Is Uber Stock (UBER) A Buy, Sell, Or Hold?

Table of Contents

Uber's Financial Performance and Growth Prospects

Revenue Growth and Profitability

Uber's financial performance is a key factor in determining whether UBER is a buy, sell, or hold. Analyzing revenue growth trends, profitability margins, and key performance indicators (KPIs) provides crucial insights. Let's examine some recent data:

- Year-over-year Revenue Growth: While Uber has demonstrated significant revenue growth in recent years, the pace has varied. [Insert specific data points here, citing sources]. This growth is largely driven by increased ridership in existing markets and expansion into new territories.

- Net Income and EBITDA: Uber's journey to profitability has been a gradual one. [Insert specific data points here, citing sources]. Factors like increasing operating expenses and intense competition continue to impact the bottom line.

- Key Performance Indicators (KPIs): Tracking metrics such as Average Revenue Per User (ARPU), customer acquisition cost, and driver satisfaction are crucial for evaluating the health of the business. [Insert relevant KPI data and analysis].

Analyzing these data points reveals the complexities of Uber's financial picture. While revenue growth is encouraging, achieving sustained profitability remains a key challenge.

Market Share and Competition

Understanding Uber's market position is essential for assessing the long-term viability of UBER stock. The ride-sharing and food delivery markets are highly competitive:

- Market Share: Uber holds a significant, but not dominant, market share in many regions. [Insert market share data for ride-sharing and food delivery, citing sources]. This varies considerably depending on the geographic location and specific service.

- Key Competitors: Lyft, DoorDash, and other regional players pose significant competitive pressures. These companies often employ similar strategies, including aggressive pricing and promotional campaigns.

- Competitive Strategies: Uber's competitive advantages lie in its brand recognition, global reach, and technological investments. However, maintaining a competitive edge requires continuous innovation and adaptation.

Uber's Strategic Initiatives and Future Plans

Expansion into New Markets and Services

Uber's future growth hinges on its strategic initiatives and its ability to expand into new markets and services:

- Geographic Expansion: Uber continues to invest in expanding its operations into new geographic areas, both domestically and internationally. [Insert specific examples of recent or planned expansions]. This expansion exposes the company to diverse economic and regulatory landscapes.

- New Service Offerings: Diversification into areas like autonomous vehicles, freight transportation, and other logistics services presents significant opportunities for growth. [Discuss specific examples and the potential impact of these initiatives]. These new ventures carry significant financial risk and regulatory hurdles.

These expansion efforts and new services are key to Uber’s future growth, but success depends on overcoming significant challenges.

Technological Advancements and Innovation

Uber's investments in technology and innovation are critical for maintaining its competitive edge:

- Autonomous Driving Technology: Self-driving vehicles could revolutionize Uber's operations, potentially reducing costs and improving efficiency. However, the development and deployment of this technology face significant hurdles, including technological challenges and regulatory approval.

- AI-Powered Logistics: Artificial intelligence is being leveraged to optimize ride-matching algorithms, route planning, and delivery logistics. [Discuss the benefits and potential limitations of these AI applications]. These technologies require continuous investment and development.

Valuation and Investment Risks

Stock Valuation

Analyzing Uber's valuation relative to its peers and its financial performance is crucial:

- Price-to-Earnings (P/E) Ratio: [Insert Uber's P/E ratio and compare it to industry averages and competitors]. A high P/E ratio suggests investors are anticipating significant future growth.

- Price-to-Sales (P/S) Ratio: [Insert Uber's P/S ratio and compare it to industry averages and competitors]. A high P/S ratio may indicate a premium valuation compared to its peers.

Assessing Uber's valuation involves comparing these ratios to historical trends and competitor data to determine if the stock is overvalued, undervalued, or fairly valued.

Key Risks and Challenges

Several risks and challenges could significantly impact Uber's stock price:

- Regulatory Hurdles: Uber faces ongoing regulatory challenges concerning labor laws, licensing, and data privacy. Changes in regulations could significantly affect its operating costs and profitability.

- Driver Labor Relations: The relationship between Uber and its drivers is a crucial factor impacting its operations and profitability. Labor disputes and potential unionization could increase costs.

- Economic Downturns: During economic downturns, demand for ride-sharing and food delivery services may decline, impacting Uber's revenue and profitability.

Conclusion: Is Uber Stock (UBER) a Buy, Sell, or Hold? A Final Verdict

Based on our analysis of UBER stock's current performance and future prospects, the decision of whether to buy, sell, or hold remains nuanced. While Uber shows strong revenue growth in certain sectors and is aggressively pursuing strategic initiatives, profitability remains elusive, and the competitive landscape is intense. Significant risks exist related to regulation, labor relations, and macroeconomic conditions. Therefore, a "hold" recommendation might be prudent for many investors at this time.

