Land Your Dream Private Credit Role: 5 Crucial Do's And Don'ts

Table of Contents

Do's for Landing Your Dream Private Credit Role

Master the Fundamentals of Private Credit Investing

The foundation of a successful private credit career lies in a deep understanding of the field. This goes beyond simply knowing the basics; you need to demonstrate expertise. This includes:

- Understanding different private credit strategies: Become proficient in various private credit strategies, including direct lending, fund investing, mezzanine financing, and distressed debt investing. Familiarize yourself with the nuances of each strategy, including their risk profiles and potential returns. Understanding the differences between senior secured debt and subordinated debt is crucial.

- Developing strong analytical skills in financial modeling and credit analysis: Private credit professionals need to be adept at financial modeling and credit analysis. Master techniques like discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and credit risk assessment. Practice building detailed financial models and interpreting credit reports.

- Staying updated on market trends, regulatory changes, and industry best practices in private credit: The private credit market is constantly evolving. Stay informed about current market trends, regulatory changes (such as those impacting leveraged lending), and best practices through industry publications, conferences, and networking events. Subscribing to relevant newsletters and following key influencers on LinkedIn can be invaluable.

- Building proficiency in using financial software relevant to the private credit industry: Familiarity with financial software such as Bloomberg Terminal, Argus, or comparable tools is essential. Demonstrate your proficiency in these tools during interviews by showcasing your ability to perform relevant tasks efficiently.

- Keywords: Private credit strategies, direct lending, fund investing, mezzanine financing, distressed debt, financial modeling, credit analysis, private debt, leveraged lending, DCF analysis, LBO modeling, credit risk assessment, Bloomberg Terminal, Argus.

Network Strategically within the Private Credit Community

Networking is paramount in securing a private credit role. Don't underestimate the power of building relationships within the industry.

- Attend industry conferences and events: Participate actively in industry conferences and networking events. These provide excellent opportunities to meet professionals, learn about new trends, and make valuable connections.

- Leverage LinkedIn to connect with recruiters and individuals working in private credit: LinkedIn is a powerful tool for networking. Optimize your profile, connect with recruiters specializing in private credit placements, and engage with posts and discussions within relevant groups.

- Informational interviews can provide valuable insights and potential leads: Reach out to professionals in private credit for informational interviews. This allows you to learn about their experiences, gain valuable insights, and potentially uncover hidden job opportunities.

- Build relationships with professors, alumni, and other contacts in your network: Tap into your existing network. Leverage relationships with professors, alumni working in the industry, and other contacts to explore potential opportunities and gain referrals.

- Keywords: Networking, private credit conferences, LinkedIn, informational interviews, private credit recruiters, industry events, referrals.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. They need to be compelling and tailored to each specific opportunity.

- Tailor your resume to highlight relevant skills and experience for each specific private credit role: Don't use a generic resume. Customize each resume to match the specific requirements and keywords of the job description.

- Quantify your achievements whenever possible to demonstrate impact: Instead of simply stating your responsibilities, quantify your achievements using metrics and numbers to demonstrate your impact on previous roles. Show, don't just tell.

- Use action verbs and concise language to showcase your strengths: Use strong action verbs and concise language to make your resume easy to read and highlight your key accomplishments.

- Customize your cover letter to each application, demonstrating your understanding of the firm and role: Your cover letter should demonstrate your understanding of the specific firm's investment strategy and culture. Show why you're a perfect fit for this specific private credit role.

- Keywords: Resume, cover letter, private credit jobs, tailored resume, quantifiable achievements, impact, action verbs.

Don'ts for Landing Your Dream Private Credit Role

Avoid Generic Applications and a Lack of Research

Sending generic applications demonstrates a lack of interest and effort. Thorough research is crucial.

- Don't send generic applications; personalize each one to reflect your understanding of the specific firm and role: Show genuine interest in the firm and position by tailoring your application to the specifics of each opportunity.

- Thoroughly research the firms you're applying to, understanding their investment strategies and culture: Before applying, research the firm's investment strategy, portfolio companies, and overall culture. This demonstrates your commitment and seriousness.

- Demonstrate genuine interest in the specific private credit opportunity, not just a general interest in finance: Highlight why you're interested in this specific firm and role, not just a general interest in the finance industry.

