Latest Oil Market News And Analysis: May 16, 2024 Update

Table of Contents

Global Crude Oil Price Movements

Brent Crude and WTI Crude Price Analysis

Both Brent crude and West Texas Intermediate (WTI) crude, the two key global benchmarks for oil pricing, experienced notable upward pressure in the days preceding May 16th, 2024. This followed several weeks of fluctuating prices, reflecting the ongoing uncertainty in the energy markets.

- Daily/weekly price changes: Brent crude saw an average daily increase of approximately 0.5% in the preceding week, while WTI mirrored this trend.

- Percentage fluctuations: The week-over-week percentage change for both benchmarks was roughly 3%, marking a significant shift from the previous period's relative stability.

- Comparison to previous periods: Compared to the previous month, prices showed a more significant increase, suggesting a potential shift in the market's overall direction.

- Influencing factors: Several factors contributed to this price movement, which we'll explore in greater detail below.

Factors Affecting Crude Oil Prices

Numerous macroeconomic factors continuously impact crude oil prices, creating a complex and volatile market environment. These factors often interact in unpredictable ways.

- Geopolitical events: Ongoing tensions in several oil-producing regions, coupled with recent sanctions, have created supply-side uncertainty, pushing prices upward.

- OPEC+ production decisions: Decisions made by the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) significantly influence global supply, impacting prices directly.

- Global demand: Robust economic growth in key markets, particularly in Asia, is driving increased demand for crude oil, further impacting prices. Seasonal changes also influence demand, with higher consumption during peak travel seasons.

- US dollar strength: The value of the US dollar, in which oil is typically traded, affects oil prices. A stronger dollar makes oil more expensive for buyers using other currencies.

- Inventory levels: Global oil inventories are closely monitored; lower-than-expected inventories tend to push prices upward, signaling tighter supply.

- Speculative trading: Financial traders' activities in futures and options markets can also increase price volatility, particularly in response to news and market sentiment.

OPEC+ and Production Decisions

Recent OPEC+ Meeting Summary

(Note: This section requires updating with the actual OPEC+ meeting summary for the period around May 16, 2024. Replace the placeholder text below with accurate information.)

Placeholder: The most recent OPEC+ meeting (date) resulted in [insert outcome, e.g., a decision to maintain current production levels, or an adjustment to quotas]. Key announcements included [insert details, e.g., specific production adjustments for individual member countries].

- Production adjustments: [Insert details on production adjustments.]

- Compliance with quotas: [Insert information on member country compliance with production quotas.]

- Statements from key OPEC+ members: [Summarize statements from key members, such as Saudi Arabia and Russia.]

- Impact on market supply: [Analyze the meeting's impact on global oil supply.]

OPEC+ Influence on Oil Prices

OPEC+'s decisions have a profound and often immediate impact on the oil market's price and stability.

- Historical impact of OPEC+ decisions: Historically, OPEC+ decisions have led to significant price swings, demonstrating the cartel's considerable influence on the global energy market.

- Market reaction to production changes: The market often reacts strongly to OPEC+ production announcements, with prices moving significantly, either upward or downward, depending on the nature of the decisions.

- Potential for future adjustments: The potential for future production adjustments by OPEC+ remains a major source of uncertainty and volatility in the oil market, driving continuous price fluctuations.

Geopolitical Risks and Their Impact on the Oil Market

Region-Specific Geopolitical Risks

Geopolitical instability in key oil-producing regions presents significant risks to the global oil market.

- Political instability: Political turmoil in regions like the Middle East can disrupt oil production and transportation, leading to price spikes.

- Conflicts: Armed conflicts and ongoing tensions frequently disrupt oil supply chains, creating uncertainty in the market.

- Sanctions: International sanctions on oil-producing nations can restrict supply, resulting in higher prices.

- Potential supply disruptions: Any disruption to oil production or transportation routes (e.g., through the Strait of Hormuz) can severely impact global supply and lead to price volatility.

- Impact on oil prices: These geopolitical risks often translate into significant price increases as the market anticipates potential shortages.

Geopolitical Uncertainty and Market Volatility

The inherent uncertainty associated with geopolitical events directly contributes to significant fluctuations in oil prices.

