Lion Electric: Investor Group Submits Revised Takeover Bid

Table of Contents

Details of the Revised Takeover Bid

An unnamed investor group, reportedly comprised of several private equity firms with significant experience in the automotive and clean energy sectors, has submitted a revised takeover bid for Lion Electric. This follows an initial bid that was previously rejected by Lion Electric's board of directors.

- The Revised Offer: The investor group is now offering $XXX per share, a significant increase from the previous bid of $YYY per share. This reflects a higher valuation of Lion Electric and demonstrates the investor group's strong belief in the company's long-term potential.

- Key Differences: The revised bid includes more favorable terms for Lion Electric shareholders, addressing some of the concerns raised during the previous negotiation. These terms may include a higher guaranteed minimum price or a less restrictive condition precedent.

- Valuation: The revised bid implies a total valuation of approximately $ZZZ billion for Lion Electric, significantly higher than its current market capitalization. This valuation underscores the investor group's confidence in Lion Electric's future growth prospects within the rapidly expanding electric vehicle market.

- Deadlines and Conditions: The revised bid includes a deadline of [Date] for Lion Electric to respond. The acceptance of the bid is also subject to certain conditions, including regulatory approvals and due diligence. Keywords: bid price, shareholder value, acquisition.

Lion Electric's Response to the Revised Bid

Lion Electric's board of directors is currently reviewing the revised takeover bid. While an official statement is pending, preliminary indications suggest a more favorable outlook compared to the initial offer.

- Board Recommendation: The board is expected to make a formal recommendation to shareholders following a comprehensive evaluation of the revised offer and its terms. This recommendation will be crucial in guiding shareholder decisions regarding the takeover bid.

- Potential Counter-Offers: While unlikely given the improved terms, Lion Electric may explore the possibility of a counter-offer or negotiation to further enhance the terms of the acquisition for its shareholders.

- Management Reaction: Lion Electric's management team has remained tight-lipped on specific details, emphasizing their commitment to acting in the best interests of all stakeholders. However, the positive market reaction to the revised bid indirectly signals some level of approval within the company. Keywords: board of directors, company response, management reaction.

Market Reaction and Analyst Opinions

The announcement of the revised takeover bid has been met with positive market reaction, resulting in a noticeable increase in Lion Electric's stock price.

- Stock Price Movement: LEV stock experienced a [Percentage]% increase immediately following the news, demonstrating investor confidence in the revised bid's potential success.

- Analyst Opinions: Several financial analysts have released positive comments on the revised bid, citing its improved terms and the potential for a successful acquisition. Many analysts have adjusted their price targets for LEV stock upward.

- Future Plans and Strategies: The successful acquisition could accelerate Lion Electric’s expansion plans and provide access to additional capital for research and development, enhancing their competitiveness in the EV industry.

- Long-Term Effects: The takeover could reshape the competitive landscape of the electric bus and truck market, potentially leading to industry consolidation and increased innovation. Keywords: stock market reaction, analyst forecast, market impact.

Potential Implications for the Electric Vehicle Industry

The potential takeover of Lion Electric by this investor group holds significant implications for the broader electric vehicle (EV) industry.

- Increased Competition: The acquisition could lead to intensified competition within the electric bus and truck manufacturing space, driving innovation and potentially lowering prices for consumers.

- Industry Consolidation: This takeover could trigger a wave of consolidation within the EV industry, as larger players seek to acquire smaller, innovative companies to expand their market share.

- Impact on Lion Electric's Projects: The investor group's involvement may expedite Lion Electric's ongoing projects and partnerships, leading to quicker deployment of electric vehicles.

- Impact on Other Players: The success of this acquisition could encourage other major players to consider similar strategic moves within the EV industry, particularly targeting manufacturers of electric buses and trucks. Keywords: EV industry, market competition, industry consolidation.

Conclusion: The Future of Lion Electric After the Revised Takeover Bid

The revised takeover bid for Lion Electric represents a significant development for the company and the wider EV industry. The improved terms, positive market reaction, and potential for increased innovation highlight the significant potential of this acquisition. It's crucial for investors and stakeholders to closely monitor the situation as Lion Electric assesses this revised offer. The outcome will significantly impact the company's future trajectory and its role in the growing EV market. To stay informed about further developments in the Lion Electric acquisition, follow the company’s official announcements and reputable financial news sources. Subscribe to our newsletter for updates on the LEV takeover and other crucial Lion Electric investor news. Keywords: Lion Electric acquisition, LEV takeover, Lion Electric investor news.

Featured Posts

-

Pokemon Fan Builds Lego Gen 3 Starters Treecko Torchic Mudkip In Brick Form

May 14, 2025

Pokemon Fan Builds Lego Gen 3 Starters Treecko Torchic Mudkip In Brick Form

May 14, 2025 -

Experience Chocolate Heaven Lindt Opens In Central London

May 14, 2025

Experience Chocolate Heaven Lindt Opens In Central London

May 14, 2025 -

Suits La Episode 2s Superpower Reveal And Ted Blacks Missed Opportunity

May 14, 2025

Suits La Episode 2s Superpower Reveal And Ted Blacks Missed Opportunity

May 14, 2025 -

Walmart Canned Bean Recall What You Need To Know

May 14, 2025

Walmart Canned Bean Recall What You Need To Know

May 14, 2025 -

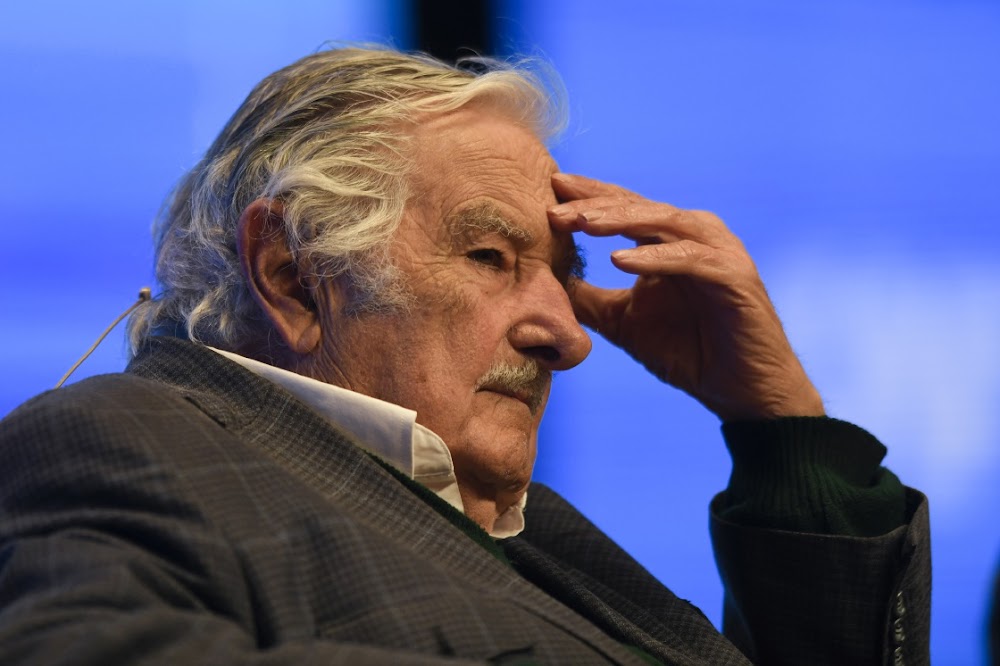

Fallece Jose Mujica Expresidente De Uruguay A Los 89 Anos

May 14, 2025

Fallece Jose Mujica Expresidente De Uruguay A Los 89 Anos

May 14, 2025