Japan's Economy Faces Pressure: The Challenge Of A Steepening Bond Yield Curve

Table of Contents

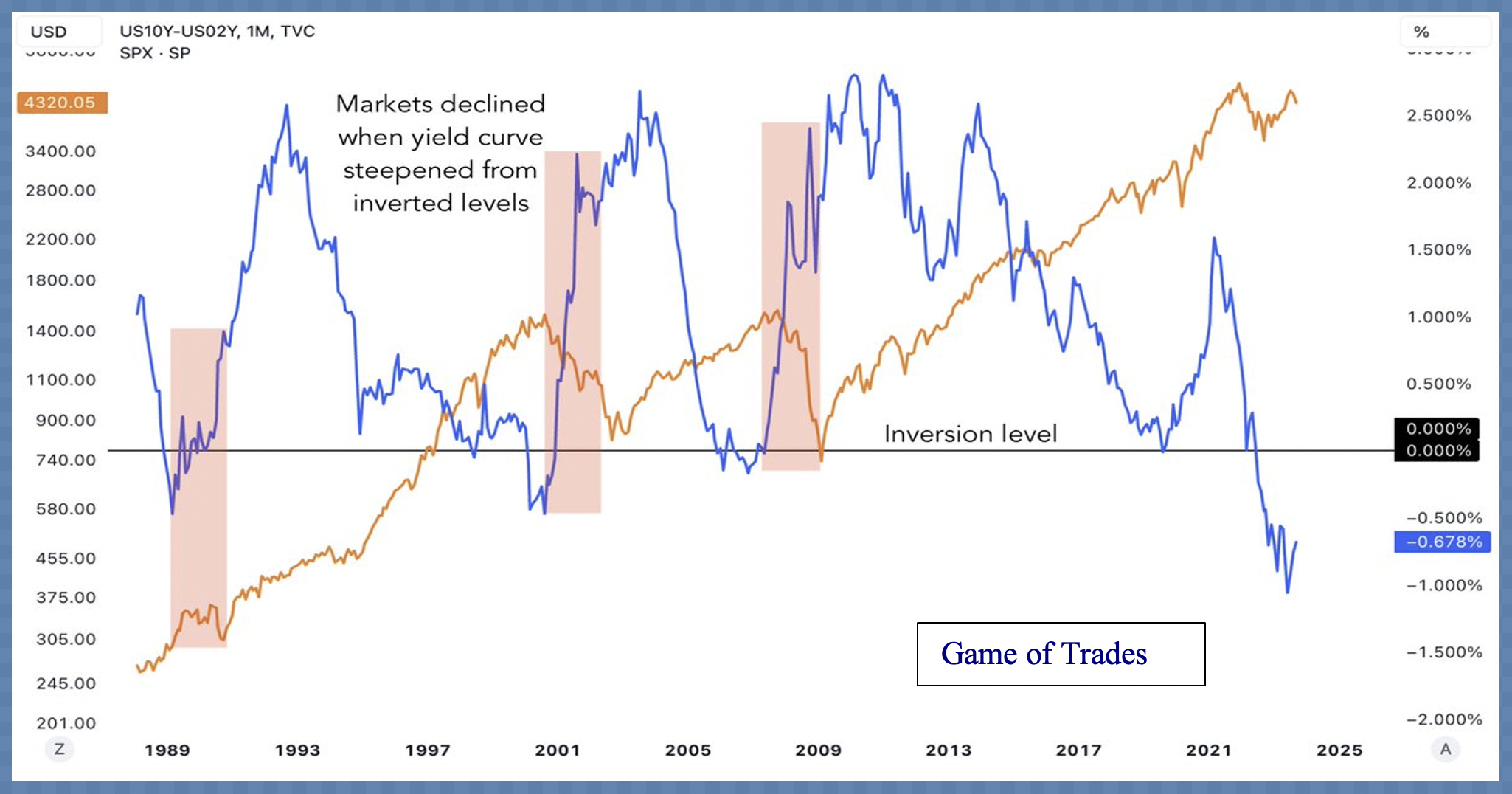

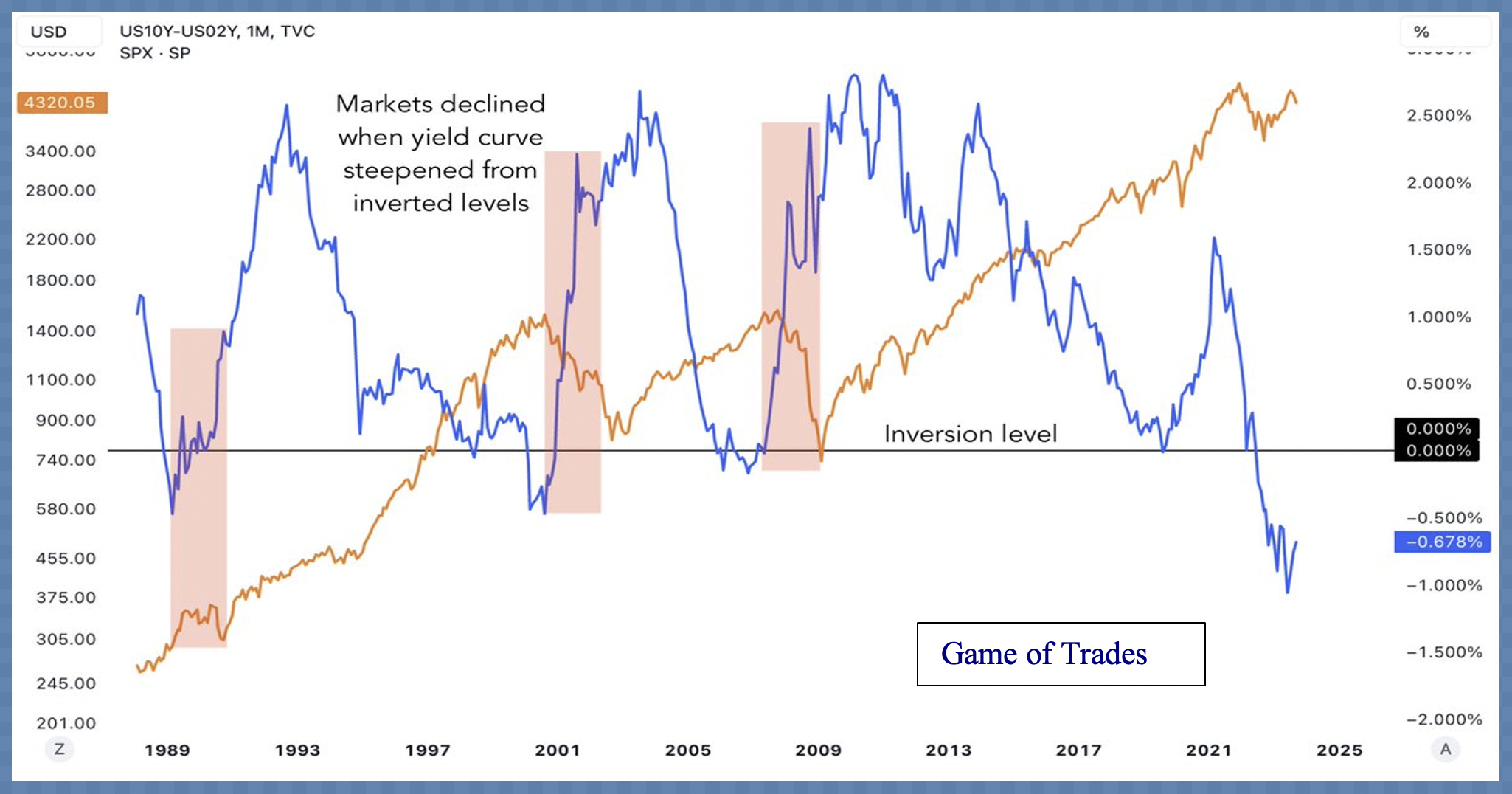

The Mechanics of a Steepening Bond Yield Curve in Japan

Understanding the mechanics of a steepening bond yield curve is crucial to grasping the current challenges facing Japan's economy. A yield curve is a graphical representation of the relationship between the interest rates (yields) and the time to maturity of bonds with the same credit quality. In Japan's context, this typically involves Japanese Government Bonds (JGBs). A flattening yield curve occurs when the difference between long-term and short-term yields narrows, while a steepening yield curve indicates that this difference is widening – long-term yields are rising faster than short-term yields.

- Definition of a yield curve: A line showing the yields of bonds with different maturities, all with the same credit rating.

- Relationship between short-term and long-term bond yields: Short-term yields are usually influenced by current monetary policy, while long-term yields reflect market expectations about future inflation and economic growth.

- Factors contributing to a steepening yield curve in Japan: Several factors are at play, including rising inflation expectations, adjustments to the Bank of Japan's (BOJ) monetary policy, and global economic influences.

- Visual aid: [Insert a simple graph here illustrating a steepening yield curve, clearly labeling the axes (maturity and yield) and highlighting the widening gap between short-term and long-term yields].

Underlying Causes of the Steepening Curve

The steepening bond yield curve in Japan is a result of a confluence of factors. Understanding these causes is essential to predicting future economic trends and formulating appropriate policy responses.

- Rising inflation rates and their effect on bond yields: Increased inflation erodes the purchasing power of future interest payments, leading investors to demand higher yields on longer-term bonds to compensate for this risk. Japan, after decades of deflation, is experiencing a rise in inflation, albeit still relatively moderate compared to other developed nations.

- The Bank of Japan's yield curve control policy and its limitations: The BOJ's attempts to control the yield curve through its monetary policy, particularly its yield curve control (YCC) policy, have faced increasing pressure. This policy aims to keep long-term interest rates low, but its effectiveness is being challenged by rising inflation and global market forces.

- Impact of global interest rate hikes on Japanese yields: The US Federal Reserve's aggressive interest rate hikes have had a ripple effect globally, influencing capital flows and increasing yields on Japanese bonds. This is because higher yields in other countries make Japanese bonds less attractive to international investors.

