JBS (JBSS3) And Banco Master: Acquisition Talks Terminated

Table of Contents

Keywords: JBS, JBSS3, Banco Master, acquisition, merger, termination, Brazilian meatpacking, financial news, investment, JBS acquisition failure, Banco Master merger abandoned, regulatory challenges, JBSS3 stock price, JBS market capitalization, impact on investors, Banco Master future, alternative investment strategies, financial performance

The Brazilian business world has witnessed a significant development with the official termination of acquisition talks between JBS (JBSS3), the global meatpacking powerhouse, and Banco Master. This unexpected turn of events leaves many questioning the reasons behind the decision and its potential ramifications for both companies. This article delves into the details surrounding the termination, exploring the possible causes and analyzing the impact on JBS's stock (JBSS3) and Banco Master's future strategies.

Confirmation of Termination

On [Insert Date of Official Announcement], both JBS and Banco Master issued official statements confirming the termination of their previously announced acquisition talks. The announcement, published in [Source of Information – e.g., JBS's investor relations website, a reputable financial news outlet], marked the end of months of speculation and negotiations.

- Key Information from the Official Statement:

- Date of Announcement: [Insert Date]

- Specific Wording: "[Insert direct quote from the official statement highlighting the termination]." The statement emphasized [mention key points like mutual respect, amicable separation, or lack of agreement].

- Mutual Agreements: [Mention any agreed-upon points, such as confidentiality agreements or non-compete clauses].

Reasons Behind the Termination

While the official statements remain relatively vague, several factors could have contributed to the termination of the JBS (JBSS3) and Banco Master merger discussions. The complexity of such a large-scale acquisition often leads to unforeseen challenges.

- Potential Reasons for Termination:

- Regulatory Hurdles: Antitrust concerns and regulatory approvals from Brazilian authorities could have proven insurmountable, leading to the JBS acquisition failure. The significant market share held by JBS in the Brazilian meatpacking industry likely raised red flags for regulators.

- Valuation Discrepancies: A significant difference in valuation between the two companies could have been a major stumbling block. Banco Master may have demanded a higher price than JBS was willing to pay, ultimately leading to the Banco Master merger abandoned.

- Strategic Shifts: Changes in the strategic direction of either JBS or Banco Master, perhaps due to shifting market conditions or internal reorganizations, may have rendered the acquisition less attractive.

- Unforeseen Market Conditions: Economic downturns, changes in interest rates, or other unforeseen market disruptions could have made the acquisition financially unviable.

Impact on JBS (JBSS3) Stock

The termination of the acquisition talks is likely to have a significant impact on JBS's stock price (JBSS3). The short-term effects might include increased volatility as investors react to the news.

- Potential Stock Market Reactions:

- Initial Price Drop/Increase: The immediate market reaction could be either a price drop, reflecting investor disappointment, or a slight increase if investors view the termination as removing uncertainty.

- Long-term Stability/Volatility: The long-term impact will depend on JBS's ability to articulate its future growth strategy and reassure investors.

- Investor Confidence: The termination could affect investor confidence, potentially leading to a reassessment of JBS's investment prospects. JBS market capitalization will be closely watched in the coming weeks and months.

Impact on Banco Master

For Banco Master, the failed acquisition represents a setback in its growth strategy. The bank will now need to re-evaluate its strategic priorities and explore alternative avenues for expansion.

- Potential Consequences for Banco Master:

- Search for Alternative Acquisition Targets: Banco Master might now actively seek other acquisition targets that better align with its strategic goals.

- Focus on Organic Growth: The bank might shift its focus toward organic growth strategies, expanding its existing operations and services.

- Potential Impact on Investor Relations: The failed acquisition could impact investor relations, requiring Banco Master to clearly communicate its revised strategy and future plans.

Conclusion

The termination of acquisition talks between JBS (JBSS3) and Banco Master marks a significant development in the Brazilian business landscape. While the exact reasons remain somewhat unclear, several factors, including regulatory hurdles, valuation discrepancies, and potential strategic shifts, likely played a role. The impact on both companies' stock prices and future strategies is significant and warrants close monitoring. JBS will need to demonstrate its ability to continue delivering strong financial performance, while Banco Master will need to outline a clear path forward.

Stay informed about future developments in the JBS (JBSS3) acquisition landscape by subscribing to our newsletter!

