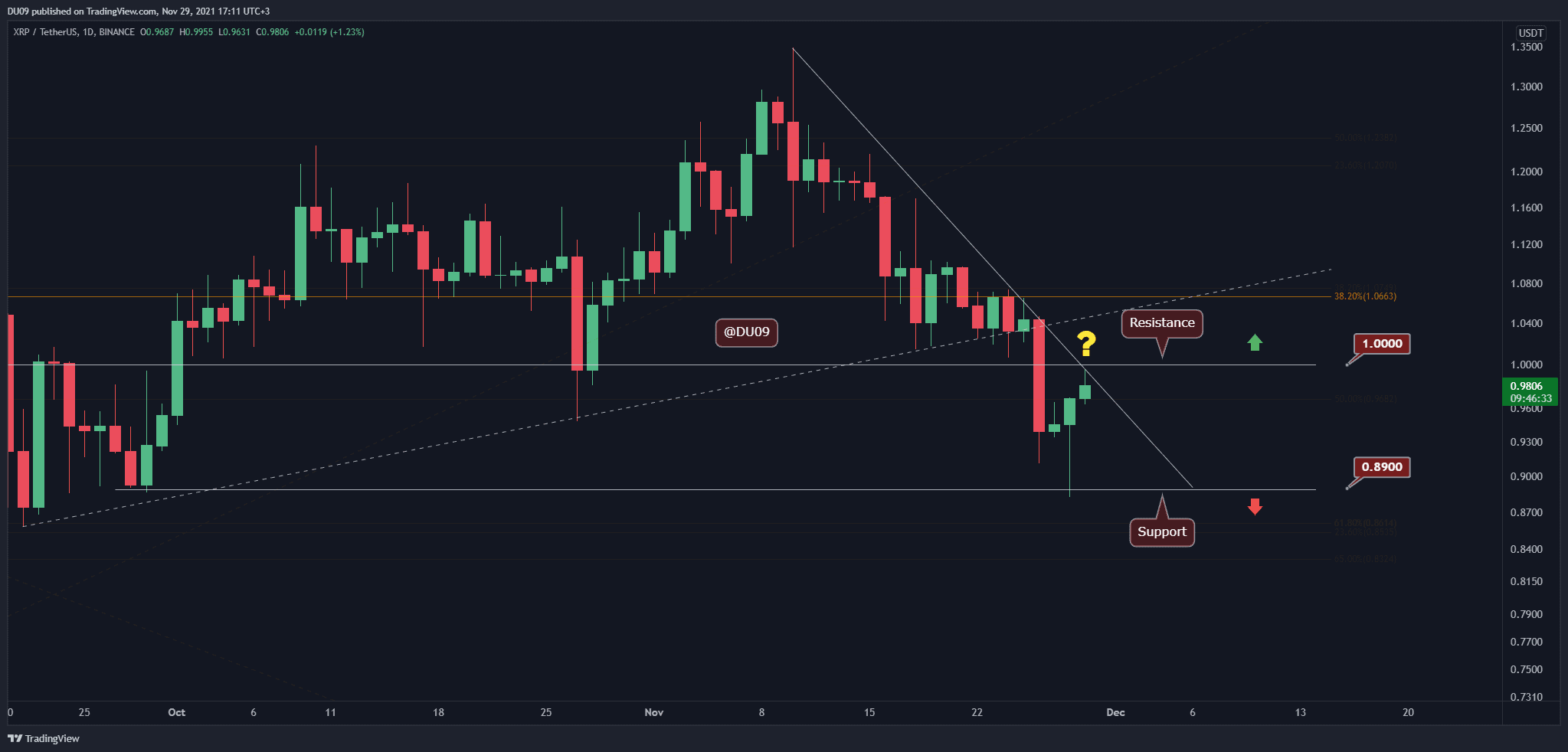

Is The XRP Recovery Stalling? Derivatives Market Insights

Table of Contents

Open Interest and its Implications for XRP Recovery

Open interest, the total number of outstanding contracts in the XRP futures and options markets, is a crucial indicator of market sentiment and potential volatility. High open interest suggests strong conviction among traders, whether bullish or bearish. A significant increase in open interest might precede substantial price movements, as a large number of contracts need to be settled. Conversely, decreasing open interest might suggest waning investor interest and a potential slowdown in the XRP recovery. Analyzing the change in open interest over time is therefore vital. We need to look at not only the absolute level of open interest but also its rate of change.

- High open interest can indicate strong conviction in either direction (bullish or bearish). A large number of contracts held indicates a significant commitment to a particular price prediction.

