Johnson Matthey Sells Catalyst Unit To Honeywell For $2.4 Billion: Implications And Future Outlook

Table of Contents

Deal Details and Rationale for Johnson Matthey

Johnson Matthey's sale encompasses a substantial portion of its catalyst business, including a wide range of automotive catalysts and chemical catalysts, with significant geographical reach spanning numerous global markets. The strategic rationale behind this divestment centers on Johnson Matthey's sharpened focus on its core competencies and long-term growth strategies. By offloading this significant unit, Johnson Matthey aims to streamline its operations, reduce debt, and reinvest capital in high-growth areas aligned with its future vision.

Key financial aspects of the transaction include:

- Purchase Price: $2.4 billion

- Expected Closing Date: [Insert Expected Closing Date if available]

- Impact on Johnson Matthey’s Financial Statements: The sale is expected to significantly impact Johnson Matthey’s financial statements, resulting in a substantial influx of cash and a restructuring of its portfolio. Specific details will be released in upcoming financial reports.

! (Replace placeholder_image.jpg with an actual image of both logos)

Implications for Honeywell

This acquisition represents a significant expansion for Honeywell in the lucrative catalyst market. The integration of Johnson Matthey's established catalyst technologies and global customer base will bolster Honeywell's existing capabilities, creating significant synergies and expansion opportunities.

Potential benefits for Honeywell include:

- Increased Market Share: A substantial increase in market share across various catalyst segments.

- Access to New Technologies and Expertise: Acquisition of cutting-edge catalyst technologies and a pool of experienced professionals.

- Growth Opportunities in Key Sectors: Expansion into new markets and growth within existing sectors like automotive and chemical manufacturing.

However, Honeywell will likely face challenges in integrating the acquired unit, including potential cultural differences and the need to streamline operations to maximize efficiency. Effective management of this integration will be crucial to realizing the full potential of this acquisition.

Impact on the Catalyst Market and Related Industries

The acquisition reshapes the competitive landscape of the catalyst industry, consolidating market power and potentially leading to increased competition among remaining players. Companies that supply PGMs, a crucial component in many catalysts, may also experience shifts in demand.

The impact extends to various industries reliant on catalysts:

- Automotive Industry (Emission Control): Changes in the supply and pricing of automotive catalysts could influence vehicle manufacturing costs and emission control regulations.

- Chemical Manufacturing: The acquisition may impact the availability and pricing of catalysts crucial for various chemical processes.

- Petroleum Refining: Similar impacts on catalyst availability and pricing are expected within the petroleum refining sector.

Potential price fluctuations and supply chain disruptions are possible in the short term as the integration process unfolds.

Future Outlook for Johnson Matthey and Honeywell

Following the sale, Johnson Matthey is expected to focus on its remaining core businesses, likely leading to further strategic adjustments and investments in areas deemed crucial for future growth. This might include further acquisitions or expansions in other promising sectors.

Honeywell's expanded catalyst business is projected to experience significant growth driven by increased market share and access to new technologies. However, long-term success will depend on several factors:

- Technological Advancements: Staying at the forefront of catalyst technology innovation.

- Environmental Regulations: Adapting to evolving environmental regulations and emission standards.

- Global Economic Conditions: Navigating economic fluctuations and geopolitical uncertainties.

Conclusion: Analyzing the Long-Term Effects of the Johnson Matthey Catalyst Sale

The sale of Johnson Matthey's catalyst unit to Honeywell for $2.4 billion marks a significant turning point for both companies and the broader catalyst market. This transaction reflects strategic shifts within the industry, emphasizing the importance of core competencies and the consolidation of market power. The acquisition's long-term implications are far-reaching, impacting the automotive, chemical, and petroleum refining industries. The success of this integration will be crucial for Honeywell, while Johnson Matthey’s strategic pivot will shape its future direction.

To stay informed about further developments concerning the Johnson Matthey catalyst sale and its long-term consequences, follow updates from Johnson Matthey's and Honeywell's investor relations websites, and monitor leading industry news sources covering the chemical and automotive sectors.

