Is XRP's 400% Price Jump A Buying Opportunity? Analysis And Predictions.

Table of Contents

Factors Contributing to XRP's Recent Price Surge

Several factors have converged to propel XRP's price to new heights. Let's examine the key contributors:

Positive Ripple Legal Developments

The ongoing legal battle between Ripple and the SEC has significantly impacted XRP's price. Recent positive developments in the case have dramatically shifted investor sentiment.

- Partial Summary Judgement Victory: The court's partial summary judgement ruling in favor of Ripple on certain aspects of the case has significantly reduced regulatory uncertainty surrounding XRP. This positive outcome boosted investor confidence.

- Increased Institutional Interest: Following the positive legal news, institutional investors have shown renewed interest in XRP, leading to increased trading volume and market capitalization.

- Expert Legal Opinions: Many legal experts have interpreted the court's ruling as favorable to Ripple, further strengthening the bullish sentiment surrounding XRP. This positive legal narrative has played a key role in the price surge.

- Keywords: Ripple lawsuit, SEC vs Ripple, XRP legal battle, Ripple court case, XRP regulatory uncertainty

Increased Institutional Adoption and Trading Volume

Beyond the legal wins, increased institutional adoption and trading volume have fueled XRP's price surge.

- Soaring Trading Volume: Major cryptocurrency exchanges have reported a substantial increase in XRP trading volume, indicating heightened investor activity and demand.

- Institutional Investor Participation: Evidence suggests that institutional investors, known for their calculated and substantial investments, are increasingly adding XRP to their portfolios.

- On-Chain Metrics: Analysis of on-chain metrics, such as transaction volume and network activity, reveals a significant increase in XRP adoption and usage.

- Keywords: XRP trading volume, institutional XRP investment, XRP on-chain analysis, XRP adoption rate

Broader Cryptocurrency Market Trends

While specific to XRP, the recent price surge also reflects broader trends in the cryptocurrency market.

- Overall Market Sentiment: The overall positive sentiment in the broader cryptocurrency market has contributed to the price appreciation of many altcoins, including XRP.

- Bitcoin's Influence: Bitcoin's price movements often influence the performance of other cryptocurrencies, including XRP. A rising Bitcoin price generally supports a positive market environment for altcoins.

- Macroeconomic Factors: While the crypto market is relatively independent, macroeconomic factors, such as inflation and interest rates, can still indirectly impact investor sentiment and cryptocurrency prices.

- Keywords: Bitcoin price, cryptocurrency market trends, altcoin market cap, macroeconomic factors, crypto market volatility

Risk Assessment: Potential Downsides of Investing in XRP

Despite the recent price surge, investing in XRP still carries inherent risks. A thorough risk assessment is crucial before committing capital.

Regulatory Uncertainty

Despite recent positive legal developments, regulatory uncertainty surrounding XRP remains a significant risk.

- Ongoing Legal Challenges: The Ripple lawsuit is not entirely resolved, and further legal battles are still possible. This lingering uncertainty could negatively impact XRP's price.

- Future Regulatory Actions: Regulatory authorities in different jurisdictions could take actions that might affect XRP's status and trading.

- Jurisdictional Differences: The regulatory landscape for cryptocurrencies varies across countries, introducing further complexity and risk.

- Keywords: XRP regulation, cryptocurrency regulation, Ripple regulatory risk, SEC regulations

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception.

- Historical Volatility: Historical data shows that XRP's price has experienced significant swings in the past. This volatility poses a risk for investors.

- Price Swings: Sharp price increases are often followed by equally sharp declines. This volatility underscores the importance of managing risk effectively.

- Emotional Investing: The volatility can trigger emotional decision-making, leading to impulsive buying or selling, often resulting in losses.

- Keywords: XRP volatility, cryptocurrency price volatility, risk management, crypto investment risk

Competition from Other Cryptocurrencies

XRP faces competition from a growing number of cryptocurrencies and blockchain technologies.

- Competitive Landscape: The cryptocurrency market is highly competitive, with new projects and innovations constantly emerging.

- Technological Advancements: Advancements in blockchain technology could render XRP's technology less competitive over time.

- Market Share: XRP's market share could be impacted by the success of competitor projects.

