Is Uber (UBER) A Good Long-Term Investment?

Table of Contents

Uber's Financial Performance and Growth Trajectory

Understanding Uber's financial health is crucial for assessing its long-term investment potential. Analyzing Uber's financial statements, including its revenue, profitability, and debt levels, paints a picture of its past performance and potential future trajectory. Key financial metrics such as Earnings Per Share (EPS), revenue growth, and free cash flow provide valuable insights.

-

Examining the trend of Uber's revenue growth over the past few years: Uber has demonstrated significant revenue growth, driven primarily by its ride-sharing and food delivery segments. However, profitability remains a challenge, with substantial investments in technology, expansion, and marketing impacting the bottom line. Analyzing the Uber stock price in conjunction with these financial reports helps gauge market sentiment.

-

Analyzing the profitability of its core ride-sharing and delivery services: While Uber's revenue is impressive, achieving consistent profitability across all segments remains a key challenge. Factors such as driver compensation, operational costs, and intense competition influence its profit margins. Accessing detailed Uber financial statements is crucial for a thorough analysis.

-

Assessing the impact of any significant acquisitions or divestitures: Uber's strategic acquisitions and divestitures can significantly impact its financial performance. Careful examination of these transactions, their integration, and their contribution to overall revenue and profitability is essential. Examining the Uber revenue growth in the context of these events provides valuable context.

Uber's market capitalization and valuation are also vital considerations. Fluctuations in the Uber stock price directly reflect investor confidence and expectations regarding future growth.

