Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

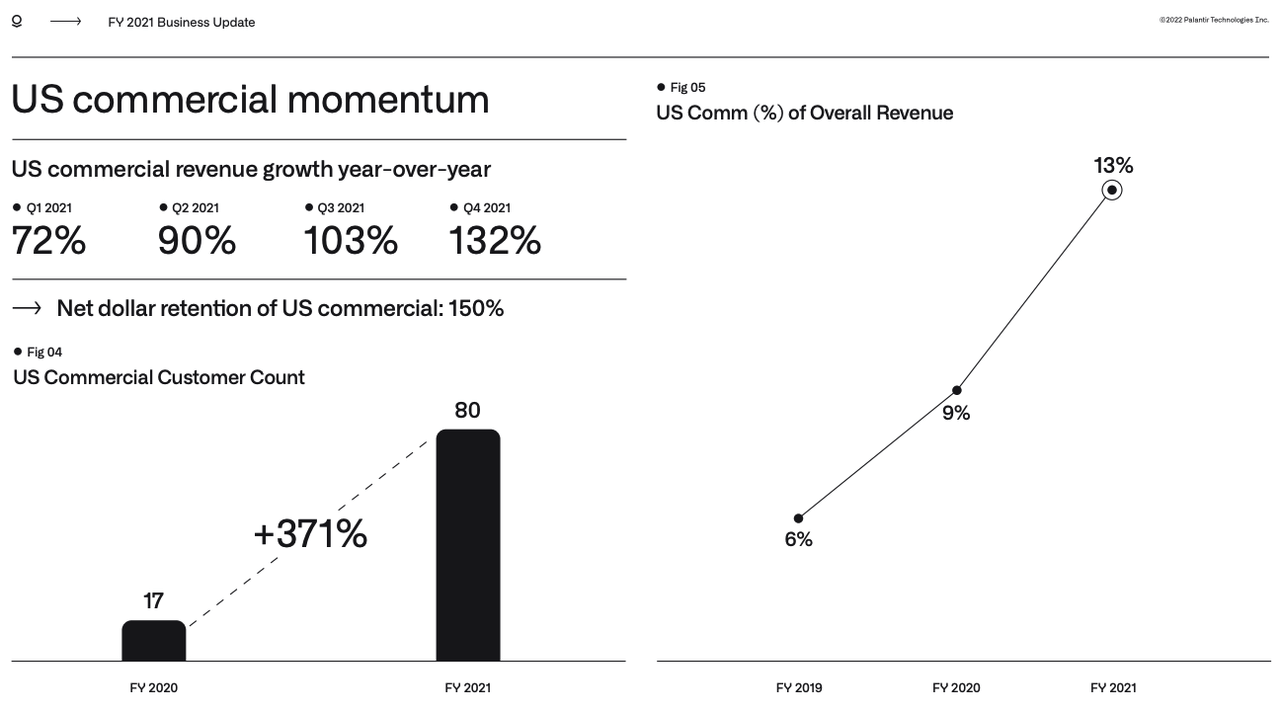

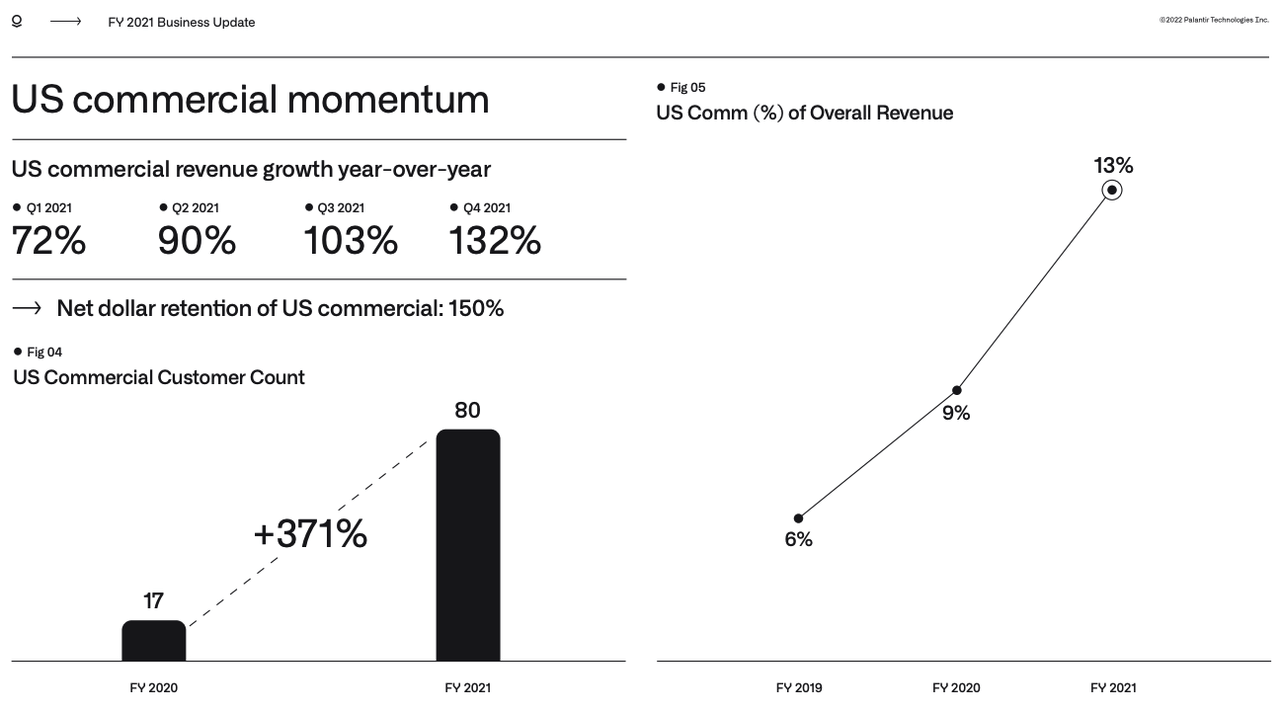

Palantir's Financial Performance and Valuation

Understanding Palantir's financial health is paramount to assessing its investment potential. We need to analyze its recent financial reports and key metrics to determine its valuation. While Palantir has shown significant revenue growth, profitability remains a key area of focus for investors.

- Revenue Growth: Examining the revenue growth rate over the last few quarters and years provides insight into the company's trajectory. A consistent upward trend suggests strong market demand and successful execution of its business strategy. Recent reports should be carefully reviewed for specific figures.

- Profitability Trends: Palantir's profitability, reflected in its operating margin and net income, is crucial. While some losses are expected during periods of high growth and investment, a clear path to profitability is essential for long-term investor confidence. Analyzing trends in gross margin and operating expenses is key here.

- Debt Levels and Solvency: High debt levels can pose significant risks. It's vital to assess Palantir's debt-to-equity ratio and its ability to service its debt obligations. A healthy balance sheet is a cornerstone of a stable and successful company.

- Price-to-Sales Ratio (P/S): Comparing Palantir's P/S ratio to its competitors and industry benchmarks helps determine if it's overvalued or undervalued. A high P/S ratio might suggest that investors are anticipating significant future growth, while a low ratio could signal a potentially undervalued opportunity. This metric should be used in conjunction with other financial indicators.

Palantir's Competitive Landscape and Market Position

Palantir operates in a competitive landscape dominated by established players and emerging startups. Understanding its competitive advantages and the potential for increased competition is critical for evaluating its long-term prospects.

- Key Competitors: Companies like AWS, Microsoft Azure, Google Cloud, and other data analytics firms pose significant competition. Analyzing their market share and strategies is important in assessing Palantir's position.

