Klarna's US IPO Filing: 24% Revenue Surge Revealed

Table of Contents

Klarna's Financial Performance: Unveiling the 24% Revenue Jump

The remarkable 24% year-over-year revenue increase is undeniably the standout figure from Klarna's IPO filing. However, a closer examination of the supporting data provides a richer, more nuanced understanding.

Revenue Growth Breakdown:

- Geographic Diversification: While the overall 24% figure is impressive, a breakdown of revenue contributions from different geographic regions is crucial. The filing likely details the relative performance of the US market versus Klarna's international operations, revealing key growth drivers and areas for future expansion. Strong performance in the US, a massive market for BNPL services, would be particularly significant.

- Product-Specific Growth: Analyzing revenue growth across Klarna's various BNPL products and services is essential for a comprehensive picture. This granular analysis could highlight the popularity of specific offerings and inform future product development strategies. For example, the filing may reveal stronger growth in certain segments, suggesting areas for strategic investment.

- Year-over-Year Comparison: Comparing the 24% increase to previous years' growth rates provides context and reveals long-term trends. A consistent pattern of high growth signifies sustained momentum, whereas fluctuating growth may indicate challenges or market sensitivities.

Profitability and Losses:

- Net Income/Loss: While the revenue surge is impressive, the IPO filing will also detail Klarna's net income or loss, a critical indicator of its financial health. Profitability is crucial for long-term sustainability and investor confidence.

- Operating Expenses: Analyzing operating expenses allows for an assessment of Klarna's cost efficiency and potential for future profit margin expansion. Understanding how effectively Klarna manages its expenses in relation to revenue growth is key to evaluating its financial strength.

- Key Financial Ratios: Investors will scrutinize key financial ratios such as the operating margin, gross margin, and return on equity (ROE) to gauge Klarna's profitability and efficiency. These ratios provide a comparative benchmark against industry standards and competitors.

User Growth and Market Share:

- Active User Growth: The number of active users is a vital metric reflecting the adoption and popularity of Klarna's services. A significant increase in active users directly supports the 24% revenue growth and signifies a strong user base.

- Market Share Analysis: The IPO filing likely provides insights into Klarna's market share within the BNPL sector. Comparing its performance against key competitors like Affirm and PayPal offers valuable context and reveals its competitive positioning.

- User Demographics: Understanding the demographics of Klarna's user base—age, location, spending habits—provides valuable insights into market segments and potential for future expansion and targeted marketing strategies.

Implications of the IPO Filing for Klarna and the BNPL Industry

Klarna's IPO filing and its revealed financial performance have substantial implications for the company and the broader BNPL landscape.

Valuation and Investor Interest:

- IPO Valuation: The IPO valuation, a critical figure revealed in the filing, will reflect investor sentiment and expectations about Klarna's future growth potential. A high valuation suggests strong confidence in the company’s prospects.

- Investor Participation: The level of interest from prominent investors will provide a strong indication of the market's confidence in Klarna's business model and long-term viability. Significant investment from established players would bolster investor confidence.

- Stock Market Performance: Post-IPO stock market performance will serve as a significant indicator of investor reaction to the company’s financials and its future prospects.

Future Growth Strategies and Expansion Plans:

- Geographic Expansion: The IPO filing may outline plans for further geographic expansion into new markets, both domestically and internationally. Expansion into new regions represents growth opportunities and diversification of revenue streams.

- Product Development: Details regarding new product offerings and innovations will demonstrate Klarna's commitment to innovation and its strategy for maintaining a competitive edge in the evolving BNPL market. New features and enhancements could attract new users and increase engagement with existing users.

- Marketing Strategies: Klarna's marketing strategies, as revealed in the filing, will illustrate its approach to attracting new customers and maintaining brand visibility in a competitive landscape. Effective marketing is crucial for driving user acquisition and sustained growth.

Impact on the BNPL Market:

- Increased Competition: Klarna's strong performance and successful IPO could trigger increased competition in the BNPL market, potentially leading to further innovation and price wars.

- Regulatory Scrutiny: The IPO filing and subsequent market activity will likely attract increased regulatory scrutiny, highlighting the importance of compliance and responsible lending practices within the BNPL sector.

- Industry Consolidation: Klarna's success could accelerate consolidation within the BNPL industry, with smaller players potentially merging or being acquired by larger competitors.

Klarna's US IPO Filing: A Look Ahead

Klarna's US IPO filing, showcasing a remarkable 24% revenue surge, paints a picture of a company on a trajectory of impressive growth. However, challenges and opportunities lie ahead in the dynamic and competitive BNPL market. The success of its IPO and its subsequent performance will significantly shape not only Klarna's future but also the trajectory of the wider BNPL industry. Stay informed about Klarna’s progress and the ever-evolving BNPL landscape to witness the unfolding of this significant chapter in financial technology. Learn more about Klarna's financial performance and the future of buy now pay later.

