Is This XRP's Big Moment? ETF Approvals, SEC Changes, And Market Impact

Table of Contents

The Ripple-SEC Lawsuit and its Implications for XRP

The protracted legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacted XRP's trajectory. The outcome of this lawsuit holds profound implications for XRP's regulatory landscape and future price action.

-

Explain the court's decision and its impact on XRP's classification as a security: The court ruling partially favored Ripple, clarifying that programmatic sales of XRP did not constitute the sale of unregistered securities. This decision created a more nuanced understanding of how the "Howey Test" applies to cryptocurrencies, offering some regulatory clarity for XRP. However, it's crucial to note that the ruling doesn't necessarily mean XRP is completely free from securities regulations in all jurisdictions.

-

Analyze how the ruling affects exchanges' listing of XRP: Following the ruling, many cryptocurrency exchanges reinstated XRP trading, signaling increased confidence in the asset's regulatory status. However, some exchanges remain cautious, reflecting the ongoing complexities surrounding XRP's regulatory landscape. This ongoing uncertainty continues to impact trading volumes and XRP price volatility.

-

Detail the potential for increased institutional investment following the ruling: The partial victory in the Ripple-SEC lawsuit could unlock institutional investment in XRP. With reduced regulatory uncertainty, larger financial institutions may be more willing to include XRP in their portfolios, leading to increased demand and price appreciation.

-

Discuss the ongoing legal uncertainties and their effect on XRP price: Despite the positive aspects of the ruling, legal uncertainties persist. Ongoing litigation and potential appeals could still influence XRP's price and investor sentiment. Regulatory clarity remains crucial for long-term stability and growth.

The Potential Impact of ETF Approvals on XRP's Price

The approval of spot Bitcoin ETFs in the US is widely considered a pivotal moment for the cryptocurrency industry. This could potentially pave the way for the approval of XRP ETFs.

-

Discuss the increased accessibility and legitimacy that ETF listings bring: ETF listings bring increased accessibility to a broader range of investors, including those who are hesitant to engage directly with crypto exchanges. This increased accessibility and the regulatory oversight associated with ETFs lend legitimacy to the asset class.

-

Analyze the potential surge in demand and trading volume resulting from ETF availability: The availability of XRP ETFs would likely lead to a significant surge in demand and trading volume. This increased liquidity could reduce price volatility and make XRP more attractive to a wider investor base.

-

Explore how ETF listings could attract institutional investors to the XRP market: Institutional investors often prefer regulated investment vehicles like ETFs due to their familiarity and compliance with regulatory requirements. ETF approval could significantly boost institutional investment in XRP.

-

Highlight the potential price increases linked to increased liquidity and mainstream adoption: Increased liquidity and mainstream adoption through ETF listings could create substantial upward pressure on XRP's price, potentially leading to significant price appreciation.

Shifting Regulatory Landscape and its Effect on XRP

The regulatory landscape for cryptocurrencies is constantly evolving. Changes in regulations, both domestically and internationally, will significantly influence XRP's future.

-

Discuss the SEC's evolving stance on cryptocurrencies and its potential implications for XRP: The SEC's stance on cryptocurrencies remains a major factor influencing XRP's price and adoption. While the Ripple-SEC lawsuit outcome provides some clarity, further regulatory actions from the SEC could significantly impact the market.

-

Examine the influence of global regulatory developments on XRP's price: Global regulatory developments significantly influence the cryptocurrency market. Positive regulatory developments in other jurisdictions could boost XRP's price, while negative developments could have the opposite effect.

-

Explain how regulatory clarity could boost investor confidence in XRP: Greater regulatory clarity surrounding XRP would significantly increase investor confidence and attract more institutional investment. This clarity would reduce uncertainty and risk, making XRP more appealing to a broader investor base.

-

Detail the impact of potential future regulatory actions on the XRP market: Future regulatory actions, whether positive or negative, could significantly impact the XRP market. Staying informed about regulatory developments is crucial for navigating this dynamic landscape.

XRP's Technological Advancements and Use Cases

Beyond the regulatory landscape, XRP's technological features and practical applications contribute to its value proposition.

-

Discuss XRP's speed and low transaction costs: XRP boasts significantly faster transaction speeds and lower fees compared to many other cryptocurrencies, making it ideal for cross-border payments.

