Japan's Bond Market: Steep Yield Curve Poses Economic Challenges

Table of Contents

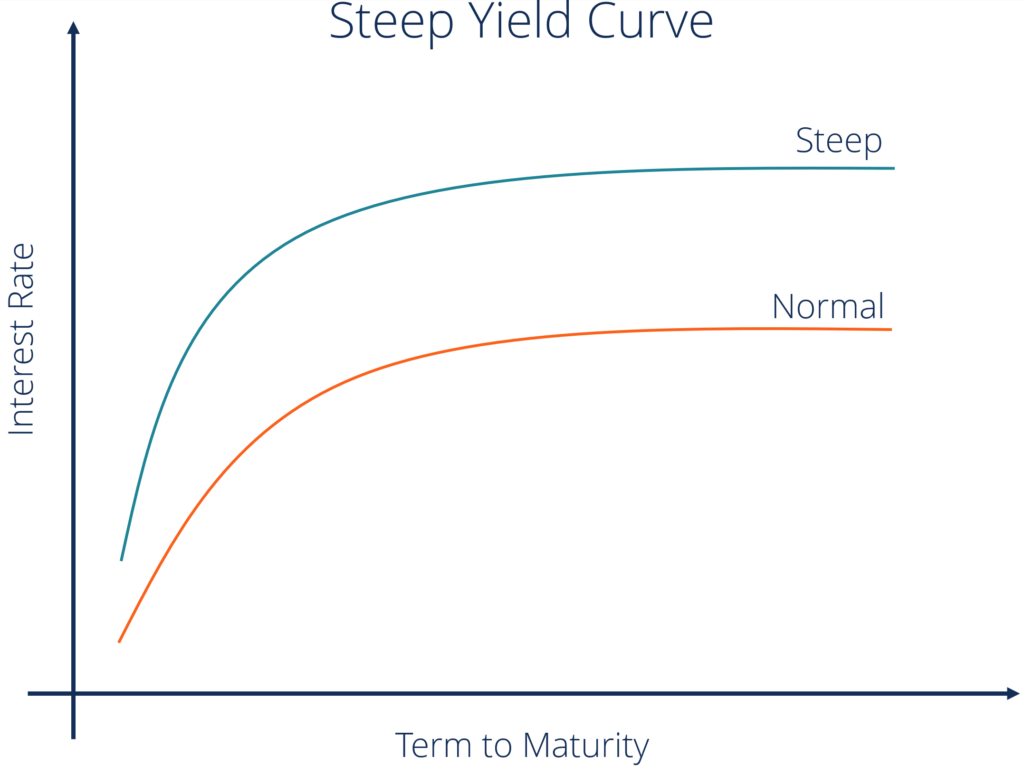

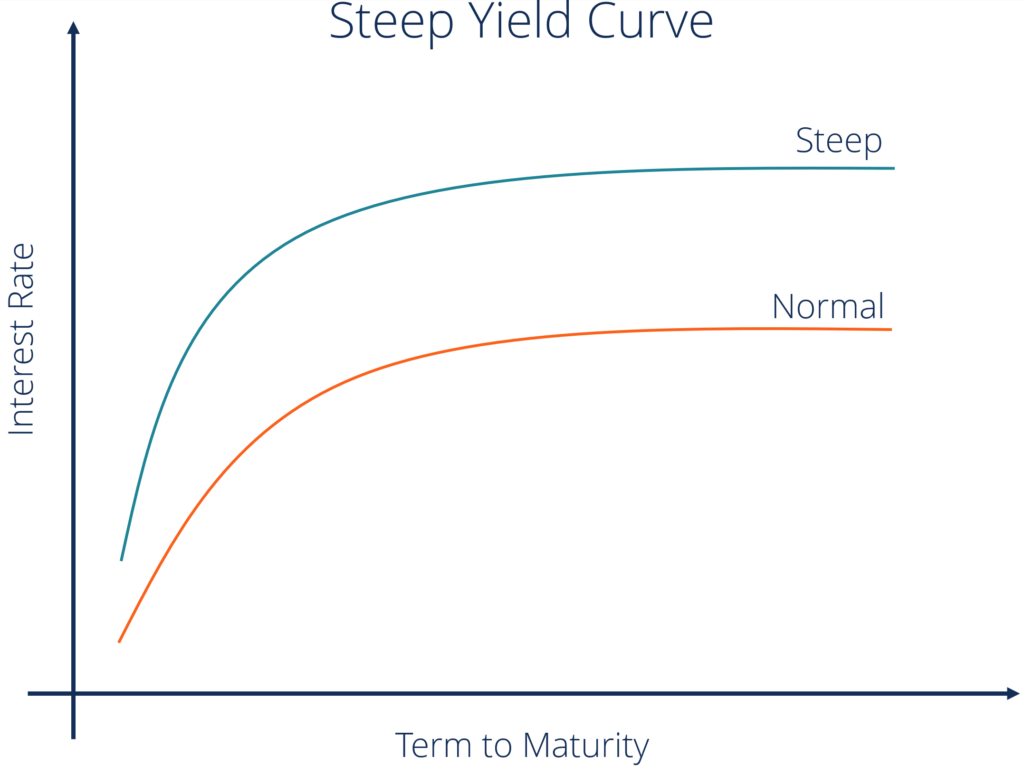

The Steepening Yield Curve: A Closer Look

The yield curve in Japan's bond market has become increasingly steep in recent months. This signifies a growing divergence between short-term and long-term interest rates. Historically, Japan has experienced a relatively flat or even inverted yield curve, reflecting its long period of deflationary pressures and ultra-loose monetary policy. However, the current situation presents a stark contrast.

- Comparison to Historical Averages: A comparison of the current yield curve to historical averages reveals a significant steepening. For example, the difference between the 10-year Japanese Government Bond (JGB) yield and the 1-year JGB yield has widened considerably, exceeding levels seen in the past decade.

- Yield Difference Examples: As of [Insert Current Date], the 10-year JGB yield might be around [Insert Approximate Yield]%, while the 1-year JGB yield might be around [Insert Approximate Yield]%. This substantial difference reflects investor expectations and market sentiment.

- The Bank of Japan's Role: The Bank of Japan (BOJ) has historically played a crucial role in influencing the yield curve through its quantitative and qualitative monetary easing (QQE) programs. However, the recent steepening suggests that market forces are now overriding some of the BOJ's attempts to maintain a controlled curve. The BOJ's recent adjustments to its yield curve control (YCC) policy have also contributed to the increased volatility and steepness.

Underlying Factors Contributing to the Steep Curve