- Market sentiment: Investor sentiment plays a crucial role; fears of supply disruptions often lead to increased risk aversion and higher prices.

- Investor behavior: Investors react to geopolitical news swiftly, leading to rapid price changes in oil futures contracts.

- Risk aversion: Uncertainty boosts risk aversion among investors, leading them to seek safer assets, potentially impacting oil prices negatively.

- Impact on futures contracts: Futures contracts, which allow investors to bet on future prices, become highly volatile during periods of geopolitical uncertainty.

Oil Market Outlook and Predictions

Short-Term and Long-Term Price Forecasts

Predicting oil prices is challenging due to the market's volatility. However, several reputable sources provide forecasts.

(Note: This section requires up-to-date information from reputable sources like the EIA, OPEC, and major financial institutions. Replace placeholder text with actual forecasts.)

Placeholder: Short-term forecasts (next 3-6 months) suggest a price range of [insert price range] for Brent crude, while long-term forecasts (next 2-5 years) indicate a range of [insert price range]. These predictions are based on [insert underlying assumptions, e.g., expected global demand, OPEC+ production levels, and geopolitical stability]. Potential risks include [insert potential risks, e.g., unexpected geopolitical events or changes in global economic growth].

Factors Shaping Future Oil Market Trends

Several long-term trends will shape the direction of oil prices in the coming years.

- Energy transition: The global shift towards renewable energy sources is anticipated to gradually reduce the long-term demand for oil.

- Renewable energy growth: The rapid growth of solar, wind, and other renewable energy technologies poses a significant challenge to the continued dominance of fossil fuels.

- Demand from emerging markets: Growing energy demand from rapidly developing economies will continue to impact oil prices, at least in the short to medium term.

- Technological advancements: Technological breakthroughs in oil extraction and refining could influence supply and potentially prices.

- Sustainable energy policies: Government policies promoting sustainable energy and stricter environmental regulations will play a critical role in shaping future oil demand.

Conclusion

The oil market remains highly volatile, influenced by a complex interplay of global crude oil price movements, OPEC+ decisions, and geopolitical risks. Recent price increases reflect a blend of factors, including geopolitical tensions and the impact of OPEC+ policy. While short-term price predictions vary, the long-term outlook suggests a gradual shift towards a less oil-dependent global energy system. Staying informed on these factors is critical for anyone involved in energy markets or simply interested in global economic trends.

Stay informed on the latest oil market developments by regularly checking back for the latest oil market news and analysis on our website. Understanding the dynamics of crude oil prices and the oil market requires continuous monitoring and analysis of these ever-changing factors. Explore our other resources for a deeper dive into commodity markets.

Featured Posts

-

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025 -

Blue Origins Rocket Launch Aborted A Subsystem Malfunction

May 17, 2025

Blue Origins Rocket Launch Aborted A Subsystem Malfunction

May 17, 2025 -

Addressing Canadas Housing Shortage Exploring The Potential Of Modular Construction

May 17, 2025

Addressing Canadas Housing Shortage Exploring The Potential Of Modular Construction

May 17, 2025 -

Broadcoms Proposed V Mware Price Hike An Unprecedented 1 050 Increase For At And T

May 17, 2025

Broadcoms Proposed V Mware Price Hike An Unprecedented 1 050 Increase For At And T

