Land A Private Credit Job: 5 Do's And Don'ts To Master The Hiring Process

Table of Contents

Do's: Maximize Your Chances of Success

1. Craft a Compelling Resume and Cover Letter Tailored to Private Credit

Your resume and cover letter are your first impression. Make them count! Focus on keywords relevant to private credit investing, showcasing your understanding of the industry. Here's how:

- Keyword Optimization: Incorporate terms like "credit analysis," "underwriting," "portfolio management," "due diligence," "financial modeling," "debt structuring," "legal documentation review," "private debt," "leveraged loans," "distressed debt," and "private equity." Use these keywords naturally, not just for keyword stuffing.

- Quantifiable Achievements: Instead of simply stating your responsibilities, quantify your achievements. For example, instead of "Managed a portfolio of loans," write "Managed a $50 million portfolio of loans, resulting in a 12% annualized return."

- Transferable Skills: Even if your previous roles weren't directly in private credit, highlight transferable skills like financial analysis, risk assessment, and relationship management. Show how these skills translate to success in a private credit environment.

- Professional Presentation: Use a clean and professional template. Ensure your contact information is easily accessible and error-free.

2. Network Strategically Within the Private Credit Industry

Networking is crucial in the private credit world. It's a relationship-driven industry, and building connections can significantly boost your job prospects.

- Industry Events: Attend conferences, networking events, and industry-specific workshops to meet professionals and learn about new opportunities.

- LinkedIn Engagement: Actively engage on LinkedIn. Connect with professionals working in private credit, participate in relevant groups, and share insightful content.

- Informational Interviews: Reach out to individuals working in private credit for informational interviews. This allows you to learn about their roles, gain insights into the industry, and build relationships.

- Recruiters: Build relationships with recruiters specializing in private credit placements. They often have exclusive job listings and can provide valuable advice.

3. Prepare Thoroughly for Behavioral and Technical Interviews

Private credit interviews assess both your technical skills and your personality. Thorough preparation is essential.

- Behavioral Interview Questions (STAR Method): Practice answering common behavioral interview questions using the STAR method (Situation, Task, Action, Result). This helps you structure your responses effectively.

- Technical Proficiency: Deepen your understanding of financial statements, credit analysis techniques, valuation methodologies, and industry best practices.

- Company Research: Thoroughly research the firms you're interviewing with. Understand their investment strategy, portfolio composition, recent deals, and company culture.

- Thoughtful Questions: Prepare insightful questions to ask the interviewer. This demonstrates your engagement and initiative.

4. Demonstrate Strong Financial Modeling and Analytical Skills

Proficiency in financial modeling and analysis is paramount in private credit. Showcase your abilities through projects and during interviews.

- Excel Mastery: Master Excel, particularly financial modeling techniques like discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and sensitivity analysis.

- Financial Modeling Software: Develop proficiency in using financial modeling software like Bloomberg Terminal or Argus.

- Financial Ratios and Metrics: Demonstrate a deep understanding of key financial ratios, credit metrics (e.g., leverage ratios, interest coverage ratios), and valuation techniques.

- Project Portfolio: Prepare to discuss projects where you've successfully applied your financial modeling and analytical skills, highlighting your contributions and outcomes.

5. Follow Up Professionally and Express Enthusiasm

Following up after interviews reinforces your interest and professionalism.

- Thank-You Notes: Send a personalized thank-you note after each interview, reiterating your interest and highlighting key discussion points from the conversation.

- Gentle Follow-Up: If you haven't heard back within the expected timeframe, gently follow up to express your continued interest.

- Enthusiasm: Maintain a positive and enthusiastic attitude throughout the entire process. Your passion for private credit will stand out.

Don'ts: Avoid These Common Mistakes

1. Submitting a Generic Resume and Cover Letter

Don't waste your opportunity by submitting a generic application. Each application should be tailored to the specific role and company.

- Avoid Templates: Avoid using generic templates that don't reflect your understanding of the private credit industry.

- Tailored Approach: Customize your resume and cover letter for each application, highlighting the skills and experiences most relevant to the specific job description.

2. Neglecting to Network

Don't underestimate the power of networking in securing a private credit job. It's a relationship-driven industry, and building connections can open doors to unadvertised opportunities.

3. Underestimating the Importance of Technical Skills

Technical skills are crucial in private credit. Don't go into interviews unprepared – master the technical aspects of private credit analysis and financial modeling.

4. Failing to Prepare for Behavioral Questions

Behavioral questions assess your soft skills and personality. Don't overlook the importance of behavioral interview preparation. Practice your responses using the STAR method.

5. Being Unprofessional or Disengaged

Maintain a high level of professionalism throughout the hiring process. Punctuality, clear communication, and enthusiastic follow-up are essential.

Conclusion

Securing a private credit job requires diligent preparation and a strategic approach. By following these "do's" and avoiding the "don'ts," you can significantly improve your chances of success. Remember to tailor your application, network effectively, master your technical skills, and demonstrate enthusiasm throughout the hiring process. Don't delay—start working towards landing your dream private credit job today!

