Is This Cryptocurrency Immune To Trade War Effects?

Table of Contents

Understanding the Impact of Trade Wars on Traditional Markets

Trade wars unleash a cascade of negative impacts on traditional financial markets. Tariffs and sanctions create uncertainty, impacting supply chains, reducing consumer confidence, and dampening economic growth. This translates into market volatility across various asset classes. The imposition of tariffs, for instance, increases the cost of imported goods, leading to inflation and potentially impacting company profits. Sanctions, on the other hand, can severely limit trade with specific countries, causing disruptions and shortages.

- Increased market uncertainty: Geopolitical risks make it challenging to predict future market movements, leading to increased volatility in stocks, bonds, and other traditional assets.

- Reduced investor confidence: Uncertainty discourages investment, as investors become hesitant to commit capital in a volatile environment.

- Potential for capital flight: Investors might move their assets to perceived safer havens, like gold or government bonds, leading to capital outflow from riskier markets.

- Currency fluctuations: Trade wars can significantly impact exchange rates, creating further uncertainty and risk for businesses and investors.

Decentralization and its Role in Cryptocurrency Resilience

Cryptocurrencies like Bitcoin operate on a decentralized, blockchain-based system. This inherent characteristic is often cited as a key factor in their potential resilience against trade war effects. Unlike traditional financial systems controlled by central banks or governments, cryptocurrencies are not subject to the same level of direct manipulation or control.

- No central authority to control or manipulate: This decentralization means no single entity can devalue or freeze cryptocurrency assets in response to trade disputes.

- Resistance to censorship: Transactions are recorded on a distributed ledger, making them resistant to censorship or blocking by any single authority.

- Global accessibility: Cryptocurrencies operate across borders, making them less vulnerable to restrictions imposed through trade sanctions.

- Reduced reliance on traditional financial systems: This independence from traditional banking and financial institutions can offer a degree of insulation from the impacts of trade wars.

Analyzing Bitcoin's Characteristics

Bitcoin's resilience against trade war effects needs a closer look at its specific characteristics. Its substantial market capitalization, wide adoption, and technological underpinnings contribute to its perceived strength. However, regulatory uncertainty remains a significant factor.

- High market capitalization: Bitcoin's substantial market cap suggests a degree of stability compared to smaller cryptocurrencies.

- Wide adoption and usage: Its established position as a leading cryptocurrency reduces its vulnerability to abrupt market shifts.

- Technological immutability: The blockchain's inherent security features and cryptographic principles make it inherently resistant to manipulation or alteration.

- Regulatory uncertainty: The evolving regulatory landscape for cryptocurrencies globally remains a source of uncertainty. Favorable regulations could enhance its appeal, while stricter rules could dampen its growth.

Historical Data and Market Analysis

Analyzing Bitcoin's performance during past periods of geopolitical tension provides insights into its potential response to trade wars. While a direct correlation is complex to establish, historical data can inform our understanding. (Note: This section would ideally include charts and graphs showing Bitcoin's price performance during periods of trade disputes. These would require external data sources and visualization tools.)

- Correlation between Bitcoin price and trade war events: Studies have shown varying correlations, with some suggesting a slight positive correlation (investors seeking safe havens) and others demonstrating no significant relationship.

- Market sentiment and trading volume: During periods of heightened geopolitical uncertainty, increased trading volume in Bitcoin has often been observed, suggesting increased investor interest.

- Comparison to the performance of traditional assets: In some instances, Bitcoin has shown less volatility compared to traditional assets during periods of trade conflict.

Potential Risks and Vulnerabilities

While Bitcoin exhibits strengths, it's crucial to acknowledge its potential vulnerabilities to trade war effects.

- Regulatory crackdowns in specific jurisdictions: Governments could impose stricter regulations or even bans on cryptocurrency trading, impacting its price and accessibility.

- Influence of large institutional investors: The actions of large holders can significantly affect Bitcoin's price, potentially creating volatility regardless of broader macroeconomic factors.

- Market manipulation: The cryptocurrency market remains susceptible to manipulation, which could be exacerbated during periods of global uncertainty.

- Technological vulnerabilities: While highly secure, the blockchain technology is not entirely immune to potential vulnerabilities that could be exploited.

Conclusion

Determining whether Bitcoin is truly immune to trade war effects requires careful consideration of its decentralized nature, market characteristics, and potential vulnerabilities. While its decentralized structure offers some level of protection from direct government control, it's not entirely impervious to broader economic impacts or regulatory changes. Its past performance during periods of geopolitical tension offers mixed signals, with some evidence suggesting potential resilience and other data indicating a degree of susceptibility. Therefore, declaring it completely immune would be an oversimplification.

