Latest Ripple SEC Lawsuit News: Potential XRP Commodity Classification

Table of Contents

The SEC's Case Against Ripple

The SEC's complaint alleges that Ripple conducted an unregistered securities offering, violating federal securities laws. Their argument hinges on the Howey Test, a legal framework used to determine whether an investment constitutes a security. The Howey Test considers four factors: an investment of money, in a common enterprise, with a reasonable expectation of profits, derived from the efforts of others.

- The SEC's Allegations: The SEC argues that XRP sales, particularly those to institutional investors, meet the criteria of the Howey Test, claiming XRP purchasers anticipated profits based on Ripple's efforts.

- Key Arguments: The SEC presented evidence suggesting that Ripple actively promoted XRP and controlled its distribution, fostering an expectation of profit for investors. They highlighted the substantial profits Ripple generated through XRP sales.

- Potential Penalties: If found guilty, Ripple faces substantial financial penalties and potential restrictions on future operations. The executives also face personal liability.

Ripple's Defense and Arguments

Ripple vehemently denies the SEC's allegations, arguing that XRP is a decentralized digital asset with utility as a functional currency, not a security. Their defense strategy focuses on several key points:

- Decentralized Nature of XRP: Ripple emphasizes that XRP operates on a decentralized, public blockchain, independent of Ripple's control. They argue this characteristic distinguishes it from securities.

- Programmatic Sales: Ripple highlights that a significant portion of XRP sales were conducted through programmatic sales on decentralized exchanges, lacking the direct investment contract element central to the SEC's argument.

- Evidence Presented: Ripple has presented expert testimony and evidence showcasing XRP's usage in cross-border payments, arguing its utility transcends mere investment potential.

- Legal Strategies: Ripple's defense has employed various legal strategies, including challenging the SEC's jurisdiction and the application of the Howey Test to XRP's unique characteristics.

Potential Implications of XRP as a Commodity

A commodity classification for XRP would significantly alter the regulatory landscape and market dynamics.

- Security vs. Commodity: Unlike securities, which are subject to the SEC's jurisdiction, commodities are primarily regulated by the Commodity Futures Trading Commission (CFTC). This shift in oversight could impact trading regulations and reporting requirements.

- Regulatory Implications: CFTC regulation could bring about different compliance standards for exchanges listing XRP and potentially affect how XRP is marketed and sold.

- Trading Impact and Price Volatility: A commodity classification might attract a different set of investors and could influence XRP's price volatility, potentially making it more susceptible to market fluctuations.

- Investor Protection: While both the SEC and CFTC offer investor protection, the specific mechanisms and levels of protection might differ under a commodity classification.

Recent Developments and Court Proceedings

The Ripple-SEC lawsuit has seen significant developments.

- Judge Torres Rulings: Judge Analisa Torres has issued several key rulings impacting the case, shaping the legal arguments and evidentiary standards.

- Expert Testimony: Both sides have presented expert testimony on various aspects of blockchain technology, cryptocurrency markets, and the application of securities law.

- Legal Briefs: Numerous legal briefs have been filed, outlining detailed legal arguments and addressing specific aspects of the case.

- Future Court Dates: The case continues to progress, with future court dates scheduled to address outstanding motions and arguments. A final judgment is eagerly anticipated by the crypto community.

Conclusion

The Ripple-SEC lawsuit remains a landmark case shaping the future of cryptocurrency regulation. The potential reclassification of XRP as a commodity carries significant implications for its price, trading volume, and the broader crypto market. The outcome is uncertain, but understanding the ongoing legal battles and their potential consequences is crucial for investors and market participants alike.

Call to Action: Stay informed about the latest developments in the Ripple SEC lawsuit and the potential commodity classification of XRP. Continue researching and following this evolving legal battle to make informed decisions regarding your investments in the cryptocurrency market. Follow reputable news sources for updates on the latest Ripple SEC lawsuit news and the ongoing XRP commodity classification debate. Understanding this complex legal battle is essential for navigating the dynamic world of cryptocurrency investment.