- Palantir's Unique Selling Propositions (USPs): Palantir's proprietary technology, particularly its expertise in government contracts and complex data integration, provides key differentiators. Understanding these USPs is vital to assessing its competitive edge.

- Barriers to Entry: The high cost of developing and deploying sophisticated data analytics platforms creates significant barriers to entry. This helps to protect Palantir's market share to some extent.

- Potential for Disruptive Technologies: The data analytics field is constantly evolving, and the emergence of new technologies could disrupt Palantir's dominance. Keeping abreast of emerging technologies and their potential impact is essential.

Future Growth Prospects and Potential Risks

Palantir's future growth depends on its ability to expand into new markets, develop innovative products, and overcome potential challenges.

- Projected Revenue Growth: Analyzing analyst projections for revenue growth in the coming years helps to gauge the market's expectation of Palantir's future performance. These projections should be considered with caution, as they are subject to inherent uncertainties.

- New Product Developments: Palantir's ability to innovate and launch new products that cater to evolving market demands is critical for its continued growth. Monitoring new product launches and their market acceptance is vital.

- Key Risks: Palantir's reliance on government contracts, potential for increased competition, and vulnerability to economic downturns all pose significant risks. Understanding these risks and Palantir's strategies to mitigate them is important for potential investors.

- Sensitivity Analysis: Conducting a sensitivity analysis to assess the impact of various economic conditions on Palantir's performance can provide valuable insights into its resilience and vulnerability.

Analyst Ratings and Investor Sentiment

Understanding analyst ratings and investor sentiment provides valuable context for evaluating Palantir stock.

- Average Analyst Rating: The consensus opinion among financial analysts can provide a general indication of the market's view on Palantir's prospects. However, it's important to understand the individual analyst reports and their rationale.

- Range of Price Targets: The range of price targets set by different analysts reflects the uncertainty inherent in stock valuation. A wide range indicates significant divergence of opinion among experts.

- Recent Stock Price Performance: Monitoring recent stock price movements and trading volume provides insights into investor sentiment and market reaction to Palantir's performance and news.

- Investor Sentiment Indicators: Indicators such as short interest (the percentage of shares that are sold short) can help gauge overall investor sentiment towards the stock.

Conclusion: Should You Buy Palantir Stock Right Now?

Based on our comprehensive analysis, Palantir stock presents both significant opportunities and considerable risks. The company exhibits strong revenue growth but profitability remains a key concern. Its innovative technology and strong government relationships offer competitive advantages, but intense competition and economic uncertainty pose challenges. The decision of whether or not to buy Palantir stock right now ultimately depends on your individual risk tolerance and investment goals. The relatively high valuation compared to some competitors also needs careful consideration.

Remember to conduct your own due diligence before investing in Palantir stock. Carefully consider the information presented here and consult with a financial advisor before making any investment decisions. Continuously monitor Palantir’s financial performance and market developments to make informed decisions about your investment in this dynamic company.

Featured Posts

-

Impact Of Stricter Uk Visa Policies On Nigerian And Pakistani Japa Plans

May 09, 2025

Impact Of Stricter Uk Visa Policies On Nigerian And Pakistani Japa Plans

May 09, 2025 -

Examining The Epstein Case Ag Pam Bondis Decision And Transparency

May 09, 2025

Examining The Epstein Case Ag Pam Bondis Decision And Transparency

May 09, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

May 09, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

May 09, 2025 -

A First Look Inside The Reimagined Queen Elizabeth 2 Cruise Ship

May 09, 2025

A First Look Inside The Reimagined Queen Elizabeth 2 Cruise Ship

May 09, 2025 -

Zvernennya Stivena Kinga Politichni Poglyadi Na Trampa Ta Maska

May 09, 2025

Zvernennya Stivena Kinga Politichni Poglyadi Na Trampa Ta Maska

May 09, 2025

Latest Posts

-

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025 -

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025 -

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025 -

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025