Is NCLH Stock A Top Pick For Hedge Fund Managers? Analyzing Norwegian Cruise Line's Investment Potential

Table of Contents

NCLH's Financial Performance and Recent Trends

Analyzing NCLH's financials is key to understanding its investment potential. Recent quarterly earnings reports reveal a picture of fluctuating revenue and profitability. While the company has shown signs of recovery, significant challenges remain. A thorough balance sheet analysis is needed to understand the company's debt levels and its ability to service those obligations. Key financial ratios, such as the debt-to-equity ratio and current ratio, provide insights into NCLH's financial health.

-

Examination of NCLH's quarterly earnings reports: A detailed review of these reports reveals the trajectory of revenue growth, operational efficiency, and profitability margins. Trends in passenger numbers, average revenue per passenger, and operating expenses are vital indicators of the company's performance.

-

Analysis of key financial ratios: Calculating and comparing ratios like the debt-to-equity ratio (measuring the proportion of debt to equity financing) and the current ratio (assessing the company's ability to meet its short-term liabilities) provides a more nuanced picture of NCLH's financial strength.

-

Comparison to competitors in the cruise industry (e.g., RCL, CCL): Benchmarking NCLH's financial performance against its major competitors, Royal Caribbean (RCL) and Carnival Corporation (CCL), reveals its relative strengths and weaknesses in areas like revenue generation, cost management, and debt levels.

-

Discussion of any significant changes in NCLH's business model: Any strategic shifts in NCLH's operations, such as changes in pricing strategies, route planning, or onboard offerings, must be considered for their impact on future financial performance.

The Impact of the COVID-19 Pandemic and Industry Recovery

The COVID-19 pandemic dealt a devastating blow to NCLH and the entire cruise industry. Travel restrictions, lockdowns, and diminished consumer confidence led to significant operational disruptions and financial losses. The pace of recovery is crucial for evaluating NCLH's investment potential. Factors like vaccination rates, easing of travel restrictions, and the resurgence of consumer confidence in travel directly impact the industry's rebound.

-

Discussion of the impact of travel bans and lockdowns on NCLH's operations: The pandemic forced the temporary suspension of NCLH's operations, resulting in massive revenue losses and substantial financial strain.

-

Analysis of the pace of the cruise industry's recovery: The speed at which the cruise industry is recovering is a critical factor. Are bookings increasing? Are passenger numbers returning to pre-pandemic levels? This analysis offers critical insight into NCLH's prospects.

-

Assessment of the long-term effects of the pandemic on consumer behavior: Will consumer preferences for travel change permanently? Will there be a lasting impact on consumer willingness to cruise? Understanding these potential long-term impacts is crucial for assessing the sustainability of NCLH's recovery.

-

Examination of NCLH's strategies for navigating the recovery: NCLH's response to the pandemic, including its cost-cutting measures, its marketing and sales strategies, and its efforts to enhance safety protocols, are vital factors to consider.

NCLH's Competitive Advantage and Future Growth Prospects

NCLH's success hinges on its competitive advantage within a crowded market. Its brand recognition, fleet modernization efforts, and innovative offerings play a crucial role in attracting customers. Its expansion plans and new ship deployments are also important factors influencing future growth prospects.

-

Analysis of NCLH's brand strength and market positioning: Does NCLH enjoy strong brand loyalty? What is its market share compared to its competitors? Understanding its brand positioning in relation to its competitors is crucial.

-

Assessment of the company's fleet and its condition: The age and condition of NCLH's ships are significant factors affecting its operational efficiency and its ability to compete.

-

Discussion of NCLH's plans for expansion and new ship deployments: Expansion plans for new routes, destinations, and new ships signal growth potential but also carry financial risks.

-

Examination of the company's innovation efforts: NCLH's ability to innovate and offer unique onboard experiences is critical to attracting customers and maintaining a competitive edge.

Hedge Fund Activity and Institutional Investment

The involvement of hedge funds and institutional investors provides valuable insights into market sentiment towards NCLH stock. Analyzing hedge fund ownership, institutional investment trends, analyst ratings, and insider trading activity provides a more comprehensive understanding of the investment landscape.