Featured Posts

-

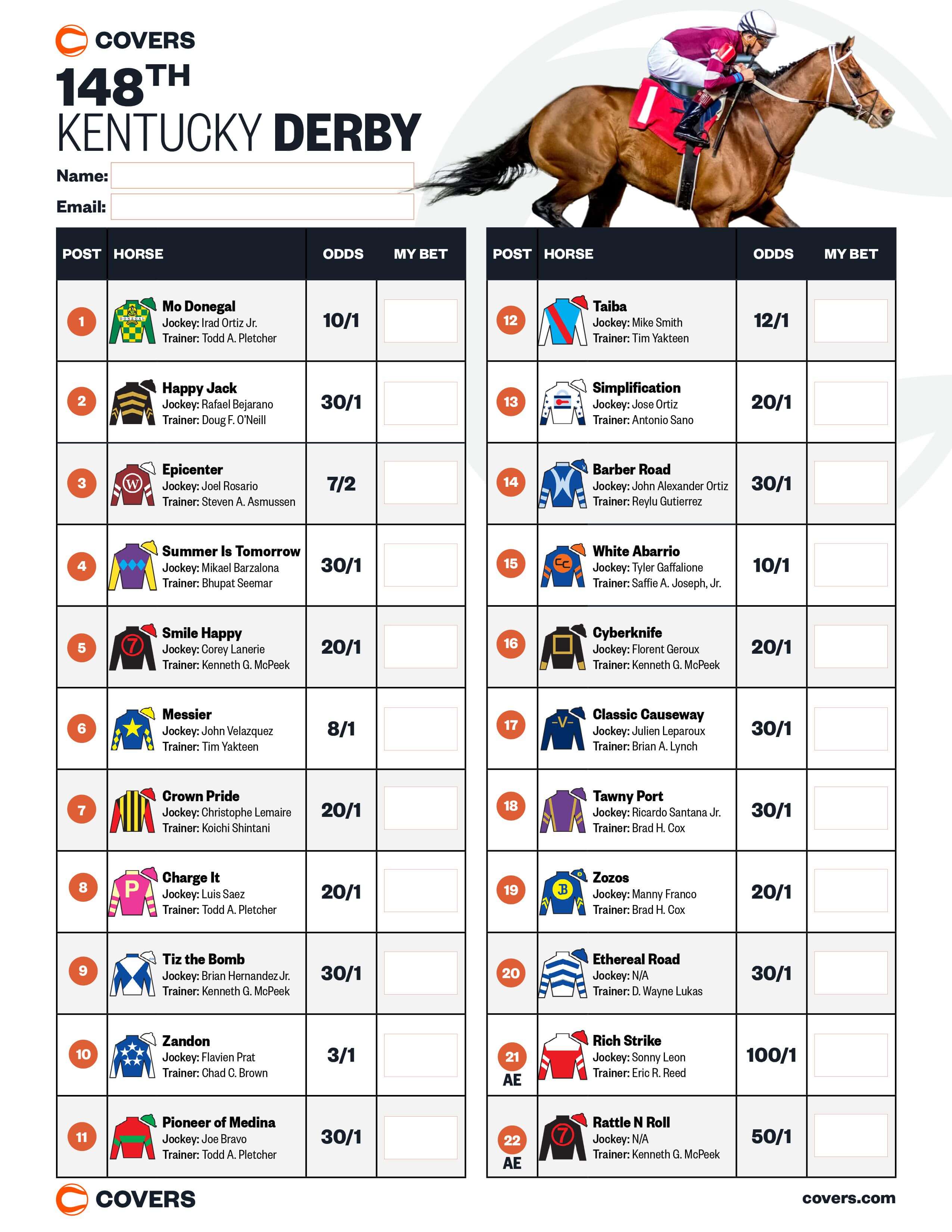

Kentucky Derby 2025 Where To Find The Best Odds And Place Your Bets

May 05, 2025

Kentucky Derby 2025 Where To Find The Best Odds And Place Your Bets

May 05, 2025 -

Fleetwood Mac Scores Big A Chart Topping Album Without Releasing New Songs

May 05, 2025

Fleetwood Mac Scores Big A Chart Topping Album Without Releasing New Songs

May 05, 2025 -

The Count Of Monte Cristo Review A Timeless Classic Reexamined

May 05, 2025

The Count Of Monte Cristo Review A Timeless Classic Reexamined

May 05, 2025 -

Max Verstappens Fatherhood Christian Horners Comment

May 05, 2025

Max Verstappens Fatherhood Christian Horners Comment

May 05, 2025 -

Sydney Sweeney And Fiance Jonathan Davino Breakup Speculation Continues

May 05, 2025

Sydney Sweeney And Fiance Jonathan Davino Breakup Speculation Continues

May 05, 2025