Is Palantir Technologies Stock A Buy Now? A Comprehensive Investment Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's revenue streams are primarily derived from two key sectors: government contracts and commercial business. Understanding the contribution of each is crucial for assessing the Palantir stock price and its future performance.

Government Contracts

Government contracts form a significant portion of Palantir's revenue, providing stability through long-term agreements. This sector benefits from consistent defense spending and a growing need for advanced data analytics in national security. The global government sector market for big data analytics is substantial, and Palantir holds a considerable market share, particularly within intelligence agencies and defense departments. Keywords like "government contracts," "defense spending," and "national security" highlight Palantir's strong position in this sector.

Commercial Business

Palantir's commercial business is experiencing substantial growth, expanding its reach across various industries. Key clients span diverse sectors, leveraging Palantir's platform for data integration, analysis, and operational efficiency. This diversification reduces reliance on government contracts and provides significant upside potential. Keywords like "commercial clients," "data analytics," "artificial intelligence," and "machine learning" showcase Palantir's capabilities beyond government contracts.

- Breakdown of revenue streams: While the exact percentage fluctuates, government contracts historically constituted a larger portion of Palantir's revenue, but the commercial segment is rapidly growing, showcasing increasing diversification.

- Key metrics indicating growth: Recent reports showcase a consistent increase in contract wins and new commercial clients, indicating strong growth across both sectors.

- Diversification of revenue base: This strategy mitigates risk associated with relying heavily on a single sector, leading to more stable and predictable revenue streams.

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is critical for assessing the Palantir stock price and its investment potential.

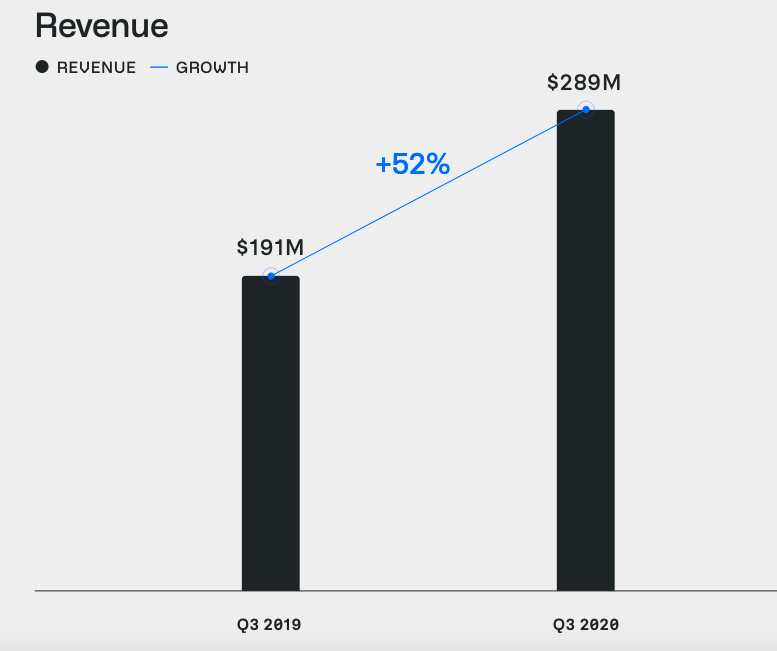

Revenue Growth and Profitability

Palantir has demonstrated consistent revenue growth, although profitability margins have varied. Examining earnings per share (EPS) and cash flow provides insights into the company's financial health and future earnings potential. Comparing these figures to industry benchmarks helps determine Palantir's competitive position and its potential for future growth. Keywords such as "revenue growth," "profitability," "earnings per share (EPS)," and "cash flow" provide context for the financial analysis.

Stock Valuation Metrics

Various valuation metrics, including the Price-to-Sales (P/S) ratio, Price-to-Earnings (P/E) ratio, and PEG ratio, help determine if Palantir's stock is overvalued or undervalued compared to its competitors and industry averages. Examining its market capitalization provides further context. Keywords like "P/S ratio," "P/E ratio," "PEG ratio," "market capitalization," and "valuation metrics" are integral to understanding Palantir's stock valuation.

- Key financial figures: (Insert recent financial data from Palantir's reports here, including revenue, EPS, and cash flow figures)

- Comparison of valuation metrics: (Compare Palantir's valuation metrics to competitors in the big data and analytics sector)

- Future earnings potential: (Provide an analysis of projected growth based on current trends and market forecasts.)

Risks and Challenges Facing Palantir

Despite Palantir's growth potential, several risks and challenges could impact its future performance and the Palantir stock price.

