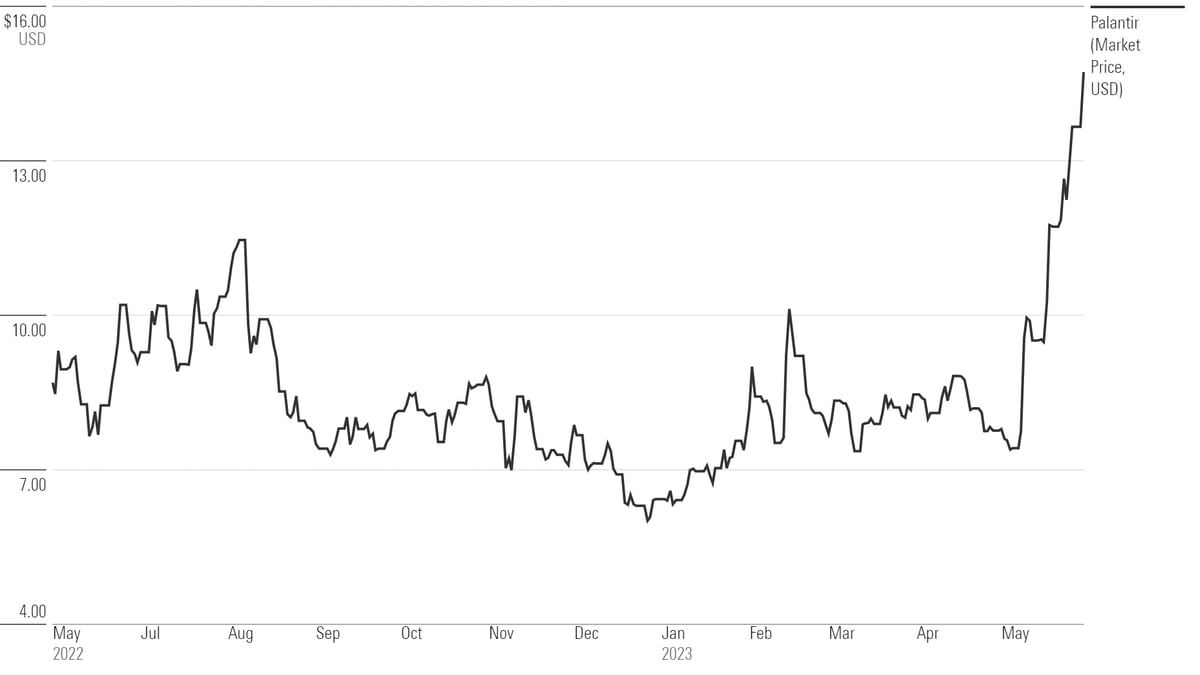

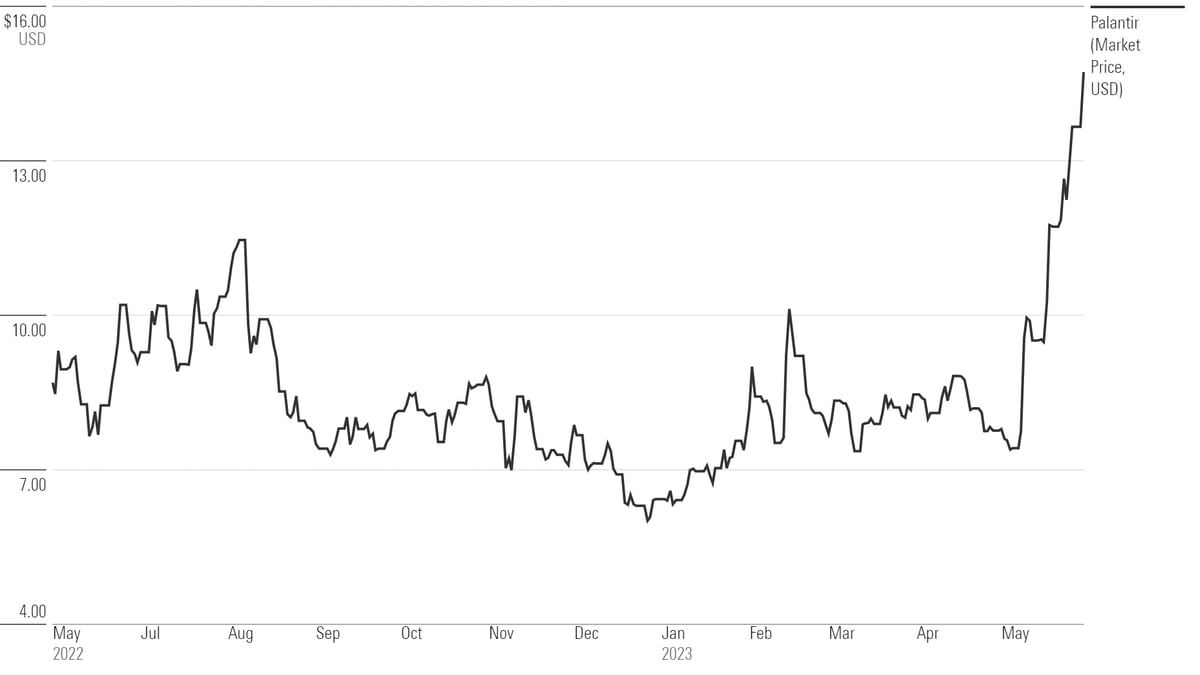

Is Palantir Stock A Good Buy Before May 5th? A Detailed Look

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Analyzing Palantir's recent financial performance is crucial for assessing its current valuation and future potential. We need to look beyond simple stock price fluctuations and delve into the company's core business metrics. Recent quarterly earnings reports reveal important trends in revenue growth, profitability, and key performance indicators (KPIs).

-

Revenue growth rate comparison to previous years: Palantir has shown consistent revenue growth, although the rate of growth might fluctuate from quarter to quarter. Investors should examine the overall trend and compare it to industry benchmarks to assess its performance relative to competitors. Analyzing the sources of revenue growth (government vs. commercial) is also critical.

-

Profitability margins and trends: Monitoring profitability margins (gross margin, operating margin, net margin) helps understand Palantir's efficiency and its ability to translate revenue into profit. Trends in these margins indicate whether the company is improving its operational efficiency or facing increasing cost pressures.

-

Key contract wins and their impact on future revenue: Large contract wins, especially in the government sector, significantly impact Palantir's future revenue streams. Analyzing the size and duration of these contracts provides valuable insights into the company's long-term revenue visibility.

-