Competitive Landscape and Market Saturation

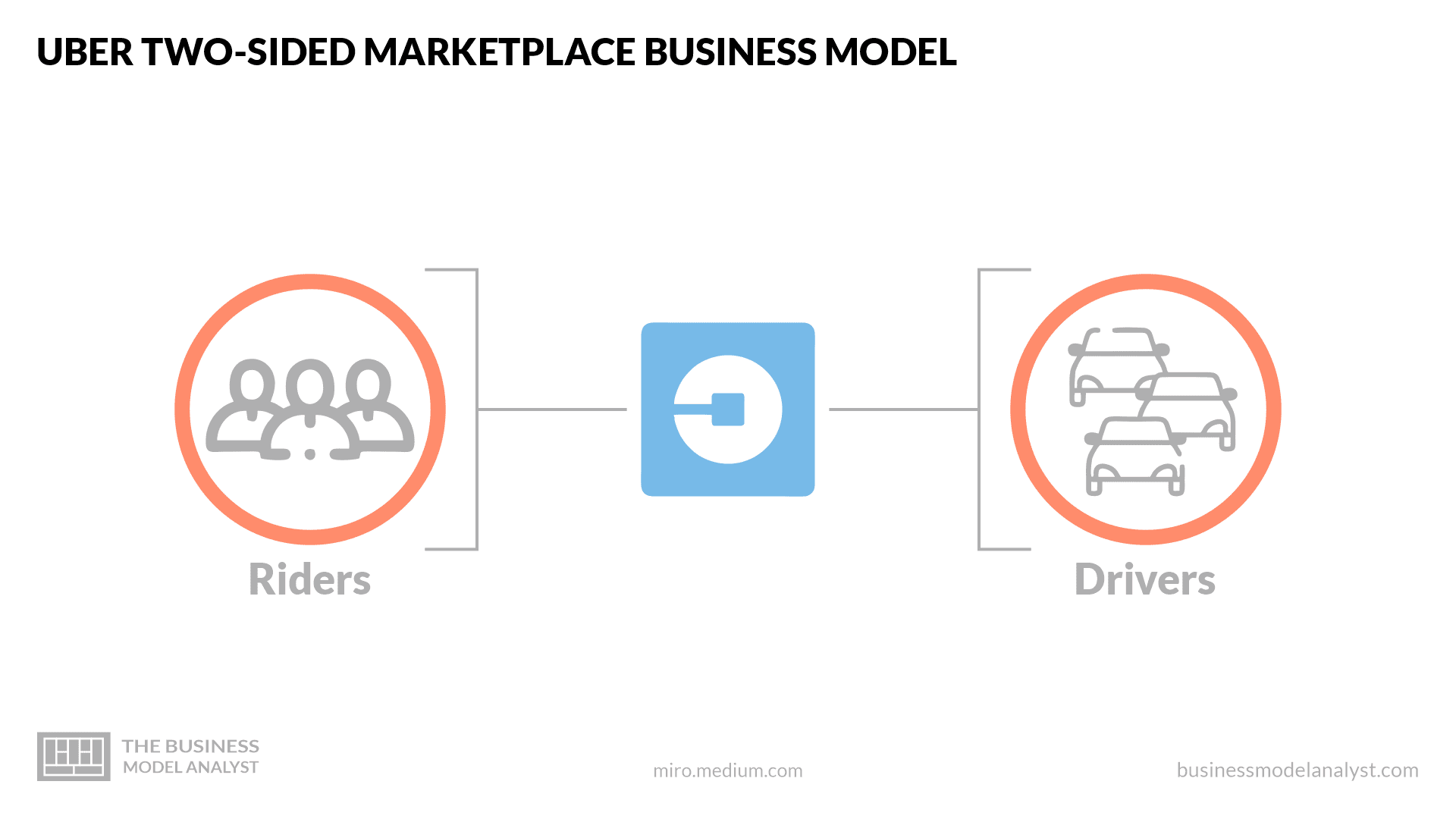

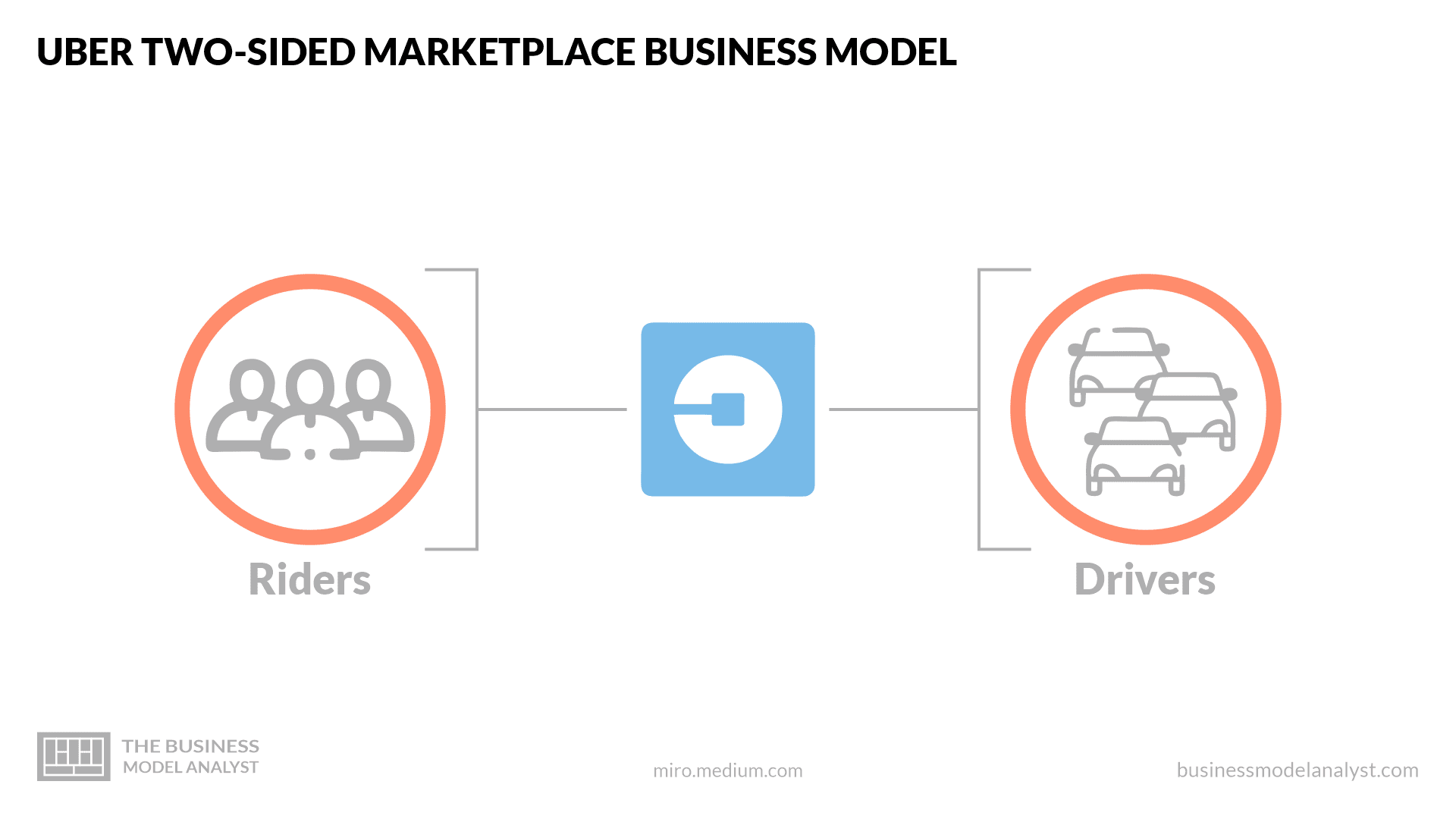

The ride-sharing and food delivery markets are fiercely competitive. Uber faces significant competition from companies like Lyft in the US, and Didi Chuxing in China. This competitive pressure impacts pricing strategies, market share, and profitability.

-

Evaluating the impact of regulatory changes on Uber's operations: Government regulations concerning licensing, worker classification, and data privacy significantly affect Uber's operational costs and profitability. Changes in these regulations can impact the Uber stock price and investor sentiment.

-

Analyzing the potential for future market expansion into new geographic areas or service categories: Uber's expansion into new markets and service categories, such as freight transportation and autonomous vehicles, presents both opportunities and risks. Success in these areas could significantly boost Uber revenue growth, while challenges could hinder progress.

-

Discussing the impact of autonomous vehicle technology on the competitive landscape: The development and deployment of autonomous vehicles represent a significant long-term opportunity and a potential game-changer for Uber. However, the technological hurdles, regulatory uncertainties, and potential costs associated with autonomous vehicles introduce considerable risk. This technological advancement is key to the ongoing ride-sharing market analysis.

Understanding the dynamics of the ride-sharing market analysis and food delivery competition is crucial for evaluating Uber's long-term prospects.

Future Growth Opportunities and Technological Innovation

Uber's future growth hinges on its ability to leverage technological innovation and expand into new markets and services. Its strategic initiatives, including investments in autonomous vehicles, freight transportation, and other mobility solutions, could significantly impact its long-term success.

-

Discussing the potential impact of electric vehicles on Uber's operations and sustainability efforts: The transition to electric vehicles could reduce operating costs, enhance sustainability, and improve brand image. However, the upfront costs of transitioning to an electric vehicle fleet represent a significant investment.

-

Analyzing the potential of Uber's freight and logistics business: This segment offers significant growth opportunities, but success depends on efficient logistics, effective competition, and regulatory compliance.

-

Evaluating the potential risks and challenges associated with new technological initiatives: Investing in new technologies like autonomous vehicles carries significant financial and technological risks. Failures in these areas could impact the company's overall profitability and market position.

Successfully navigating the evolving technological landscape will be critical to Uber future growth.

Risks and Challenges Facing Uber

Investing in Uber involves several inherent risks. These include regulatory hurdles, economic downturns, intense competition, and labor relations issues.