- Potential effects of geopolitical instability: Global uncertainties, including geopolitical tensions and energy price volatility, contribute to investor anxiety, impacting the demand for Japanese government bonds and thus influencing yield curve dynamics.

The Impact of Global Economic Trends

The Japanese economy is deeply intertwined with the global economy. Understanding the impact of global trends is critical in analyzing the steepening yield curve.

- US interest rate hikes and their spillover effects on Japan: The US Federal Reserve's monetary tightening has led to capital outflows from Japan as investors seek higher returns in the US market, putting upward pressure on Japanese bond yields.

- Impact of global investors' shifting preferences: Changes in global investor sentiment and risk appetite directly influence demand for Japanese government bonds. A flight to safety during times of global uncertainty can temporarily flatten the yield curve, but the long-term trend remains towards steepening.

- Analysis of capital flight and its consequences: Significant capital flight from Japan could exacerbate the steepening yield curve, potentially triggering further economic challenges.

Economic Consequences for Japan

A steepening bond yield curve carries substantial economic consequences for Japan.

- Rising government debt servicing costs: Japan has the world's highest public debt-to-GDP ratio. A steepening yield curve dramatically increases the cost of servicing this debt, placing a greater burden on the national budget and potentially limiting government spending in other areas.

- Increased borrowing costs for businesses, potentially hindering investment: Higher borrowing costs make it more expensive for Japanese companies to invest in expansion, research and development, and hiring, potentially dampening economic growth.

- Implications for household savings and retirement planning: Higher interest rates on government bonds might benefit savers, but the overall impact on household finances depends on the interaction of rising rates with other economic factors such as inflation and wage growth.

- Potential for economic slowdown or recession: The combined effects of increased borrowing costs, reduced investment, and potential strain on household finances could lead to an economic slowdown or even a recession.

Potential Mitigation Strategies

Addressing the challenges posed by the steepening bond yield curve in Japan requires a multi-pronged approach.

- Potential adjustments to the yield curve control policy: The BOJ might need to reconsider or adjust its YCC policy, allowing for greater flexibility in managing long-term interest rates. A gradual adjustment would be crucial to avoid market disruption.

- Fiscal measures to reduce government debt: Implementing fiscal reforms to reduce Japan's massive public debt is crucial. This might involve measures to increase tax revenues or reduce government spending.

- Structural reforms to improve productivity and economic growth: Structural reforms aimed at boosting productivity, fostering innovation, and encouraging greater labor market participation are necessary to create a more robust and resilient economy less vulnerable to external shocks.

Conclusion

The steepening bond yield curve in Japan presents a significant challenge to the nation's economic stability. Understanding the underlying causes, including inflation, global economic trends, and the Bank of Japan's policy adjustments, is crucial to developing effective mitigation strategies. Increased borrowing costs for the government, businesses, and households pose considerable risks. Addressing this issue requires a multifaceted approach involving monetary policy adjustments, fiscal reforms, and structural changes to improve long-term economic growth. Staying informed about developments in the steepening bond yield curve in Japan is vital for investors, businesses, and policymakers alike. Further research into the dynamics of Japan's bond market and proactive policy responses are essential to navigating this critical economic challenge and ensuring a sustainable future for the Japanese economy.

Featured Posts

-

Supporting Her Brother Angel Reeses Moving Tribute To Her Mother

May 17, 2025

Supporting Her Brother Angel Reeses Moving Tribute To Her Mother

May 17, 2025 -

Cheap Doesnt Mean Crappy Smart Shopping Guide

May 17, 2025

Cheap Doesnt Mean Crappy Smart Shopping Guide

May 17, 2025 -

A New Cold War The Rare Earth Minerals Struggle

May 17, 2025

A New Cold War The Rare Earth Minerals Struggle

May 17, 2025 -

Tampering Allegations Wnba Star Criticizes Angel Reese

May 17, 2025

Tampering Allegations Wnba Star Criticizes Angel Reese

May 17, 2025 -

Mitchell Robinson Injury Update Good News For The Knicks After Recent Defeats

May 17, 2025

Mitchell Robinson Injury Update Good News For The Knicks After Recent Defeats

May 17, 2025

Latest Posts

-

Injury Concerns For Giants And Mariners April 4 6 Matchup

May 17, 2025

Injury Concerns For Giants And Mariners April 4 6 Matchup

May 17, 2025 -

Ex Mariners Star Blasts Teams Inaction During Offseason

May 17, 2025

Ex Mariners Star Blasts Teams Inaction During Offseason

May 17, 2025 -

April 4 6 Giants Vs Mariners Whos On The Injured List

May 17, 2025

April 4 6 Giants Vs Mariners Whos On The Injured List

May 17, 2025 -

Seattle Mariners Quiet Winter Draws Criticism From Former Player

May 17, 2025

Seattle Mariners Quiet Winter Draws Criticism From Former Player

May 17, 2025 -

Mariners Giants Injury News Key Players Out For April 4 6 Series

May 17, 2025

Mariners Giants Injury News Key Players Out For April 4 6 Series

May 17, 2025