Is Uber Stock Recession-Resistant? A Deep Dive

Table of Contents

Uber's Revenue Streams and Recession Resilience

Uber's diverse revenue streams, encompassing ride-sharing, food delivery (Uber Eats), and freight services (Uber Freight), offer a complex picture regarding recession resilience. Let's examine each segment individually.

Ride-Sharing Segment

Historically, ride-sharing services have shown vulnerability during economic downturns.

- Decreased Discretionary Spending: Recessions often lead to reduced discretionary spending, impacting ride-hailing demand as people cut back on non-essential travel.

- Unemployment: Rising unemployment directly impacts ride-sharing demand, as fewer people have disposable income for rides.

However, mitigating factors exist:

- Price Sensitivity: Uber's pricing model allows for adjustments based on demand. During recessions, price reductions can stimulate demand, although profitability might suffer.

- Essential Travel Needs: Even during economic downturns, essential travel needs persist. Commuting to work, medical appointments, and airport transfers remain relatively unaffected by economic fluctuations.

Uber Eats and Delivery Services

The performance of Uber Eats during recessions presents a mixed bag.

- Increased Demand for Convenience: Some argue that during recessions, consumers may opt for more affordable at-home meal options, potentially boosting food delivery demand.

- Inflationary Pressures: Conversely, high inflation can significantly impact food delivery spending. Consumers might reduce their frequency of ordering or switch to cheaper alternatives. Analyzing inflation rates alongside Uber Eats usage data is crucial here.

Reliable data on Uber Eats' performance during past recessions is necessary for conclusive analysis. However, the convenience factor could offer a degree of recession resistance.

Freight Services

Uber Freight, connecting shippers with truckers, presents a potentially more recession-resistant aspect of Uber's business.

- Essential Goods Movement: The transportation of essential goods remains vital regardless of economic conditions. This segment is less susceptible to discretionary spending reductions.

- Supply Chain Disruptions: Paradoxically, recessions sometimes lead to supply chain disruptions, increasing reliance on flexible logistics solutions like Uber Freight. The demand for efficient delivery could potentially rise.

Analyzing Uber's Cost Structure and Profitability

Uber's ability to navigate a recession effectively hinges on its cost structure and financial health.

Cost-Cutting Measures

Uber has demonstrated a capacity to cut costs.

- Workforce Reductions: Past instances of layoffs demonstrate Uber's willingness to adjust its workforce size to match demand fluctuations.

- Marketing Expenses: Reducing marketing spending is another cost-cutting strategy often employed during economic downturns.

However, aggressive cost-cutting can negatively impact long-term growth and innovation. The balance between short-term cost reduction and sustained growth is critical.

Debt Levels and Financial Health

A crucial aspect of recession resilience is Uber's financial stability.

- Debt-to-Equity Ratio: Examining Uber's debt-to-equity ratio helps assess its financial leverage and risk during a downturn. A high ratio indicates higher vulnerability.

- Cash Reserves and Liquidity: Sufficient cash reserves and a strong liquidity position are essential for weathering a recession. This allows the company to meet its obligations even with reduced revenue.

Competitive Landscape and Market Share

Understanding Uber's position within the competitive landscape is vital.

Competition Analysis

Uber faces fierce competition from companies like Lyft (ride-sharing) and DoorDash (food delivery).

- Competitive Advantages: Uber's larger market share and brand recognition could provide a competitive edge during a recession.

- Price Wars: Increased competition might lead to price wars, impacting profitability for all players in the market.

Market Dominance and Pricing Power

Uber's market dominance in certain regions grants it some pricing power. However, this power is limited, and intense competition can restrict its ability to significantly raise prices.

Investor Sentiment and Stock Valuation

Understanding investor sentiment and stock valuation is essential for assessing Uber's recession resilience.

