Jim Cramer's Take On CoreWeave (CRWV): A Scrappy Company's Success

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV): A Bullish Outlook?

While Jim Cramer hasn't dedicated a full "Mad Money" segment solely to CoreWeave (CRWV), his frequent commentary on the explosive growth of the GPU cloud computing sector strongly suggests a positive outlook on companies like CRWV. His emphasis on innovative technology and disruptive businesses aligns perfectly with CoreWeave's unique position in the market. Although direct quotes specifically mentioning CRWV are scarce, his general enthusiasm for AI infrastructure and the companies powering it hints at a bullish stance.

- Inference from broader market commentary: Cramer frequently highlights the importance of investing in companies leading the AI revolution. Given CoreWeave's central role in providing the computing power behind many AI advancements, this indirectly supports a positive outlook.

- Focus on disruptive potential: Cramer's investment philosophy often favors companies with strong disruptive potential. CoreWeave's innovative approach to GPU-accelerated cloud computing clearly fits this criterion.

- Growth potential in a burgeoning market: Cramer is known for his keen eye on rapidly expanding markets. The explosive growth of the AI and machine learning sectors directly benefits CoreWeave, making it an attractive investment candidate from this perspective.

CoreWeave's (CRWV) Business Model and Competitive Advantage

CoreWeave's competitive advantage lies in its specialized focus on providing GPU-accelerated cloud computing services. Unlike general-purpose cloud providers like AWS, Google Cloud, and Azure, CoreWeave caters specifically to the high-performance computing needs of AI, machine learning, and other computationally intensive applications. This niche focus allows them to offer superior performance and efficiency.

- Unique selling proposition (USP): CoreWeave's dedication to optimized GPU infrastructure provides faster processing speeds and improved cost-efficiency for clients working with massive datasets.

- Focus on AI and Machine Learning: The company is ideally positioned to capitalize on the surging demand for powerful computing resources needed to train and run advanced AI models.

- Target Market and Customer Base: CoreWeave serves a range of clients, from startups to large enterprises, who require high-performance computing capabilities for various applications like AI research, video rendering, and scientific simulations.

- Growth Strategy: CoreWeave’s aggressive expansion plans include further investments in infrastructure and geographical reach, suggesting significant future growth potential.

Financial Performance and Future Projections for CoreWeave (CRWV)

Analyzing CoreWeave's financial performance requires examining publicly available data, considering the company's relatively recent IPO. While specific numbers are subject to change and require further analysis from financial experts, early indications suggest significant revenue growth. This positive trajectory, coupled with analysts' projections, paints a picture of a company with considerable future potential. However, investors must acknowledge inherent risks associated with any young, growth-oriented company.

- Revenue Growth: Early indications showcase strong revenue growth, driven by increasing demand for their services.

- Profitability: While profitability might not be immediately apparent in the early stages, the company's growth trajectory suggests a potential path to profitability.

- Analyst Ratings and Price Targets: A range of analyst ratings and price targets exist, reflecting the inherent uncertainty in valuing a rapidly growing company. Investors should consult multiple sources before making investment decisions.

- Potential Risks and Challenges: Competition from established cloud providers remains a key challenge, alongside potential market fluctuations and economic downturns.

(Note: Including relevant charts and graphs here would significantly enhance the article's visual appeal and informational value.)

Is CoreWeave (CRWV) a Good Investment Based on Jim Cramer's Insights?

Whether CoreWeave (CRWV) is a "good" investment depends heavily on individual risk tolerance and investment goals. While Jim Cramer's apparent bullishness towards the sector is encouraging, it shouldn't be the sole basis for an investment decision. A comprehensive analysis, taking into account financial performance, market trends, and competitive landscape, is crucial.

- Balanced Perspective: While the company shows strong potential, investors should acknowledge the inherent risks associated with growth stocks, especially in a volatile market.

- Comparison with Other Analyses: Investors should compare Cramer's implied outlook with other independent analyses and expert opinions before making any investment choices.

- Risk-Reward Profile: Assess the risk-reward profile carefully, considering potential returns against potential losses.

- Investment Strategies: Potential strategies range from long-term buy-and-hold strategies to more active, short-term trading approaches, depending on personal risk tolerance.

Conclusion: The Verdict on CoreWeave (CRWV) – Should You Follow Cramer's Lead?

Jim Cramer’s apparent positive sentiment towards the growth of GPU-accelerated cloud computing, combined with CoreWeave’s strong early performance and promising future prospects, paints a compelling picture. However, this article should not be interpreted as investment advice. CoreWeave (CRWV) presents a potentially lucrative investment opportunity, but investors must conduct thorough due diligence, analyzing financial statements, market trends, and competitive landscapes before making any decisions. While considering Jim Cramer’s insights on CoreWeave (CRWV) can be valuable, remember that it's crucial to form your own informed opinion based on comprehensive research. Consider CoreWeave (CRWV) as part of a well-diversified portfolio, aligning with your individual risk tolerance and financial objectives.