- Keywords: XRP competitors, cryptocurrency competition, blockchain technology

XRP Price Prediction and Future Outlook

Predicting XRP's future price is inherently speculative, but combining technical and fundamental analysis can provide insights.

Technical Analysis

Technical indicators can offer clues about potential price movements.

- Moving Averages: Analyzing moving averages can reveal potential support and resistance levels for XRP.

- RSI (Relative Strength Index): The RSI can help identify overbought or oversold conditions, potentially indicating future price direction.

- Chart Patterns: Identifying chart patterns, such as head and shoulders or triangles, can offer insights into potential price trends.

- Keywords: XRP technical analysis, XRP price chart, moving averages, RSI, technical indicators, XRP support and resistance levels

Fundamental Analysis

Fundamental analysis focuses on Ripple's underlying technology and adoption.

- Ripple's Technology: Assessing the scalability, security, and functionality of Ripple's technology is crucial for evaluating XRP's long-term value.

- Adoption Rate: Analyzing the adoption rate of XRP by businesses and financial institutions provides insights into its future potential.

- Use Cases: Identifying and evaluating the real-world use cases for XRP helps determine its long-term value proposition.

- Keywords: Ripple technology, XRP use cases, XRP adoption, fundamental analysis

Conclusion

XRP's recent 400% price jump is a complex phenomenon driven by a combination of positive legal developments, increased institutional adoption, and broader market trends. However, significant risks remain, including regulatory uncertainty, market volatility, and competition from other cryptocurrencies. Whether this jump presents a buying opportunity depends heavily on your risk tolerance and investment strategy. While the positive legal news is significant, the inherent volatility of the crypto market cannot be ignored.

Call to Action: While this analysis provides valuable insights into whether XRP's 400% price jump is a buying opportunity, thorough research and careful consideration of your individual risk tolerance are crucial before investing in any cryptocurrency, including XRP. Conduct your own due diligence and consult with a financial advisor before making any investment decisions related to XRP price movements or other cryptocurrencies. Remember that investing in cryptocurrencies like XRP involves significant risk.

Featured Posts

-

Dosarele X Redeschise Ancheta Continua La Galati

May 01, 2025

Dosarele X Redeschise Ancheta Continua La Galati

May 01, 2025 -

Charlotte Jordan And Lucy Fallons Heartfelt Coronation Street Goodbye

May 01, 2025

Charlotte Jordan And Lucy Fallons Heartfelt Coronation Street Goodbye

May 01, 2025 -

Priscilla Pointer Dies At 100 Amy Irvings Mother And Carrie Star Passes Away

May 01, 2025

Priscilla Pointer Dies At 100 Amy Irvings Mother And Carrie Star Passes Away

May 01, 2025 -

Yankees Salvage Series Win Against Guardians

May 01, 2025

Yankees Salvage Series Win Against Guardians

May 01, 2025 -

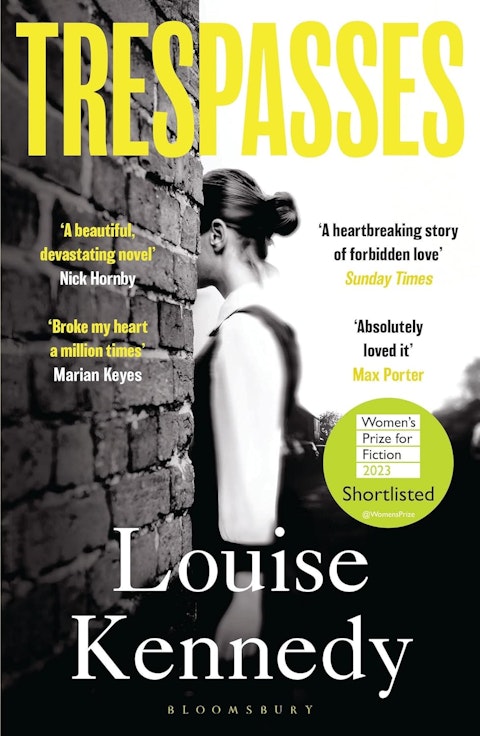

Trespasses Channel 4 Releases First Teaser Images For Upcoming Drama

May 01, 2025

Trespasses Channel 4 Releases First Teaser Images For Upcoming Drama

May 01, 2025