Several key economic factors are driving the steepening yield curve in Japan's bond market. These factors interact in complex ways, creating a challenging environment for policymakers and investors.

- Inflationary Pressures: While still relatively low compared to other developed nations, inflation in Japan is rising, driven by factors such as increased energy prices and supply chain disruptions. This upward pressure on inflation is pushing up expectations for future interest rate hikes, contributing to higher long-term bond yields.

- Market Expectations of BOJ Rate Hikes: The market increasingly anticipates that the BOJ will eventually adjust its ultra-loose monetary policy, potentially leading to higher interest rates. This anticipation is reflected in the steepening yield curve, as investors price in future rate increases.

- Global Economic Uncertainties: Global economic uncertainties, including geopolitical risks and slowing growth in major economies, are also influencing Japanese bond yields. Investors may seek safer havens, leading to increased demand for Japanese government bonds, pushing down short-term yields while long-term yields remain elevated.

- Government Debt and Fiscal Policy: Japan's substantial government debt levels pose a significant challenge. Continued large-scale government borrowing could exert upward pressure on long-term bond yields, further contributing to the steepening yield curve.

Economic Consequences of a Steep Yield Curve

A steep yield curve in Japan's bond market carries several potential economic ramifications.

- Increased Borrowing Costs: A steep yield curve translates to higher borrowing costs for businesses and consumers, potentially hindering investment and consumption. This could slow economic growth and impact overall economic activity.