Analysis of operating expenses and efficiency improvements: Scrutinizing operating expenses helps evaluate Palantir's cost structure and identify areas for potential efficiency improvements. A reduction in operating expenses without compromising growth can boost profitability.

-

Significant changes in customer acquisition or retention: Tracking customer acquisition cost (CAC) and customer lifetime value (CLTV) provides insights into the company's ability to attract and retain customers. Improvements in these metrics signal a healthy and sustainable business model.

Palantir's guidance for the upcoming quarter and full year offers further insights into management's expectations. Comparing their guidance to analyst predictions allows for a comprehensive assessment of the company's outlook.

Market Sentiment and Analyst Ratings for Palantir Stock

Understanding market sentiment towards Palantir stock is vital for assessing its investment potential. The broader technology sector's performance also influences Palantir's stock price. Analyst ratings and price targets provide further insights into market expectations.

-

Overview of buy, hold, and sell ratings from major investment banks: Consolidating ratings from reputable investment banks gives a holistic view of the market's perception of Palantir's prospects. A preponderance of "buy" ratings suggests positive sentiment, while a higher proportion of "sell" ratings indicates caution.

-

Average price target and range of predictions: The average price target offers a consensus view of Palantir's potential future price. The range of predictions highlights the uncertainty surrounding the stock's valuation.