Competition

The big data and analytics market is competitive. Identifying key competitors and analyzing their strengths and weaknesses is crucial. Competition could impact Palantir's market share and growth trajectory. Keywords like "competitor analysis," "market share," and "competitive advantage" are essential for this assessment.

Dependence on Government Contracts

Palantir's significant reliance on government contracts introduces risk. Changes in government spending, policy shifts, and contract renewal challenges could significantly impact revenue. Keywords like "government regulation," "political risk," and "contract renewal" highlight this vulnerability.

Economic Uncertainty

Broader macroeconomic factors, such as inflation and recessionary fears, can significantly impact Palantir's performance. Economic downturns often lead to reduced government spending and decreased commercial investment in data analytics. Keywords such as "economic outlook," "inflation," and "recession" reflect this external risk.

- Key Competitors: (List and analyze key competitors in the data analytics and government contracting space)

- Potential Risks: (Summarize potential risks related to competition, government contracts, economic downturns and other potential challenges)

- Mitigation Strategies: (Discuss strategies Palantir is employing to mitigate these risks)

Future Outlook and Growth Potential

Palantir's future prospects depend on its ability to capitalize on growth opportunities and adapt to technological advancements.

Growth Opportunities

Future growth for Palantir hinges on continued expansion in both the government and commercial sectors. Analyzing Palantir's strategic initiatives, product development, and expansion plans provides insights into its future growth potential. Keywords such as "future growth," "market expansion," "product innovation," and "strategic initiatives" are relevant here.

Technological Advancements

Palantir's investment in artificial intelligence (AI), machine learning, and other cutting-edge technologies is crucial for maintaining its competitive edge. These technologies enhance its data analytics capabilities and create opportunities for new products and services. Keywords like "AI," "machine learning," "data analytics," and "technological advancements" are key to understanding Palantir's innovative capacity.

- Key Growth Drivers: (Identify key factors that could drive future growth for Palantir)

- Market Projections: (Present potential market size and market share projections for Palantir)

- Impact of New Technologies: (Analyze the expected impact of new technologies on Palantir's future performance)

Conclusion

This analysis has examined Palantir Technologies' business model, financial performance, risks, and future growth potential, considering the many factors that influence the Palantir stock price. While Palantir offers compelling growth opportunities in the rapidly expanding data analytics market, significant risks associated with its dependence on government contracts and competitive pressures need careful consideration. Whether Palantir Technologies stock is a buy, hold, or sell depends on your individual risk tolerance, investment goals, and the weighting you give to the presented factors. This analysis provides a framework for your own due diligence, but remember to conduct your own thorough research before making any investment decisions related to Palantir Technologies stock. Considering individual risk tolerance and investment goals is paramount before investing in any stock, including Palantir stock. Remember, this is not financial advice; consult with a financial professional before making any investment decisions.

Featured Posts

-

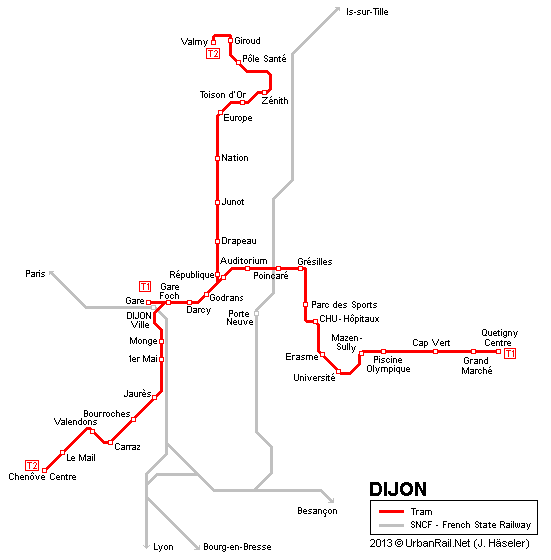

Le Projet De 3e Ligne De Tram A Dijon Concertation Et Decisions Du Conseil Metropolitain

May 10, 2025

Le Projet De 3e Ligne De Tram A Dijon Concertation Et Decisions Du Conseil Metropolitain

May 10, 2025 -

High Fashion Collaboration Elizabeth Stewart Designs For Lilysilk

May 10, 2025

High Fashion Collaboration Elizabeth Stewart Designs For Lilysilk

May 10, 2025 -

Find Your Fun Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025

Find Your Fun Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025 -

Cite De La Gastronomie De Dijon Position De La Ville Concernant Les Problemes D Epicure

May 10, 2025

Cite De La Gastronomie De Dijon Position De La Ville Concernant Les Problemes D Epicure

May 10, 2025 -

Understanding Wynne And Joanna All At Sea Character Development And Plot

May 10, 2025

Understanding Wynne And Joanna All At Sea Character Development And Plot

May 10, 2025