Featured Posts

-

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025 -

Is Taylor Swifts Reputation Taylors Version Finally Coming A Look At The Recent Teaser

May 18, 2025

Is Taylor Swifts Reputation Taylors Version Finally Coming A Look At The Recent Teaser

May 18, 2025 -

New Music Friday Ezra Furman Billy Nomates And Damiano David

May 18, 2025

New Music Friday Ezra Furman Billy Nomates And Damiano David

May 18, 2025 -

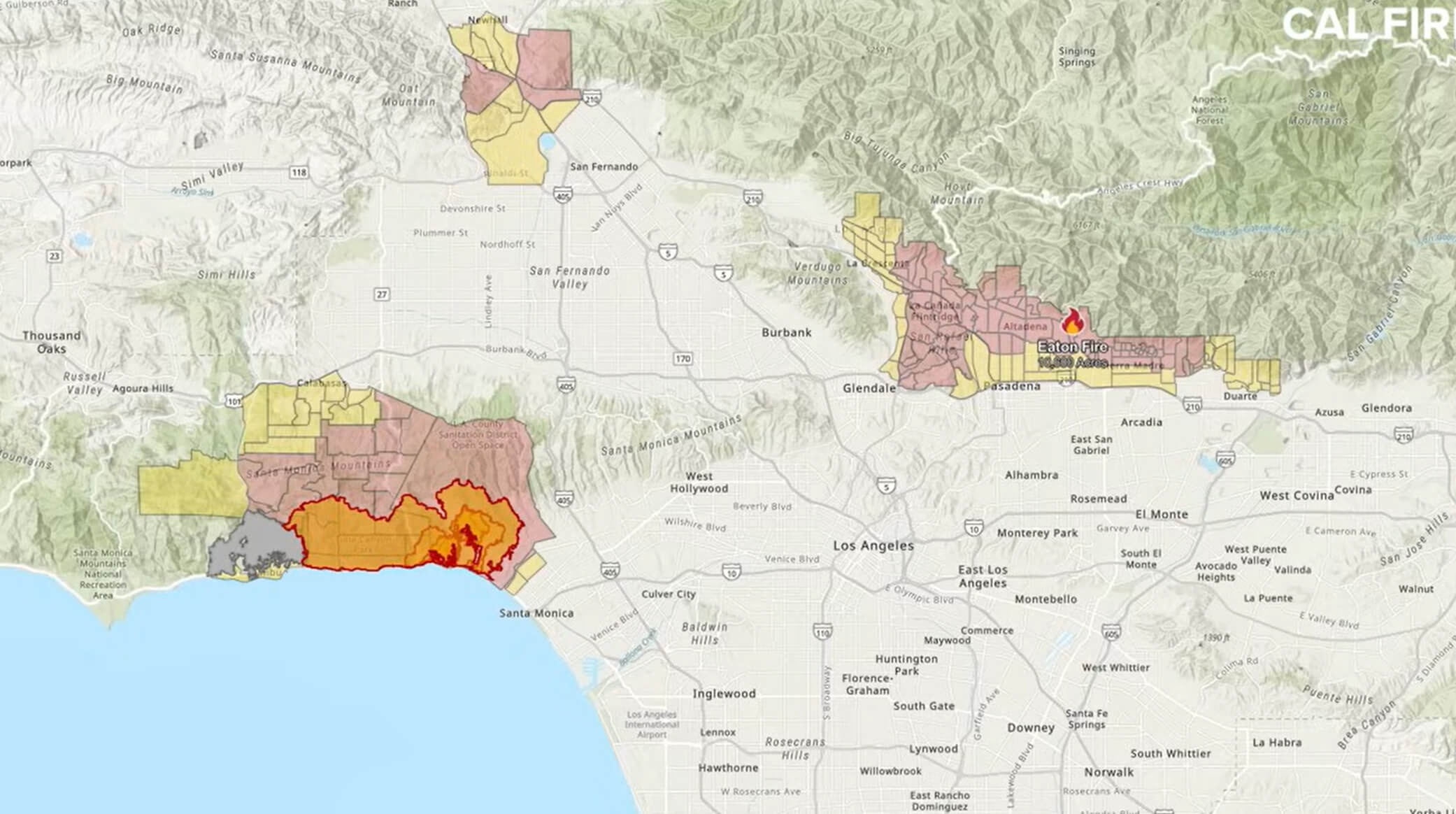

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 18, 2025

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 18, 2025 -

Analyzing Trumps Middle East Visit Impact On Arab Israeli Relations

May 18, 2025

Analyzing Trumps Middle East Visit Impact On Arab Israeli Relations

May 18, 2025

Latest Posts

-

Emergency Response To Stabbing At Brooklyn Bridge City Hall Subway Station

May 18, 2025

Emergency Response To Stabbing At Brooklyn Bridge City Hall Subway Station

May 18, 2025 -

Five Boro Bike Tour Training Preparation And What To Expect

May 18, 2025

Five Boro Bike Tour Training Preparation And What To Expect

May 18, 2025 -

Man Injured In Stabbing Incident Near Brooklyn Bridge City Hall Subway

May 18, 2025

Man Injured In Stabbing Incident Near Brooklyn Bridge City Hall Subway

May 18, 2025 -

The Division 2 Sixth Anniversary Celebrating Six Years Of Gameplay And Community

May 18, 2025

The Division 2 Sixth Anniversary Celebrating Six Years Of Gameplay And Community

May 18, 2025 -

Nyc Rush Hour Stabbing Man Attacked Near Brooklyn Bridge Subway Station

May 18, 2025

Nyc Rush Hour Stabbing Man Attacked Near Brooklyn Bridge Subway Station

May 18, 2025