Land Your Dream Private Credit Job: 5 Do's And Don'ts To Follow

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Network Strategically

Networking is paramount in the private credit industry. Building strong relationships can significantly increase your chances of finding unadvertised opportunities and gaining valuable insights.

- Attend industry events: Conferences, seminars, and workshops provide excellent opportunities to meet private credit professionals and learn about current market trends.

- Join relevant LinkedIn groups: Engage in discussions, share your expertise, and connect with people working in private credit. Private credit networking thrives online.

- Reach out to private credit professionals for informational interviews: Don't be afraid to contact individuals for informational interviews. These conversations can provide valuable career advice and potential leads.

- Leverage your existing network: Tap into your existing contacts to see if anyone can connect you with private credit professionals or opportunities.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Generic applications rarely succeed in the competitive private credit job market.

- Highlight relevant skills and experience: Focus on accomplishments directly related to private credit, such as financial modeling, credit analysis, or deal structuring.

- Use keywords from job descriptions: Incorporate relevant keywords from the job descriptions you're targeting to improve your chances of getting noticed by applicant tracking systems (ATS).

- Quantify accomplishments: Instead of simply stating your responsibilities, quantify your achievements using numbers and metrics (e.g., "Increased portfolio yield by 15%"). This demonstrates the impact you've made.

- Tailor each application to the specific company and role: Generic applications show a lack of interest. Take the time to personalize each cover letter to reflect your understanding of the specific company and role.

Do 3: Master the Private Credit Interview

Private credit interviews often involve behavioral, technical, and case study questions designed to assess your skills and knowledge.

- Practice answering common interview questions: Prepare answers for common behavioral questions (e.g., "Tell me about a time you failed") and technical questions related to private credit (e.g., "Explain your understanding of different credit rating agencies").

- Research the firm and interviewer: Demonstrate your genuine interest by thoroughly researching the firm's investment strategy, recent transactions, and the interviewer's background.

- Prepare examples to showcase your skills: Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete examples of your accomplishments.

- Demonstrate your understanding of private credit markets and strategies: Show your knowledge of different private credit strategies (direct lending, mezzanine financing, distressed debt), current market trends, and economic factors affecting the industry.

Do 4: Showcase Your Financial Modeling Skills

Proficiency in financial modeling is critical for private credit roles. You'll need to demonstrate your ability to build and interpret complex financial models.

- Proficiency in Excel: Master advanced Excel functions, including data manipulation, forecasting, and scenario analysis.

- Experience building complex financial models: Showcase your ability to build models for leveraged buyouts (LBOs), discounted cash flow (DCF) analysis, and other valuation methodologies relevant to private credit.

- Demonstrate understanding of valuation methodologies: Be prepared to discuss your understanding of different valuation methodologies (e.g., precedent transactions, comparable company analysis).

- Showcase proficiency with relevant software (e.g., Argus, Bloomberg Terminal): Demonstrate your experience with industry-standard software used for financial analysis and deal execution.

Do 5: Demonstrate Understanding of Private Credit Markets

Staying up-to-date on market trends and economic factors is essential for success in private credit.

- Show awareness of interest rates: Understand how interest rate changes impact private credit lending and borrowing.

- Understanding of credit spreads: Demonstrate your knowledge of credit spreads and how they reflect risk in the private credit market.

- Macroeconomic factors affecting private credit: Show your understanding of how macroeconomic factors (inflation, recession, etc.) influence private credit markets and investment strategies.

- Different types of private credit strategies (e.g., direct lending, mezzanine financing): Demonstrate your knowledge of different private credit strategies and their associated risks and returns.

5 Don'ts to Avoid When Seeking a Private Credit Job

Don't 1: Send Generic Applications

Sending generic applications demonstrates a lack of interest and effort. Each application should be tailored to the specific role and company.

- Tailor each application: Customize your resume and cover letter to highlight the skills and experiences most relevant to each specific job description.

- Personalize cover letters: Don't just repeat information from your resume. Use your cover letter to tell a compelling story about why you're interested in the specific role and firm.

- Demonstrate genuine interest: Show that you've taken the time to research the company and understand its investment strategy.

Don't 2: Neglect Research

Thorough research is crucial for a successful job search. Understand the firm's investment strategy, team, and recent transactions.

- Understand the firm's investment strategy: Research the types of investments the firm makes, its target industries, and its investment philosophy.

- Research the team: Learn about the individuals you'll be interviewing with and their backgrounds.

- Learn about recent transactions: Familiarize yourself with the firm's recent investment activity to demonstrate your knowledge of the market.

Don't 3: Underestimate the Importance of Networking

Networking is not just about attending events; it's about building genuine relationships and leveraging your connections.

- Actively participate in networking events: Attend industry events, conferences, and workshops to meet private credit professionals.

- Maintain relationships: Stay in touch with your contacts and nurture your professional relationships.

- Leverage online platforms like LinkedIn: Use LinkedIn to connect with professionals in the private credit industry and learn about new opportunities.

Don't 4: Lack Confidence

Projecting confidence is crucial during interviews. Thorough preparation will boost your self-assurance.

- Prepare thoroughly: The more prepared you are, the more confident you'll feel.

- Practice your answers: Practice answering common interview questions to refine your responses and build your confidence.

- Project confidence and enthusiasm: Show your passion for private credit and your eagerness to contribute to the firm's success.

