Is XRP A Commodity? The SEC's Regulatory Uncertainty And Ongoing Debate

Table of Contents

The SEC's Case Against Ripple and its Implications for XRP Classification

The SEC's lawsuit against Ripple Labs alleges that XRP is an unregistered security, a claim with far-reaching consequences for XRP's future. The SEC's argument hinges on their definition of a "security," primarily relying on the Howey Test. This test determines whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

The SEC argues that XRP's distribution during various fundraising rounds constitutes an offering of securities. They contend that investors reasonably expected profits based on Ripple's efforts to develop and promote the XRP ecosystem. Furthermore, they highlight the existence of a common enterprise, linking Ripple's actions directly to the value and success of XRP.

- Key SEC Arguments:

- Fundraising: XRP distribution through private placements and programmatic sales qualified as investment contracts.

- Profit Expectation: Investors purchased XRP anticipating its value would increase due to Ripple's development and market initiatives.

- Common Enterprise: Ripple’s efforts directly impacted the success and profitability of XRP, creating a shared enterprise between Ripple and XRP investors.

Arguments for XRP as a Commodity

Counterarguments posit that XRP operates more as a commodity than a security. Proponents emphasize XRP's decentralized nature, highlighting its use as a bridge for cross-border payments on the XRP Ledger. This decentralized aspect, they claim, distinguishes it from securities typically issued by centralized entities.

- Key Arguments for XRP as a Commodity:

- Decentralization: The XRP Ledger operates independently of Ripple, with no single entity controlling its functionality or value.

- Medium of Exchange: XRP facilitates rapid and low-cost transactions, functioning as a medium of exchange similar to fiat currencies or precious metals.

- Market-Driven Price: XRP's price is determined by market forces of supply and demand, mirroring the price dynamics of commodities like gold or oil.

- Commodity Comparisons: The characteristics of XRP align more closely with traditional commodities than with securities.

The Ongoing Debate and Legal Uncertainty

The Ripple vs. SEC case remains a focal point of legal and market uncertainty. The outcome will significantly impact not only XRP but the broader cryptocurrency landscape. Legal experts are divided, with some predicting a win for the SEC that could severely impact the cryptocurrency space, while others anticipate a ruling that provides more clarity and potentially legitimizes certain cryptocurrencies as commodities. This uncertainty directly affects investor confidence, trading volumes, and the overall price of XRP.

- Uncertainty's Impact:

- Investor Confidence: The lack of regulatory clarity creates uncertainty and hesitation among investors.

- Market Volatility: The case's outcome will significantly influence XRP's price and trading volume, potentially impacting the entire crypto market.

- Ripple Effect: The legal precedent set could influence the classification and regulation of other cryptocurrencies.

The Importance of Regulatory Clarity for the Cryptocurrency Market

The XRP case underscores the crucial need for clear and consistent regulatory frameworks for digital assets. Regulatory clarity is vital for investor protection, market stability, and fostering innovation within the cryptocurrency industry. Without clear guidelines, investors face heightened risks, and the potential for market manipulation and fraud increases. A well-defined regulatory landscape would encourage responsible development and attract further investment into this burgeoning sector.

- Benefits of Regulatory Clarity:

- Investor Protection: Clear regulations protect investors from fraudulent activities and scams.

- Market Stability: Well-defined rules promote trust and reduce market volatility.

- Industry Growth: A stable regulatory environment fosters innovation and attracts investment, driving growth in the cryptocurrency sector.

Navigating the Future of XRP and Commodity Classification

The arguments for and against XRP's classification as a commodity highlight the complexities inherent in regulating this new asset class. The SEC's position and the ongoing legal battle create significant uncertainty. However, the eventual outcome, whatever it may be, will undoubtedly shape the future of cryptocurrency regulation and the status of XRP within the market. Stay updated on the XRP commodity debate; follow the legal battle to understand the future of XRP and learn more about the regulatory implications of XRP classification. The future of XRP and the broader cryptocurrency market hinges on achieving regulatory clarity.

