Is Uber Stock Recession-Resistant? Analyzing The Market

Table of Contents

Uber's Business Model and its Vulnerability to Recessions

Uber's core business model, built on ride-sharing and food delivery, inherently exposes it to economic downturns. This vulnerability stems from several key factors:

Dependence on Discretionary Spending

Uber's services are largely considered discretionary spending. This means that usage fluctuates significantly based on consumer confidence and disposable income.

- Reduced ride-hailing during recessions: As people tighten their belts, non-essential transportation like Uber rides often takes a backseat to cheaper alternatives like public transport or carpooling.

- Lower food delivery orders as consumers prioritize essential spending: During economic hardship, consumers are more likely to cook at home, reducing reliance on convenience services like Uber Eats. This directly impacts Uber's revenue streams.

- Impact on Uber's revenue streams during economic hardship: The combined effect of decreased ride-hailing and food delivery orders directly translates to lower overall revenue for Uber during a recession. This makes evaluating its financial health during such periods critical for any potential investor.

Price Sensitivity of Consumers

During economic downturns, consumers become acutely aware of pricing. This price sensitivity impacts Uber's ability to maintain profitability.

- Competition from cheaper alternatives: In a recession, the competition from cheaper ride-sharing or food delivery services intensifies, putting pressure on Uber's pricing strategy.

- Potential for reduced ridership due to higher prices: If Uber cannot adjust its pricing to remain competitive, it risks losing market share to more affordable options.

- Impact of pricing strategies on Uber's market share: Balancing profitability with competitive pricing is a crucial challenge for Uber during a recession, directly influencing its market share and overall performance.

Impact of Unemployment on Drivers and Riders

High unemployment rates create a double-edged sword for Uber. It impacts both the supply (drivers) and the demand (riders) sides of the platform.

- Fewer drivers on the platform during recessions: Increased unemployment may lead some drivers to seek more stable employment, reducing the availability of drivers on the platform.

- Reduced demand due to lower disposable income among riders: High unemployment directly correlates with decreased disposable income, leading to lower demand for both ride-sharing and food delivery.

- The interplay between driver and rider availability during economic downturns: The simultaneous reduction in both drivers and riders creates a vicious cycle, further impacting Uber's revenue and operational efficiency.

Uber's Potential for Recession Resistance

Despite these vulnerabilities, Uber possesses certain characteristics that could enhance its resilience during a recession:

Diversification of Revenue Streams

Uber's strategic expansion beyond ride-sharing into food delivery (Uber Eats), freight transportation (Uber Freight), and other services diversifies its revenue streams.

- Uber Eats as a potentially more recession-resistant segment: While still susceptible to economic downturns, Uber Eats may show some resilience as consumers still rely on food delivery, even during tough times.

- The role of freight transportation in stabilizing revenue: Uber Freight, operating in a less discretionary market, could help stabilize revenue during economic downturns.

- The potential for new revenue streams to offset declines in others: Continuous innovation and expansion into new sectors could help Uber offset declines in other areas.

Cost-Cutting Measures and Efficiency Improvements

Uber's capacity to implement cost-cutting measures and improve operational efficiency is key to weathering economic storms.

- Examples of successful cost-cutting strategies employed by Uber: Previous instances of streamlining operations, reducing administrative costs, and optimizing logistics could serve as a model for future recessionary responses.

- Technological improvements that increase efficiency: Uber's investment in technology, including AI and automation, can improve efficiency and reduce operational costs.

- The impact of automation and AI on cost reduction: AI-driven optimization of driver routes and automated customer service can significantly cut costs.

Long-Term Growth Potential

Uber's potential for growth in emerging markets and untapped sectors offers a buffer against short-term economic challenges.

- Opportunities for expansion in developing countries: Untapped markets in developing countries offer significant growth opportunities for the future.

- Untapped market potential for new services and partnerships: Expanding into new service areas and strategic partnerships diversifies risk and fosters long-term growth.

- The influence of long-term strategic planning on recession resistance: Proactive strategic planning, focusing on diversification and sustainable growth, is critical to enhancing Uber's recession resistance.

