Is XRP (Ripple) A Good Buy Under $3? Investment Analysis

Table of Contents

Ripple's Current Market Position and Technological Advantages

XRP's Role in the Global Payment System

RippleNet, Ripple's payment solution, is gaining traction among financial institutions. XRP acts as a bridge currency, facilitating faster and cheaper cross-border transactions than traditional methods or other cryptocurrencies. This speed and efficiency are significant advantages. Several major banks and financial institutions are already utilizing RippleNet, benefiting from reduced processing times and lower costs.

- Specific examples of RippleNet adoption: MoneyGram, Santander, and several other banks are using Ripple's technology for international money transfers. Transaction volumes are increasing, indicating growing adoption. The reported efficiency gains using RippleNet compared to SWIFT (the traditional system) range from 40% to 80% in transaction times and significant cost reductions.

Technological Innovations and Future Developments

Ripple is continuously developing its technology, focusing on improvements to scalability, security, and functionality. These advancements have the potential to significantly impact XRP's price and adoption. Future developments could include enhanced features and integrations, further solidifying its position in the financial industry.

- Key technological advancements: Ripple is working on improving the scalability of its network to handle a larger volume of transactions. Security enhancements are also ongoing, focusing on protecting against attacks and ensuring the integrity of the system.

Analysis of XRP's Price Volatility and Historical Performance

Factors Influencing XRP Price

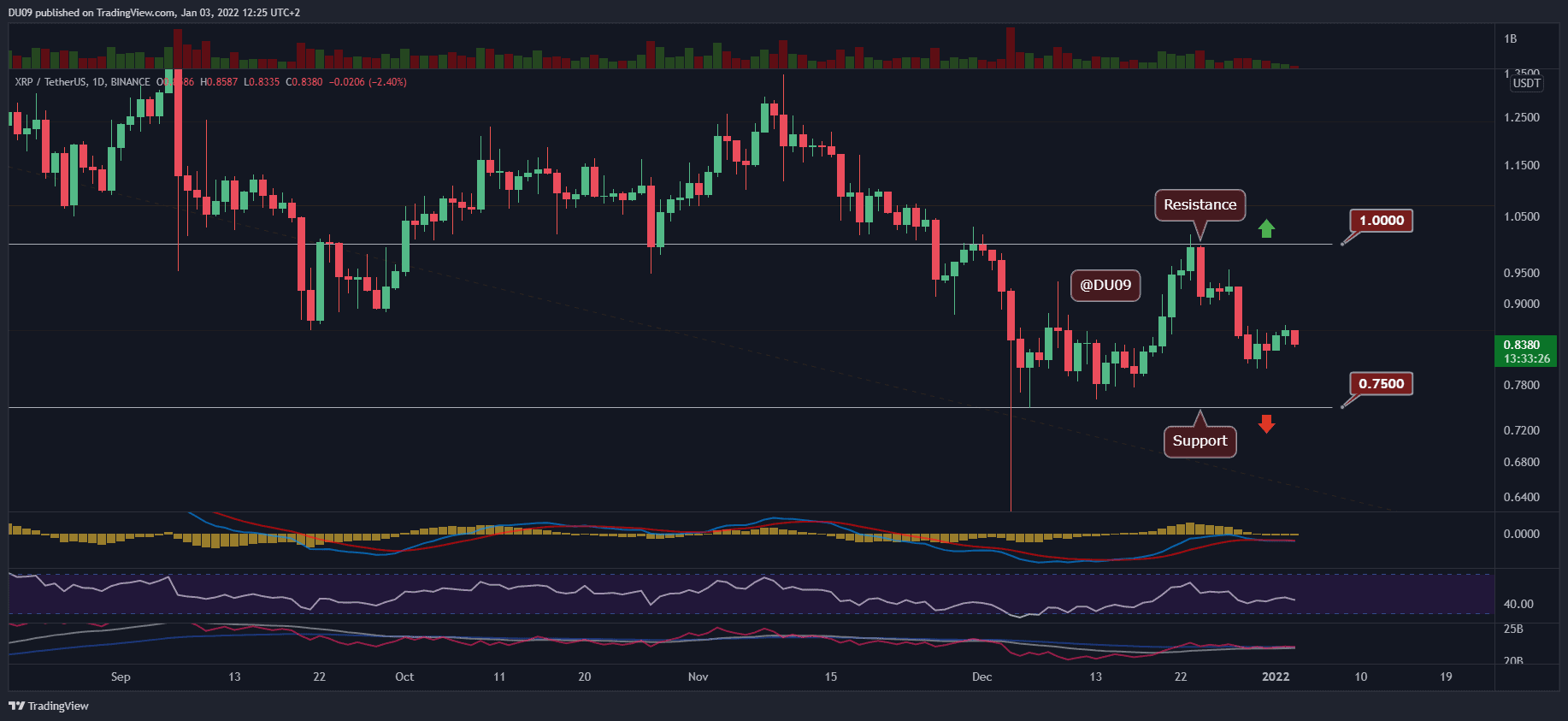

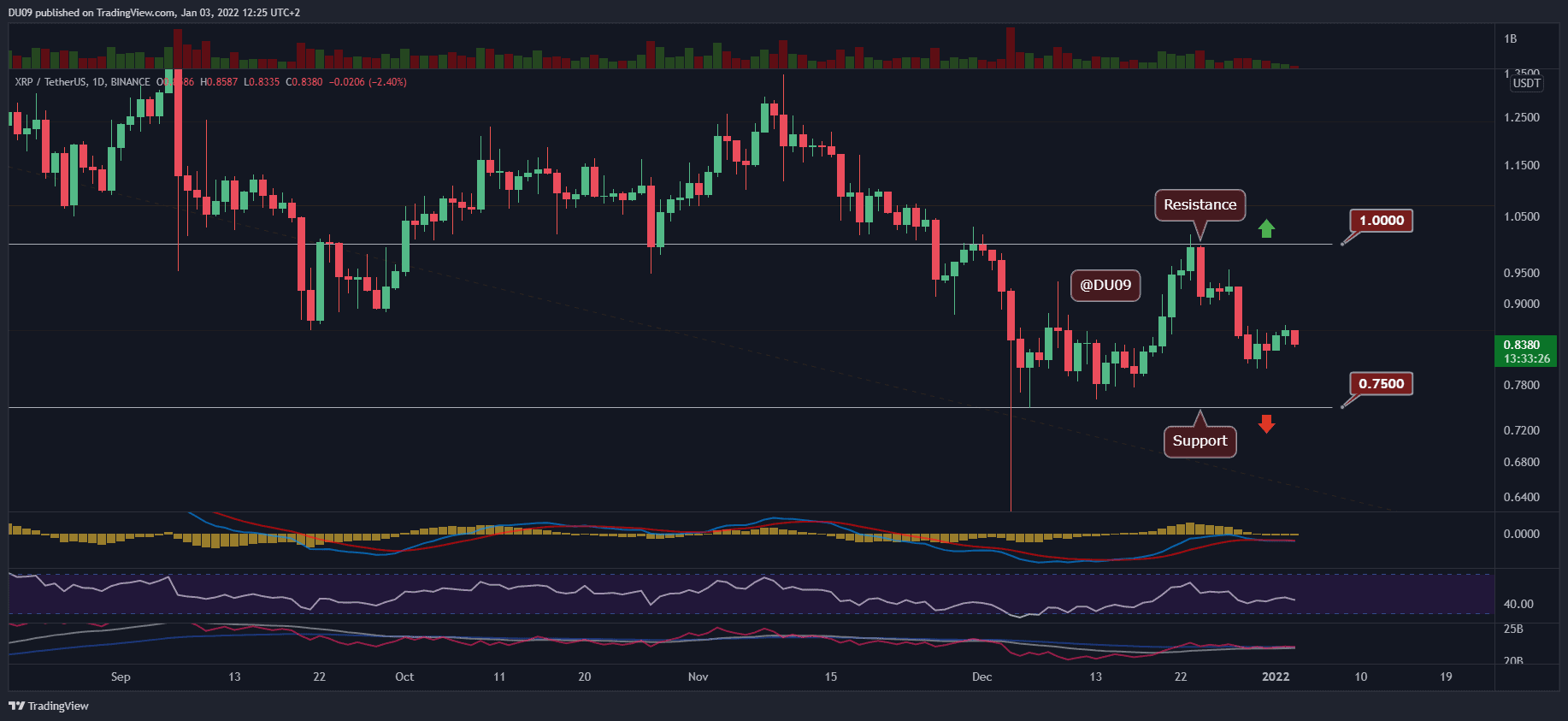

XRP's price is highly susceptible to several factors, including regulatory uncertainty, Bitcoin's price movements, and overall market sentiment. The ongoing SEC lawsuit has significantly impacted its price, causing considerable volatility. Positive news, partnerships, and increased adoption can drive price increases, while negative news can trigger sharp declines.