-

Detail its use in cross-border payments and remittance solutions: XRP's speed and efficiency make it well-suited for cross-border payments and remittance solutions, significantly reducing transaction times and costs compared to traditional banking systems.

-

Explain its role in the broader Ripple ecosystem: XRP is integral to the RippleNet network, a global payment network utilized by many financial institutions. This integration provides practical real-world applications and enhances its value.

-

Show how technological improvements might influence future adoption: Ongoing technological improvements, such as enhanced scalability and integration with other blockchain technologies, could further drive XRP adoption and increase its utility.

Conclusion

The recent developments surrounding XRP, including the Ripple-SEC lawsuit resolution, the potential for ETF approvals, and a shifting regulatory landscape, all point towards a potentially significant turning point for the cryptocurrency. While uncertainties remain, the positive developments suggest a brighter future for XRP. The increased clarity surrounding its regulatory status and the possibility of widespread ETF adoption could lead to a substantial increase in investor interest and market capitalization. To stay informed about the future of XRP and its potential for growth, continue to research and follow market developments. Remember, careful consideration and due diligence are crucial before investing in any cryptocurrency, including XRP.

Featured Posts

-

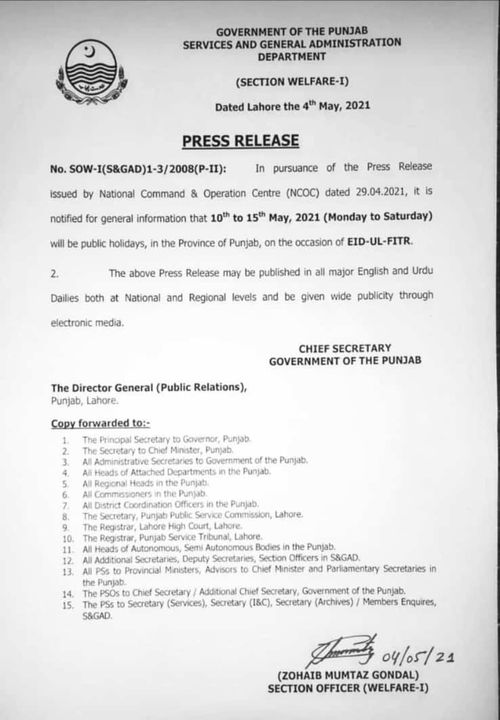

Punjab Weather Eid Ul Fitr Predictions For Lahore

May 08, 2025

Punjab Weather Eid Ul Fitr Predictions For Lahore

May 08, 2025 -

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 08, 2025

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 08, 2025 -

National Media Under Fire From Oklahoma City Thunder Players

May 08, 2025

National Media Under Fire From Oklahoma City Thunder Players

May 08, 2025 -

Seged Go Shokira Pariz Chetvrtfinale Vo Ligata Na Shampionite

May 08, 2025

Seged Go Shokira Pariz Chetvrtfinale Vo Ligata Na Shampionite

May 08, 2025 -

Arsenal Vs Ps Zh Luchshie Momenty I Klyuchevye Igry Evrokubkov

May 08, 2025

Arsenal Vs Ps Zh Luchshie Momenty I Klyuchevye Igry Evrokubkov

May 08, 2025

Latest Posts

-

Is Colin Cowherd Right About Jayson Tatum Examining The Evidence

May 08, 2025

Is Colin Cowherd Right About Jayson Tatum Examining The Evidence

May 08, 2025 -

The Colin Cowherd Jayson Tatum Debate A Comprehensive Analysis

May 08, 2025

The Colin Cowherd Jayson Tatum Debate A Comprehensive Analysis

May 08, 2025 -

Update On Jayson Tatums Wrist Boston Celtics Head Coach Weighs In

May 08, 2025

Update On Jayson Tatums Wrist Boston Celtics Head Coach Weighs In

May 08, 2025 -

Jayson Tatums Place In The Nba Analyzing Colin Cowherds Perspective

May 08, 2025

Jayson Tatums Place In The Nba Analyzing Colin Cowherds Perspective

May 08, 2025 -

Jayson Tatums Wrist Injury Boston Celtics Head Coach Gives Update

May 08, 2025

Jayson Tatums Wrist Injury Boston Celtics Head Coach Gives Update

May 08, 2025