Landing A Private Credit Job: 5 Do's And Don'ts For Success

Table of Contents

Do: Network Strategically to Secure Your Private Credit Job

Networking is paramount in the private credit industry. Building strong relationships can significantly increase your chances of landing a private credit job. Don't underestimate the power of personal connections.

- Attend industry events: Conferences, workshops, and networking events are excellent places to meet professionals and recruiters in private credit. Actively participate, exchange business cards, and follow up afterward.

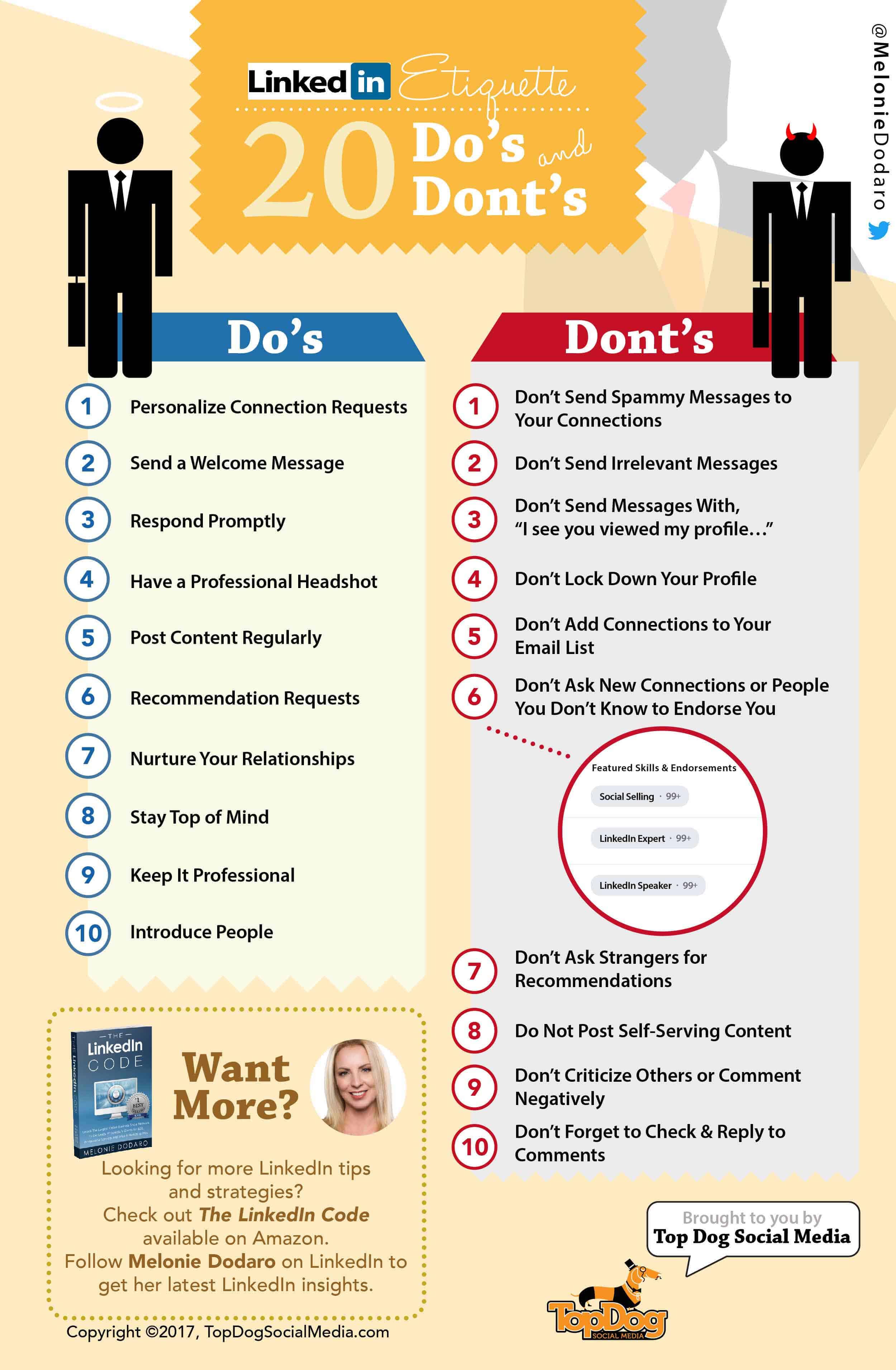

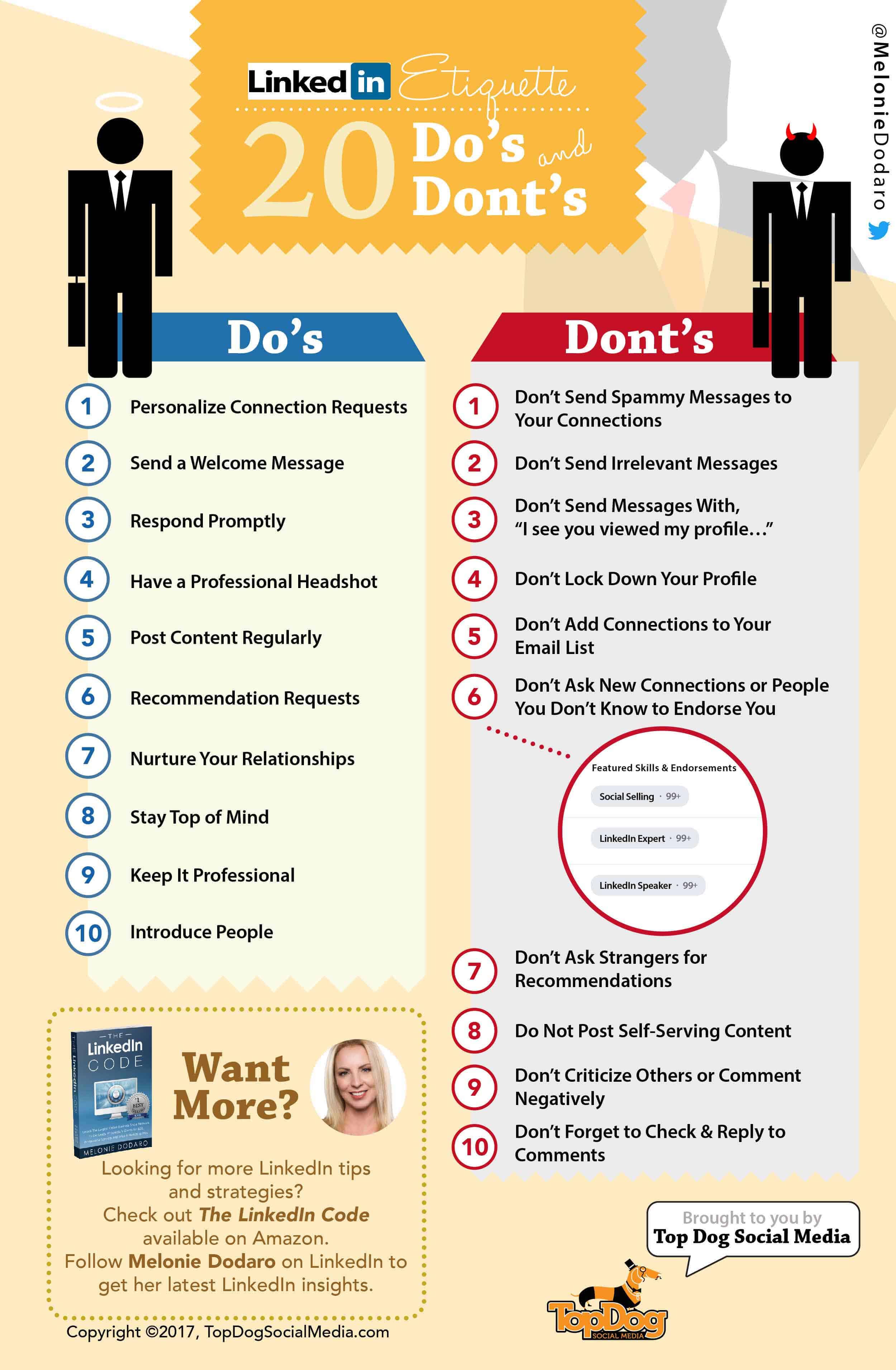

- Leverage LinkedIn effectively: Optimize your LinkedIn profile with relevant keywords like "private credit," "private debt," and "credit analysis." Connect with recruiters specializing in private credit placements and engage with industry professionals' posts and articles.

- Informational interviews: Reach out to people working in private credit for informational interviews. This allows you to learn more about their roles, the industry, and gain valuable insights while making a personal connection.

