Is The Great Decoupling Inevitable? Examining The Evidence

Table of Contents

Economic Interdependence: A Powerful Force Against Decoupling

The idea of a complete "Great Decoupling" faces a significant hurdle: the deeply intertwined nature of the US and Chinese economies. Decades of globalization have created a level of interdependence that would be incredibly difficult and costly to unravel.

Deeply Integrated Supply Chains

- Reliance on Chinese Manufacturing: Numerous industries, particularly electronics, rely heavily on Chinese manufacturing for components and finished goods. From smartphones to medical devices, intricate supply chains crisscross the Pacific.

- Rare Earth Minerals: China holds a dominant position in the production of rare earth minerals, crucial for various technologies, including renewable energy and defense systems. Severing these ties would severely impact global technological advancement.

- Textiles and Apparel: The US heavily relies on Chinese factories for the production of textiles and apparel. Shifting this production would require significant investment and time.

The cost of disentangling these deeply integrated supply chains is enormous. A 2023 study by the Peterson Institute for International Economics estimated that a complete decoupling could reduce global GDP by up to 10%. This illustrates the economic gravity preventing a swift and complete severance of ties. The sheer scale of bilateral trade, exceeding $690 billion in 2022, further underscores the immense interdependence.

Financial Interconnectedness

- Chinese Investment in US Treasuries: China holds a substantial portion of US Treasury bonds, making it a significant creditor to the United States. A decoupling could trigger a significant financial shock.

- US Investment in China: Conversely, numerous American companies have substantial investments in China, generating significant profits and employing millions of workers. Cutting these ties would result in substantial financial losses.

The potential for global financial instability resulting from a decoupling is immense. Disruptions to global capital markets and a potential domino effect on other economies are serious concerns. The interconnectedness of financial markets means that a decoupling between the US and China would likely have far-reaching consequences beyond the two countries themselves.

Geopolitical Tensions Fueling the Decoupling Narrative

While economic interdependence argues against a complete decoupling, geopolitical tensions are undeniably fueling the narrative. These tensions are driven by several key factors.

Technological Competition and National Security Concerns

- Semiconductor Rivalry: The competition for dominance in semiconductor technology is fierce, with concerns over China's ambitions in this critical sector.

- AI and 5G: Similar concerns exist regarding artificial intelligence and 5G technology, where national security implications are paramount.

- Intellectual Property Theft: Accusations of intellectual property theft and concerns about data security are further exacerbating tensions.

These concerns are driving efforts towards technological self-reliance and reducing dependence on China. Policies like restrictions on technology exports, investment screening, and the promotion of domestic manufacturing are indicative of this trend. The US CHIPS and Science Act, for example, aims to boost domestic semiconductor production, reducing reliance on foreign suppliers.

Ideological Differences and Human Rights

- Human Rights Concerns: Concerns about human rights abuses in China, particularly in Xinjiang and Tibet, have significantly impacted US-China relations.

- Differing Political Systems: The fundamental differences in political systems and governance models contribute to the ongoing tensions.

Sanctions imposed due to human rights concerns have directly affected economic relations, further highlighting the complex interplay between political values and economic ties. These sanctions, while aimed at addressing human rights issues, inevitably contribute to the growing trend towards decoupling in specific sectors.

The Partial Decoupling Scenario: A More Realistic Outcome?

A complete "Great Decoupling" appears unlikely given the scale of existing economic ties. A more realistic scenario is a partial decoupling, characterized by strategic diversification and a focus on specific high-risk sectors.

Strategic Diversification, Not Complete Separation

- Friend-Shoring and Near-Shoring: The concepts of "friend-shoring" (relocating production to countries with aligned values) and "near-shoring" (moving production closer to home) are gaining traction.

- Supply Chain Resilience: Companies are actively working to diversify their supply chains, reducing reliance on any single country, particularly China.

This strategic diversification, however, is a gradual process. Shifting production involves substantial investment, logistical challenges, and potential disruptions to existing operations. Case studies of companies diversifying their supply chains reveal that this is a complex and costly undertaking.

Focus on Specific High-Risk Sectors

- Technology and Defense: Decoupling efforts are likely to focus on sectors deemed critical for national security, such as technology (semiconductors, AI) and defense.

- Strategic Resources: Similar prioritization may be given to decoupling in sectors related to strategic resources where dependence on China presents a vulnerability.

By prioritizing specific high-risk sectors, governments and businesses can mitigate vulnerabilities without triggering a complete collapse of economic ties. This targeted approach allows for a more manageable transition and reduces the overall economic disruption.

Conclusion: Is a Complete Great Decoupling Inevitable?

The evidence suggests that a complete "Great Decoupling" is unlikely in the near future. While geopolitical tensions and concerns about national security are driving efforts to reduce reliance on China, the sheer scale of economic interdependence presents a powerful counterforce. A more realistic scenario involves a partial decoupling, focusing on strategic diversification and mitigating vulnerabilities in high-risk sectors. The ongoing evolution of the US-China relationship will continue to shape the pace and nature of this decoupling. Continue exploring the complexities of the Great Decoupling to understand the future of global economics.