- Decreasing open interest might suggest waning investor interest. A decline in open interest could indicate that traders are becoming less certain about the future price of XRP.

- Sudden spikes in open interest could precede significant price movements. A sudden surge in open interest could be a warning sign of a potential market shift, either up or down. This requires careful monitoring alongside other indicators.

Funding Rates and Their Predictive Power

Funding rates represent the cost of holding a long position in XRP futures contracts. They represent the equilibrium between buyers and sellers of perpetual contracts. Positive funding rates indicate that there's more demand to go long than to go short, and vice versa. In the context of XRP recovery, positive funding rates might suggest bearish sentiment, as long positions are more expensive to maintain. Conversely, high negative funding rates might signal bullish pressure, indicating that investors are willing to pay a premium to hold long positions.

- High positive funding rates suggest bearish pressure and potential downward correction. Traders are less bullish and may be anticipating a price drop.

- High negative funding rates indicate bullish pressure and potential upward momentum. Traders are optimistic about the future price of XRP.

- Consistent neutral funding rates might suggest market indecision. The market is unsure about the direction of XRP's price.

Volatility and its Effect on XRP Price

Volatility, a measure of price fluctuations, plays a significant role in the XRP recovery. We need to distinguish between implied volatility (IV) and realized volatility (RV). Implied volatility, derived from options prices, reflects market expectations of future price swings. Realized volatility measures past price fluctuations. High implied volatility suggests uncertainty and the potential for significant price swings, which could either hinder or accelerate the XRP recovery. Conversely, low implied volatility might indicate low expected price movements and a more stable, albeit potentially slower, recovery.

- High implied volatility suggests uncertainty and potential for significant price swings. This could lead to heightened risk for investors.

- Low implied volatility might indicate low expected price movements. This might suggest a period of consolidation or sideways trading.

- Sudden changes in volatility can be a leading indicator of market shifts. A sharp increase or decrease in volatility often precedes significant price movements.

Analyzing the Relationship Between Spot and Futures Prices

Comparing the price movements of XRP in the spot market (immediate buying and selling) and the futures market provides further insight. The difference between the spot and futures price creates a market condition known as contango or backwardation. Contango occurs when the futures price is higher than the spot price, often suggesting bearish sentiment and potential downward pressure. Backwardation, where the spot price is higher than the futures price, often indicates bullish sentiment and potentially stronger upward momentum.

- A significant difference (contango or backwardation) can signal market sentiment. This disparity can be a powerful indicator of future price direction.

- Contango (futures price > spot price) could indicate bearish sentiment. Traders expect lower prices in the future.

- Backwardation (spot price > futures price) could indicate bullish sentiment. Traders expect higher prices in the future.

Conclusion

The derivatives market offers valuable insights into the potential trajectory of the XRP recovery. Analyzing open interest, funding rates, and volatility, along with the relationship between spot and futures prices, provides a more holistic perspective than relying solely on spot price analysis. While the current data may suggest a potential slowdown, it's crucial to continuously monitor these indicators. The future of the XRP recovery remains dynamic and requires diligent observation of these market dynamics. Continue to stay informed and track the XRP recovery by regularly reviewing the latest derivatives market data. Don't miss out on crucial information impacting the XRP recovery – stay informed!

Featured Posts

-

Py Ays Ayl Ke Dwran Lahwr Myn Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025

Py Ays Ayl Ke Dwran Lahwr Myn Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025 -