- Impact on Investment Decisions: The uncertainty surrounding future interest rates, as reflected in the steep yield curve, can make investment decisions more challenging for businesses. This uncertainty can lead to delayed or cancelled investment projects, further dampening economic growth.

- Potential for Increased Inflation: While inflation is already rising, a steep yield curve could exacerbate inflationary pressures. Higher borrowing costs can lead to price increases across various sectors of the economy.

- Challenges to BOJ Monetary Policy: The steep yield curve poses significant challenges to the BOJ's monetary policy goals. Maintaining price stability while managing the yield curve effectively becomes more complex in this environment.

Strategies for Navigating the Challenges

Mitigating the negative impacts of the steep yield curve requires a multi-pronged approach.

- BOJ Monetary Policy Adjustments: The BOJ may need to carefully calibrate its monetary policy response to address the steepening yield curve. This might involve gradual adjustments to its YCC policy or other interventions aimed at smoothing the curve.

- Government Measures: The Japanese government could implement fiscal measures to control inflation and manage its debt levels effectively. This could involve fiscal consolidation efforts or targeted spending programs.

- Investment Strategies: Investors need to adapt their investment strategies to navigate the challenges of a steep yield curve. This may involve diversifying portfolios and carefully selecting bonds with appropriate maturities.

- International Coordination: Global economic cooperation and coordination are crucial in addressing the interconnected challenges posed by a steepening yield curve in Japan's bond market. International collaboration can help mitigate the impact of global economic uncertainties.

Conclusion

This article has examined the steep yield curve in Japan's bond market, analyzing its underlying causes and potential economic consequences. The widening gap between short-term and long-term bond yields presents significant challenges for economic growth, inflation control, and the effectiveness of the BOJ's monetary policy. Understanding these dynamics is crucial for navigating the current market conditions. Stay informed on the evolving dynamics of Japan's bond market. Continuous monitoring of yield curve movements and related economic indicators is crucial for investors and policymakers alike. Further research into the complexities of Japan's bond market is vital for informed decision-making.

Featured Posts

-

Canada China Trade Relations Ambassadors Remarks On Formal Trade Deal

May 17, 2025

Canada China Trade Relations Ambassadors Remarks On Formal Trade Deal

May 17, 2025 -

Cnn Business Cybersecurity Experts Deepfake Deception

May 17, 2025

Cnn Business Cybersecurity Experts Deepfake Deception

May 17, 2025 -

Ftc Appeals Activision Blizzard Ruling Microsoft Deal Uncertain

May 17, 2025

Ftc Appeals Activision Blizzard Ruling Microsoft Deal Uncertain

May 17, 2025 -

Ftc To Appeal Microsoft Activision Merger Decision

May 17, 2025

Ftc To Appeal Microsoft Activision Merger Decision

May 17, 2025 -

Tampering Allegations Wnba Star Criticizes Angel Reese

May 17, 2025

Tampering Allegations Wnba Star Criticizes Angel Reese

May 17, 2025

Latest Posts

-

Two Decades On The Continued Impact Of Seattle Mariners Legend Ichiro Suzuki

May 17, 2025

Two Decades On The Continued Impact Of Seattle Mariners Legend Ichiro Suzuki

May 17, 2025 -

The Impact Of False Angel Reese Quotes On Social Media

May 17, 2025

The Impact Of False Angel Reese Quotes On Social Media

May 17, 2025 -

The Lasting Influence Of Ichiro Suzuki A Look Back At Two Decades Of Excellence

May 17, 2025

The Lasting Influence Of Ichiro Suzuki A Look Back At Two Decades Of Excellence

May 17, 2025 -

First Inning Domination Mariners 14 0 Shutout Of Marlins

May 17, 2025

First Inning Domination Mariners 14 0 Shutout Of Marlins

May 17, 2025 -

Identifying And Reporting Fake Angel Reese Quotes

May 17, 2025

Identifying And Reporting Fake Angel Reese Quotes

May 17, 2025