Is XRP's 400% Price Jump A Buy Signal? Analysis And Investment Advice

Table of Contents

Analyzing the 400% XRP Price Surge: Understanding the Factors

Understanding the reasons behind XRP's dramatic price jump is crucial for determining its sustainability. Several interconnected factors likely contributed to this significant increase.

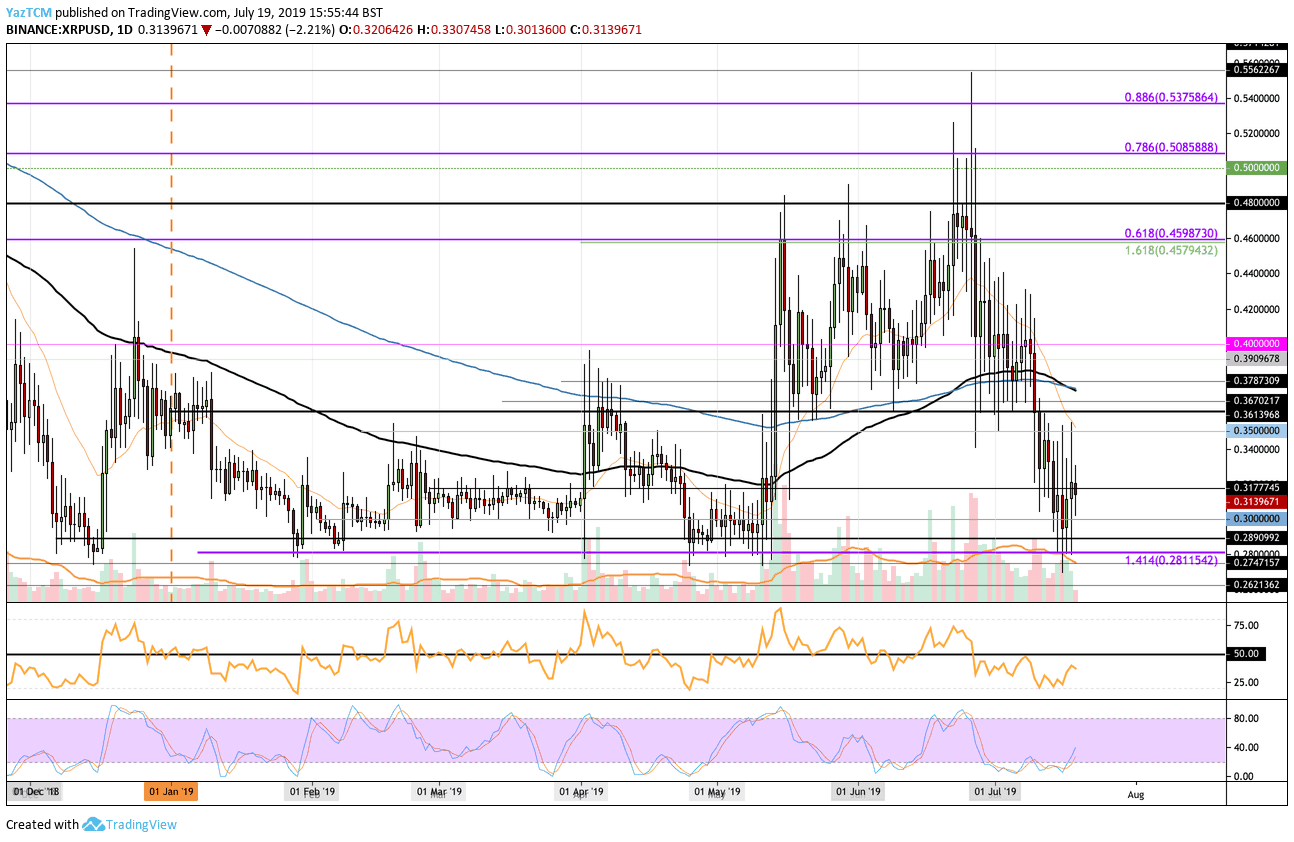

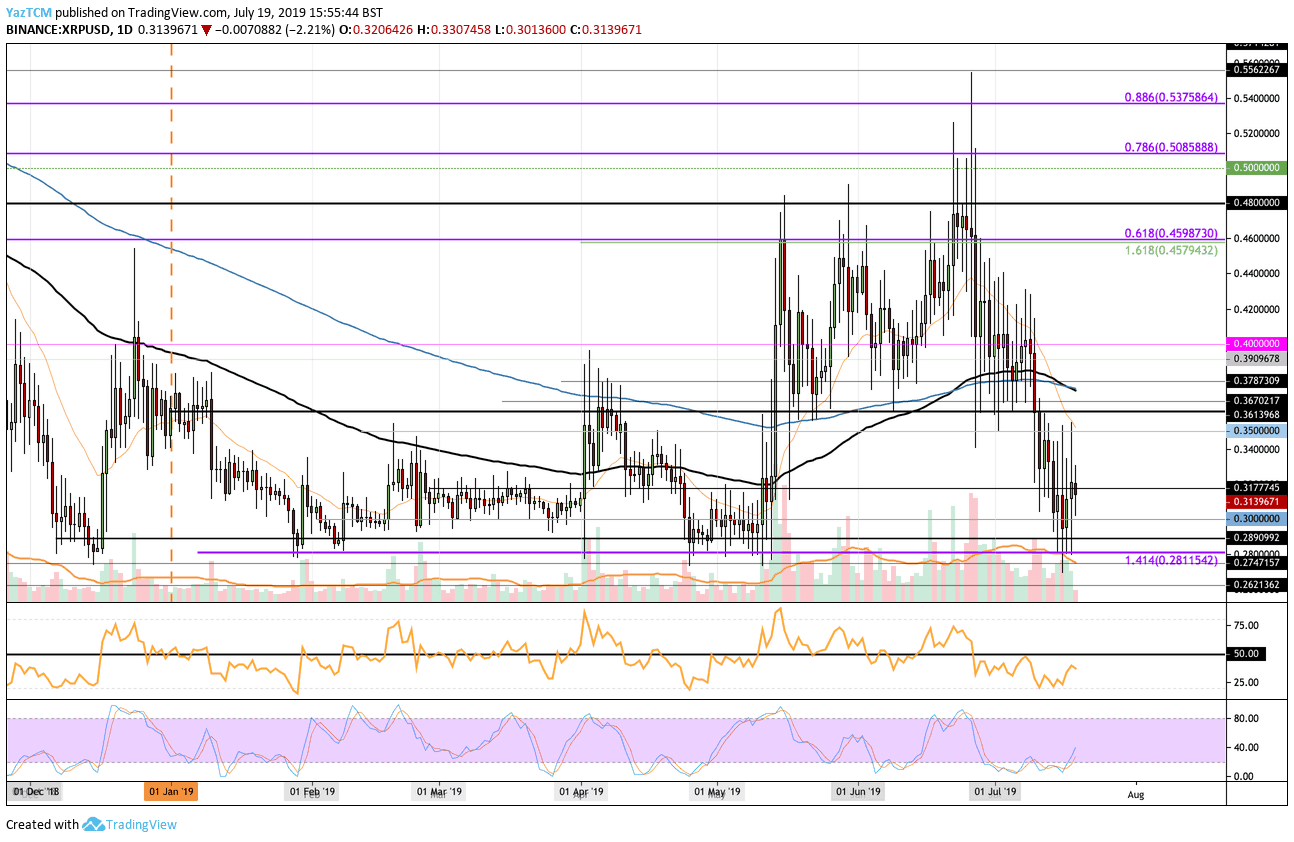

Technical Analysis of XRP's Chart

A technical analysis of XRP's chart reveals intriguing patterns. The recent price surge was accompanied by a substantial increase in trading volume, suggesting strong buying pressure.

- RSI (Relative Strength Index): Readings above 70 often indicate overbought conditions, while readings below 30 suggest oversold conditions. Analyzing the RSI can help identify potential trend reversals.

- MACD (Moving Average Convergence Divergence): This indicator helps identify momentum changes and potential buy/sell signals based on the relationship between two moving averages.

- Moving Averages (MA): Analyzing different moving averages (e.g., 50-day MA, 200-day MA) can help identify support and resistance levels and potential trend changes.

Recent charts show a possible breakout pattern, suggesting a potential continuation of the upward trend. However, it's crucial to remember that technical analysis is not foolproof and should be considered alongside fundamental analysis. (Insert relevant chart/graph here)

Fundamental Factors Influencing XRP's Price

Beyond technical indicators, several fundamental factors likely fueled XRP's price increase:

- Ripple's Ongoing Legal Battle with the SEC: Positive developments in the ongoing SEC lawsuit against Ripple could significantly impact XRP's price. Any favorable court rulings or settlements could boost investor confidence.