-

Discussion of any recent upgrades or downgrades: Recent upgrades or downgrades by analysts reflect changing perspectives on Palantir's prospects. Understanding the reasons behind these rating changes is crucial for assessing the stock's investment potential.

-

Influence of macroeconomic factors (interest rates, inflation) on Palantir's stock price: Macroeconomic factors such as interest rate hikes and inflation significantly impact investor sentiment and stock valuations. Considering these factors is essential for a comprehensive analysis.

Key Risks and Opportunities Associated with Investing in Palantir

Investing in Palantir stock, like any investment, carries both risks and opportunities. A thorough assessment of these factors is crucial before making any investment decisions.

-

Competitive landscape analysis (competitors and their market share): Palantir operates in a competitive market. Analyzing the competitive landscape, including competitors' market share and strategies, helps understand Palantir's position and potential challenges.

-

Dependence on government contracts and potential risks associated with this: A significant portion of Palantir's revenue comes from government contracts. This dependence exposes the company to potential risks associated with changes in government spending or policy.

-

Potential for growth in the commercial sector (e.g., healthcare, finance): Palantir is actively expanding its presence in the commercial sector. The potential for growth in this sector offers significant upside potential.

-

Technological innovation and its impact on Palantir's competitive advantage: Continuous technological innovation is crucial for maintaining a competitive edge. Palantir's ability to innovate and adapt to changing technological landscapes will influence its long-term success.

-

Risk assessment of geopolitical events and their effect on the company's performance: Geopolitical events can significantly impact Palantir's performance, particularly its government contracts. Assessing these risks is crucial.

Palantir's Long-Term Growth Potential

Palantir's long-term vision focuses on expanding its platform's capabilities and penetrating new markets. Its strategic initiatives, including investments in R&D and strategic acquisitions, will shape its future performance.

-

Expansion into new markets and industries: Palantir's continued expansion into new markets and industries will be a key driver of its long-term growth.

-

Investment in research and development: Significant investments in R&D are crucial for maintaining a competitive edge and developing innovative solutions.

-

Potential for strategic acquisitions: Strategic acquisitions can accelerate Palantir's growth and expand its capabilities.

-

Long-term revenue projections and potential for profitability: Analyzing long-term revenue projections and the potential for increased profitability provides insights into Palantir's long-term value creation potential.

Conclusion

Determining whether Palantir stock is a good buy before May 5th requires a careful evaluation of its recent performance, market sentiment, and future prospects. While Palantir exhibits significant growth potential, particularly in the commercial sector and through technological innovation, risks associated with government contract reliance and macroeconomic factors must be considered. The analysis suggests that Palantir stock offers a compelling investment opportunity for long-term investors with a high-risk tolerance. However, the short-term price movements leading up to May 5th remain uncertain.

Ultimately, the decision of whether or not to buy Palantir stock before May 5th is a personal one. However, by carefully considering the factors discussed in this analysis of Palantir stock, you can make a more informed investment decision. Continue your own due diligence and research before investing in Palantir stock or any other security.

Featured Posts

-

Nottingham Police Under Scrutiny Following Attack Investigation

May 10, 2025

Nottingham Police Under Scrutiny Following Attack Investigation

May 10, 2025 -

Debate Erupts Jeanine Pirros Views On Due Process For Us Citizens In El Salvador Prisons

May 10, 2025

Debate Erupts Jeanine Pirros Views On Due Process For Us Citizens In El Salvador Prisons

May 10, 2025 -

How Trumps Executive Orders Affected Transgender Rights And Well Being A Community Perspective

May 10, 2025

How Trumps Executive Orders Affected Transgender Rights And Well Being A Community Perspective

May 10, 2025 -

Thailands Transgender Community A Call For Equality In The Bangkok Post

May 10, 2025

Thailands Transgender Community A Call For Equality In The Bangkok Post

May 10, 2025 -

9 Maya Pochemu Makron Starmer Merts I Tusk Ne Priekhali V Kiev

May 10, 2025

9 Maya Pochemu Makron Starmer Merts I Tusk Ne Priekhali V Kiev

May 10, 2025