Featured Posts

-

Big 12 Tournament Arizona Edges Texas Tech In Semifinal Thriller

May 02, 2025

Big 12 Tournament Arizona Edges Texas Tech In Semifinal Thriller

May 02, 2025 -

London Fashion Week Kate And Lila Moss Twin In Little Black Dresses

May 02, 2025

London Fashion Week Kate And Lila Moss Twin In Little Black Dresses

May 02, 2025 -

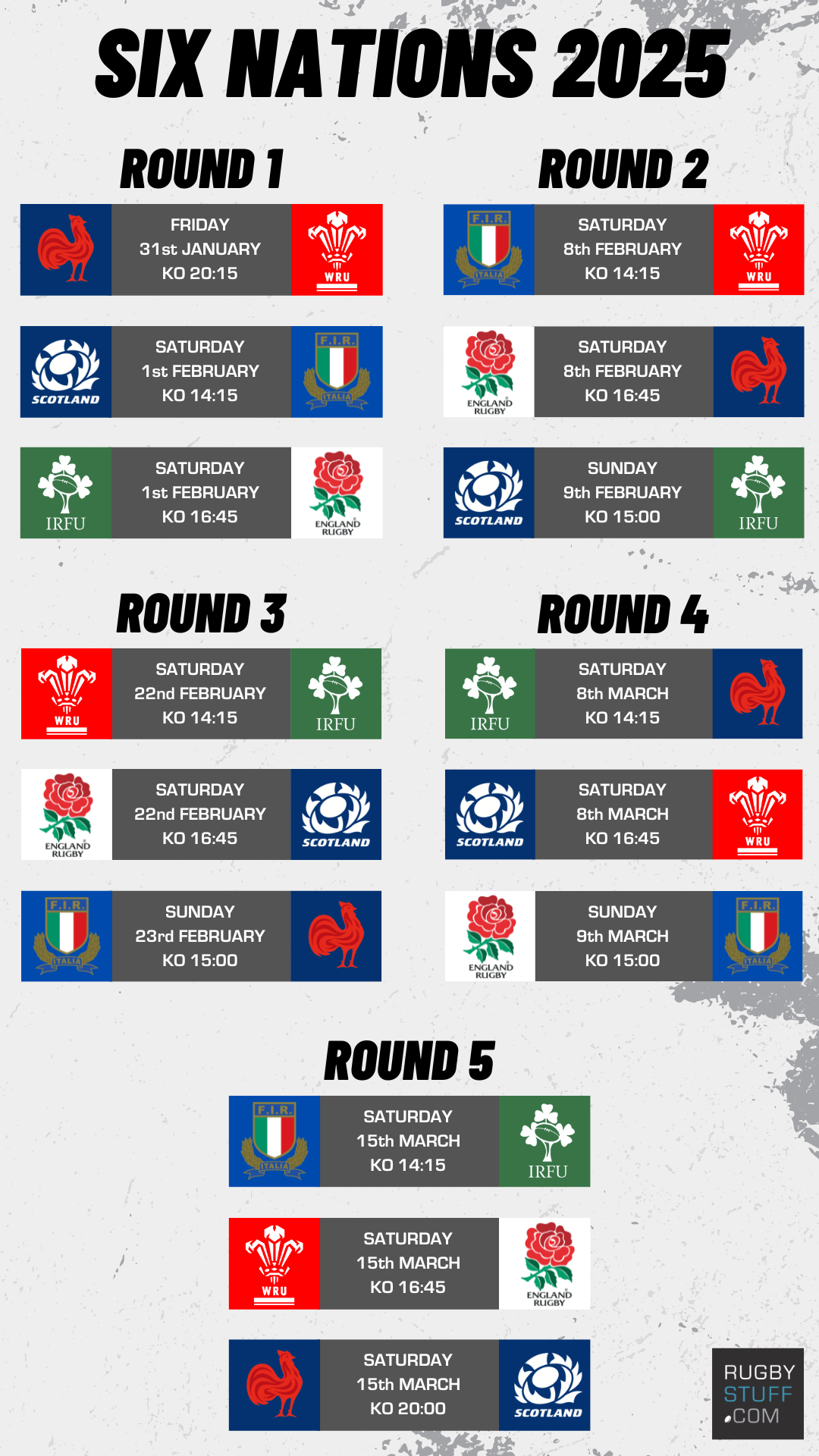

Six Nations 2025 Scotlands True Potential Deception Or Reality

May 02, 2025

Six Nations 2025 Scotlands True Potential Deception Or Reality

May 02, 2025 -

The Stigma Surrounding Mental Health Impact On Claim Rates And Access To Treatment

May 02, 2025

The Stigma Surrounding Mental Health Impact On Claim Rates And Access To Treatment

May 02, 2025 -

Fortnites New Icon Series Skin Revealed

May 02, 2025

Fortnites New Icon Series Skin Revealed

May 02, 2025