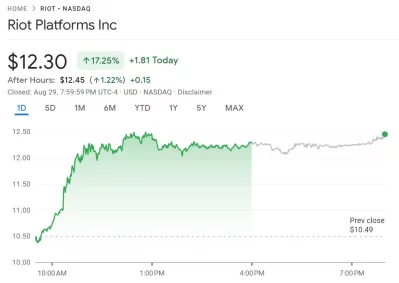

Is Riot Platforms (RIOT) Stock A Good Investment? Comparing It To Coinbase (COIN)

Table of Contents

We'll delve into the business models, financial performance, and risk profiles of both companies to help you determine which, if either, aligns with your investment strategy.

Riot Platforms (RIOT): A Deep Dive into Bitcoin Mining

Riot Platforms' core business centers around Bitcoin mining. They operate large-scale mining facilities, utilizing powerful computers to solve complex mathematical problems and earn Bitcoin rewards. Understanding their operational efficiency and scalability is key to assessing their investment potential.

Understanding Riot Platforms' Business Model

Riot Platforms' success hinges on several factors:

- Hashing Power: The company's ability to generate significant hashing power—the computational power used to mine Bitcoin—directly impacts its Bitcoin mining output. Higher hashing power translates to more mined Bitcoin.

- Energy Consumption: Bitcoin mining is energy-intensive. Riot's operational costs are heavily influenced by energy prices and their strategies for procuring sustainable and cost-effective energy.

- Geographical Location: The strategic placement of their mining facilities considers factors like energy costs, regulatory environments, and access to infrastructure.

- Scalability: Riot's ability to expand its mining operations and increase its hashing power is crucial for future growth and profitability.

Advantages: Direct exposure to Bitcoin price appreciation. Potential for high returns if Bitcoin's price increases significantly.

Disadvantages: High dependence on Bitcoin's price volatility. Significant energy costs and environmental concerns. Regulatory risks related to cryptocurrency mining.

Financial Performance and Future Projections

Analyzing Riot Platforms' financial statements reveals key insights:

- Revenue Growth: RIOT's revenue is directly tied to the price of Bitcoin and its mining output. Examining historical revenue growth patterns helps predict future performance.

- Profitability Margins: Understanding RIOT's profitability margins helps assess the efficiency of their operations and their ability to withstand price fluctuations.

- Debt Levels: High debt levels can increase financial risk and limit future growth potential. Analyzing RIOT's debt structure is crucial.

- Partnerships and Acquisitions: Strategic partnerships and acquisitions can enhance Riot Platforms' growth trajectory and technological advancements.

(Insert relevant chart/graph visualizing RIOT's financial performance)

Key risks include Bitcoin price volatility, fluctuating energy costs, and increasing competition in the Bitcoin mining sector. Analyst predictions for RIOT's future growth should be carefully considered, keeping in mind their inherent uncertainty.

RIOT Stock Valuation and Risk Assessment

RIOT's stock price reflects market sentiment toward Bitcoin and the company's performance. Key valuation metrics include:

- Market Capitalization: Indicates the total value of the company's outstanding shares.

- P/E Ratio: A measure of the company's valuation relative to its earnings.

- Stock Price Volatility: RIOT stock is known for its volatility, reflecting the inherent risk in the cryptocurrency market.

Investing in RIOT involves considerable risk. Positive factors include potential high returns if Bitcoin's price rises significantly, but negative factors include significant price volatility and dependency on Bitcoin's success.

Coinbase (COIN): Navigating the Cryptocurrency Exchange Landscape

Coinbase operates as a major cryptocurrency exchange, facilitating the buying, selling, and trading of various cryptocurrencies. Its success is linked to the growth of the overall cryptocurrency market and its ability to maintain a strong competitive position.

Coinbase's Business Model and Market Position

Coinbase offers a range of services, including:

- Cryptocurrency Trading: Provides a platform for users to trade various cryptocurrencies.

- Custody Services: Offers secure storage solutions for users' crypto assets.

- Staking Services: Allows users to earn rewards by participating in the validation of blockchain transactions.

