Key Provisions In The Trump Tax Bill Passed By The House

Table of Contents

Individual Income Tax Rate Reductions

The Trump Tax Bill dramatically altered individual income tax brackets and rates. The TCJA reduced the number of tax brackets and lowered the rates for most taxpayers. This section will explore the Tax Brackets and Tax Rates under this Tax Reform.

- Pre-TCJA Rates: The previous tax code featured seven brackets, ranging from 10% to 39.6%.

- Post-TCJA Rates: The TCJA reduced the number of brackets to seven, but with significantly lower rates. These new individual income tax rates, effective for the 2018 tax year and beyond, were as follows:

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

- Impact: While the lower rates provided tax cuts for many, the impact varied significantly based on income level. Higher-income earners generally benefited more from the lower rates, while the impact on lower-income taxpayers was more modest due to other changes in deductions.

Changes to Standard Deduction and Itemized Deductions

The Trump Tax Bill significantly increased the standard deduction and made changes to itemized deductions. Understanding these changes is crucial for properly calculating your tax deductions under the new tax law.

- Standard Deduction Increase: The standard deduction was substantially increased. This meant that fewer taxpayers would itemize their deductions.

- Single filers saw a significant rise.

- Married couples filing jointly also benefited from a considerable increase.

- Itemized Deduction Limitations: Several itemized deductions were limited or eliminated. The most notable change was the limitation on the deduction for state and local taxes (SALT). This cap, originally set at $10,000 per household, had significant implications for taxpayers in high-tax states. Other itemized deductions also experienced limitations.

Corporate Tax Rate Reduction

One of the most significant changes introduced by the Trump Tax Bill was a dramatic reduction in the corporate tax rate.

- Pre-TCJA Rate: The top corporate tax rate was 35%.

- Post-TCJA Rate: The TCJA slashed the corporate tax rate to a flat 21%.

- Impact: This substantial reduction aimed to boost corporate profitability and investment, potentially stimulating economic growth. However, the long-term economic consequences are still being debated. The lower corporate tax rate has implications for both domestic and international businesses.

Pass-Through Business Tax Changes

The TCJA also introduced changes to the taxation of pass-through entities, such as S-corporations and partnerships. A key element of this reform was the creation of the qualified business income (QBI) deduction.

- Qualified Business Income (QBI) Deduction: This deduction allowed eligible self-employed individuals, small business owners, and partners in pass-through entities to deduct up to 20% of their qualified business income.

- Limitations and Complexities: The QBI deduction had limitations and complexities, with income thresholds and other restrictions affecting its applicability. Determining eligibility and calculating the deduction accurately required careful consideration of the specific rules. This made small business taxes more intricate.

Impact on Specific Taxpayers

The effects of the Trump Tax Bill varied considerably across different groups of taxpayers. While lower tax rates were a general benefit, the changes to deductions and other provisions led to diverse outcomes. High-income earners generally saw significant tax cuts, while the benefits for low-income taxpayers were less pronounced. Families with children benefited from changes to child tax credits.

Conclusion

The Trump Tax Bill, or Tax Cuts and Jobs Act, implemented significant changes to the US tax code. Key provisions included reductions in individual and corporate tax rates, increased standard deduction amounts, limitations on itemized deductions (especially the SALT deduction), and the introduction of the QBI deduction for pass-through entities. The long-term economic consequences of these changes are subject to ongoing analysis and debate. Understanding the intricacies of the Trump Tax Bill is crucial for effective tax planning. To further explore how these changes affect your personal finances, research the TCJA and consider consulting with a tax professional for personalized guidance on tax planning based on the Tax Cuts and Jobs Act.