Featured Posts

-

Half Dome Lands Major Victorian Account Abn Group

May 22, 2025

Half Dome Lands Major Victorian Account Abn Group

May 22, 2025 -

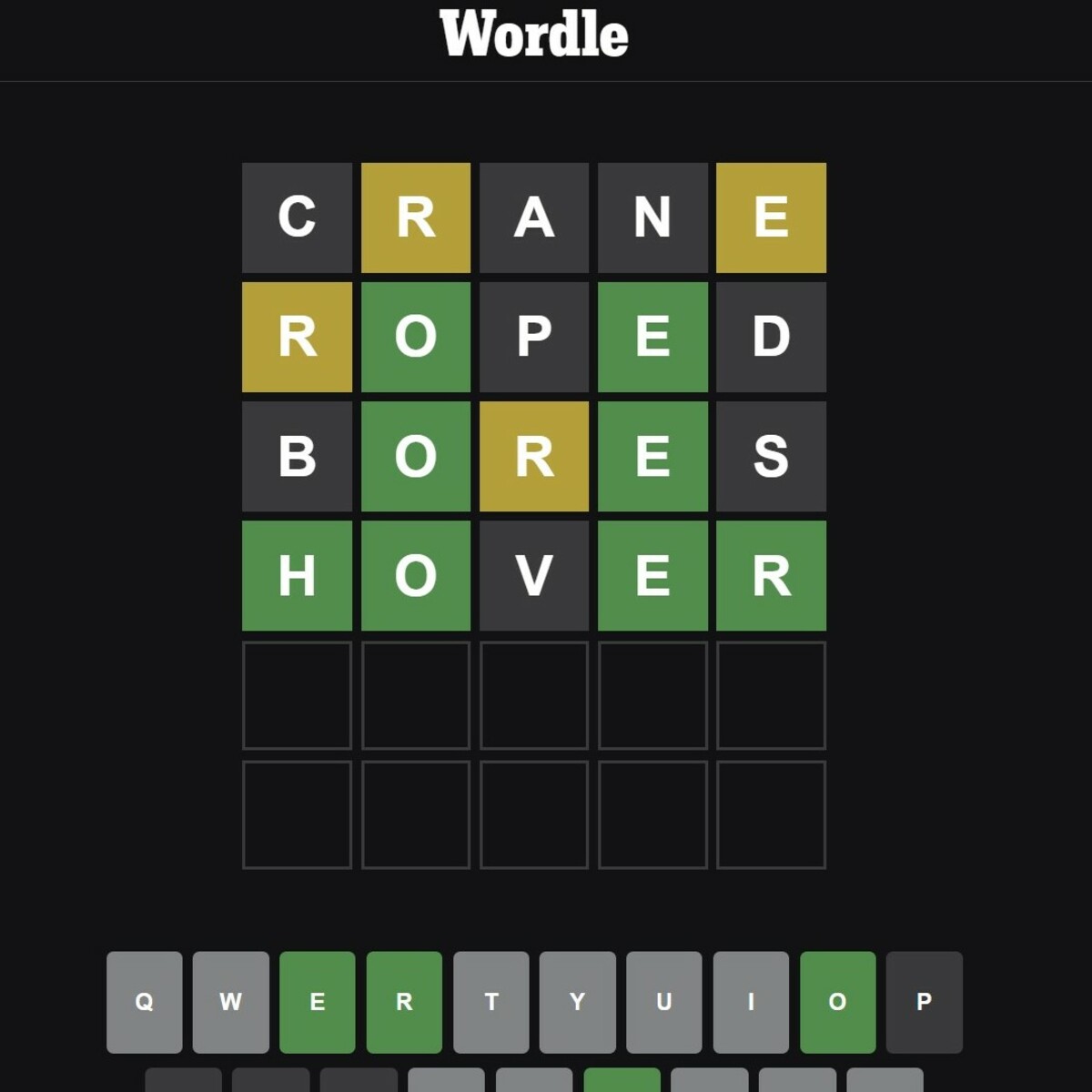

Wordle Help March 18th 2024 Puzzle 1368 Nyt

May 22, 2025

Wordle Help March 18th 2024 Puzzle 1368 Nyt

May 22, 2025 -

Abn Amro Impact Van Groeiend Autobezit Op De Occasionmarkt

May 22, 2025

Abn Amro Impact Van Groeiend Autobezit Op De Occasionmarkt

May 22, 2025 -

Real Sociedad El Impacto Del Virus Fifa En El Rendimiento Del Equipo

May 22, 2025

Real Sociedad El Impacto Del Virus Fifa En El Rendimiento Del Equipo

May 22, 2025 -

Chay Bo Lien Tinh Dak Lak Phu Yen Hon 200 Van Dong Vien Tham Gia

May 22, 2025

Chay Bo Lien Tinh Dak Lak Phu Yen Hon 200 Van Dong Vien Tham Gia

May 22, 2025