Japan's Steep Yield Curve: A Growing Concern For Investors And The Economy

Table of Contents

Understanding Japan's Yield Curve

A yield curve illustrates the relationship between the interest rates (yields) and the time to maturity of debt instruments of the same credit quality. It's typically plotted with short-term yields on the left and long-term yields on the right. A "steep" yield curve signifies a substantial difference between short-term and long-term interest rates – meaning long-term rates are significantly higher than short-term rates.

[Insert current chart/graph of the Japanese Government Bond (JGB) yield curve here. Source should be cited.]

- Relationship between short-term and long-term interest rates: Short-term rates reflect current monetary policy, while long-term rates reflect inflation expectations, economic growth prospects, and risk premiums. A steep curve often suggests expectations of future economic growth and higher inflation.

- Historical context of Japan's yield curve: Japan has historically maintained a relatively flat or inverted yield curve, reflecting its long period of low interest rates and deflationary pressures. The recent steepening represents a significant departure from this historical norm.

- The Bank of Japan (BOJ)'s role: The BOJ's monetary policies, particularly its quantitative and qualitative easing (QQE) programs, have significantly influenced Japanese interest rates.

Factors Contributing to the Steep Yield Curve

Several factors are contributing to Japan's increasingly steep yield curve:

-

BOJ's monetary policy: The BOJ's prolonged period of near-zero interest rates and massive asset purchases under QQE initially suppressed long-term yields. However, the recent adjustments to its Yield Curve Control (YCC) policy, while still aiming for low rates, have allowed for a rise in longer-term yields.

-

Inflation expectations: Rising inflation expectations, fueled by factors such as increased energy prices and global supply chain disruptions, are pushing up long-term bond yields. Investors demand higher returns to compensate for the erosion of purchasing power.

-

Global interest rate hikes: Global central banks, including the Federal Reserve, have been aggressively raising interest rates to combat inflation. This has put upward pressure on global bond yields, indirectly influencing the JGB market.

-

Government debt and fiscal policy: Japan's massive public debt burden puts upward pressure on long-term interest rates. Concerns about the government's ability to manage its debt load contribute to higher risk premiums demanded by investors.

-

Bullet points detailing contributing factors:

- BOJ's YCC limitations: The BOJ's attempts to control the yield curve through YCC have faced limitations, as market forces have exerted pressure on longer-term yields.

- Impact of rising energy prices: Soaring energy costs, particularly after the Russia-Ukraine conflict, significantly contributed to inflationary pressures in Japan.

- Influence of foreign investors: Foreign investors' decisions regarding JGB holdings can significantly impact market yields. Changes in their appetite for Japanese bonds can exacerbate the steepening curve.

- Sustainability of Japan's high public debt: The sustainability of Japan's high public debt levels remains a crucial concern, impacting investor confidence and bond yields.

Implications for Investors

The steepening yield curve presents both risks and opportunities for investors:

-

Risks for bond investors: Rising yields imply capital losses for investors holding long-term Japanese government bonds, as bond prices and yields move inversely.

-

Opportunities in less interest-sensitive sectors: Sectors less sensitive to interest rate changes, such as certain consumer staples or technology companies, may offer better investment opportunities in this environment.

-

Impact on the Japanese equity market: Rising interest rates can negatively impact equity valuations, particularly for growth stocks, as higher borrowing costs reduce corporate profitability.

-

Impact on the Japanese yen's exchange rate: A steeper yield curve can attract foreign investment into Japan, potentially strengthening the Japanese yen.

-

Bullet points detailing investor implications:

- Challenges due to rising yields: Bond investors face significant challenges due to the increased risk of capital losses in a rising-yield environment.

- Opportunities in less sensitive sectors: Investors can find opportunities in companies less impacted by rising interest rates.

- Impact on foreign investment flows: The steepening curve might attract or deter foreign investment depending on the overall economic outlook.

- Hedging strategies for currency risk: Investors need to consider hedging strategies to mitigate potential risks from fluctuations in the Japanese yen's exchange rate.

Implications for the Japanese Economy

The steepening yield curve has significant implications for the Japanese economy:

-

Impact on economic growth: Higher borrowing costs for businesses can hinder investment and economic expansion. Consumer spending might also be affected as interest rates on loans increase.

-

Corporate investment and borrowing costs: Companies face higher borrowing costs, potentially leading to reduced investment and hiring.

-

Impact on consumer spending: Rising interest rates increase the cost of borrowing for consumers, potentially impacting their spending on durable goods and housing.

-

Bullet points detailing economic implications:

- Relationship between interest rates and economic activity: Higher interest rates generally slow down economic activity by reducing borrowing and investment.

- Challenges for businesses: Businesses face higher costs of capital, potentially impacting their profitability and growth prospects.

- Impact on household consumption: Higher borrowing costs for consumers can lead to reduced consumption, impacting overall economic growth.

- Potential policy responses: The Japanese government may need to implement fiscal or monetary policy adjustments to mitigate the negative economic impacts of a steep yield curve.