- Keywords: Generic applications, private credit firm research, target companies, investment strategy, due diligence.

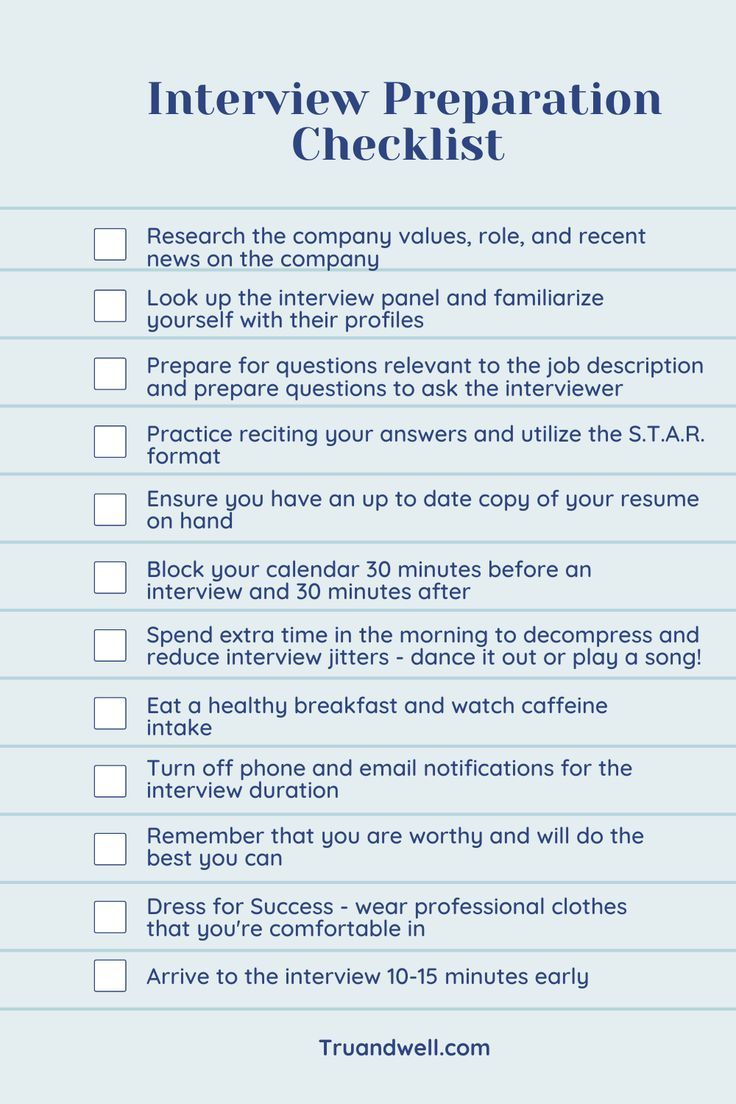

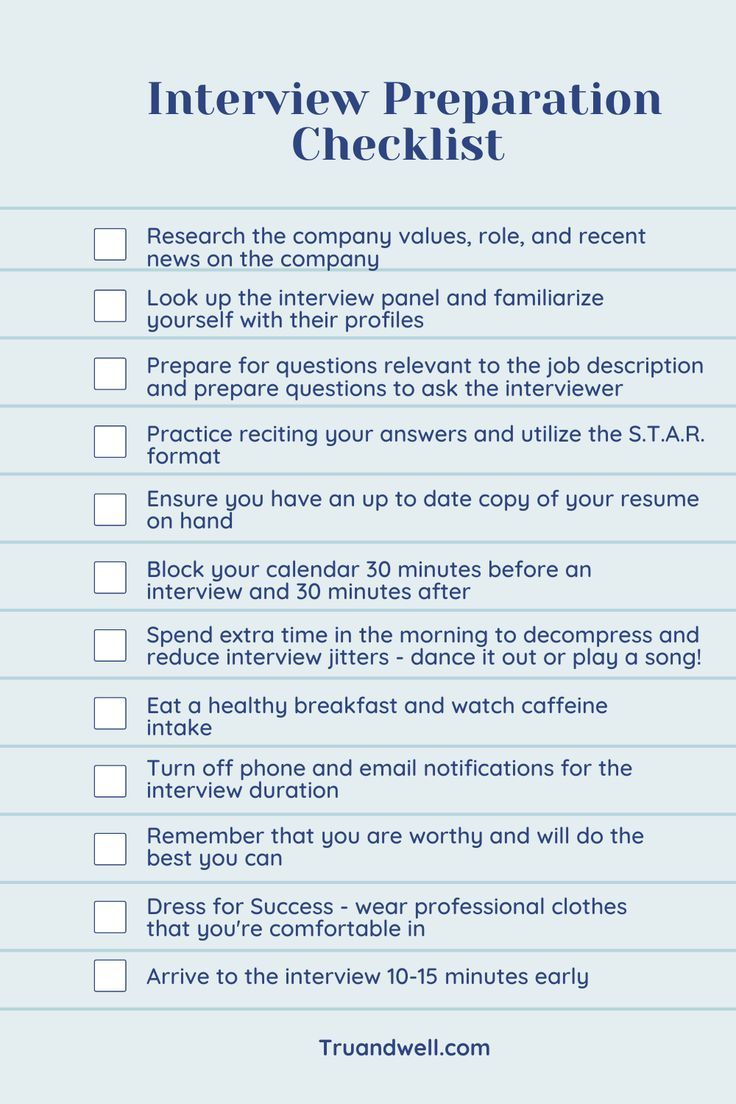

Underestimate the Importance of Interview Preparation

Interview preparation is critical. Practice and preparation will set you apart.

- Don't go into interviews unprepared; practice common private credit interview questions: Prepare for both behavioral questions (assessing your soft skills) and technical questions (testing your knowledge of private credit principles). Practice answering common questions aloud.

- Prepare examples demonstrating your analytical skills and problem-solving abilities: Use the STAR method (Situation, Task, Action, Result) to structure your answers and showcase your analytical and problem-solving skills using concrete examples from your experience.

- Research the interviewers beforehand to personalize your responses and build rapport: Research the interviewers on LinkedIn to find common ground and personalize your responses. This shows initiative and genuine interest.

- Ask insightful questions to show your genuine interest and engagement: Prepare insightful questions to ask the interviewers. This demonstrates your engagement and genuine interest in the role and the firm.

- Keywords: Interview preparation, private credit interview questions, behavioral questions, technical questions, STAR method.

Neglect Follow-Up After Interviews

Following up is a crucial step often overlooked.

- Don't neglect following up with a thank-you note after each interview: Send a personalized thank-you note within 24 hours of each interview, reiterating your interest and highlighting key points from the conversation.

- Express your continued interest and reiterate your key qualifications: Reiterate your key qualifications and enthusiasm for the role in your follow-up communication.