Featured Posts

-

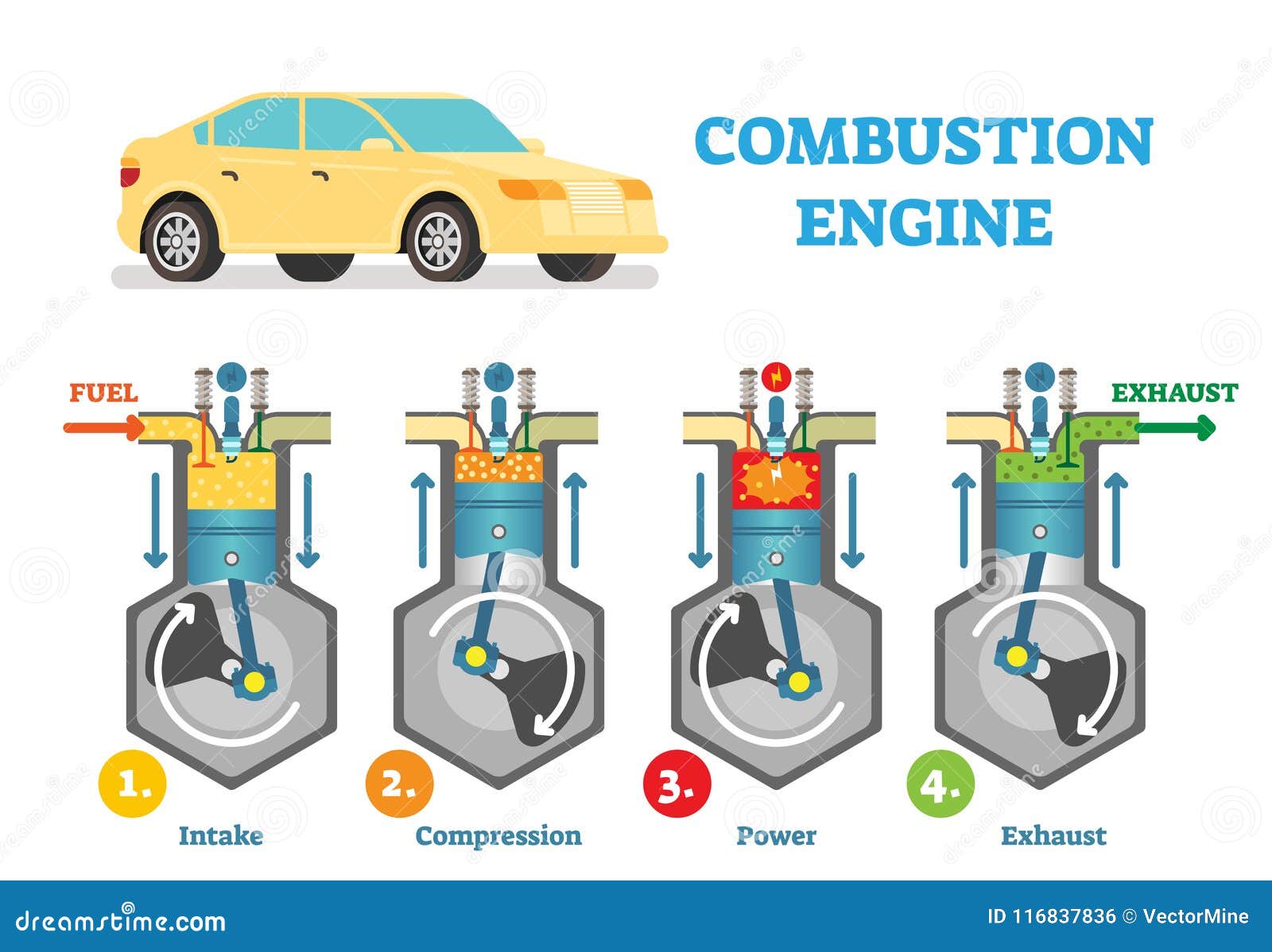

Reino Unido Crea Motor De Combustion Con Tecnologia De Agua Un Salto Gigantesco

May 23, 2025

Reino Unido Crea Motor De Combustion Con Tecnologia De Agua Un Salto Gigantesco

May 23, 2025 -

Freddie Flintoffs Crash A Candid Look In New Disney Documentary

May 23, 2025

Freddie Flintoffs Crash A Candid Look In New Disney Documentary

May 23, 2025 -

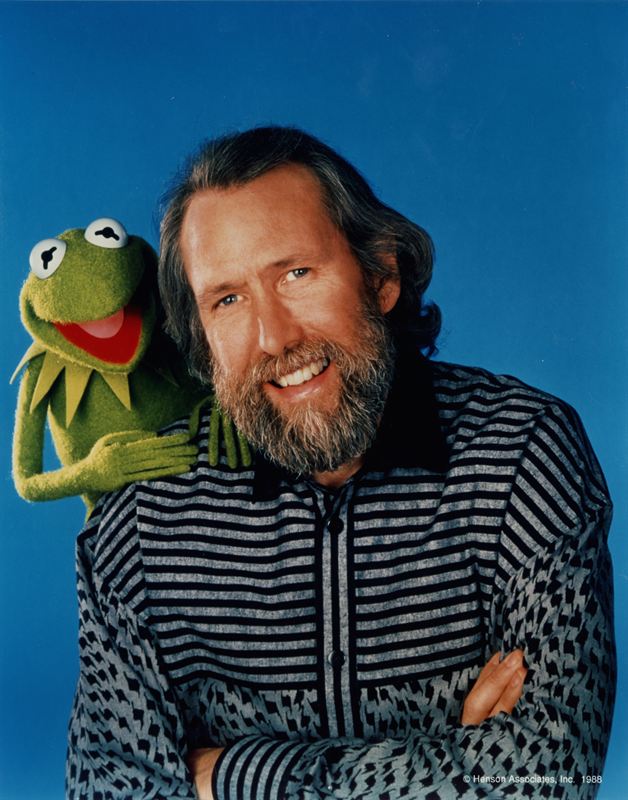

University Of Maryland Announces Kermit The Frog As 2025 Commencement Speaker

May 23, 2025

University Of Maryland Announces Kermit The Frog As 2025 Commencement Speaker

May 23, 2025 -

Dylan Dreyers Postpartum Weight Loss Her Inspiring Nbc Story

May 23, 2025

Dylan Dreyers Postpartum Weight Loss Her Inspiring Nbc Story

May 23, 2025 -

Gefaengnisstrafen Fuer Angeklagte Notenmanipulation An Nrw Universitaeten

May 23, 2025

Gefaengnisstrafen Fuer Angeklagte Notenmanipulation An Nrw Universitaeten

May 23, 2025