Don't 5: Ignore Follow-Up

Following up after interviews and applications shows professionalism and initiative.

- Send thank-you notes: Send personalized thank-you notes to each interviewer within 24 hours of your interview.

- Follow up on application status: If you haven't heard back within a reasonable timeframe, it's acceptable to follow up politely.

- Maintain professional communication: Maintain professional and courteous communication throughout the entire application process.

Conclusion

Landing your dream private credit job requires a multifaceted approach. By diligently following these five "Do's" and avoiding the five "Don'ts," you'll significantly enhance your chances of success. Remember, the private credit job market is competitive, but with thorough preparation, strategic networking, and a confident presentation, you can secure your dream private credit job. Start networking, tailoring your applications, and mastering the interview process today! Begin your journey to landing your dream private credit job now!

Featured Posts

-

Pope Francis Death Confirmed Pneumonia Complication At 88

Apr 22, 2025

Pope Francis Death Confirmed Pneumonia Complication At 88

Apr 22, 2025 -

Signal Chat Leak Hegseths Military Plans Exposed Family Members Included

Apr 22, 2025

Signal Chat Leak Hegseths Military Plans Exposed Family Members Included

Apr 22, 2025 -

Joint Effort South Sudan And Us To Manage Deportees Return

Apr 22, 2025

Joint Effort South Sudan And Us To Manage Deportees Return

Apr 22, 2025 -

Investigation Into Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 22, 2025

Investigation Into Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 22, 2025 -

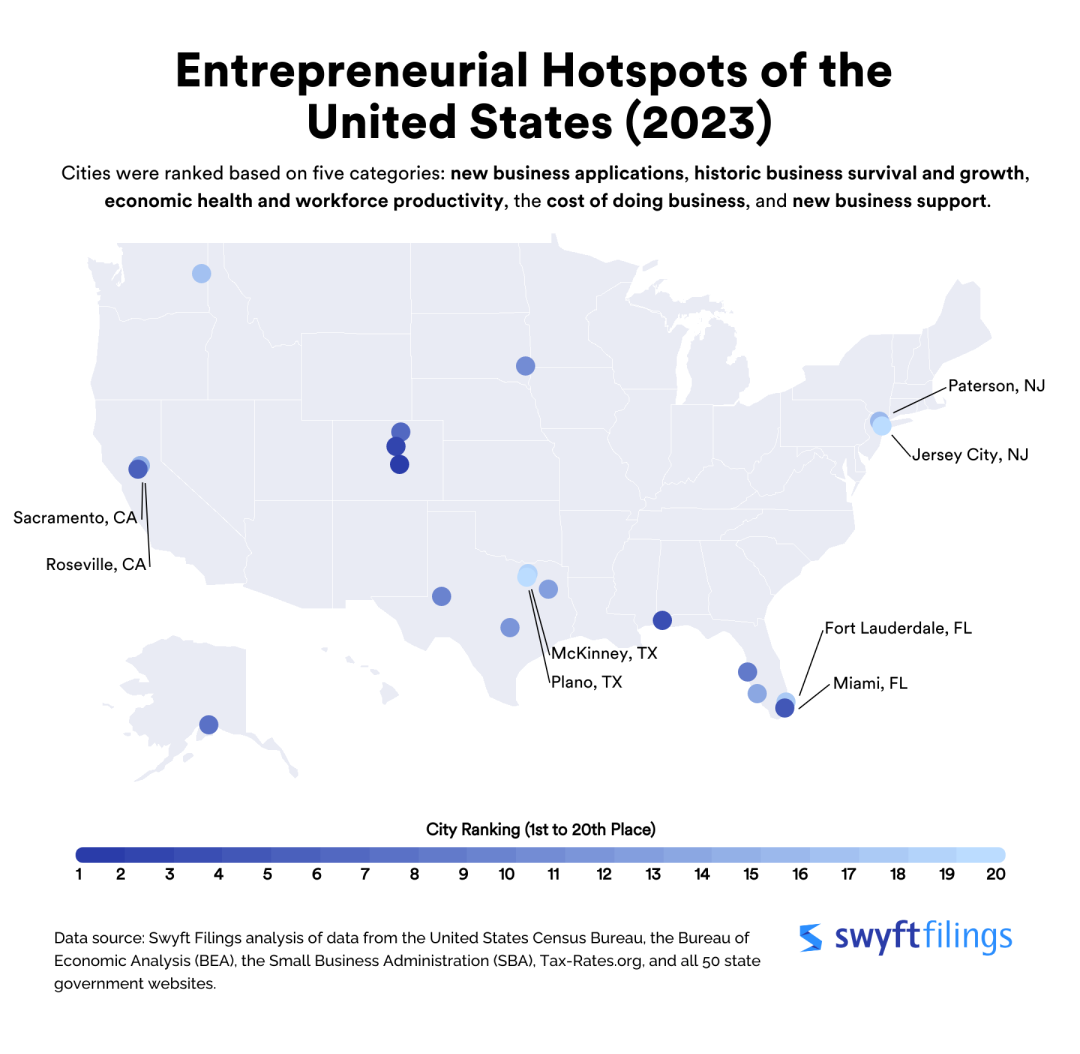

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025

Mapping The Countrys Emerging Business Hotspots

Apr 22, 2025