- Use the follow-up to address any questions or concerns raised during the interview: If any questions or concerns were raised during the interview, use the follow-up to address them directly and comprehensively.

- Keywords: Follow up, thank you note, interview feedback, continued interest.

Conclusion

Securing your dream private credit role involves a strategic combination of skill development, networking, and effective communication. By following these do's and don'ts, you can significantly increase your chances of success. Remember to master the fundamentals of private credit investing, network strategically, craft a compelling application, prepare thoroughly for interviews, and always follow up. Don't delay your pursuit of the perfect private credit role – start implementing these strategies today! Begin your journey to land your dream private credit role now.

Featured Posts

-

Alvarez Remains Focused On Plant Ignores Crawford Mega Fight Chatter

May 04, 2025

Alvarez Remains Focused On Plant Ignores Crawford Mega Fight Chatter

May 04, 2025 -

Analyzing The Final Destination Film Series Worldwide Box Office Performance And Bloodline Trailer Impact

May 04, 2025

Analyzing The Final Destination Film Series Worldwide Box Office Performance And Bloodline Trailer Impact

May 04, 2025 -

Ufc Fight Night In Depth Preview Of Sandhagen Vs Figueiredo Fight

May 04, 2025

Ufc Fight Night In Depth Preview Of Sandhagen Vs Figueiredo Fight

May 04, 2025 -

Navigating The Chinese Market The Bmw And Porsche Case Study

May 04, 2025

Navigating The Chinese Market The Bmw And Porsche Case Study

May 04, 2025 -

Nyc Press Conference Canelo And Ggg Face Off Before Undisputed Title Bout

May 04, 2025

Nyc Press Conference Canelo And Ggg Face Off Before Undisputed Title Bout

May 04, 2025