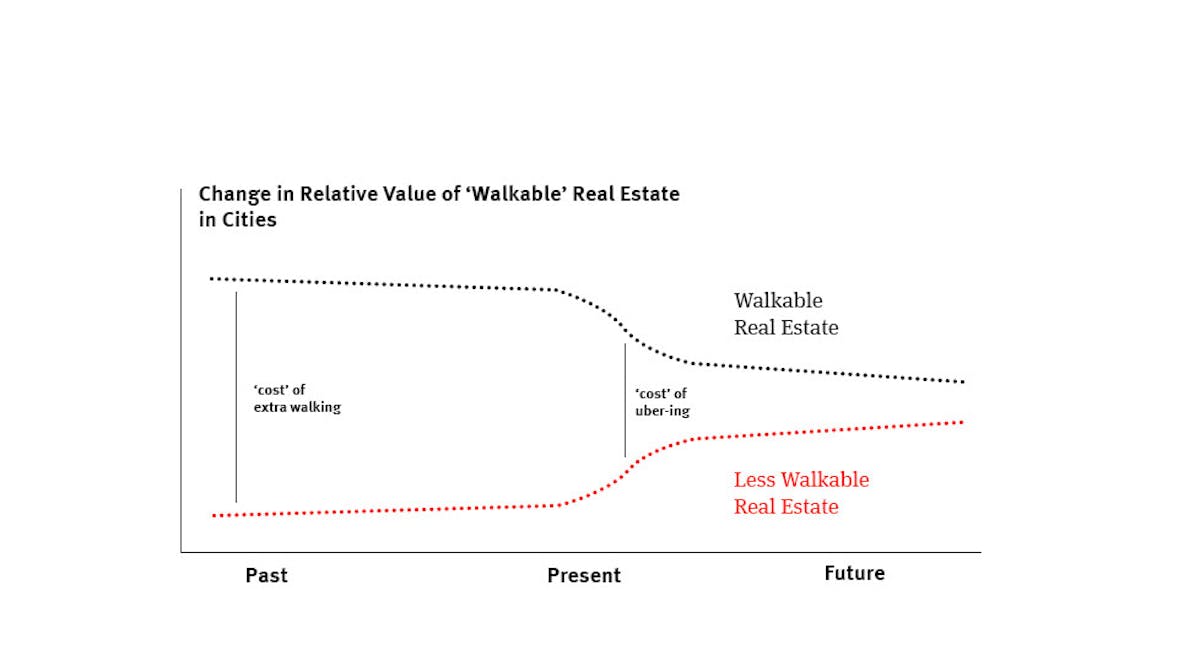

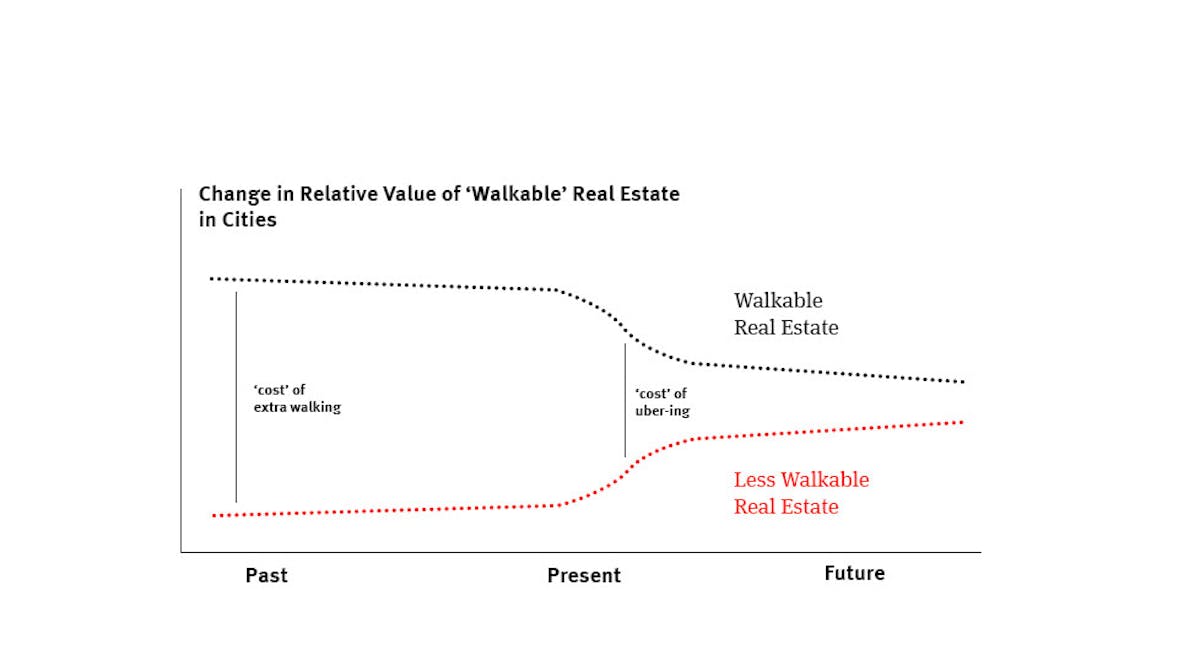

Historical Performance During Previous Recessions

Analyzing Uber's performance during past economic downturns, including the 2008 financial crisis (while Uber itself wasn't established then, analyzing similar ride-sharing companies of the time offers insights), is essential. While precise data directly correlating Uber's performance to specific recessionary periods needs further analysis, assessing its financial reports during periods of economic slowdown reveals key trends. This would involve examining KPIs like revenue growth, user acquisition, and driver retention. Comparing Uber's performance against competitors during economic crises provides valuable context for understanding its resilience. Ideally, this section would include relevant charts and graphs illustrating key performance indicators over time, demonstrating how Uber reacted to prior economic shocks.

Conclusion

Uber's recession resistance is a complex issue. While its reliance on discretionary spending presents a significant vulnerability, its diversification efforts, cost-cutting capabilities, and long-term growth potential offer mitigating factors. Analyzing Uber's past performance during economic downturns provides crucial context. Ultimately, whether Uber stock is truly recession-resistant requires careful consideration of its business model, market position, and the overall economic outlook. Conduct thorough research and consult a financial advisor before making any investment decisions regarding Uber stock and other recession-resistant stocks. Remember to consider all factors before investing in any stock, especially during times of economic uncertainty.