Learn more about Bitcoin and its potential as a trade war hedge. Further research into the Bitcoin market is essential before making investment decisions. Understanding whether this cryptocurrency is truly immune to trade war effects requires continued analysis. The future of cryptocurrencies in a volatile global market remains an area of ongoing investigation and debate, making careful due diligence essential for any investor.

Featured Posts

-

Nintendo Direct March 2025 Predicted Ps 5 And Ps 4 Game Reveals

May 08, 2025

Nintendo Direct March 2025 Predicted Ps 5 And Ps 4 Game Reveals

May 08, 2025 -

Bitcoin Price Forecast Evaluating The Potential Impact Of Trumps Economic Plans

May 08, 2025

Bitcoin Price Forecast Evaluating The Potential Impact Of Trumps Economic Plans

May 08, 2025 -

Lahwr Myn Py Ays Ayl Trafy Shayqyn Ka Jwsh W Khrwsh

May 08, 2025

Lahwr Myn Py Ays Ayl Trafy Shayqyn Ka Jwsh W Khrwsh

May 08, 2025 -

Inter Milan Goalkeeper Yann Sommer Suffers Thumb Injury

May 08, 2025

Inter Milan Goalkeeper Yann Sommer Suffers Thumb Injury

May 08, 2025 -

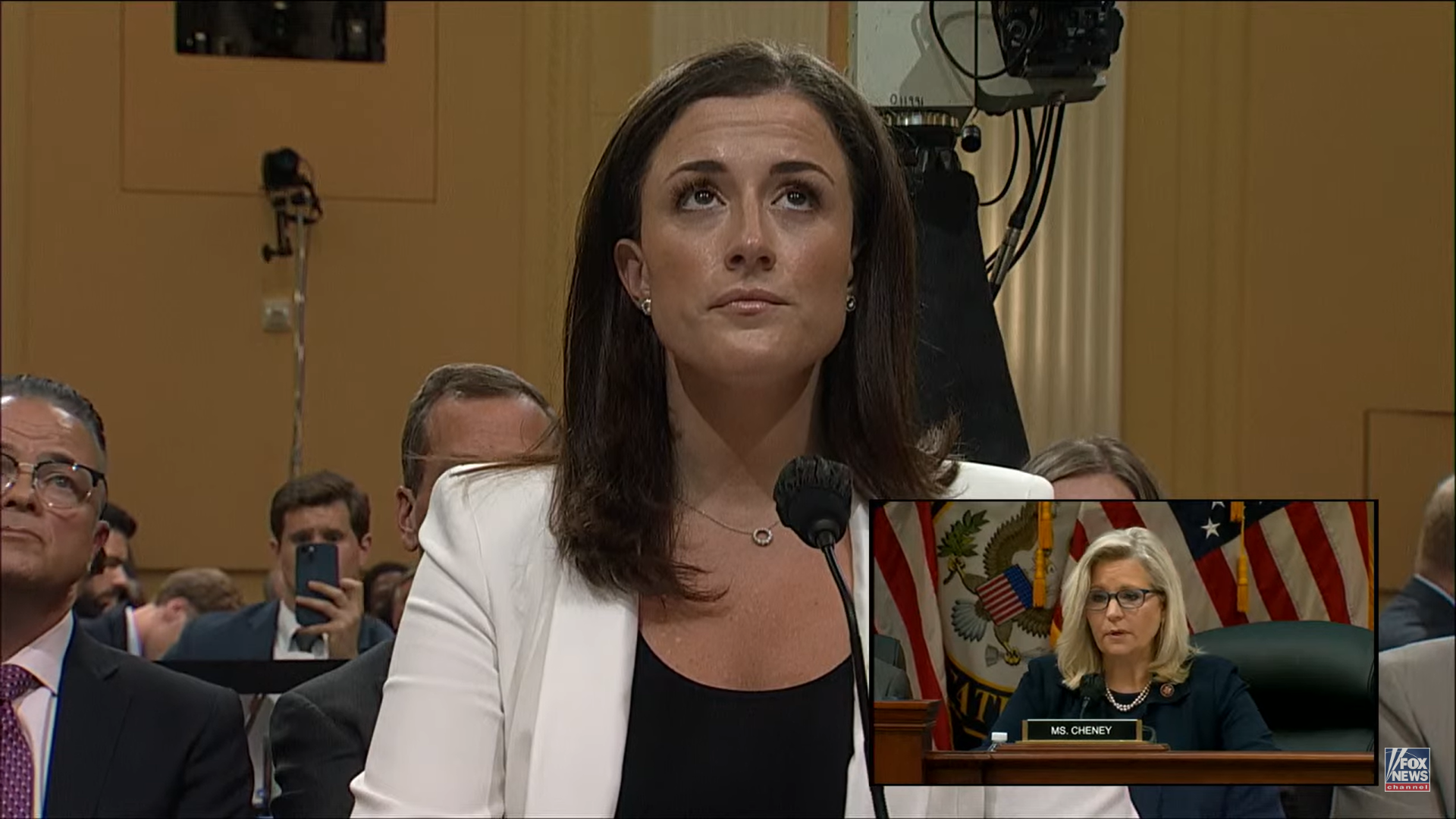

Cassidy Hutchinsons Account Of January 6th A Forthcoming Memoir

May 08, 2025

Cassidy Hutchinsons Account Of January 6th A Forthcoming Memoir

May 08, 2025

Latest Posts

-

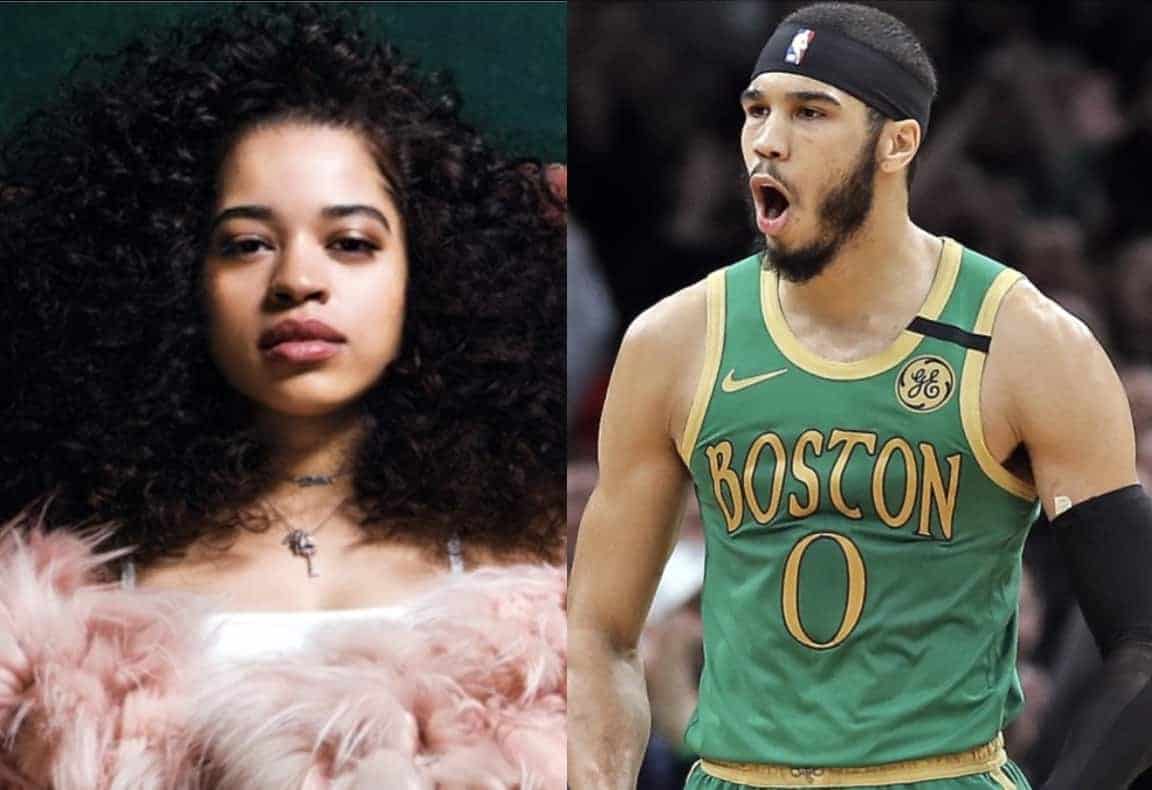

Jayson Tatum Confirms Sons Birth With Ella Mai In New Commercial

May 08, 2025

Jayson Tatum Confirms Sons Birth With Ella Mai In New Commercial

May 08, 2025 -

Flamnghw Wjysws Alshmrany Yelq Ela Alsfqt Almthyrt Fydyw

May 08, 2025

Flamnghw Wjysws Alshmrany Yelq Ela Alsfqt Almthyrt Fydyw

May 08, 2025 -

Hdyth Jysws En Antqalh Lflamnghw Rd Alshmrany Waltfasyl Alkamlt Fydyw

May 08, 2025

Hdyth Jysws En Antqalh Lflamnghw Rd Alshmrany Waltfasyl Alkamlt Fydyw

May 08, 2025 -

Jayson Tatum And Ella Mai New Commercial Hints At Sons Birth

May 08, 2025

Jayson Tatum And Ella Mai New Commercial Hints At Sons Birth

May 08, 2025 -

Alshmrany Tsryhat Jysws Hwl Antqalh Lflamnghw Fydyw Wthlyl

May 08, 2025

Alshmrany Tsryhat Jysws Hwl Antqalh Lflamnghw Fydyw Wthlyl

May 08, 2025