May 17, 2025 -

Paramounts Mission Impossible Gets China Release Date

May 17, 2025

Paramounts Mission Impossible Gets China Release Date

May 17, 2025

Latest Posts

-

Gncc Mx Sx Flat Track And Enduro Your Source For Moto News

May 17, 2025

Gncc Mx Sx Flat Track And Enduro Your Source For Moto News

May 17, 2025 -

Nba Analyst Perkins Criticizes Jalen Brunsons Podcast

May 17, 2025

Nba Analyst Perkins Criticizes Jalen Brunsons Podcast

May 17, 2025 -

How Josh Cavallo Is Changing Football After His Public Coming Out

May 17, 2025

How Josh Cavallo Is Changing Football After His Public Coming Out

May 17, 2025 -

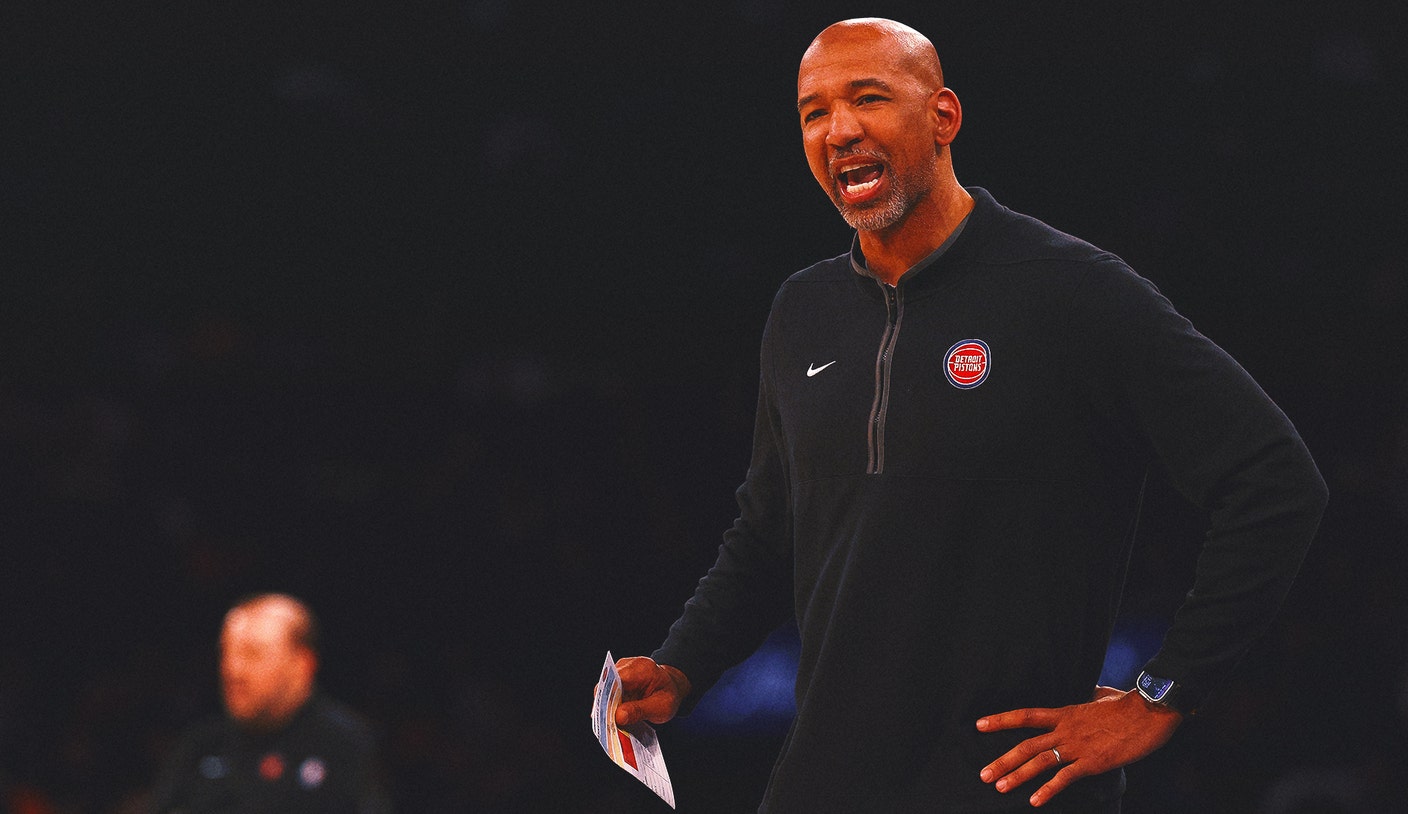

Hardaway Jr S Final Shot Crew Chief Acknowledges Missed Call In Pistons Loss

May 17, 2025

Hardaway Jr S Final Shot Crew Chief Acknowledges Missed Call In Pistons Loss

May 17, 2025 -

Perkins Tells Brunson To Ditch Podcast Knicks Star Under Fire

May 17, 2025

Perkins Tells Brunson To Ditch Podcast Knicks Star Under Fire

May 17, 2025