Coinbase’s competitive advantages lie in its user-friendly platform, regulatory compliance (relatively speaking), and established brand recognition. However, increasing competition from other exchanges poses a challenge.

Coinbase's Financial Performance and Future Outlook

Analyzing Coinbase's financial performance requires examining:

- Trading Volume: Higher trading volume directly translates to higher revenue for Coinbase.

- Revenue Streams: Coinbase generates revenue from transaction fees, subscription services, and other sources.

- Profitability: Coinbase's profitability is influenced by trading volume, market conditions, and operating costs.

- Expansion into New Markets: Coinbase's expansion into new geographic markets and services will impact future growth.

(Insert relevant chart/graph visualizing COIN's financial performance)

Risks include regulatory uncertainty, competition from other cryptocurrency exchanges, and the overall volatility of the cryptocurrency market.

COIN Stock Valuation and Investment Risks

COIN's stock valuation reflects the market's perception of its long-term prospects.

- Market Capitalization: A key indicator of the company's overall size and value.

- P/E Ratio: Helps assess the company's valuation relative to its earnings.

- Stock Price Volatility: COIN's stock price can be volatile, reflecting the overall uncertainty in the cryptocurrency market.

Investing in COIN involves risks associated with regulatory changes, market competition, and the inherent volatility of the cryptocurrency market. However, it also offers potential rewards through exposure to the growth of the broader cryptocurrency sector.

Direct Comparison: RIOT vs. COIN

To effectively compare RIOT and COIN, we need to consider several key factors:

Growth Potential

- RIOT: High growth potential if Bitcoin's price appreciates and mining profitability increases. However, highly dependent on Bitcoin's price.

- COIN: Growth potential tied to the overall growth of the cryptocurrency market and Coinbase's ability to maintain its market share. Less dependent on a single cryptocurrency.

Risk Tolerance

- RIOT: Higher risk due to Bitcoin's price volatility and the energy-intensive nature of Bitcoin mining. Suitable for investors with a higher risk tolerance.

- COIN: Moderate risk, although still subject to market volatility and regulatory uncertainty. More suitable for investors with a moderate risk tolerance.

Diversification Strategies

Both RIOT and COIN can be part of a diversified investment portfolio. However, it's crucial to consider their correlation with other assets and the overall risk profile of your portfolio. Diversification is key to mitigating risk.

Conclusion: Is Riot Platforms (RIOT) or Coinbase (COIN) Right for You?

This comparison highlights the distinct characteristics of Riot Platforms and Coinbase. RIOT offers high-risk, high-reward potential tied directly to Bitcoin's price, while COIN presents a more diversified approach within the broader cryptocurrency market with moderate risk.

For investors with a higher risk tolerance and a bullish outlook on Bitcoin mining, RIOT might be a suitable option. However, investors seeking more stability and exposure to the broader cryptocurrency market may find COIN more appealing. Ultimately, the best choice depends on your individual financial goals, risk tolerance, and investment timeline. Invest wisely in cryptocurrency-related stocks. Learn more about RIOT and COIN investments and make informed decisions about RIOT and COIN stock before investing. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Enhancing Mental Health Literacy An Educational Approach

May 03, 2025

Enhancing Mental Health Literacy An Educational Approach

May 03, 2025 -

Avrupa Is Birligimizi Gelistirme Yolunda Yeni Politikalar Ve Stratejiler

May 03, 2025

Avrupa Is Birligimizi Gelistirme Yolunda Yeni Politikalar Ve Stratejiler

May 03, 2025 -

East Coast Ev Drivers 100 Rebate On Hpc Charging With Shell Recharge This Raya

May 03, 2025

East Coast Ev Drivers 100 Rebate On Hpc Charging With Shell Recharge This Raya

May 03, 2025 -

April 12 2025 Lotto Results Winning Numbers For Lotto And Lotto Plus

May 03, 2025

April 12 2025 Lotto Results Winning Numbers For Lotto And Lotto Plus

May 03, 2025 -

Reform Uk Backs Snp In Next Scottish Election Farages Controversial Prediction

May 03, 2025

Reform Uk Backs Snp In Next Scottish Election Farages Controversial Prediction

May 03, 2025