Featured Posts

-

Bahnverbindungen Ab Oschatz Direkt In Die Saechsische Schweiz

May 14, 2025

Bahnverbindungen Ab Oschatz Direkt In Die Saechsische Schweiz

May 14, 2025 -

The Impact Of Logo Design Sinners Fox And Federers Rf

May 14, 2025

The Impact Of Logo Design Sinners Fox And Federers Rf

May 14, 2025 -

Ash Ketchums Pokemon Teams A Definitive Ranking Of His Top 10

May 14, 2025

Ash Ketchums Pokemon Teams A Definitive Ranking Of His Top 10

May 14, 2025 -

Situation Des Vols Jet Blue Vers Port Au Prince Haiti

May 14, 2025

Situation Des Vols Jet Blue Vers Port Au Prince Haiti

May 14, 2025 -

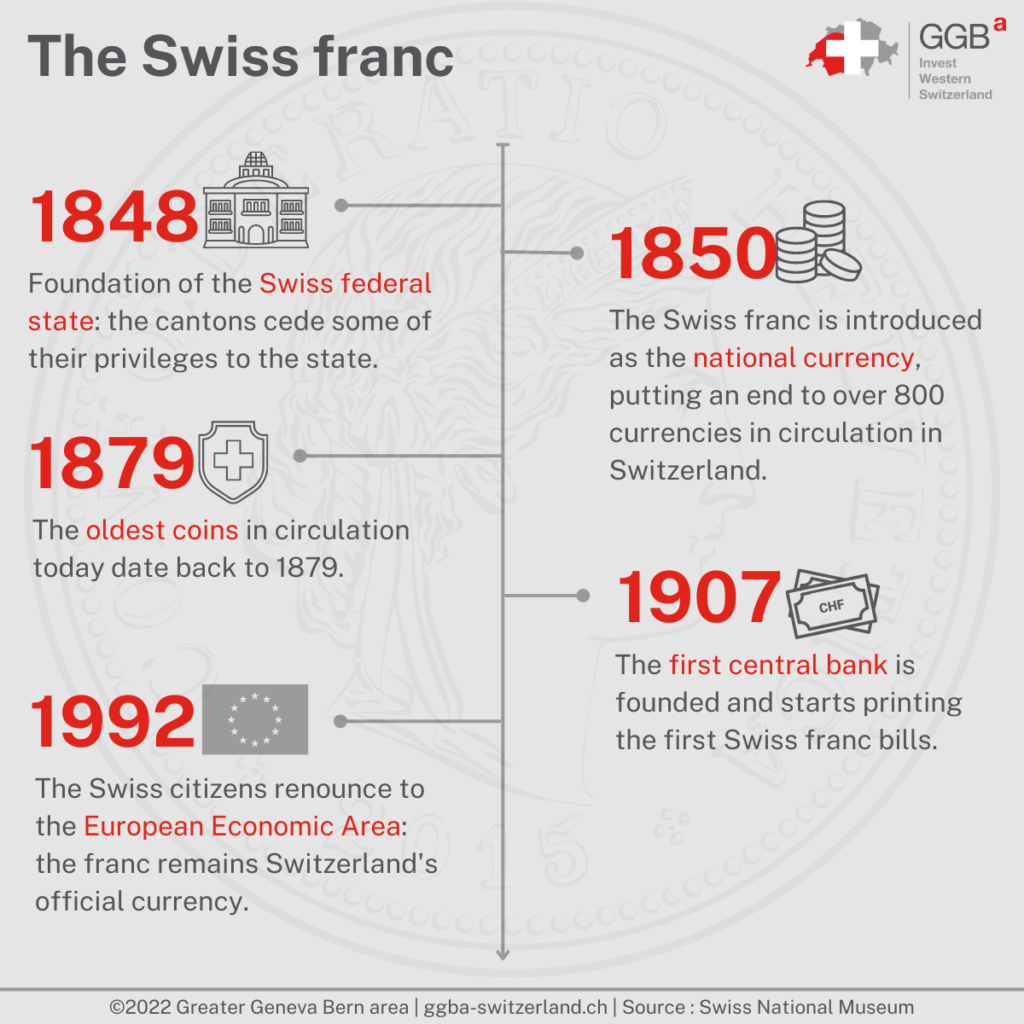

Impact Of Swiss Franc Increase On Eurovision Attendance And Spending

May 14, 2025

Impact Of Swiss Franc Increase On Eurovision Attendance And Spending

May 14, 2025