- Key events impacting XRP's price: The SEC lawsuit against Ripple is a major factor, creating uncertainty and impacting investor confidence. Positive press releases announcing new partnerships or collaborations often result in price surges. Conversely, negative media coverage or regulatory setbacks can cause significant price drops. Analyzing historical price data alongside these events helps understand the dynamics.

Predicting Future Price Movements (with caveats)

Predicting XRP's future price is challenging and speculative. Technical analysis can offer potential price targets, but these are not guarantees. Future price movements largely depend on regulatory developments, market adoption, and broader cryptocurrency market trends. It's crucial to remember that even the most sophisticated predictions have limitations.

- Potential price scenarios: A bullish scenario might predict XRP reaching $5-$10 based on successful resolution of the SEC lawsuit and widespread adoption. A bearish scenario could see prices dropping further due to ongoing regulatory hurdles. A neutral scenario suggests a gradual price increase based on steady but not explosive market adoption. These are just possibilities and should not be taken as financial advice.

Risks Associated with Investing in XRP

Regulatory Risks and Legal Challenges

The ongoing SEC lawsuit poses a significant risk to XRP investors. The outcome could dramatically affect the price and future prospects of XRP. Future regulations regarding cryptocurrencies could also create further uncertainty and potentially impact XRP’s value negatively. Understanding the legal landscape and potential risks is crucial before investing.

- Summary of the SEC lawsuit: The SEC alleges that Ripple sold XRP as an unregistered security, which, if proven, could result in significant penalties and restrictions on XRP trading.

Market Volatility and Investment Risks

The cryptocurrency market is inherently volatile, and XRP is no exception. Investing in a single cryptocurrency carries considerable risk, emphasizing the importance of diversification. Proper risk management strategies, including only investing what you can afford to lose, are paramount.

- Examples of historical volatility: Historical data clearly shows dramatic price swings in the cryptocurrency market, highlighting the significant risk involved.

Conclusion

This analysis has examined XRP's technological advantages, market position, price volatility, and inherent risks. While XRP shows potential in the cross-border payment sector, investment decisions should carefully consider regulatory uncertainties and the cryptocurrency market's volatility.

Call to Action: Before investing in XRP or any cryptocurrency, conduct thorough research and consider consulting a financial advisor. Remember, whether XRP is a good buy under $3 depends on your individual risk tolerance and investment strategy. Proceed with caution and only invest what you can afford to lose. Do your own research before buying XRP.

Featured Posts

-

Dau Tu An Toan Kiem Tra Ky Cang Truoc Khi Gop Von Vao Bat Ky Cong Ty Nao

May 01, 2025

Dau Tu An Toan Kiem Tra Ky Cang Truoc Khi Gop Von Vao Bat Ky Cong Ty Nao

May 01, 2025 -

Xrp To 10 Price Prediction After Ripples Dubai License And Technical Breakout

May 01, 2025

Xrp To 10 Price Prediction After Ripples Dubai License And Technical Breakout

May 01, 2025 -

Eurovision Irishmans Armenian Song Achieves Historic First

May 01, 2025

Eurovision Irishmans Armenian Song Achieves Historic First

May 01, 2025 -

Charlotte Old Lantern Barn Farmers And Foragers Owner Sale

May 01, 2025

Charlotte Old Lantern Barn Farmers And Foragers Owner Sale

May 01, 2025 -

Te Ipukarea Societys Contribution To Seabird Conservation Focusing On Rarely Seen Species

May 01, 2025

Te Ipukarea Societys Contribution To Seabird Conservation Focusing On Rarely Seen Species

May 01, 2025