While this analysis provides insights into whether Uber stock is a buy, sell, or hold, remember to conduct your own thorough due diligence before investing. Make informed decisions about your UBER stock investments, considering your own risk tolerance and investment goals.

Featured Posts

-

Who Is Ali Marks Jalen Brunsons Wife Revealed

May 17, 2025

Who Is Ali Marks Jalen Brunsons Wife Revealed

May 17, 2025 -

Eminem Reportedly Considering Wnba Ownership

May 17, 2025

Eminem Reportedly Considering Wnba Ownership

May 17, 2025 -

Playing At Bitcoin And Crypto Casinos In 2025 A Safe And Smart Guide

May 17, 2025

Playing At Bitcoin And Crypto Casinos In 2025 A Safe And Smart Guide

May 17, 2025 -

Jalen Brunsons Return Knicks Pistons Playoff Push Hinges On Point Guard

May 17, 2025

Jalen Brunsons Return Knicks Pistons Playoff Push Hinges On Point Guard

May 17, 2025 -

Thibodeaus Evolution How He Saved The Knicks From Disaster

May 17, 2025

Thibodeaus Evolution How He Saved The Knicks From Disaster

May 17, 2025

Latest Posts

-

Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Live Stream Options

May 17, 2025

Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Live Stream Options

May 17, 2025 -

Last Chance Score Boston Celtics Championship Gear Under 20

May 17, 2025

Last Chance Score Boston Celtics Championship Gear Under 20

May 17, 2025 -

Celtics Vs Magic Game 1 How To Watch The Nba Playoffs Live

May 17, 2025

Celtics Vs Magic Game 1 How To Watch The Nba Playoffs Live

May 17, 2025 -

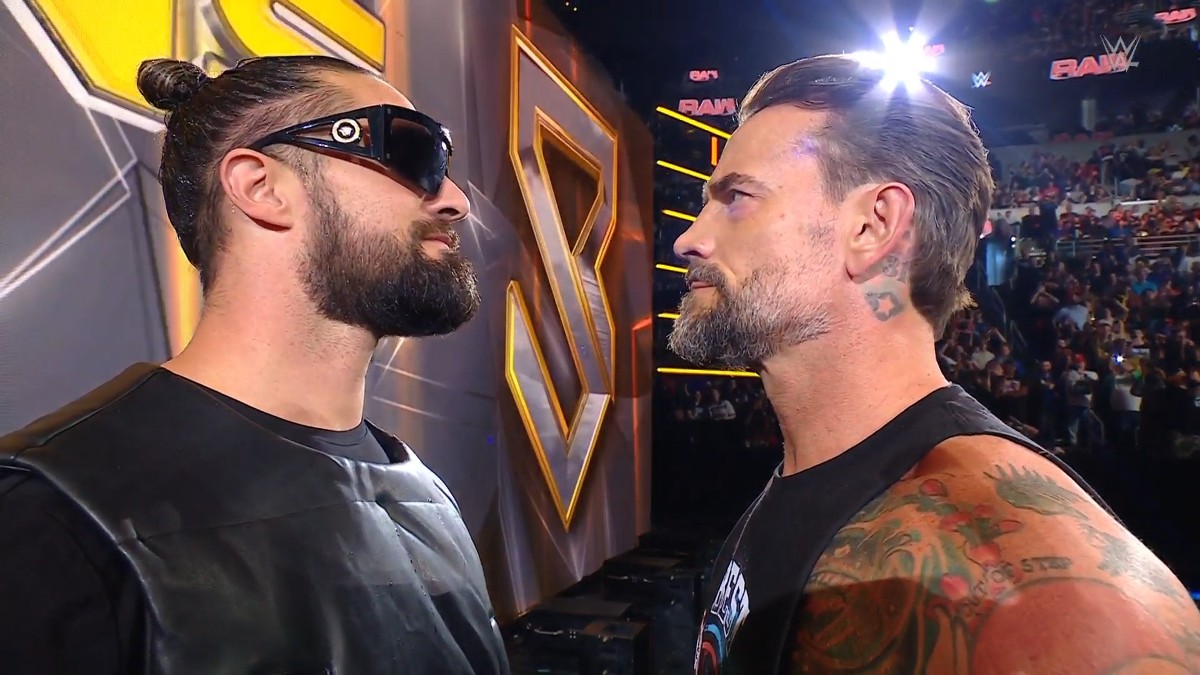

Jalen Brunson Misses Cm Punk Vs Seth Rollins Raw Match

May 17, 2025

Jalen Brunson Misses Cm Punk Vs Seth Rollins Raw Match

May 17, 2025 -

Boston Celtics Finals Gear Under 20 Deals Still Available

May 17, 2025

Boston Celtics Finals Gear Under 20 Deals Still Available

May 17, 2025