The Bitcoin Golden Cross Historical Context And Future Outlook

May 08, 2025

The Bitcoin Golden Cross Historical Context And Future Outlook

May 08, 2025 -

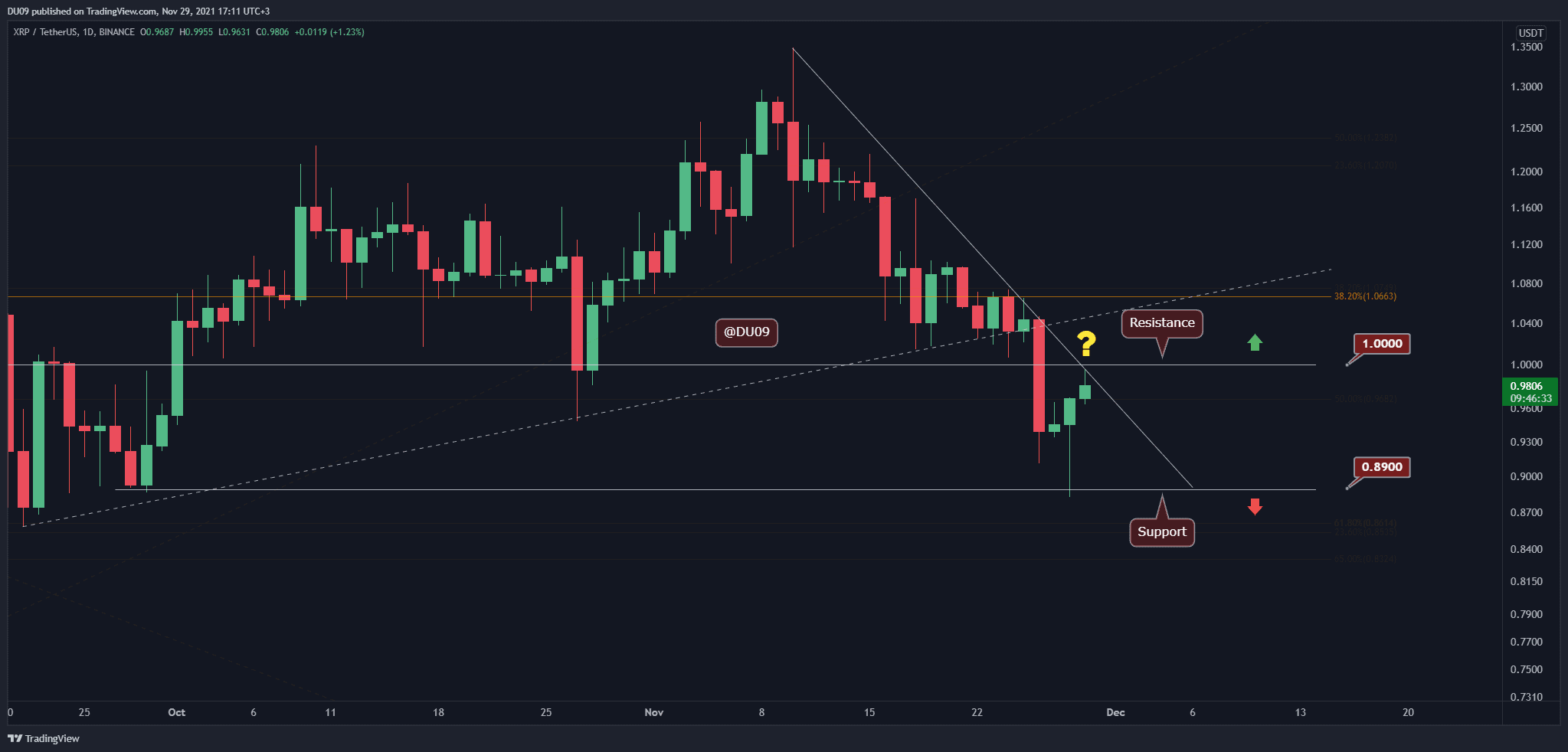

John Fetterman Responds To Ny Magazine Article Questioning His Health

May 08, 2025

John Fetterman Responds To Ny Magazine Article Questioning His Health

May 08, 2025 -

Where To Buy A Ps 5 Before A Potential Price Increase

May 08, 2025

Where To Buy A Ps 5 Before A Potential Price Increase

May 08, 2025 -

Lahwr Ke Askwlwn Ke Awqat Kar Myn Tbdyly Py Ays Ayl 2024 Ka Nwtyfkyshn

May 08, 2025

Lahwr Ke Askwlwn Ke Awqat Kar Myn Tbdyly Py Ays Ayl 2024 Ka Nwtyfkyshn

May 08, 2025

Latest Posts

-

Dwp Alert Verify Your Bank Details 12 Benefits May Be Affected

May 08, 2025

Dwp Alert Verify Your Bank Details 12 Benefits May Be Affected

May 08, 2025 -

Imminent Benefit Cuts Dwps Planned Changes Explained

May 08, 2025

Imminent Benefit Cuts Dwps Planned Changes Explained

May 08, 2025 -

Dwp Reforms What Universal Credit Claimants Need To Know

May 08, 2025

Dwp Reforms What Universal Credit Claimants Need To Know

May 08, 2025 -

Dwp Warning 12 Benefits At Risk Urgent Bank Account Check Needed

May 08, 2025

Dwp Warning 12 Benefits At Risk Urgent Bank Account Check Needed

May 08, 2025 -

Warning Dwp Changes Could Leave Universal Credit Claimants Worse Off

May 08, 2025

Warning Dwp Changes Could Leave Universal Credit Claimants Worse Off

May 08, 2025