-

Review of recent filings showing hedge fund positions in NCLH: Examining SEC filings provides insight into the level of hedge fund ownership and any significant changes in their positions.

-

Analysis of analyst ratings and price targets for NCLH stock: Analyst opinions and price target predictions offer a range of perspectives on NCLH's future performance and valuation.

-

Discussion of any significant insider trading activity: Insider trading can indicate optimism or pessimism within the company itself.

-

Overview of overall institutional investor sentiment towards NCLH: The collective sentiment among institutional investors reflects a broader market assessment of NCLH's investment prospects.

Conclusion

Is NCLH stock a top pick for hedge fund managers? The answer is nuanced. While the cruise industry shows signs of recovery, NCLH faces significant challenges, including high debt levels and lingering uncertainty surrounding the long-term impact of the pandemic. However, the company's innovative approach, brand recognition, and potential for future growth present opportunities. Analyzing NCLH's financials, the pace of industry recovery, its competitive landscape, and investor sentiment is crucial for a thorough evaluation. Considering the current state of the cruise industry and NCLH's financial performance, is NCLH stock a suitable addition to your portfolio? Conduct your own thorough due diligence before investing in NCLH or any other stock.

Featured Posts

-

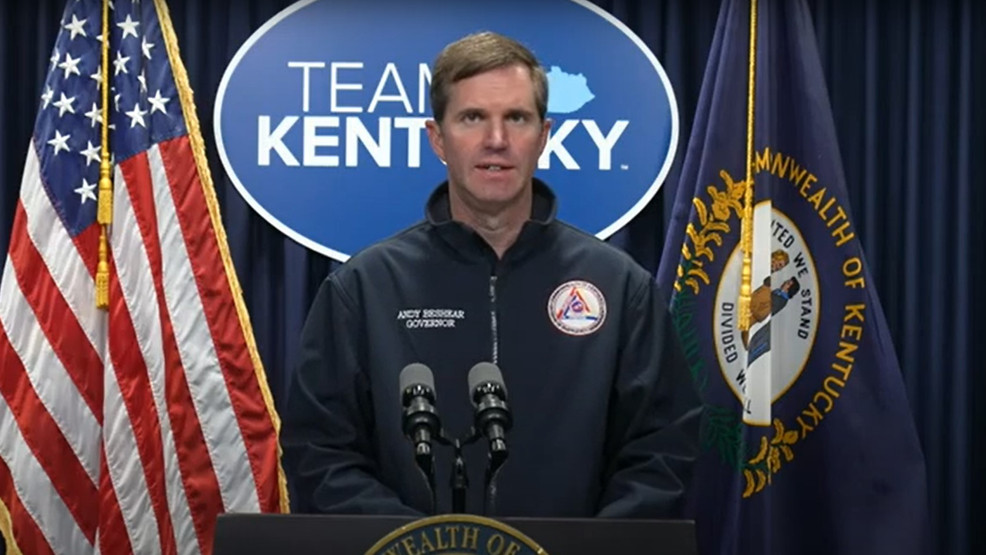

Understanding The Delays In Storm Damage Assessments In Kentucky

Apr 30, 2025

Understanding The Delays In Storm Damage Assessments In Kentucky

Apr 30, 2025 -

Stars Take 3 2 Series Lead With Johnstons Lightning Fast Goal

Apr 30, 2025

Stars Take 3 2 Series Lead With Johnstons Lightning Fast Goal

Apr 30, 2025 -

Unlock Cruise Rewards Cruises Coms Points Based Loyalty Program

Apr 30, 2025

Unlock Cruise Rewards Cruises Coms Points Based Loyalty Program

Apr 30, 2025 -

Amanda And Clive Owen A Look At Their Continued Relationship Challenges On Our Yorkshire Farm

Apr 30, 2025

Amanda And Clive Owen A Look At Their Continued Relationship Challenges On Our Yorkshire Farm

Apr 30, 2025 -

Federal Investigation Millions Stolen After Office365 Executive Inbox Breaches

Apr 30, 2025

Federal Investigation Millions Stolen After Office365 Executive Inbox Breaches

Apr 30, 2025