Key Provisions Of The Amended Trump Tax Bill Passed By The House

Table of Contents

Changes to Individual Income Tax Rates

The Amended Trump Tax Bill introduces several changes to individual income tax rates, impacting taxpayers across various income brackets. These adjustments modify the existing tax brackets and the corresponding rates, resulting in potential increases or decreases in tax liability depending on individual circumstances.

-

Specific changes to tax rates for different income levels: The amended bill may (hypothetical example) increase the tax rate for the highest income bracket while slightly lowering it for the lower brackets. Precise figures would need to be referenced from the official bill text. This is a complex area requiring careful analysis.

-

Impact on taxpayers in various income brackets: High-income earners might experience a net increase in their tax liability, while low-to-middle-income earners could see a slight reduction or no change, depending on the specifics of the amended rates and their individual deductions.

-

Comparison with pre-amendment rates: A detailed comparison between the original Trump tax bill's rates and the amended rates is crucial for understanding the full scope of the changes. This comparison should highlight the percentage changes for each bracket.

-

Potential increase or decrease in tax liability for different income groups: The impact varies considerably. For example, individuals close to a bracket threshold may find themselves pushed into a higher bracket, leading to a significant increase in tax. Others may experience minimal change.

| Income Bracket | Pre-Amendment Rate | Amended Rate (Hypothetical) | Change |

|---|---|---|---|

| $0 - $10,000 | 10% | 9% | -1% |

| $10,001 - $40,000 | 12% | 11% | -1% |

| $40,001 - $80,000 | 22% | 22% | 0% |

| $80,001 - $170,000 | 24% | 25% | +1% |

| Over $170,000 | 37% | 39% | +2% |

Note: The above table is a hypothetical example. Consult the official bill text for accurate figures. The actual changes in tax brackets and rates will dictate the true impact on taxpayers. Using keywords like "income tax rates," "tax brackets," and "tax liability" is crucial for SEO.

Modifications to Corporate Tax Rates

The Amended Trump Tax Bill also incorporates modifications to corporate tax rates. These changes impact businesses of all sizes and have significant implications for investment, job creation, and overall economic growth.

-

New corporate tax rate and its comparison to the original bill: The amendment might adjust the corporate tax rate upward or downward from the original Trump tax bill's rate. Again, precise figures must be obtained from the official bill.

-

Impact on small businesses and large corporations: The effects on small businesses will likely differ from the impact on large corporations due to variations in their tax structures and deductions. Small businesses often benefit from specific tax credits, influencing the net impact.

-

Potential effects on job creation and investment: Changes in corporate tax rates can influence business decisions regarding investment and hiring. A lower rate might stimulate investment and job growth, while a higher rate could have the opposite effect.

-

Consideration of deductions and credits available to corporations: It's essential to analyze the interplay between the adjusted corporate tax rate and the availability of various deductions and tax credits for corporations. This nuanced interaction determines the final tax burden. Keywords such as "corporate tax rate," "business tax," and "corporate tax reform" are essential here.

Alterations to Itemized Deductions and Standard Deduction

The Amended Trump Tax Bill makes adjustments to both itemized deductions and the standard deduction. These changes significantly impact taxpayers' decisions on whether to itemize or take the standard deduction.

-

Changes to the standard deduction amounts for individuals and families: The standard deduction amounts may be increased or decreased, affecting the number of taxpayers who choose to itemize.

-

Modifications to various itemized deductions (e.g., mortgage interest, state and local taxes): The bill may alter the limitations or eligibility criteria for various itemized deductions. This directly impacts the tax savings for those who itemize.

-

Impact on taxpayers who itemize vs. those who take the standard deduction: Taxpayers who previously itemized may find the standard deduction more advantageous, and vice-versa. The changes might shift the balance significantly.

-

Strategies for optimizing deductions under the amended bill: Given the changes, taxpayers need to reassess their deduction strategies to minimize their tax liability. Tax professionals can assist in identifying optimal strategies. Keywords here include "itemized deductions," "standard deduction," "tax deductions," and "tax optimization."

Impact on Pass-Through Businesses

Pass-through businesses, such as S corporations and partnerships, are also affected by the amendments in the Amended Trump Tax Bill. The modifications mainly center around the Qualified Business Income (QBI) deduction.

-

Changes to qualified business income (QBI) deduction: The QBI deduction, which allows pass-through businesses to deduct a portion of their qualified business income, may be modified, potentially altering the tax burden for self-employed individuals and small business owners.

-

Impact on self-employed individuals and small business owners: These changes directly affect the taxable income and tax liability of self-employed individuals and small business owners.

-

Implications for tax planning strategies for pass-through entities: Tax planning strategies for pass-through entities require reassessment to accommodate the amended QBI deduction and other changes.

-

Comparison of tax implications before and after the amendments: A clear comparison of tax implications before and after the amendments is crucial for understanding the overall impact on pass-through businesses. Keywords to use include "pass-through entities," "QBI deduction," "small business tax," and "self-employment tax."

Conclusion

This article summarized the key provisions of the Amended Trump Tax Bill passed by the House, highlighting changes to individual and corporate tax rates, itemized deductions, the standard deduction, and the impact on pass-through businesses. These changes will have significant consequences for taxpayers and businesses, necessitating careful review and strategic planning.

Understanding the intricacies of the Amended Trump Tax Bill is crucial for effective financial planning. Consult a qualified tax professional to assess how these changes impact your specific situation and develop a strategy to minimize your tax liability under the Amended Trump Tax Bill. Don't delay; proactive tax planning is essential in navigating the complexities of this amended legislation.

Featured Posts

-

Ferrari Hot Wheels New Releases Have Arrived Mamma Mia

May 24, 2025

Ferrari Hot Wheels New Releases Have Arrived Mamma Mia

May 24, 2025 -

Actress Mia Farrow Wants Trump Imprisoned Venezuelan Deportation Controversy

May 24, 2025

Actress Mia Farrow Wants Trump Imprisoned Venezuelan Deportation Controversy

May 24, 2025 -

Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del Mondo Nel 2025

May 24, 2025

Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del Mondo Nel 2025

May 24, 2025 -

Piazza Affari Oggi Fed Banche E L Andamento Di Italgas

May 24, 2025

Piazza Affari Oggi Fed Banche E L Andamento Di Italgas

May 24, 2025 -

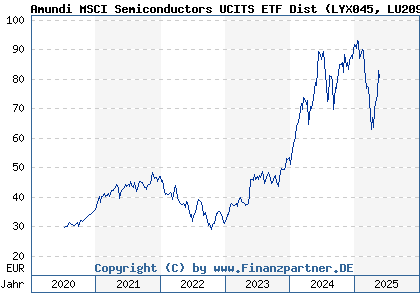

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Nav And Investment

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Nav And Investment

May 24, 2025