Featured Posts

-

Sergio Perez And Franco Colapintos Emotional Tributes After F1 Tragedy

May 09, 2025

Sergio Perez And Franco Colapintos Emotional Tributes After F1 Tragedy

May 09, 2025 -

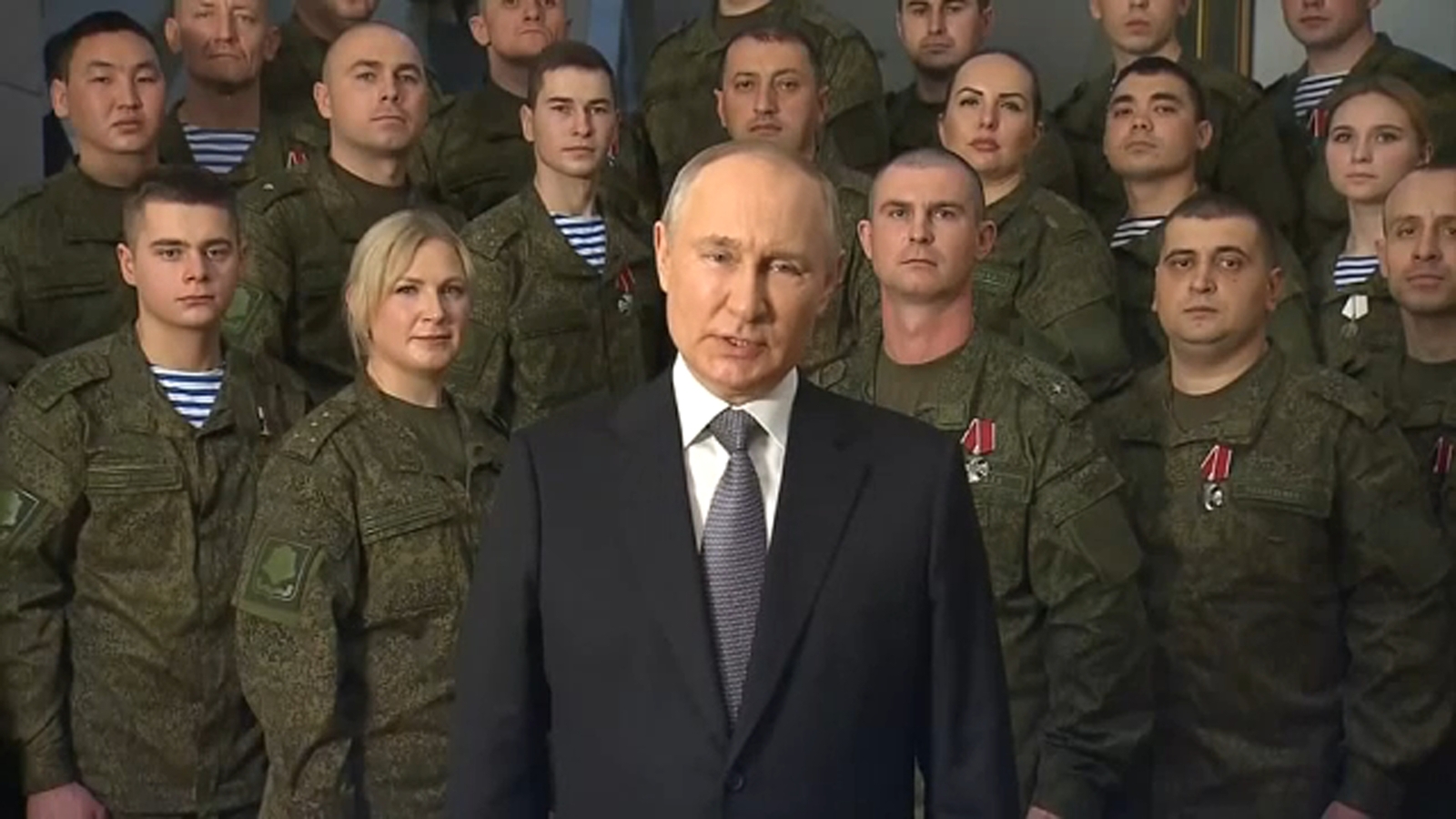

Putins Victory Day Ceasefire A Temporary Truce

May 09, 2025

Putins Victory Day Ceasefire A Temporary Truce

May 09, 2025 -

Silniy Snegopad Ostavil 45 000 Chelovek V Sverdlovskoy Oblasti Bez Sveta

May 09, 2025

Silniy Snegopad Ostavil 45 000 Chelovek V Sverdlovskoy Oblasti Bez Sveta

May 09, 2025 -

Billionaires Favorite Etf Projected 110 Growth In 2025

May 09, 2025

Billionaires Favorite Etf Projected 110 Growth In 2025

May 09, 2025 -

Surgeon General Nomination Withdrawn White House Selects Maha Influencer

May 09, 2025

Surgeon General Nomination Withdrawn White House Selects Maha Influencer

May 09, 2025

Latest Posts

-

Examining The Epstein Case Ag Pam Bondis Decision And Transparency

May 09, 2025

Examining The Epstein Case Ag Pam Bondis Decision And Transparency

May 09, 2025 -

Assessing Ag Pam Bondis Decision The Publics Right To Know Regarding The Epstein Files

May 09, 2025

Assessing Ag Pam Bondis Decision The Publics Right To Know Regarding The Epstein Files

May 09, 2025 -

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025 -

Pam Bondi And James Comer Clash Over Epstein Files

May 09, 2025

Pam Bondi And James Comer Clash Over Epstein Files

May 09, 2025 -

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025