Featured Posts

-

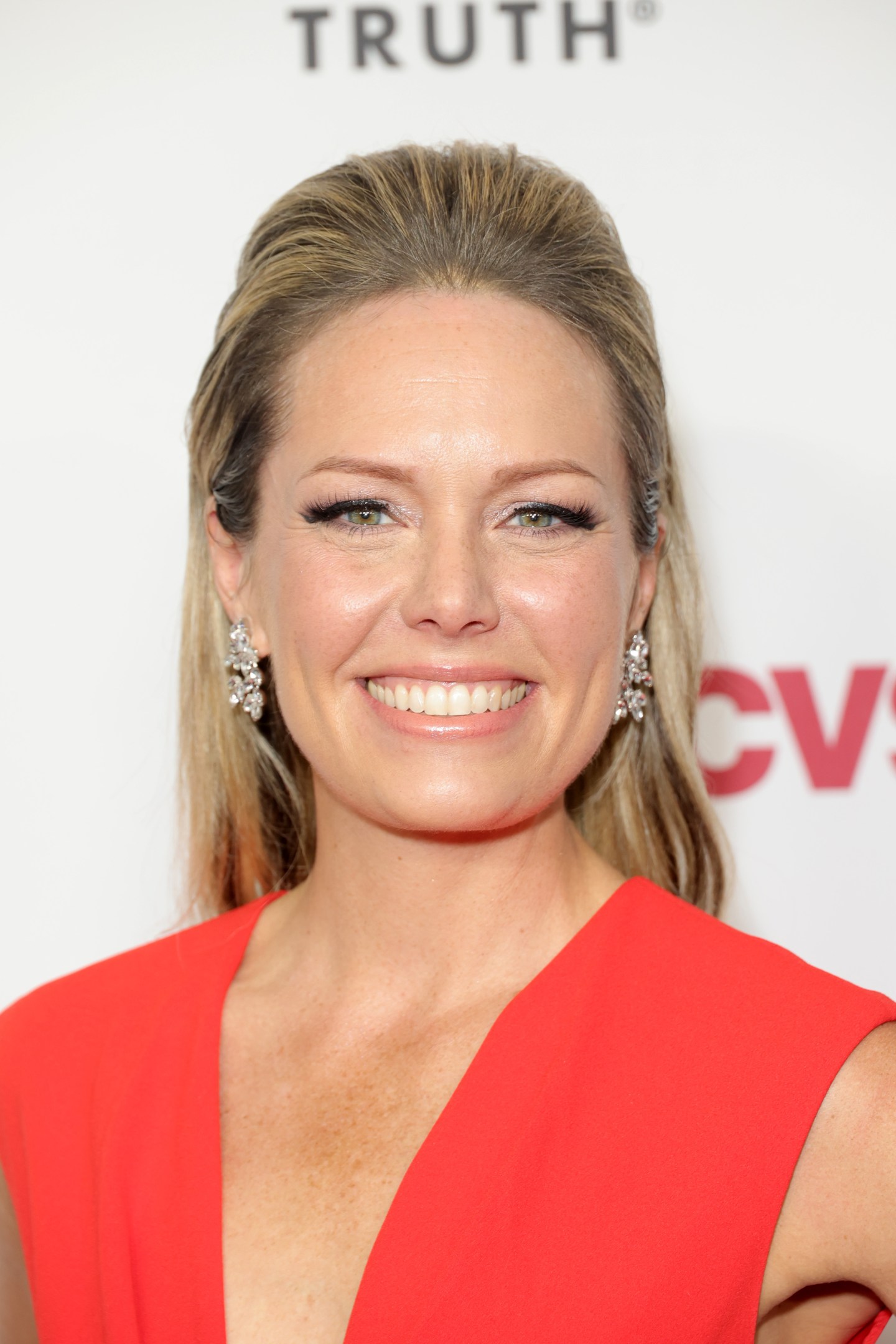

Nbcs Dylan Dreyer A Remarkable Transformation

May 23, 2025

Nbcs Dylan Dreyer A Remarkable Transformation

May 23, 2025 -

Englands Team Selection For Zimbabwe Test Revealed

May 23, 2025

Englands Team Selection For Zimbabwe Test Revealed

May 23, 2025 -

Dancehall Star Faces Travel Restrictions To Trinidad Show Of Support From Kartel

May 23, 2025

Dancehall Star Faces Travel Restrictions To Trinidad Show Of Support From Kartel

May 23, 2025 -

Swiss Alps Emergency Livestock Evacuation Following Landslide Warning

May 23, 2025

Swiss Alps Emergency Livestock Evacuation Following Landslide Warning

May 23, 2025 -

Oscar Piastris Pole Position A Bahrain Gp Surprise

May 23, 2025

Oscar Piastris Pole Position A Bahrain Gp Surprise

May 23, 2025

Latest Posts

-

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025 -

Instinct Magazine Interview Jonathan Groff On Asexuality

May 23, 2025

Instinct Magazine Interview Jonathan Groff On Asexuality

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groff On Bobby Darin Method Acting And Broadway Buzz

May 23, 2025

Jonathan Groff On Bobby Darin Method Acting And Broadway Buzz

May 23, 2025 -

Jonathan Groffs Just In Time A Night Of Broadway Camaraderie

May 23, 2025

Jonathan Groffs Just In Time A Night Of Broadway Camaraderie

May 23, 2025