Live Now, Pay Later: How To Use It Responsibly And Avoid Debt

Table of Contents

Understanding Buy Now, Pay Later (BNPL) Services

Before diving into responsible usage, it’s crucial to understand what BNPL services entail.

Types of BNPL Services

BNPL services aren't all created equal. They fall into several categories:

- Point-of-sale financing: This is the most common type, offered directly at the checkout of online and brick-and-mortar stores. Examples include Afterpay, Klarna, and Affirm. These usually involve splitting the purchase price into several interest-free installments over a short period.

- Installment loans: These loans are typically for larger purchases and may involve interest charges. They offer longer repayment periods than point-of-sale financing.

- Credit cards with deferred interest: Some credit cards offer a promotional period where interest is deferred, but if the balance isn't paid in full by the end of the period, interest accrues retroactively.

The key differences lie in fees, interest rates, and repayment terms. Always compare offers before committing to a specific provider.

How BNPL Affects Your Credit Score

While some BNPL providers don't report to credit bureaus, an increasing number do. This means your payment behavior can impact your credit score:

- On-time payments: Consistent on-time payments can positively influence your credit score, demonstrating responsible borrowing habits.

- Late payments: Late payments, missed payments, and defaults can severely damage your credit score, making it harder to secure loans or credit in the future. This can impact your ability to rent an apartment, get a car loan, or even secure a mortgage.

- Reporting to credit bureaus: Check with your BNPL provider to understand their reporting practices. This information is crucial for managing your credit health.

The Hidden Costs of BNPL

The seemingly interest-free nature of many BNPL services can be deceptive. Hidden fees can quickly add up:

- Late fees: Missing a payment can result in substantial late fees, significantly increasing the total cost of your purchase.

- Interest charges: While some BNPL services advertise "interest-free" installments, failing to repay on time often triggers interest charges, often at a high rate.

- APR (Annual Percentage Rate): Carefully compare the APRs across different BNPL providers to understand the true cost of borrowing. A seemingly small fee can translate to a high APR over time.

Responsible Use of Buy Now, Pay Later

Utilizing BNPL services responsibly requires a proactive approach to financial management.

Budgeting Before Using BNPL

Before using any BNPL service, create a detailed budget:

- Track income and expenses: Monitor your income and spending habits to understand your financial capacity.

- Essential vs. non-essential spending: Distinguish between necessary purchases and wants. BNPL should ideally be used for essential items only.

- Include BNPL repayments: Incorporate BNPL repayments into your monthly budget to ensure you can afford the payments without straining your finances.

Only Use BNPL for Essential Purchases

Resist the temptation to use BNPL for impulse buys:

- Appropriate uses: BNPL can be suitable for necessary expenses like urgent home repairs or essential medical treatments.

- Inappropriate uses: Avoid using BNPL for non-essential items like clothing, entertainment, or gadgets, especially if you're already struggling financially. Prioritize needs over wants.

Prioritize Repayment

Timely repayment is paramount to avoid accumulating debt:

- Automatic payments: Set up automatic payments to avoid missing deadlines.

- Payment reminders: Use calendar reminders or budgeting apps to stay on track.

- Debt consolidation: If you're struggling to manage multiple BNPL repayments, consider debt consolidation to simplify your payments.

Monitoring Your BNPL Accounts

Stay organized and vigilant in managing your BNPL accounts:

- Budgeting apps: Use budgeting apps to track your spending and BNPL balances.

- Regular account checks: Review your BNPL account balances regularly to monitor your progress.

- Payment alerts: Set up alerts for upcoming payments to avoid missing deadlines.

Avoiding Debt Traps with BNPL

Falling into a debt cycle with BNPL is a real risk. Here's how to avoid it:

Alternatives to BNPL

Consider alternatives to BNPL:

- Saving up: The best way to avoid debt is to save up for purchases before making them.

- Responsible credit card usage: If you have a good credit score, a credit card with a low interest rate can be a responsible alternative, provided you pay your balance in full each month.

- Personal loans: For larger purchases, consider a personal loan with a fixed interest rate and repayment schedule.

Seeking Financial Advice

Don't hesitate to seek professional help if needed:

- Financial counseling: Many organizations offer free or low-cost financial counseling services.

- Credit counseling agencies: Credit counselors can help you create a debt management plan.

- Debt management programs: These programs can help you negotiate lower interest rates and consolidate your debts.

Recognizing the Signs of Overspending

Be aware of warning signs indicating potential debt problems:

- Payment difficulties: Struggling to make your BNPL payments on time.

- Constant new BNPL loans: Continuously taking out new BNPL loans to pay off existing ones.

- Non-essential spending: Regularly using BNPL for non-essential items.

Conclusion

Mastering the art of "live now, pay later" requires responsible financial management. By carefully budgeting, prioritizing repayments, and understanding the potential risks, you can effectively use BNPL services without falling into a debt trap. Remember, responsible use of "live now, pay later" means understanding the costs, sticking to your budget, and always prioritizing timely payments. Continue your financial education by researching resources on financial literacy and responsible credit management. Share this article with others to help them avoid the pitfalls of irresponsible BNPL use.

Featured Posts

-

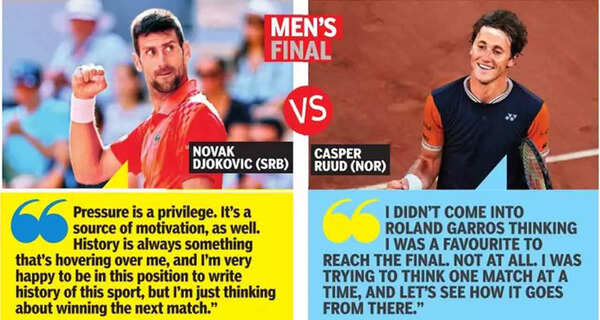

Borges Triumphs Over Injured Ruud At French Open

May 30, 2025

Borges Triumphs Over Injured Ruud At French Open

May 30, 2025 -

The Six Victims Of A Death Bath A Serial Killers Signature

May 30, 2025

The Six Victims Of A Death Bath A Serial Killers Signature

May 30, 2025 -

Natural Ingredients For Bladder Control In Women Primera

May 30, 2025

Natural Ingredients For Bladder Control In Women Primera

May 30, 2025 -

Ticketmaster Reportes De Caida El 8 De Abril Noticias Grupo Milenio

May 30, 2025

Ticketmaster Reportes De Caida El 8 De Abril Noticias Grupo Milenio

May 30, 2025 -

Dolbergs Malprognose 25 Mal Realistisk Eller Urealistisk

May 30, 2025

Dolbergs Malprognose 25 Mal Realistisk Eller Urealistisk

May 30, 2025