- Join relevant professional organizations: Membership in organizations like the CFA Institute or industry-specific groups provides networking opportunities and access to industry news and events. This shows commitment to your chosen private credit networking path.

Effective private equity networking, private debt networking, and building strong industry connections are all vital for success in this sector.

Do: Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression. A generic application won't cut it in the competitive world of private credit. You need to tailor your materials to highlight the skills and experience most relevant to each specific private credit role.

- Quantify accomplishments: Don't just list your responsibilities; quantify your accomplishments with concrete examples. Instead of saying "managed a portfolio," say "managed a $50 million portfolio, resulting in a 15% increase in ROI."

- Highlight relevant keywords: Carefully review job descriptions and incorporate relevant keywords like "private credit resume," "financial modeling," "credit analysis," and "due diligence" throughout your resume and cover letter.

- Showcase understanding of private credit concepts: Demonstrate your knowledge of key concepts such as credit analysis, due diligence, leveraged buyouts (LBOs), and discounted cash flow (DCF) analysis.

- Proofread meticulously: Errors are unacceptable. Have multiple people review your resume and cover letter before submitting them.

Do: Master the Private Credit Interview Process

The private credit interview process is rigorous and often involves behavioral, technical, and case study interviews. Thorough preparation is crucial.

- Research the firm: Understand the firm's investment strategy, portfolio companies, and recent transactions. Demonstrate your knowledge during the interview.

- Practice common interview questions: Prepare for behavioral questions ("Tell me about a time you failed"), technical questions about financial statements and credit metrics, and case study questions requiring analytical problem-solving skills.

- Discuss financial statements and credit metrics: Demonstrate a strong understanding of financial statement analysis, key credit ratios, and credit risk assessment.

- Develop strong case study examples: Practice working through case studies to showcase your analytical and problem-solving abilities in situations relevant to private credit. This is key to nailing that private credit interview.

Don't: Neglect Your Financial Modeling Skills

Proficiency in financial modeling is non-negotiable in private credit. You'll be building and interpreting models constantly.

- Practice building and interpreting models: Master discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other relevant modeling techniques.

- Demonstrate proficiency with software: Become highly proficient in Excel and other financial modeling software.

- Highlight relevant projects: In your resume and cover letter, clearly showcase projects where you utilized your financial modeling skills. Emphasize your proficiency in DCF analysis, LBO modeling, and Excel skills.

Don't: Underestimate the Importance of Soft Skills

While technical skills are essential, soft skills are equally important in private credit. You need to be a strong communicator and team player.

- Demonstrate strong communication skills: Clearly articulate your thoughts and ideas during interviews and presentations. Showcase your ability to communicate complex financial information effectively.

- Showcase teamwork experience: Provide examples of successful teamwork experiences, highlighting your contributions and ability to collaborate effectively.

- Highlight your ability to handle pressure: Demonstrate your ability to work under pressure, manage multiple priorities, and meet tight deadlines—all essential in the fast-paced world of private credit.

Secure Your Dream Private Credit Job

To land your dream private credit job, remember these key takeaways: strategic networking is crucial; tailor your resume and cover letter to each specific role; master the interview process, including behavioral, technical, and case study questions; hone your financial modeling skills, particularly in DCF analysis and LBO modeling; and don't underestimate the importance of strong soft skills, including communication and teamwork. By following these do's and don'ts, you'll significantly improve your chances of landing your dream private credit job. Start networking and tailoring your application today!

Featured Posts

-

Analyzing Voter Turnout In Florida And Wisconsin Understanding The Shifting Political Tide

May 02, 2025

Analyzing Voter Turnout In Florida And Wisconsin Understanding The Shifting Political Tide

May 02, 2025 -

80s Soap Opera Star Dies Dallas And Beyond

May 02, 2025

80s Soap Opera Star Dies Dallas And Beyond

May 02, 2025 -

Bio Based Scholen En De Uitdaging Van Energieonafhankelijkheid Generatoren Als Oplossing

May 02, 2025

Bio Based Scholen En De Uitdaging Van Energieonafhankelijkheid Generatoren Als Oplossing

May 02, 2025 -

Daily Lotto Results Wednesday 16 April 2025

May 02, 2025

Daily Lotto Results Wednesday 16 April 2025

May 02, 2025 -

Is Fortnite Experiencing Server Issues Checking Status And Update 34 20

May 02, 2025

Is Fortnite Experiencing Server Issues Checking Status And Update 34 20

May 02, 2025