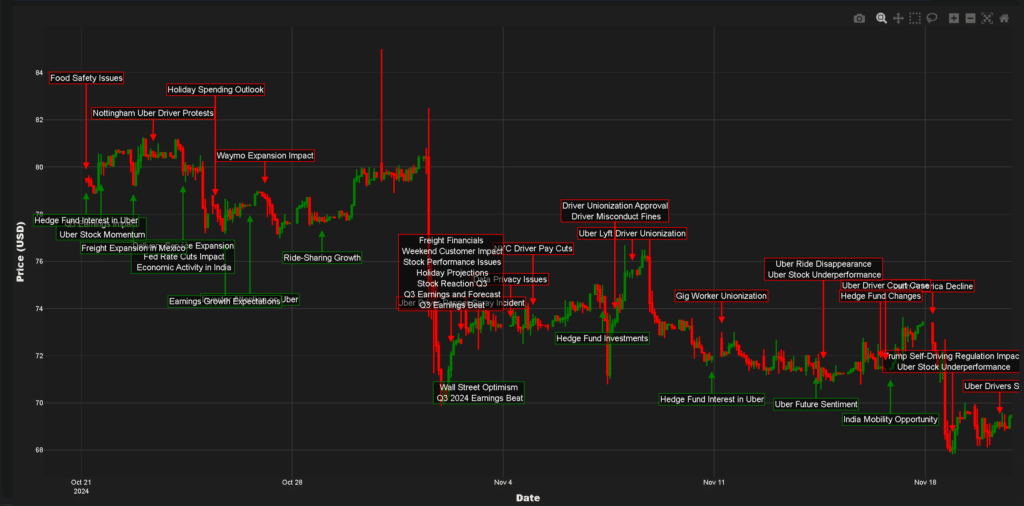

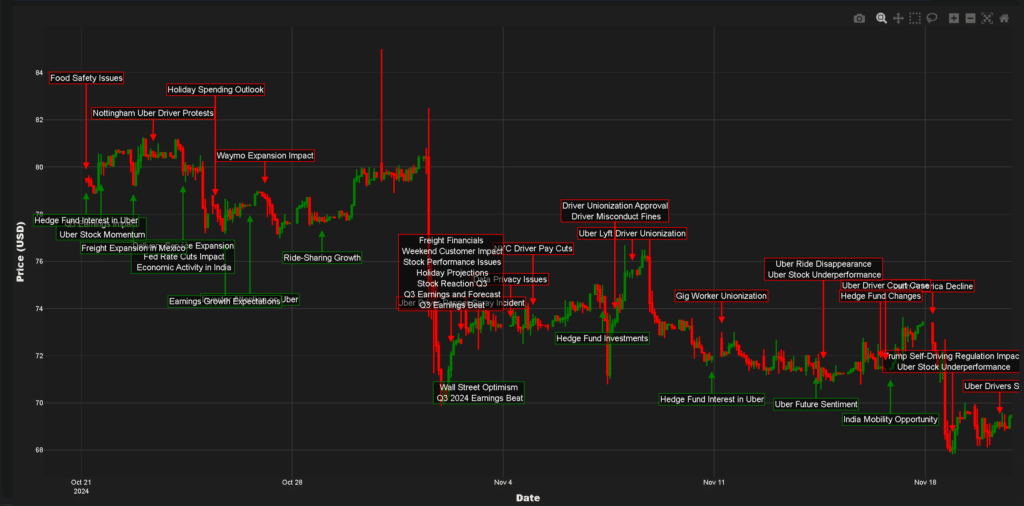

Stock Price Performance During Past Recessions

Analyzing how Uber's stock price performed during previous economic downturns provides valuable insights. Historical data should be reviewed to identify trends and patterns.

Analyst Ratings and Predictions

Consulting analyst ratings and predictions provides an external perspective on Uber's future performance. However, these should be viewed critically and in the context of the overall economic outlook.

Conclusion

Determining whether Uber stock is truly recession-resistant requires careful consideration of its diverse revenue streams, cost structure, competitive landscape, and overall financial health. While some segments, like Uber Freight, might exhibit greater resilience, others, like ride-sharing, remain vulnerable to economic downturns. The company's ability to adapt its cost structure and maintain market share will ultimately determine its performance during a recession. Therefore, it's not definitively "recession-resistant," but its diversified model offers a degree of resilience compared to some other companies. Learn more about investing in Uber stock, assess the recession-resistance of Uber stock for your portfolio, and analyze whether Uber stock fits your recession-proofing strategy. Remember to conduct thorough research and consider your own risk tolerance before making any investment decisions.

Featured Posts

-

Easy Chateau Diy Ideas For Beginners And Experts

May 19, 2025

Easy Chateau Diy Ideas For Beginners And Experts

May 19, 2025 -

Spring Budget Update Leaves Voters Feeling Unsettled

May 19, 2025

Spring Budget Update Leaves Voters Feeling Unsettled

May 19, 2025 -

The Trial Deciphering Teahs Involvement And The Familys Hidden Truths

May 19, 2025

The Trial Deciphering Teahs Involvement And The Familys Hidden Truths

May 19, 2025 -

Sinner Em Hamburgo Volta As Competicoes Apos Caso De Doping

May 19, 2025

Sinner Em Hamburgo Volta As Competicoes Apos Caso De Doping

May 19, 2025 -

Muere Juan Aguilera El Tenis Espanol Pierde A Una Leyenda Del Masters 1000

May 19, 2025

Muere Juan Aguilera El Tenis Espanol Pierde A Una Leyenda Del Masters 1000

May 19, 2025