Jerome Powell On Tariffs: A Threat To Fed Goals

Table of Contents

Powell's Stance on Tariffs and Their Economic Impact

Jerome Powell hasn't minced words regarding the negative consequences of tariffs. His statements consistently highlight the significant economic risks associated with trade protectionism.

Inflationary Pressures

Tariffs directly contribute to inflation by increasing the cost of imported goods. This effect ripples through the economy, impacting consumers and businesses alike.

- Increased Prices for Consumer Goods: Higher tariffs translate to higher prices for a wide range of consumer products, from clothing and electronics to food and furniture. This directly reduces consumer purchasing power and potentially dampens consumer spending.

- Impact on Businesses' Input Costs: Many businesses rely on imported materials and components. Tariffs on these inputs increase production costs, forcing businesses to either absorb the increased expense or pass it on to consumers through higher prices, fueling tariff inflation.

- Potential for Wage-Price Spirals: If businesses raise prices due to increased input costs, workers may demand higher wages to compensate for the reduced purchasing power of their earnings. This can create a wage-price spiral, leading to persistent and potentially uncontrollable inflation.

Powell's public addresses and testimony before Congress repeatedly mention these inflationary concerns, emphasizing the difficulty of controlling import prices and maintaining CPI and PPI stability in the face of escalating tariffs.

Impact on Supply Chains and Business Investment

Tariffs disrupt global supply chains, leading to uncertainty and reduced efficiency. This uncertainty discourages business investment and stifles economic growth.

- Reduced Productivity: Disruptions in supply chains lead to production delays and shortages, reducing overall productivity and efficiency.

- Job Losses: Businesses facing increased costs and supply chain disruptions may be forced to reduce their workforce, resulting in job losses and increased unemployment.

- Relocation of Production Overseas: To avoid tariffs, some businesses may relocate their production facilities to countries outside the tariff zone, potentially harming domestic industries and employment.

The resulting economic uncertainty created by trade wars significantly impacts the investment decisions of businesses, delaying or canceling expansion plans and hindering long-term economic growth.

The Fed's Mandate and the Challenge of Tariffs

The Federal Reserve operates under a dual mandate: maintaining price stability and achieving maximum employment. Tariffs create a direct conflict with this mandate.

Dual Mandate Conflict

Addressing the inflationary pressures caused by tariffs often requires the Fed to raise interest rates. While this can help control inflation, it simultaneously slows economic growth and can lead to higher unemployment. This creates a difficult balancing act for the Fed, forcing it to choose between potentially undesirable outcomes.

Limited Tools to Counter Tariff Impacts

The Fed's monetary policy tools, such as quantitative easing and interest rate hikes, are primarily designed to address domestic economic conditions. They may be insufficient to fully offset the negative effects of tariffs, which are largely externally imposed. The Fed lacks the power to directly influence trade policy; its influence is indirect and limited. This highlights the need for coordinated fiscal policy actions to effectively address the challenges posed by tariffs.

Alternative Perspectives and Policy Recommendations

While the negative impacts of tariffs are widely documented, some argue that targeted tariffs can protect specific industries and promote domestic production. However, Powell's emphasis remains on the broader macroeconomic risks. Mitigating the negative effects requires comprehensive policy solutions:

- Targeted Subsidies: Providing financial assistance to industries significantly impacted by tariffs could help them absorb increased costs and remain competitive.

- Investment in Domestic Industries: Investing in domestic production and infrastructure can reduce reliance on imports and bolster the resilience of the economy against trade disruptions.

- Trade Negotiations and Agreements: Focusing on negotiation and collaborative trade agreements can reduce trade barriers and foster greater economic stability.

Conclusion: Navigating the Challenges of Tariffs – A Call to Action

In conclusion, Jerome Powell on tariffs has consistently highlighted the substantial threat they pose to the Federal Reserve's goals. The inflationary pressures and supply chain disruptions caused by tariffs create a complex challenge for monetary policy. The Fed's tools have limitations in fully countering the damage inflicted by trade protectionism. Understanding Powell's views on tariffs and the impact of tariffs on the Fed is crucial for navigating the economic complexities of the current landscape. We urge readers to stay informed about Jerome Powell’s statements and their implications. Further research into Jerome Powell and trade policy is highly recommended to gain a comprehensive understanding of this critical issue. Stay informed, stay engaged, and understand the ongoing implications of tariffs on the US economy.

Featured Posts

-

Memorial Service Announced For Hells Angels Craig Mc Ilquham This Sunday

May 26, 2025

Memorial Service Announced For Hells Angels Craig Mc Ilquham This Sunday

May 26, 2025 -

Debloquer La Rtbf Pourquoi C Est Une Mauvaise Idee

May 26, 2025

Debloquer La Rtbf Pourquoi C Est Une Mauvaise Idee

May 26, 2025 -

L Avenir Des Locaux De La Rtbf Au Palais Des Congres De Liege

May 26, 2025

L Avenir Des Locaux De La Rtbf Au Palais Des Congres De Liege

May 26, 2025 -

Jadwal Lengkap Moto Gp Inggris 2024 Jangan Lewatkan Aksi Para Pembalap

May 26, 2025

Jadwal Lengkap Moto Gp Inggris 2024 Jangan Lewatkan Aksi Para Pembalap

May 26, 2025 -

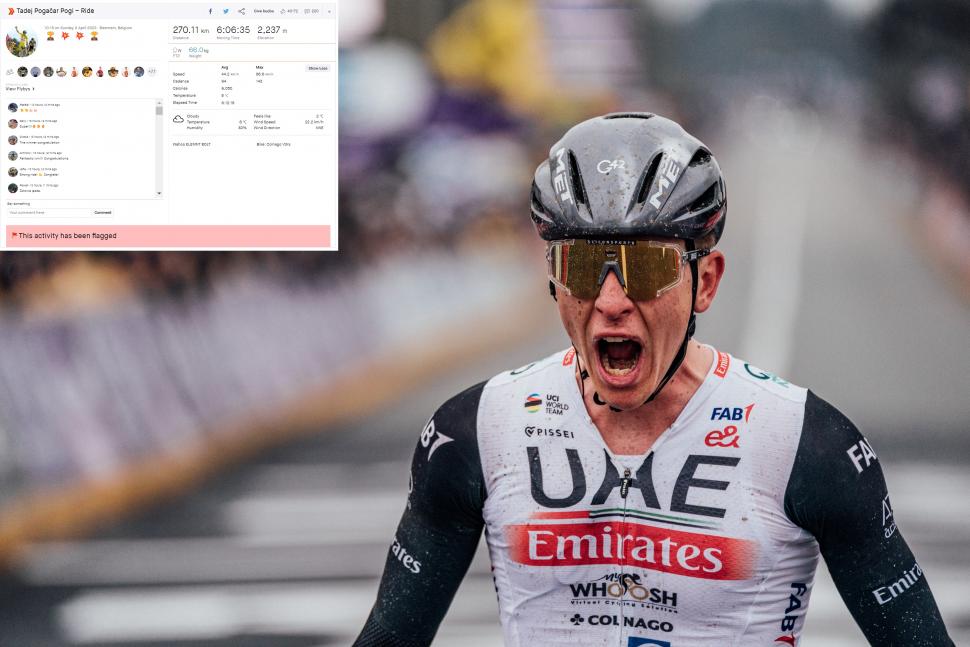

Tadej Pogacars Tour Of Flanders Strava Data No Flag This Year

May 26, 2025

Tadej Pogacars Tour Of Flanders Strava Data No Flag This Year

May 26, 2025