-

Analyzing the impact of driver labor issues and potential unionization: Driver classification and compensation remain contentious issues, potentially impacting operational costs and profitability. Unionization efforts could further increase these costs.

-

Discussing the cybersecurity risks and data privacy concerns associated with Uber's services: Data breaches and privacy violations can severely damage Uber's reputation and lead to significant financial losses.

-

Evaluating the impact of geopolitical factors on Uber's international operations: Political instability, regulatory changes, and economic downturns in various international markets can significantly affect Uber's operations and profitability.

Understanding the Uber risks and Uber challenges, including Uber regulatory risks, is critical for informed investment decisions.

Conclusion: Is Uber (UBER) a Good Long-Term Investment? Making an Informed Decision

Uber's financial performance, competitive landscape, growth opportunities, and inherent risks all need careful consideration. While Uber's revenue growth is impressive and its expansion into new markets is promising, achieving consistent profitability and navigating intense competition remain significant challenges. The potential impact of autonomous vehicles and other technological advancements presents both substantial upside and considerable risk.

Is Uber (UBER) a good long-term investment? The answer depends on your individual risk tolerance, investment horizon, and assessment of the company's ability to overcome the challenges ahead. Conducting thorough due diligence, including analyzing detailed financial statements and market trends, is crucial before making any investment decisions. Consider exploring different Uber investment strategy options based on your risk profile. Ask yourself: "Is Uber a good investment for me?" Only after careful research can you make an informed decision about whether to include Uber in your portfolio.

Featured Posts

-

Analiza 5 Najpopularniejszych Publikacji Jacka Harlukowicza Z Onetu 2024

May 18, 2025

Analiza 5 Najpopularniejszych Publikacji Jacka Harlukowicza Z Onetu 2024

May 18, 2025 -

Best No Verification Casinos 2025 7 Bit Casinos Top Rated Instant Withdrawal Service

May 18, 2025

Best No Verification Casinos 2025 7 Bit Casinos Top Rated Instant Withdrawal Service