Conclusion

Japan's steepening yield curve presents a complex and evolving economic challenge. The factors driving this phenomenon – including the BOJ's monetary policy adjustments, rising inflation expectations, global interest rate hikes, and Japan's high public debt – create significant uncertainty. This has important implications for investors, potentially leading to capital losses in long-term bonds while presenting opportunities in other sectors. For the broader Japanese economy, higher interest rates could hinder economic growth by dampening investment and consumer spending. Stay informed about the evolving situation of Japan's steep yield curve. Understanding this complex economic indicator is crucial for investors making decisions in the Japanese market and beyond. Further research into Japan's yield curve and its related macroeconomic factors is recommended for a comprehensive understanding.

Featured Posts

-

China Open To Formal Trade Deal With Canada Ambassadors Statement

May 17, 2025

China Open To Formal Trade Deal With Canada Ambassadors Statement

May 17, 2025 -

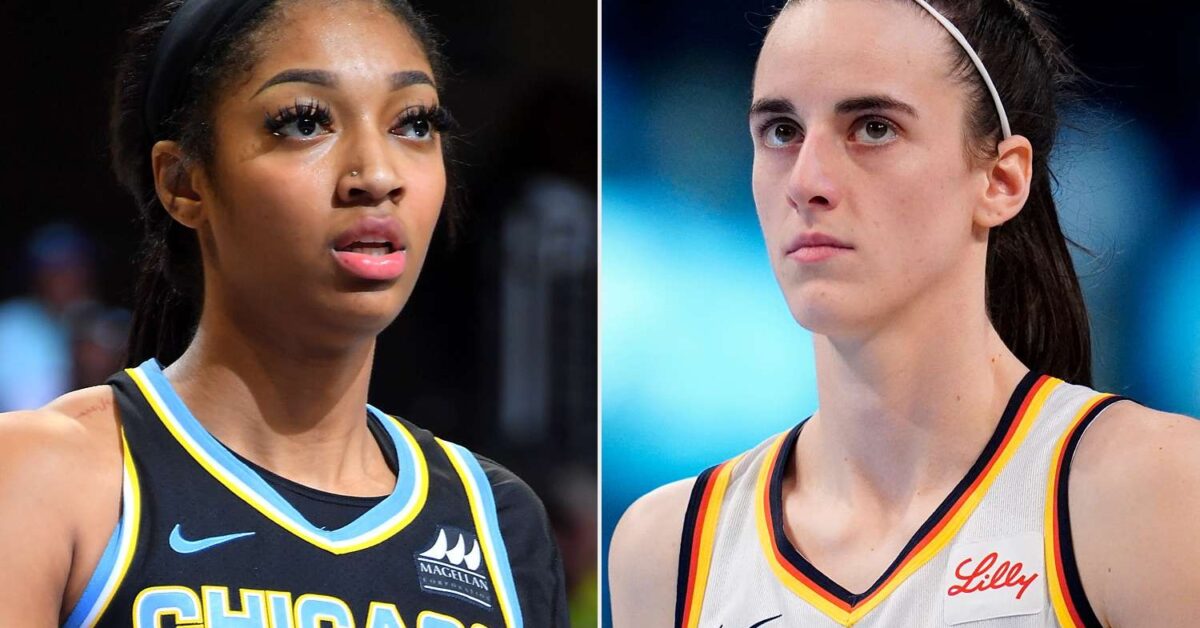

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025 -

Deepfake Technology Challenged A Cybersecurity Experts Success Story Cnn Business

May 17, 2025

Deepfake Technology Challenged A Cybersecurity Experts Success Story Cnn Business

May 17, 2025 -

The Ultimate Guide To Creatine Myths And Facts

May 17, 2025

The Ultimate Guide To Creatine Myths And Facts

May 17, 2025 -

Canadas New Tariffs On Us Goods Plummet Near Zero Rates And Key Exemptions

May 17, 2025

Canadas New Tariffs On Us Goods Plummet Near Zero Rates And Key Exemptions

May 17, 2025

Latest Posts

-

Angel Reeses Fiery Rebuttal To Chrisean Rock Interview Criticism

May 17, 2025

Angel Reeses Fiery Rebuttal To Chrisean Rock Interview Criticism

May 17, 2025 -

Angel Reeses Concise Answer To A Caitlin Clark Inquiry

May 17, 2025

Angel Reeses Concise Answer To A Caitlin Clark Inquiry

May 17, 2025 -

Angel Reeses Post Game Statement Chicago Sky Game Analysis

May 17, 2025

Angel Reeses Post Game Statement Chicago Sky Game Analysis

May 17, 2025 -

Angel Reeses Sharp Response To Caitlin Clark Question

May 17, 2025

Angel Reeses Sharp Response To Caitlin Clark Question

May 17, 2025 -

Reeses Post Game Comments After Chicago Sky Game

May 17, 2025

Reeses Post Game Comments After Chicago Sky Game

May 17, 2025