusions about Microsoft's ability to withstand trade-related economic shocks.

Conclusion: Is Microsoft Stock a Safe Haven?

Microsoft's diversified revenue, robust global presence, and strong market leadership suggest it's a relatively safe software stock during trade war uncertainty. While no investment is without risk, Microsoft's position offers a degree of protection against some negative impacts of trade disputes. Further research and consideration of your personal risk tolerance are crucial before investing. However, Microsoft's stability makes it a strong candidate for inclusion in a diversified portfolio during times of trade war anxiety. Consider adding Microsoft stock to your portfolio as part of a well-diversified investment strategy, and continue learning about mitigating trade war risks in your investments.

Featured Posts

-

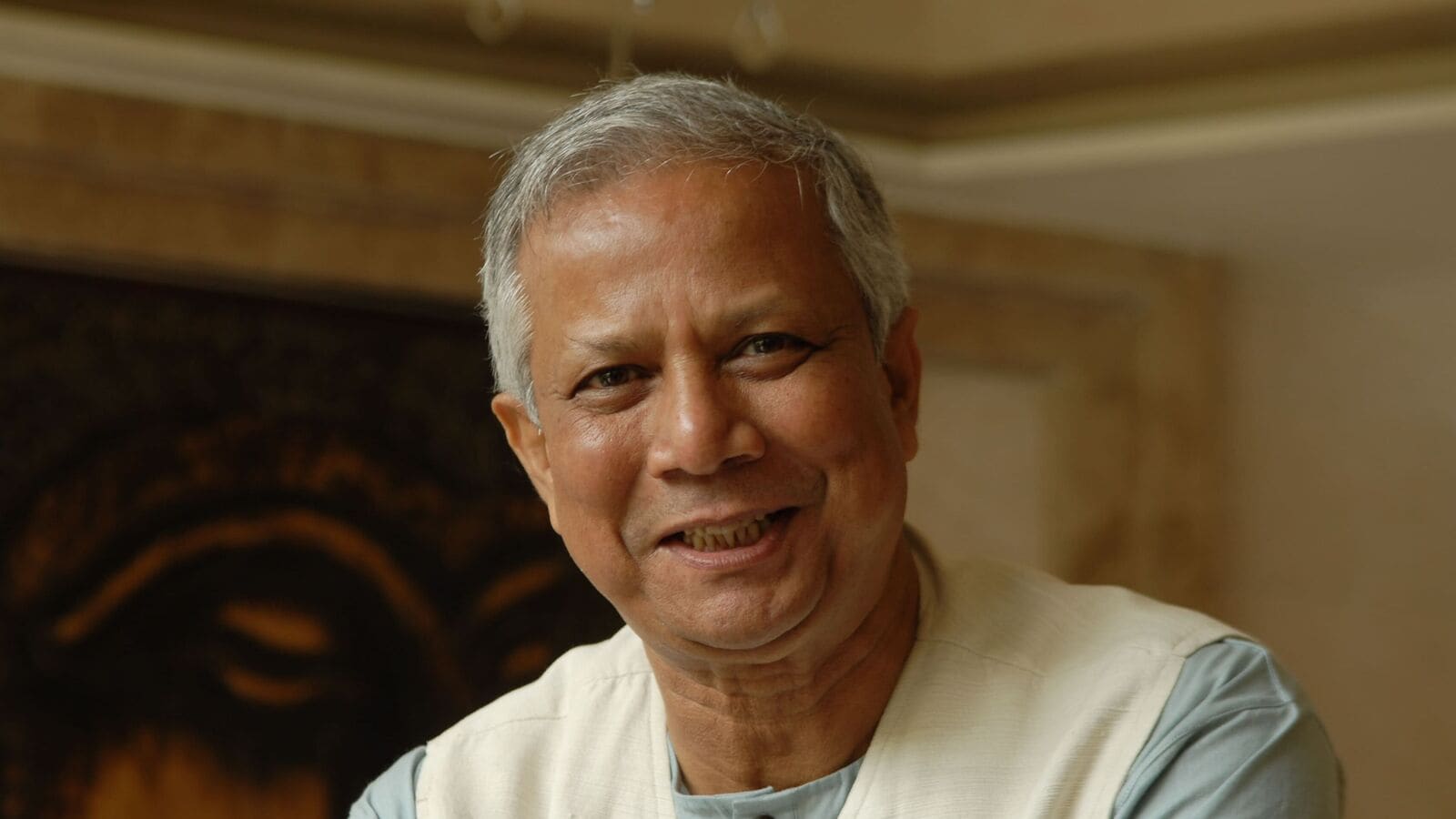

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News

May 16, 2025

First Up Bangladesh Yunus In China Rubios Caribbean Trip And More Top News

May 16, 2025 -

Telford Steam Railway Announces Station Platform Reopening Following Extensive Renovation

May 16, 2025

Telford Steam Railway Announces Station Platform Reopening Following Extensive Renovation

May 16, 2025 -

Mlb All Star Explains His Aversion To The Torpedo Bat

May 16, 2025

Mlb All Star Explains His Aversion To The Torpedo Bat

May 16, 2025 -

Historic Sherman Tank Vs Modern Tesla A 98 Year Old Veterans Demonstration

May 16, 2025

Historic Sherman Tank Vs Modern Tesla A 98 Year Old Veterans Demonstration

May 16, 2025 -

Jalen Brunson Injury Latest Update And Projected Return Date For The Knicks

May 16, 2025

Jalen Brunson Injury Latest Update And Projected Return Date For The Knicks

May 16, 2025