May 18, 2025 -

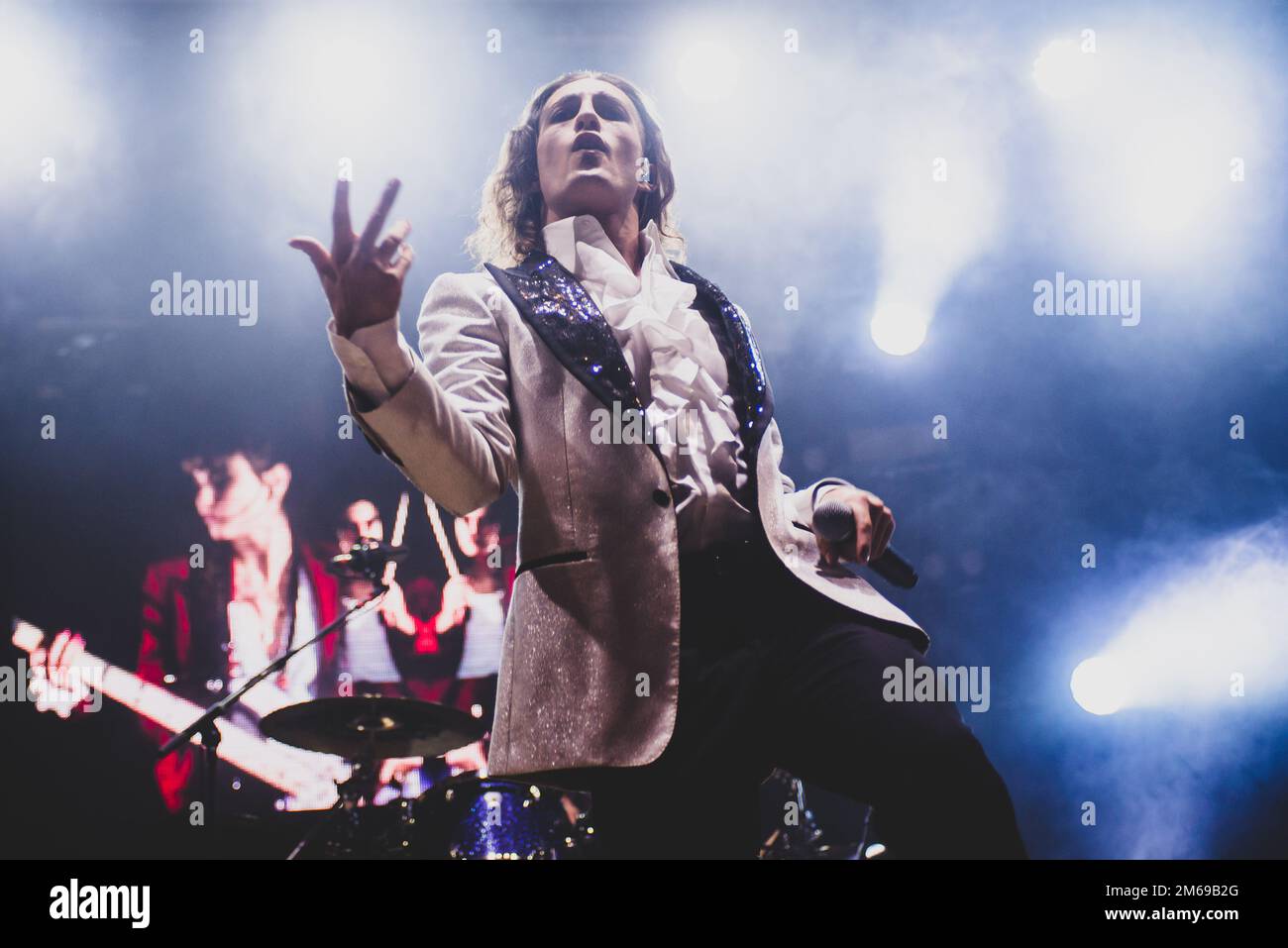

Il Frontemanne Dei Maneskin Damiano David Si Lancia Da Solista

May 18, 2025

Il Frontemanne Dei Maneskin Damiano David Si Lancia Da Solista

May 18, 2025 -

Dodgers Left Handed Bats Overcoming The Slump

May 18, 2025

Dodgers Left Handed Bats Overcoming The Slump

May 18, 2025 -

Uber Stocks Unexpected Strength Defying Recessionary Trends

May 18, 2025

Uber Stocks Unexpected Strength Defying Recessionary Trends

May 18, 2025

Latest Posts

-

Keengganan Israel Mengirim Pejabat Senior Ke Pemakaman Paus Fransiskus Konteks Dan Implikasinya

May 18, 2025

Keengganan Israel Mengirim Pejabat Senior Ke Pemakaman Paus Fransiskus Konteks Dan Implikasinya

May 18, 2025 -

G7 La Question De La Solution A Deux Etats Pour Israel Et La Palestine Ignoree

May 18, 2025

G7 La Question De La Solution A Deux Etats Pour Israel Et La Palestine Ignoree

May 18, 2025 -

Misir Gazze Yoenetimi Teklifini Reddetti

May 18, 2025

Misir Gazze Yoenetimi Teklifini Reddetti

May 18, 2025 -

Peran Jusuf Kalla Sebagai Mediator Konflik Israel Palestina Ucapan Selamat Ulang Tahun Dari Gaza

May 18, 2025

Peran Jusuf Kalla Sebagai Mediator Konflik Israel Palestina Ucapan Selamat Ulang Tahun Dari Gaza

May 18, 2025 -

Dendam Israel Pada Paus Fransiskus Analisis Lengkap Keengganan Mengirim Pejabat Senior

May 18, 2025

Dendam Israel Pada Paus Fransiskus Analisis Lengkap Keengganan Mengirim Pejabat Senior

May 18, 2025