Featured Posts

-

School Desegregation Order Ended The Future Of Equal Education

May 02, 2025

School Desegregation Order Ended The Future Of Equal Education

May 02, 2025 -

Leaked 2008 Disney Game Surfaces On Ps Plus Premium

May 02, 2025

Leaked 2008 Disney Game Surfaces On Ps Plus Premium

May 02, 2025 -

The Fall Of Saigon Untold Stories Of Us Officers Bravery And Disobedience

May 02, 2025

The Fall Of Saigon Untold Stories Of Us Officers Bravery And Disobedience

May 02, 2025 -

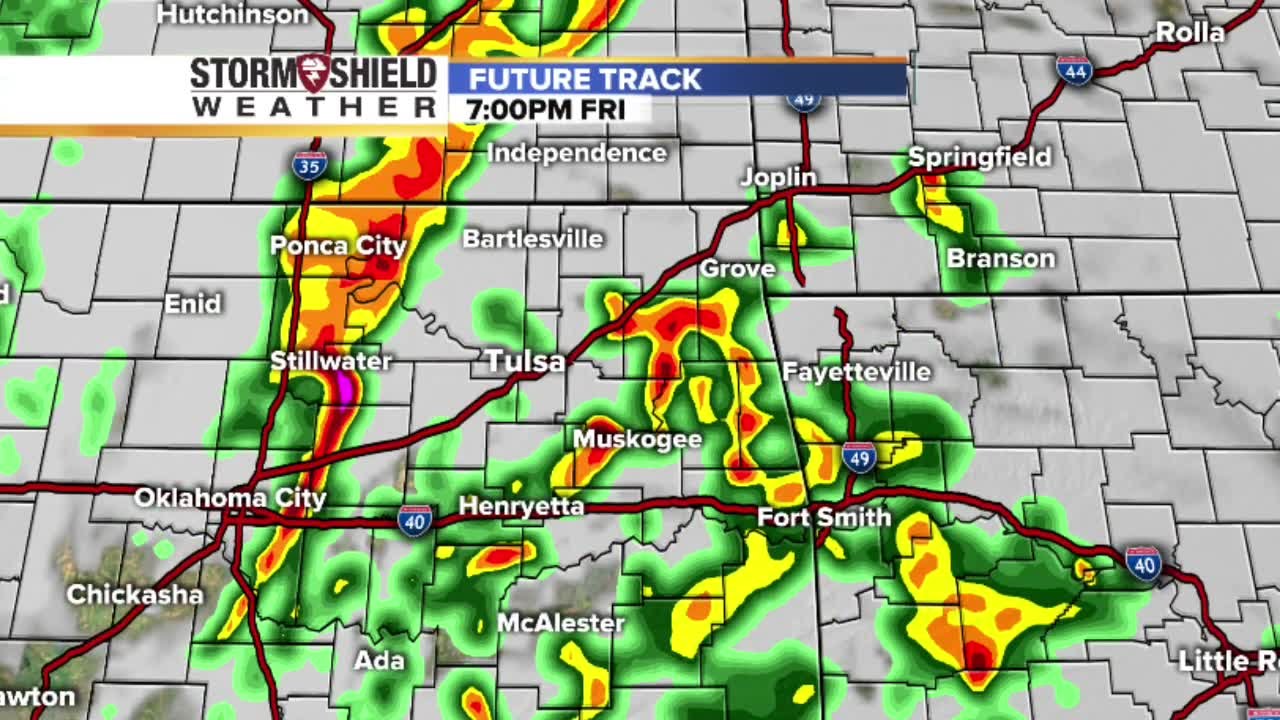

Tulsa Storm Warning Highest Severe Weather Risk After 2 Am

May 02, 2025

Tulsa Storm Warning Highest Severe Weather Risk After 2 Am

May 02, 2025 -

Russell T Davies Hints At A Doctor Who Hiatus Whats Next

May 02, 2025

Russell T Davies Hints At A Doctor Who Hiatus Whats Next

May 02, 2025