- Partnerships and Technological Advancements: New partnerships and technological advancements by Ripple could increase demand for XRP and its utility within the payment ecosystem.

- Market Sentiment: Overall positive sentiment in the broader cryptocurrency market, coupled with renewed interest in XRP, contributed to the price increase.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain globally. Positive regulatory developments or clarity could influence XRP's price positively.

Market Sentiment and Social Media Influence

Social media plays a significant role in shaping market sentiment. A surge in positive sentiment towards XRP on platforms like Twitter and Reddit, fueled by news and speculation, may have contributed to the FOMO (Fear Of Missing Out) effect, pushing the price upwards. Analyzing social media trends and influencer opinions can provide valuable insights into market sentiment, although it's crucial to approach such information critically.

Risk Assessment: Is Investing in XRP Currently Wise?

While the 400% price jump is tempting, it's crucial to assess the risks before investing in XRP.

The Ongoing SEC Lawsuit and its Implications

The SEC lawsuit remains a significant overhang on XRP's price. A negative ruling could lead to a substantial price drop. Potential outcomes range from a complete ban on XRP in the US to a settlement with conditions. Investing in XRP during this legal uncertainty involves considerable risk.

Market Volatility and Cryptocurrency Risks

The cryptocurrency market is inherently volatile. XRP's price is susceptible to significant fluctuations driven by market sentiment, regulatory changes, and unforeseen events. Investing in XRP requires a high-risk tolerance.

- Potential for Significant Price Drops: The price could drop dramatically, potentially wiping out significant investments.

- Risk Management: Employing appropriate risk management strategies, such as diversification and stop-loss orders, is crucial.

- Portfolio Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes to mitigate risk.

Alternative Investment Options

Before investing in XRP, consider exploring other investment opportunities in the cryptocurrency market or traditional asset classes. Researching and comparing various cryptocurrencies and their underlying technologies is essential for making informed decisions.

Investment Strategies and Advice for XRP

Investing in XRP requires a careful and informed approach. Consider these strategies:

Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy helps mitigate the risk of investing a large sum at a market peak.

Setting Stop-Loss Orders

A stop-loss order automatically sells your XRP if the price falls below a predetermined level, limiting potential losses. Setting stop-loss orders is crucial for managing risk in the volatile cryptocurrency market.

Diversification

Diversification is essential for managing risk. Don't invest all your capital in a single cryptocurrency. Spread your investments across different assets to reduce your overall risk exposure.

Conclusion: Is XRP's Price Jump a Sustainable Buy Signal? Your Next Steps

XRP's recent price surge is a complex phenomenon driven by a combination of technical, fundamental, and sentiment-related factors. While the potential for future gains exists, the risks associated with investing in XRP during the ongoing SEC lawsuit and inherent market volatility cannot be ignored. This analysis highlights the importance of thorough due diligence and risk assessment before considering any XRP investment. Carefully consider your risk tolerance and only invest what you can afford to lose. Research XRP thoroughly before investing, and remember that past performance is not indicative of future results. Make informed decisions about your XRP investment, understanding the potential upside and downside equally.

Featured Posts

-

Ovechkin And Orlov A Miami Break During The 4 Nations Face Off

May 07, 2025

Ovechkin And Orlov A Miami Break During The 4 Nations Face Off

May 07, 2025 -

Harvard Presidents Response To Trumps Allegations

May 07, 2025

Harvard Presidents Response To Trumps Allegations

May 07, 2025 -

Bulls Fall To Cavaliers 22 Point Defeat In Nba Matchup

May 07, 2025

Bulls Fall To Cavaliers 22 Point Defeat In Nba Matchup

May 07, 2025 -

Cleveland Cavaliers Secure No 1 Seed In East

May 07, 2025

Cleveland Cavaliers Secure No 1 Seed In East

May 07, 2025 -

The Last Of Us Season 2 Dinas Character Arc And Isabela Merceds Portrayal

May 07, 2025

The Last Of Us Season 2 Dinas Character Arc And Isabela Merceds Portrayal

May 07, 2025