Featured Posts

-

Wednesdays Market Winners Rockwell Automation Disney And Others Post Strong Gains

May 17, 2025

Wednesdays Market Winners Rockwell Automation Disney And Others Post Strong Gains

May 17, 2025 -

Alkaras Povreda Rune Osvaja Barselonu

May 17, 2025

Alkaras Povreda Rune Osvaja Barselonu

May 17, 2025 -

Casa Reformada De Alan Carr Y Amanda Holden En Venta En Espana

May 17, 2025

Casa Reformada De Alan Carr Y Amanda Holden En Venta En Espana

May 17, 2025 -

Improving Florida School Lockdown Response Addressing Generational Gaps

May 17, 2025

Improving Florida School Lockdown Response Addressing Generational Gaps

May 17, 2025 -

Landry Shamet And The New York Knicks A Difficult Decision

May 17, 2025

Landry Shamet And The New York Knicks A Difficult Decision

May 17, 2025

Latest Posts

-

Unlock Bet365 Bonus Code Nypbet Knicks Vs Pistons Series Betting Guide

May 17, 2025

Unlock Bet365 Bonus Code Nypbet Knicks Vs Pistons Series Betting Guide

May 17, 2025 -

Nba Playoffs Knicks Vs Pistons Betting Preview With Bet365 Bonus Code Nypbet

May 17, 2025

Nba Playoffs Knicks Vs Pistons Betting Preview With Bet365 Bonus Code Nypbet

May 17, 2025 -

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025 -

Roma Vs Monza Partido En Directo

May 17, 2025

Roma Vs Monza Partido En Directo

May 17, 2025 -

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 17, 2025

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 17, 2025